What Can You Do With A 700 Credit Score

Instead of focusing only on whether a 700 score is good or not, consider whether it will allow you to reach your goals, says Victoria Sechrist, certified financial trainer at The Financial Gym.

For example, some mortgage refinance lenders are requiring a minimum of 700, says Sechrist. Some credit card issuers say they want people with 720-plus to get their top tier cards. That doesnt mean you cant get approved for credit cards or a mortgage refinance. It just means you may have to shop around more to find a lender with lower credit requirements.

If youre looking for a personal loan or a 0 percent balance transfer credit card to refinance higher interest debt, then 700 should be good enough for you to qualify, says Sechrist.

In the 700 club, your credit limit will likely be close to the average credit limit for a newly issued card, about $5,000, says Ted Rossman, senior industry analyst at Bankrate. That limit can vary based on income and other debt.

With an average credit score, expect to pay around the average credit card interest rate of 16.51 percent, Rossman says. Thats better than the 20 percent or 25 percent those with lower scores will pay, but not as nice as the 7 percent or 10 percent people with scores of 740 and higher might achieve.

Using A Debt Settlement Company

Having an account back in good standing is obviously a good thing for your credit â but how you get there matters.

The idea of settling your debt for less than the full amount is enticing, but when dealing with a debt settlement company, you are likely to incur fees for their services.

Most importantly though, your credit score will suffer. It is a much safer bet to contact your creditors directly and aim to find a solution instead.

Become An Authorized User

If you have a trusted family member with a good credit score, you have an opportunity to dramatically increase your credit score. You can become an authorized user of their account in order to boost your score.

However, this can be a taxing emotional burden. If you dont repay your debts, then you could hurt their credit score. Talk through the pros and cons with your family member before trying this method.

Also Check: How Long Do Collections Stay On Credit Report

What Did You Learn

These steps are very easy to follow. Once you get into the routine, monitoring things will only take a few minutes a week. First, get your credit report from Equifax and TransUnion.

You will feel great when your credit score is approaching 800. It will create opportunities that only a select few Canadians can enjoy, so start your journey today.

What Does A 700 Credit Score Mean In Canada

In Canada, your ability to borrow money or make large purchases is partially based on your credit score. Your credit score is based on your credit history, credit utilization, debt-to-income ratio, any collections or bankruptcies as well as how many credit tradelines you have on your credit report and how many credit accounts you have on your credit report. While many people think it& rsquo s how much money you have that dictates your purchases, it’s actually a smaller piece of the puzzle than you would think.

Read Also: How Does Your Credit Score Go Down

Understand The Benefits Of A Good Credit Score

A credit score in the good range may reflect a relatively short credit history marked by good credit management. It may also characterize a longer credit history with a few mistakes along the way, such as occasional late or missed payments, or a tendency toward relatively high credit usage rates.

Late payments appear in the credit reports of 33% of people with FICO® Scores of 700.

Lenders see people with scores like yours as solid business prospects. Most lenders are willing to extend credit to borrowers with credit scores in the good range, although they may not offer their very best interest rates, and card issuers may not offer you their most compelling rewards and loyalty bonuses.

