Derogatory Mark: Missed Payments

If you are at least 30 days late, expect a derogatory mark on your credit report. Missed payments typically stay on your credit reports for 7½ years from the date the account was first reported late. The later the payment goes moving to 60 days late, 90 days late and so on the greater the damage to your credit scores.

What to do: Pay your bill as soon as you can afford to. If youve never or rarely been late before, you might be able to get the creditor to drop the late fee. Call the customer service number, explain your oversight and ask if the fee can be removed. You can also write a goodwill letter. If paying the bill is not an option, call your creditor and let them know about your financial situation to see if you can work out a hardship plan.

The negative effect on your credit scores will fade over time. Try to stay on top of all your; payments so positive information in your credit reports dilutes the effect of the missed payment.

Negative Information From Late Payments

- Late Payments: You must be at least 30 days late on a payment for it to show up on your credit report. Information about payments that are late by 30 days or more will remain on your credit file for 7 years from the date creditors report them to the credit bureaus. People often get concerned that a payment thats just a few days late will be noted on their credit reports, but thats not the case.

- Charged-Off Account: When you are 120 days behind on a loan payment or 180 days late on a credit card, your lender will be required to write the debt off its books , and your account will be classified as Not Paid as Agreed on your credit reports. This information will remain on file for 7 years, starting from when the delinquency that led to the charge-off is first reported to the credit bureaus.

For example, if your account was reported as late to the credit bureaus in September 2020 and it charged-off in December 2020, the late payments and charge-off record would stay on your credit report until September 2027.

You can read more in our Q&A about how long late payments stay on your credit report.

Why Is It Important To Know When Credit Companies Report

Some confusion can be cleared up by knowing when credit-card companies report to the CRAs. Its usually at your statement closing date.

Dont be alarmed if you check your credit report and see a balance when you know your card is paid off in full each month. At the end of your billing cycle, theres a great fluctuation, sometimes causing as much as a 30% shift in the credit score for most consumers. But when the payment is accounted for, it shifts back into form.

Billing cycles can vary. Some credit-card companies might do it at mid-month and others at the end of the month.

Credit-card companies probably are providing a snapshot of your current balance when they report to the CRAs. If this is a concern, keep track of your spending by your statement closing date. Making a payment before your statement closing date will keep the balance lower when its reported, helping your overall credit.

This also helps your credit utilization rate, an important factor when it comes to your credit score. Your credit utilization rate is your total credit-card balance divided by your total credit-card limit. Experts advise consumers to keep that ratio under 30%. Paying down your revolving debt and carrying a lower balance is a possible way to help your credit score, although it is influenced by several factors.

The bottom line is if you pay your bills on time and you keep a low credit-card balance, your credit score will take care of itself.

All that being said, here are some tricks:

Don’t Miss: Speedy Cash Credit Check

Hire A Professional To Remove Late Payments

To make this process easier, you can work with that will help you to challenge inaccuracies on your credit report. Credit repair professionals have the expertise, knowledge and, most importantly, the time available to help you through the dispute process from beginning to end.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

