Ways To Help Build Your Credit

If your credit score falls below the Canadian average of 672, donât stress. Many individuals fall into this category, and there are concrete steps you can take to build your credit. Here are just a few of the steps you can take:

1. Pay your bills on time!

Paying your bills on time â every time â is one of the best things you can do to improve your credit score. Your payment history is the largest factor that impacts your credit score, and it makes up 35% of your score. Use a free bill tracking app to monitor your bills, or try setting up monthly automatic payments so you donât miss your bills. If you have any past due accounts, try to pay off the oldest ones first.

2. Keep your credit utilization under 30%

Your credit utilization is the second largest factor that impacts your credit score. Itâs the amount of credit youâve used versus the total amount of credit you have available. You should aim to keep your credit utilization below 30%. This means if you have a credit card with a limit of $3,000, then you should keep the balance below $1,000.

3. Regularly monitor your credit score

Can You Get A Personal Loan With A Credit Score Of 659

Very few lenders will approve you for a personal loan with a 659 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

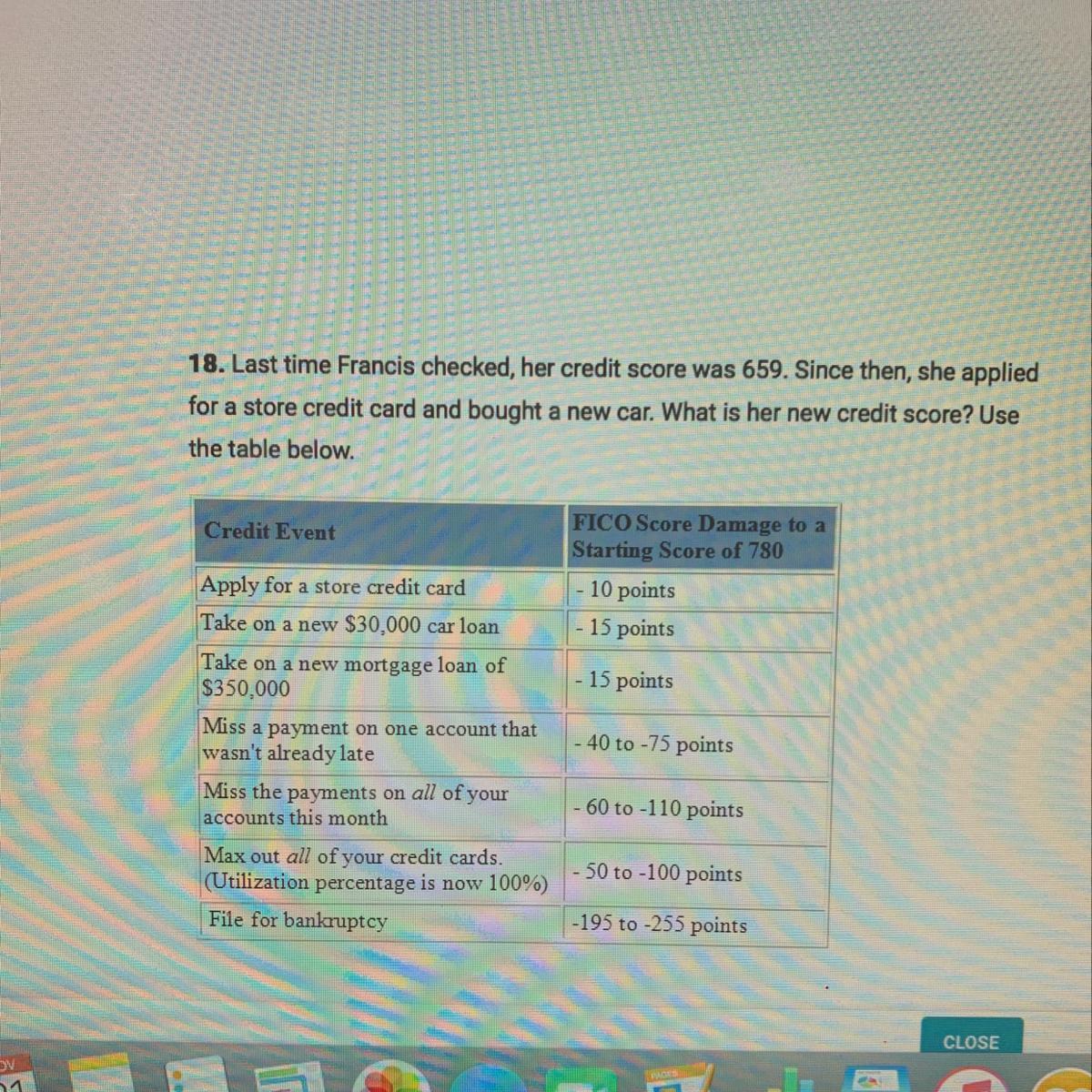

What Does A 659 Credit Score Mean And How It Affects Your Life

While being in the fair credit range is not the worst, it still has cons. Because many with a 659 credit score may be deemed a potentially risky borrower, it is not uncommon for folks with this credit score to be offered credit cards and loans with higher interest rates. If one wishes to have any increased shot at a low interest rate loan, approval for a credit card or a home rental, and better car insurance rates, having the best credit possible is a must.

On the bright side, a credit score of 659 is not the end of the world. Typically, it is individuals with scores lower than 630 who have a lower shot of approval and fair interest rates on loans, credit cards, and the like, that is, if they get approved at all. Being in the poor or very poor credit score range means that one may only be approved for secured loans: money borrowed that must be backed up with an expensive possession in exchange for borrowed finances in case you fail to pay back your dues.

What happens if you improve your 659 credit score by 50 or 100 points?

What happens if your 659 FICO score goes down?

Don’t Miss: What Is A Good Business Credit Score

The Ground For Your Credit Score

There are many factors that go into a credit score, such as the FICO® Score. Your is based on your credit history, which is everything that is recorded in your credit file. This includes things like how well you have handled credit and bill payments in the past. If you have good credit habits, this will tend to lead to a higher credit score such as 700 credit score. On the other hand, if you have had poor or erratic credit habits, this will likely result in a lower score such as 600 credit score.