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

You May Like: Does Checking Fico Score Hurt Credit

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

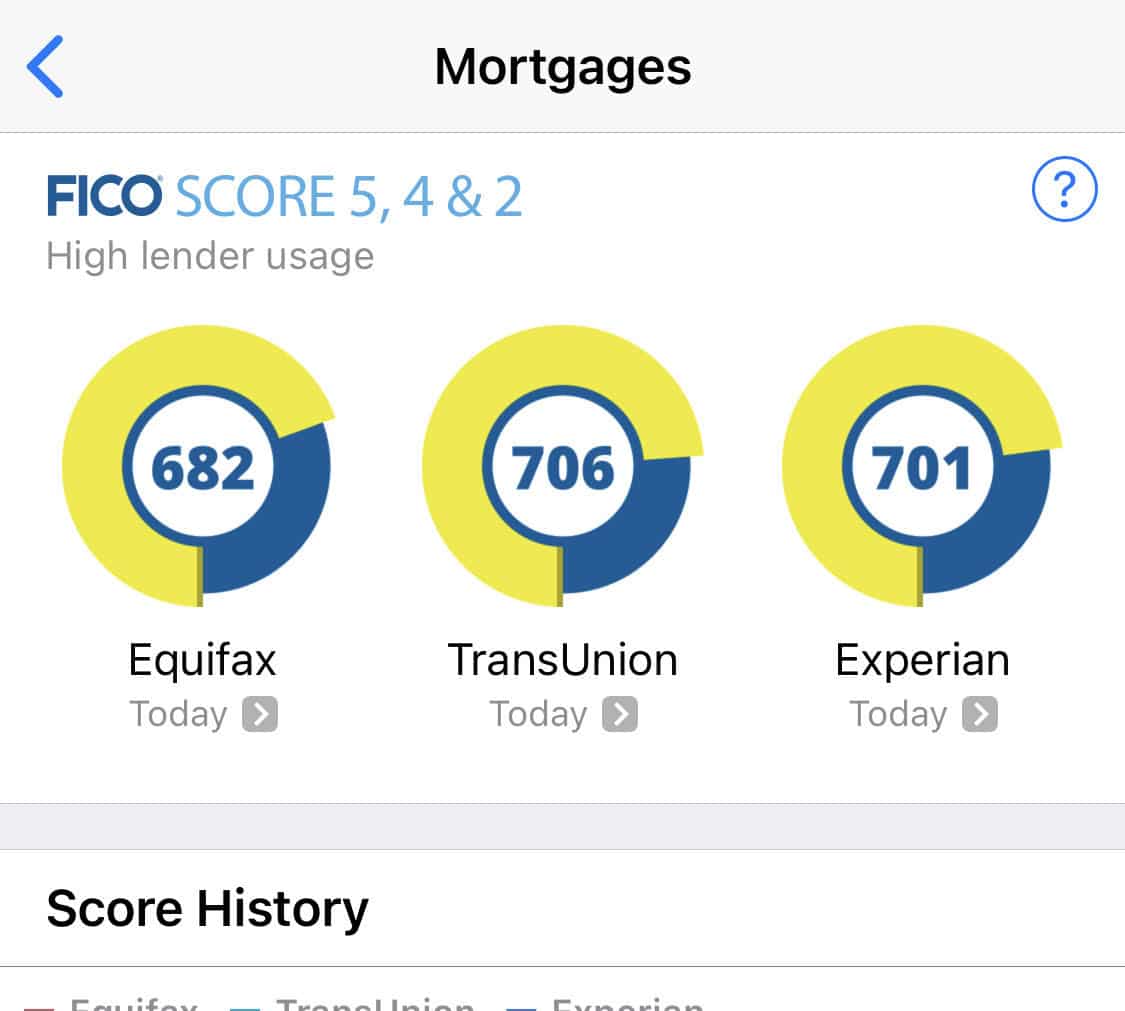

Mortgage Lenders Set Their Own Rules For Credit And Interest Rates

Thats a pretty good rough guide to the difference a higher score can make to your costs of borrowing.

But lenders dont typically use the same types of credit score ranges as FICO.

They often have narrower credit tiers that can be beneficial to borrowers, as many lenders have a tier that starts at 720.

Just getting your score up to 720 might be enough to put you in a better credit tier and earn you big savings.

Just getting your score up to 720 might be enough to put you in a better credit tier and earn you big savings.

So suppose your current score is 710 or 715. That means it might take only 5 or 10 more points to push you into a higher tier, and that could possibly save you thousands.

Should you take two or three months to work on your credit score before you apply for your mortgage?

Well, thats up to you. But if you want to, we have some tips for moving your score quickly.

Also Check: How To Remove A Default Judgement From Credit Report

What Credit Cards Can You Get With A 700 Credit Score

Although the prestige credit cards with rewards creeping up to 6 percent are probably still out of reach, a 700 score will put you into a better rewards bracket than those with a 600 score who qualify only for credit builder cards with minimal rewards, says Rossman.

Today, a 700 credit score has you in the ballpark, says Rossman. But other factors are going to tip the balance as to whether you get approved or not.

Lenders will take a hard look at your income, your debt-to-income ratio, late payments and recent debt.