Recommended Reading: What Credit Report Does Comenity Bank Pull

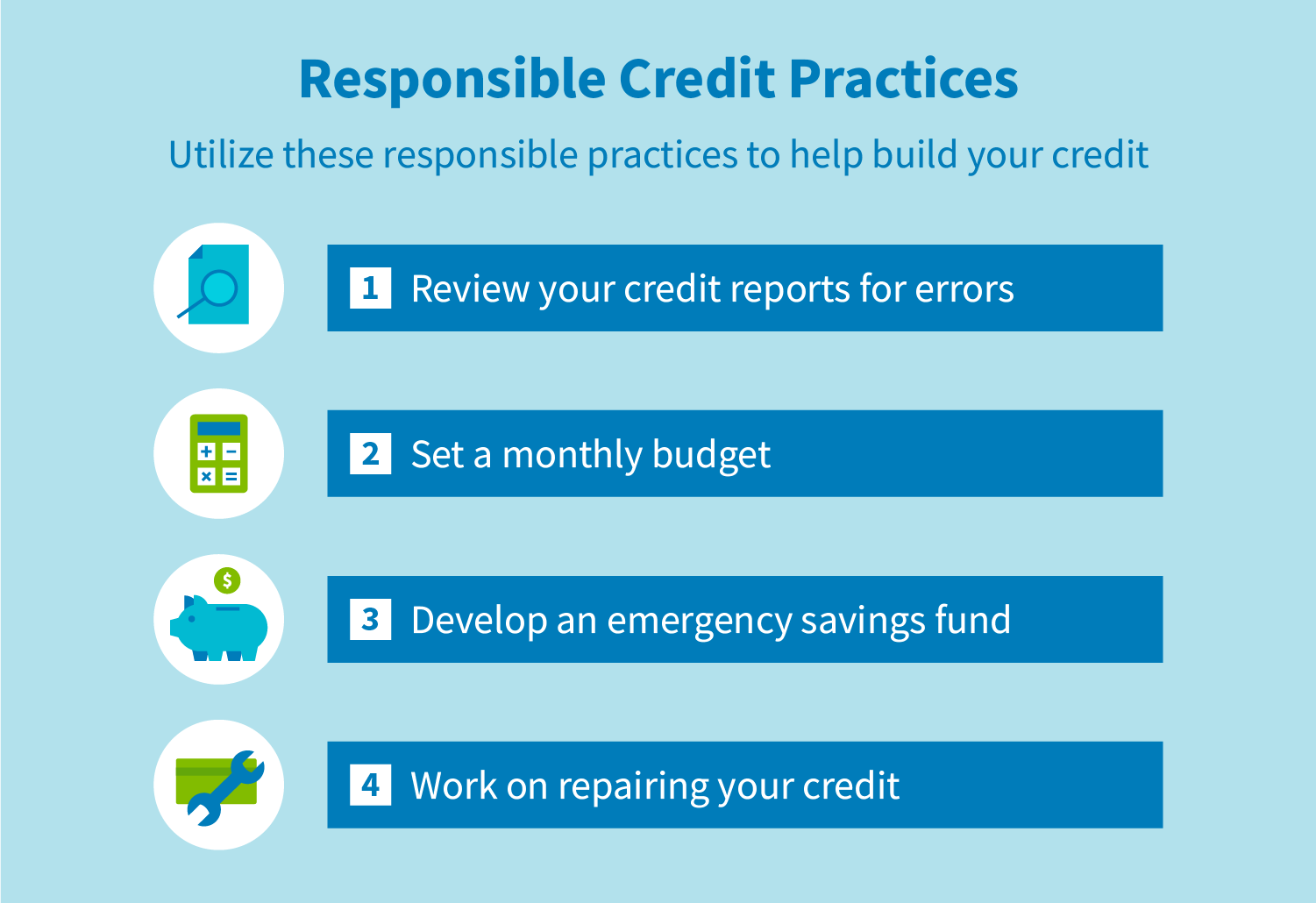

Tips To Overcome Derogatory Credit

Your credit score benefits from having positive information, so your score may start improving long before the derogatory items are removed from your credit report if you’re paying other accounts on time.

Your recent credit history affects your credit more than old derogatory credit items, so having open accounts with on-time payments will help improve your credit score.

You may not be able to have excellent credit until the derogatory items are completely removed from your credit report, but with good credit, youll still be able to qualify for many credit cards and loans.

Does Debt Settlement Negatively Impact My Credit

When you settle debt, it means your lender has agreed to take less than you actually owe. This is a bad sign for future lenders. To them, it looks like youre risky to lend to because they may not get all of their money back. This is why its a negative item on your , even though it seems positive because you got out of debt.

Read Also: How To Remove Inquiries Off Credit

What Is The Statute Of Limitations In Canada

The statutes of limitations for collection actions bars a creditor, or collection agency, from suing you after a specific time limit. After this times expiration, it is much harderand often impossiblefor a creditor to collect money from a debtor for an unpaid debt.

Canadian law starts with a limitation period of six years. However, each province and territory in Canada has its own statute of limitations. Each provincial limitation period as of January 2020 is as follows:

- Alberta: 2 years

- Saskatchewan: 2 years

- Yukon: 6 years

Limitation periods typically apply to unsecured debts. An old credit card debt, cell phone bill or gym membership account, for example, is subject to the limitation period. However, you cannot use provincial limitation laws to avoid a court judgment for:

- secured debt

- government debt, including student loans and tax debts

- non-dischargeable debts such as child and spousal support, fines and obligations arising out of fraud.

Provincial limitations laws do not apply to the Canada Revenue Agency. Generally, CRA collections has ten years to commence legal action for most tax debts and government student debt.

How Long Will Derogatory Credit Last

Derogatory credit can follow you around for a long time. Some types of derogatory informationlike a bankruptcycan remain on your credit report for up to 10 years.

Most other derogatory informationlate payments and debt collection accountswill only remain on your credit report for seven years. Typically, these items will automatically fall off your credit report once theyre past the credit reporting time limit.

Only accurate, timely, and complete information can be included on your credit report. You can dispute an error or outdated derogatory item with the credit bureaus to have it removed from your credit report.

In some cases, having negative information removed can increase your credit score, but it depends on the rest of the information on your credit report.

Recommended Reading: Removing Hard Inquiries From Your Credit Report

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

How Discharged Debts Appear On Your Credit Report

If your debts are legally gone, how do they remain on your credit report?; Your former creditor just doesnt bother to update the report.

Some of them, and I kid you not, some of them will be so out of it that they will keep automatically pulling your credit report every month just like you still had an open account with them!

Everyone thinks it wont happen to them, but it does.; It happens to thousands and thousands of people every year many of whom become my clients.

Also Check: Is 524 A Good Credit Score

Hard Inquiry Removal Letter Template

Send your message through certified mail rather than ordinary postal delivery to guarantee a quicker response and that it gets received.

Make the message seem more personal than this boilerplate letter by using your own words. Keep in mind that this is only an example. Your letter should look something like this:

Sample Credit Query Removal Letter

RE: To inquire about the legitimacy and legality of an unknown credit inquiry

Dear

I reviewed my personal credit report, which I obtained from your company on , and discovered an illegal credit inquiry.