Public Information: Negative public records, like bankruptcies, on your credit report, can have serious negative impacts on your credit score.

Payment history: An individual’s credit score can be negatively impacted by delinquent accounts and late or missed payments. Conversely, a history of punctual bill payments will help improve one’s credit score. This is a direct relationship- the single biggest influence on your credit score is payment history accounting for up to 35% of your FICO® Score.

Length of credit history: There’s not much new credit users can do about their length of credit history, except avoid bad habits and work to establish a track record of timely payments and good credit decisions. Length of credit history can constitute up to 15% of your FICO® Score, so it’s important to keep that in mind when building your credit.

The average credit utilization rate is 78.2% for consumers with FICO credit scores of 659.

What Is A Good Credit Score To Buy A House 2020

While you don’t need a perfect 850 credit score to get the best mortgage rates, there are general credit score requirements you will need to meet in order to take out a mortgage. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages.

Also Check: How To Find Credit Score

Heres How To Improve A 659 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Bayport Credit Union Newport News

1. BayPort Credit Union in Newport News, VA at 12512 Warwick BayPort CU Hidenwood Branch hours, phone, reviews, map at 12512 Warwick Boulevard, Newport News, VA. BayPort CU Main Office hours, phone, reviews, map at One Bayport Way, Newport News, VA. Organized as Newport News Shipbuilding and Dry Dock

Also Check: What’s Considered A Great Credit Score

Factors That Can Affect The Calculation Of Your Credit Scores

There are five main factors that can affect the calculation of credit scores. If youre interested in improving your credit, understanding what these factors are can help you create a plan to build healthy credit habits.

1. Payment History

How you manage your payments is one important factor used during the calculation of your credit scores. This includes how many accounts you have open as well as all the positive and negative information about these accounts. For example, if you make payments on time or late, how often you make late payments, how late the payments were, how much you owe, and whether or not any accounts are delinquent.

2. Outstanding Debt

Sometimes referred to as a , many credit scoring models take into account how high your balance is compared to your total available credit limit. Specifically when it comes to revolving credit, for examples credit cards and lines of credit.