Somebody who has opened a bunch of credit cards is going to look risky, says Rossman, as is somebody who has run up a bunch of debt.

Rossman said a consumer likely would qualify for a card like the Capital One Quicksilver Cash Rewards Credit Card, with 1.5 percent cash back and no annual fee, and the Citi® Double Cash Card, which offers 1 percent cash back when you spend and 1 percent back when you pay for your purchases.

Factors in your favor include your relationship with the issuing bankif you have a checking account or mortgage at that bank, for instance.

Even if you have a very good or excellent credit rating, issuers may turn you down if they see youre adding lots of new cards. For example, some credit card issuers such as Chase may turn you down if youve opened five or more credit cards in the past two years.

Getting Auto Loans With A 700 Credit Score

There is no credit score too low to get an auto loan, and youll be able to get one when your credit score is 700. However, if you want the best interest rates on the market, youll probably need to wait until you get your score a bit higher.

According to a 2020 quarterly report by Experian, people with credit scores of 661780 had average interest rates of 5.59% on their used car loans and 3.69% on new car loans, whereas people with credit scores of 781850 received average rates of 3.80% and 2.65%. 4 Although this is a relatively small difference, waiting until your score improves could still potentially save you hundreds of dollars on a car loan.

If youre set on getting an auto loan right now, then pay as large of a down payment as you can afford and consider getting prequalified or applying for a preapproval from your bank or credit union to increase your bargaining power.

Recommended Reading: What Credit Score Do You Need For A Macy’s Card

Staying The Course With Your Good Credit History

Having a Good FICO® Score makes you pretty typical among American consumers. That’s certainly not a bad thing, but with some time and effort, you can increase your score into the Very Good range or even the Exceptional range . Moving in that direction will require understanding of the behaviors that help grow your score, and those that hinder growth:

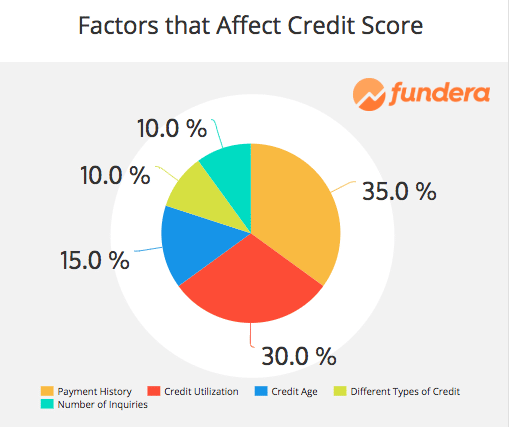

Late and missed payments are among the most significant influences on your credit scoreand they aren’t good influences. Lenders want borrowers who pay their bills on time, and statisticians predict that people who have missed payments likelier to default on debt than those who pay promptly. If you have a history of making late payments , you’ll do your credit score a big solid by kicking that habit. More than one-third of your score is influenced by the presence of late or missed payments.

Utilization rate, or usage rate, is a technical way of describing how close you are to “maxing out” your credit card accounts. You can measure utilization on an account-by-account basis by dividing each outstanding balance by the card’s spending limit, and then multiplying by 100 to get a percentage. Find your total utilization rate by adding up all the balances and dividing by the sum of all the spending limits:

| Balance | |

|---|---|

| $20,000 | 26% |

42% Individuals with a 700 FICO® Score have credit portfolios that include auto loan and 29% have a mortgage loan.

Do Pay Down Your Credit Card Debt

Your credit utilization rate, also referred to as credit utilization ratio, is a significant factor in determining your credit score.

You must keep your credit utilization below 30%. Below that 30%, further improvements will earn you only a few points. But a few points is a lot in these circumstances. By coincidence, 30% is also the proportion of your score that credit card balances influence.

Recommended Reading: How To Keep Your Credit Score High

Increase Your Credit Limit

Increasing your credit limit isnt a viable solution for everyone, but if you already have good credit, doing this can encourage your score to rise above 700. Your credit limit is a contributing factor to the utilization ratio because it represents the amount of available credit. An increased limit can help lower the ratio, improving overall credit.

What Is A Fair Credit Score Range

Fair credit score = 620- 679: Individuals with scores over 620 are considered less risky and are even more likely to be approved for credit.