I contacted the originator of the inquiry and requested that they delete their credit inquiry off my credit report.

I am requesting that you look into the inquiry on my credit report to ascertain who authorized it. If, upon completion of your investigation, you determine that my complaint is accurate, please delete the query and give me an updated copy of my credit report to the address stated above.

If you determine that the query mentioned above is legitimate, please give me a summary of the processes followed throughout your investigation within 15 business days of completion.

I appreciate your help with this issue.

Derogatory Mark: Account Charge

If you dont or cannot pay your debt as agreed, your lender may eventually;charge the account off. The charge-off will appear on your credit reports for seven years.

What to do: Try to pay off the debt or negotiate a settlement. While this wont get the charge-off;removed from your credit reports, it’ll remove the risk;that youll be sued over the debt.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Do I Still Have To Pay

Although your debt comes with both a statute of limitations and a credit report time limit, you should still plan on paying. Even if your debt becomes time-barred, you are still responsible for paying it off.;

Not making payments can have a drastically negative effect on your financial well-being. The longer you wait to make payments, the more you may be charged in interest and late fees.;

If you havent made payments in a while or are struggling to make payments, there are options available to help make your debts more manageable. These include:;

If you choose to stop making debt payments, your collectors will continue to attempt to contact you. To stop these communications, the Fair Debt Collection Practices Ace permits you to send the collections agency a cease and desist letter. Once they receive the letter, the collections agency has a final chance to contact you and inform you of their next steps of action.;

Need to know which debt solution is right for you? Have a quick, free conversation with us today so we can point you in the right direction!

How Long Can A Creditor Pursue A Debt In Canada

The straight answer is that a collection agency can try to collect on a debt forever, but they only have a short window to pursue you legally to recover any money. Specifically, a limitation period sets a time limit during which a creditor can commence legal action by filing a claim with the court to collect on a debt.

Canadas base limitation period is six years; however, many provinces have lowered that time limit to 2 years.

Is it legal for a debt collector to pursue a 20-year-old debt? Unfortunately, the answer is yes. A collection agency or creditor can try to collect an outstanding debt in perpetuity; however, through provincial statutes of limitation, you have a defense against any legal action once the limitation period has expired.

This means that even though a collection agency can continue to call and try to collect the debt, any legal action they might suggest after the time limit is up is an empty threat. Moreover, you have the right to file a complaint with the consumer protection office if you feel that the debt collectors are harassing you.

Also Check: Syncb/ppc Closed

Final Thoughts: How To Remove A Collection From Your Credit Report

Your best bet is to pay your debts on time and not end up in collections. If you do, keep careful track of every detail. One mistake and you can dispute the account, getting it removed from your credit report. This will increase your credit score.

If its valid and you can pay it, consider negotiations to delete the trade line from your report or ask for a goodwill deletion.

If none of those work, know that paying the debt makes you look better to future creditors even if the collection still exists on your report.

How Long Late Payments Stay On Your Credit Report

Late payments typically stay on your credit report for up to seven years and can negatively impact your credit score as long as they remain in your credit history. Thats seven years of struggling to get new credit or facing higher interest rates. However, there are things that you can do to remove negative late payments from your credit report.

Don’t Miss: Is 779 A Good Credit Score

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

Will A Debt Collection Agency Sue You To Recover The Debt

We now know that if your debt is too old because its past the limitations period, a debt collector no longer has the legal right to sue even though they can continue to call.

But if the limitation period has not expired, will they sue?

Suing debtors costs money for lawyers and court fees. It also involves a lot of time and paperwork. A debt collector will have to consider the chances of succeeding in court and how much money they expect to recover against these costs. In most cases, if your debts are small, or if you have no income to garnishee or assets to seize, a debt collector wont pursue legal action.

And remember, if a creditor sues you after the limitation period has passed, you have the right to file a statement of defense and argue that the debt is time-barred.

Also Check: What Credit Report Does Comenity Bank Pull

Restarting Your Statute Of Limitations Countdown

One of the dangers of waiting for the Statute of Limitations to expire is restarting the clock. It can be done accidentally and can cost you years of waiting and built-up interest and fees.;

The statute of limitations begins on the date of the last activity on your account. This includes:;

- Making payments

- Entering a payment or settlement plan

- Acknowledging that the debt is yours;

- Using the account

You may be able to find the date of the last activity on your account on your . Be sure to check your report before contacting any collections agency or acknowledging that the debt is yours.;

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

You May Like: Paypal Credit Hard Pull

Become An Authorized User

You may want to consider talking to a close friend or family member about the possibility of adding you as an authorized user to one of their longer established credit cards. This can help you gain some positive credit history that you lost. But you may not want to do that until all your settlements are complete.

Related article: Can being an authorized user on someone elses credit card help build your credit?

How long it takes to rebuild your credit after debt settlement depends on a number of factors. Theres no quick fix, but settling your debts wont hurt your credit nearly as much as not paying them at all with the added bonus of lifting the weight of the debt-related stress youve likely been experiencing.