3. Length Of Credit History

Your credit file includes how old your credit accounts are and will influence the calculation of your credit scores. The importance of this factor will differ depending on the scoring models, but generally speaking, how long your oldest and newest accounts have been open is important.

4. Public Records

Public records include bankruptcies, collection issues, liens, lawsuits, etc. Having these types of public records on your credit report may have a negative effect on your credit scores.

5. Inquires

Additional Reading

Extra Tips For Improving Your Credit Score

If necessary, work with a reputable credit counseling or repair service. If you have bad credit, it is not shameful to seek help from a professional service. Just be sure to choose a reputable company that will help you improve your score in a legitimate way.

It is recommended that you use a mix of different types of credit. Lenders tend to view borrowers who can responsibly handle different types of debt, such as installment loans and revolving lines of credit, as more responsible overall.

Signing up for a credit monitoring service is a good way to keep track of your progress and identify any potential problems early on.

Keep old accounts open even if you don’t use them often.

Limit new applications for credit.

You May Like: Does Acima Report To Credit

Secured Vs Unsecured Cards

Secured cards

Secured cards are just what the name implies. The amount of your credit line is typically based on the security deposit you put up. For example, if you make a $300 deposit, youll usually have a corresponding $300 credit limit.

Other than the security deposit, secured cards work just like unsecured cards. You run charges and make monthly payments. The payment history is reported to the major credit bureaus, which will impact your credit score. And even though there is a security deposit, you will still be charged interest on outstanding balances.

Secured cards often come with no annual fee or a very low one. Most will eventually increase your credit limit based on your on-time monthly payments. And some will convert your card to unsecured after a certain amount of time.

Read more:Best Secured Credit Cards

Unsecured cards

Naturally, no security deposit is required for unsecured cards. But the annual fee may be higher than it is for a secured card. The table below summarizes the difference between secured and unsecured credit cards:

Note: All cards on this page selected for credit scores between 650 and 699 are unsecured.

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

Also Check: What Date Does Capital One Report To The Credit Bureaus

How To Find The Best Credit Cards If Your Fico Score Is 650 To 699

When you reach a FICO score between 650 and 699 your credit card options start to open up considerably.

One type of card that is less relevant after you reach this credit score range is a secured credit card. These cards are more suitable if your credit score is below 650, and especially when its below 600.

But in the average credit score range, you should be able to qualify for unsecured cards with very little effort. What you wont find available to you are unsecured cards with the best terms on the market. For example, you wont qualify for the lowest interest rates, nor will you be eligible for the cards with the most generous rewards programs. But you can still get a card with an adequate credit limit, and at least some cash back rewards. And if you pay your balance off monthly as we will recommend throughout this guide the high interest rate wont matter so much.