In the mid-600s range, consumers become prime borrowers. This means they may qualify for higher loan amounts, higher credit limits, lower down payments and better negotiating power with loan and credit card terms. Only 15-30% of borrowers in this range become delinquent.

Read Also: How To Report Rent For Credit

The 800 Credit Score: What It Means And How To Get One

The Balance / Caitlin Rogers

Your is one of the most important numbers in your life. This three-digit number indicates your creditworthiness or the likelihood that you’ll repay the money you borrow. Credit scores generally range from 300 to 850. The higher your credit score, the more likely it is you’ll be approved for new and better credit.

As of April 2018, 21.8% of Americans had a FICO score above 800, according to data from FICO. That made a record-high percentage of people with credit scores over 800 and correlated directly to fewer blemishes on people’s credit reports, from improvements in payment history to fewer inquiries.

Since payment history makes up 35% of the credit scoring calculation, there’s a strong relationship between having a high credit score and a low number of late payments.

How To Improve Your Credit Score

Five main factors compose your credit score:

One: Payment history.

This is the most significant aspect of your score, accounting for 35 percent of the calculation. Missed or late payments on your monthly balances or outstanding credit card debt can be detrimental, especially if this behavior persists, so always pay on time. Doing so helps you avoid interest or additional penalties.

One way to ensure that you donât miss a payment due date is by setting up automatic payments or enabling notifications.

You can also add rent and utility payments to your credit report. These types of bills do not typically show up on your report, but you can submit a request to add them. If you have a healthy payment history, this can boost your score.

Two: Credit utilization.

Experts recommend keeping your utilization rate below 30 percent to avoid any problems.

Three: Length of your credit history.

How long youâve had your credit accounts makes up 15 percent of your score. This includes both new and old accounts. Banks and other lenders look at this section of your score to see if youâre able to manage credit over time in a responsible manner.

Itâs better to keep accounts open instead of closing them since youâll lose the activity associated with it, good or bad, and your credit score could drop.

Four: New credit.

Five: Credit mixes.

You May Like: How To Remove Multiple Late Payments From Credit Report

Good Range Credit Scores By Income

People who make at least $50K per year are significantly more likely to have a credit score of 700 or above. And people who make between $75K and $100K per year are in the ideal range for a score that begins with a 7 or an 8. But it’s important to note that it is possible to have a score of 700 or above even if you earn less money, or to have a much lower score even if you make a lot more money. It all depends on spending within your means.

Forty percent of consumers have credit scores that are lower than 700.

What Is A Bad Credit Score Range

Bad credit score = 300 549: It is generally accepted that credit scores below 550 are going to result in a rejection of credit every time. If your score has fallen into this range, improving your score is going to take some work.

Filing for bankruptcy can bring a score down to this level. Statistically, borrowers with scores this low are delinquent approximately 75% of the time. But if you continue to make your payments on time, your score should improve. There are certain types of loans, like home loans, that are hard to get with a score in this range, but there are still options for getting a mortgage with bad credit.

Also Check: Does Paying Off Collections Improve Credit Score

Mortgage Rates For Good Credit

Your credit scores are just one factor to consider when youre looking to get a great mortgage rate. Having good credit can help you get a better rate, but so can factors such as

- The type of mortgage loan youre looking for

- The total cost of your home

- Your debt-to-income ratio

- The size of your down payment

The average credit score it takes to buy a house can also vary greatly by location.

Once you have a general picture of your overall credit as well as how much house you can afford and the type of loan you want its a good idea to shop around. This can give you a better idea of what different lenders could offer you.

Compare your current mortgage rates on Credit Karma to learn more.

Learn More About Your Credit Score

A 700 FICO® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Read Also: How To Boost Your Credit Score

Mortgage Rates For Excellent Credit

Having excellent credit is one of the first steps to getting a great mortgage rate. But there are other factors at play here too, like the total cost of your home and your debt-to-income ratio.

Once youve got a sense of how much house you can afford and the type of mortgage you want, its time to shop around to understand the rates that might be available to you. Getting a mortgage preapproval can help you understand how much you can borrow and make your offer more competitive.

Compare current mortgage rates on Credit Karma to explore your options.