Read more:How to Use a Credit Card Responsibly

How To Boost Your Credit Score With Your Credit Card Cbs Minnesota

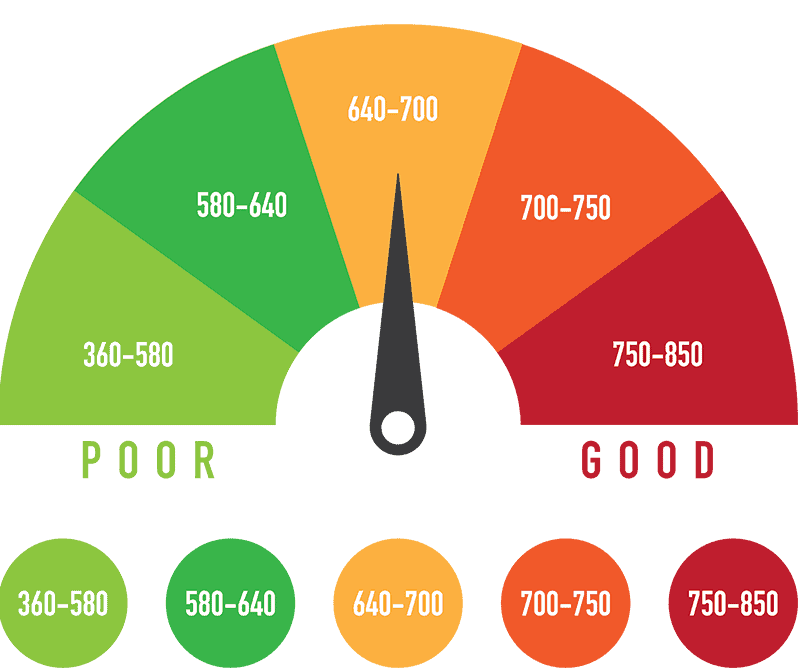

The information below is provided to help you identify. This makes improving your score imperative so that you can access the many positive aspects that come with maintaining good credit. Percentage of generation with While a lot of people have fair scores, you may still find it difficult to get approved for credit without high fees and interest rates with a score in this range.

You may also have to pay a security deposit when you rent an apartment. A fico ® score of 659 places you within a population of consumers whose credit may be seen as fair. But a little bit of credit improvement will give you. 08/04/2021 · a score is considered fair when it is between 580 and 669 points.

The information below is provided to help you identify. 6 rows · the minimum credit score is around 620 for most conventional lenders. But a 659 credit score isnt bad, either. 30/04/2021 · a 659 credit score is generally a fair score.

Recommended Reading: How To Unfreeze Your Credit Report Equifax

What Is A Good Credit Score In Canada In 2022

What is considered a good credit score in Canada and what is the average credit score of the general population?

A credit score is a financial gauge that tells you and others how you are doing financially and whether or not you can be trusted to use credit responsibly.

Youd be surprised at how much influence a three-digit number can have on your life, particularly, if you are like the average Canadian who will carry some level of debt at some point in their life.

How Is A Credit Score Calculated

In Canada, there are two main credit bureaus Equifax and TransUnion that are responsible for calculating individuals credit scores. These companies collect data about your financial activity and then distil that information into a credit score based on five key factors, as outlined below.

» MORE:What is a credit report?

Read Also: Does Mortgage Help Credit Score

How To Check Your Credit Score

Canadians can access their credit scores directly from TransUnion and Equifax for a fee .

Alternatively, companies like Borrowell provide you with free credit scores and it is updated every month at no charge.

Borrowell was the first Canadian company to provide free credit scores in Canada.

In addition to its free credit monitoring service, the company also offers personal loans, mortgages, insurance, credit cards, and investment products.

More than 1 million Canadians have obtained their credit scores through the Borrowell platform.

Improving Your Credit Score

Fair credit scores can’t be turned into exceptional ones overnight, and only the passage of time can repair some negative issues that contribute to Fair credit scores, such as bankruptcy and foreclosure. No matter the reason for your Fair score, you can start immediately to improve the ways you handle credit, which can lead in turn to credit-score improvements.

Look into obtaining a secured credit card. A secured credit card requires you to put down a deposit in the full amount of your spending limittypically a few hundred dollars. Confirm that the As you use the card and make regular payments, the lender reports your activity to the national credit bureaus, where they are recorded in your credit files. (Making timely payments and avoiding “maxing out” the card will favor credit-score improvements.

Consider a credit-builder loan. Available from many credit unions, these loans take can several forms, but all are designed to help improve personal credit histories. In one popular version, the credit union places the money you borrow in a savings account, where it earns interest but is inaccessible to you until the loan is paid off. Once you’ve paid the loan in full, you get access to the funds and the accumulated interest. It’s a clever savings tool, but the credit union also reports your payments to national credit bureaus, so regular, on-time payments can lead to credit-score improvements.

Also Check: How To Remove Hard Inquiries From Credit Report Online

D Mand And Credit Score Ratings Stock Photo By C Nasirkhan 8617507

There are still lenders who will give you a loan, and landlords who will rent to you. Its actually in the fair credit tier. Below is the breakdown of a credit score rating: A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card.

This makes improving your score imperative so that you can access the many positive aspects that come with maintaining good credit. Statistically speaking, 28% of consumers with credit scores in the fair range are likely to become seriously delinquent in So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. Your 659 fico ® score is lower than the average u.s.