Write A Goodwill Deletion Letter

A goodwill deletion is a request sent to your original creditor or a debt collector to remove the negative item out of goodwill. This option is best for accounts that youve already paid. You might be able to guess how youre going to request thisanother letter.

Write to the collector explaining your situation. Include the reason why youd like the collection removed. Its not a guarantee that this will help, but it doesnt hurt to ask, especially if youre about to make a big financial move like applying for a mortgage.

How Long Does A Collection Entry Remain On Your Credit Bureau

Regardless of whether you paid the collection amount owing or not, the collection entry will stay on your credit report for seven years. As a result of this, for seven years, the collection entry will impact your chances of applying for new credit.

The unfortunate part is that even if they approve your credit, youre almost always going to pay a higher interest rate. As the collection entry gets older, it will affect your credit score less and less.

Paid Or Not Paid Collections

A common assumption people often make is assuming that paying off a collection will instantly remove collections from your credit bureau.

Its important to remember that a collection entry wont disappear from your credit bureau even if you settle it and pay it off.

That means when a lender, whether its a credit card company or the bank, sees a collection entry on your credit bureau, it will likely impact their decision of whether to lend to you or not.

Even if your credit account application is approved, your interest rate will likely be higher than someone without a collection entry on their credit report. That being said, its certainly worthwhile to take the necessary steps to get rid of a collection entry on your credit report.

When theres a collection entry on your credit report, chances are pretty good that there are some late payments associated with it. This is likely due to the fact that you were late on your payments.

There is often a separate entry for this debt, apart from the collection entry. There are steps you can take to remove the late payments from your credit report too.

Also Check: Where To Get My Credit Report

Debts That Dont Require Pay For Delete To Remove Credit Damage

Its definitely worth noting that some collection accounts can drop off your credit report without pay for delete. If you meet certain payment requirements for these debts, the credit bureaus will remove them from your report. You wont have to wait seven years for them to stop affecting your credit score.

Can You Remove A Collection Entry From Your Report

If you have a collection entry, the simple answer is yes. Its possible to remove it in most cases. And thats something youll want to do. A collection entry appearing on your credit bureau can hurt your credit score and, in some cases, stop you from getting car loans and mortgages.

Before we discuss how to remove a collection entry, it helps to talk about what a collection entry actually means, how much it can lower your credit score and how long it can remain on your credit report if you dont do anything about it.

Can you use some help with your finances? Learn about credit counselling today.

Don’t Miss: What Is A Good Experian Credit Score

How Do I Get A Paid Collection Removed

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

What Is A Pay For Delete Letter

A borrower can initiate pay for delete by calling the collection agency or submitting a formal request letterknown as a pay for delete letter. When submitting a pay for delete letter, clearly state your offer to repay all or part of the debt in exchange for the collection agency removing the account from your credit report. The collection agency can then decide whether to remove the account as requested.

Unfortunately, a pay for delete letter doesnt carry any legal weight. This means that collection agencies can take your payment and still refuse to have the account removed from your credit report. For that reason, you should request written confirmation from the collection agency that they are willing to have the account deleted before you send payment.

Don’t Miss: Is 671 A Good Credit Score

How Many Points Will My Credit Score Increase When I Pay Off Collections

A question many folks have about collections is does paying off collections improve credit score? Its hard to say exactly how many points clearing a collection from your credit report will do. If the collection in question is the only one on your credit, then it wont take as long as someone who has multiple debts that have gone into collection.

Remember, payment history is around 35% of your FICO credit score. Debt collections have a large impact on your credit score because of this. Lenders are less likely to loan money for things like mortgages and cars with someone who doesnt pay their debts on time.

So, the answer to the question does collections affect credit score? is yes!

However, the FICO 9 scoring system no longer reports paid debt collection accounts on their credit report. If you can pay off a debt collection and have it removed from your credit score, you can start increasing your credit score much faster than before.

Offer Pay For Removal

Pay for removal is when you request that the debt collector removes a collection entry from your credit bureau for payment. Theres nothing that requires the debt collector to agree to this. Whether a debt collector agrees to this usually depends on the debts age and the amount, and your previous account history.

Before you request this, make sure youre aware that by offering pay for removal, youre agreeing to pay the full amount owing to the debt collector, plus any interest and fees. If you were in the position to do this, you probably wouldnt have ended up in collections in the first place, so this isnt always feasible.

Recommended Reading: How To Improve Your Credit Report

Asking A Creditor To Remove A Paid Account From Your Credit Report

If the collections activity listed on your credit report is accurate, you can ask the debt collection agency to remove the paid-off item from your credit report. If they agree to remove this item, it will be removed. If they will not remove it, then your only alternative is to keep the debt on your credit report until the statute of limitations has been satisfied. If you havenât yet paid your debt, you can try to get the collections agency to agree to remove the item once it is paid off. If youâve already paid the debt, you donât have much bargaining power but you can ask your creditor to take this action on your behalf as a gesture of goodwill.

The simplest and most direct method of getting a paid collections account removed from your credit report is to simply write your creditor a goodwill letter asking them to remove this account from your credit history. This may or may not work, depending most likely upon the size of the account and when you paid it off. But in many cases, as outlined above, the creditor will not grant this request because of the contracts that they have with the credit bureaus.

You may be able to get some of your debts temporarily frozen by the credit bureaus, but this will not be permanent. If they are able to validate a specific debt, then it will quickly reappear on your credit report. The usual waiting period is 30 days, but after that, your accounts will most likely reappear on your credit report.

Table : Distribution Across Census Tract Characteristics Of All Ccp Consumers Of Ccp Consumers With Medical Collections In March 2022 And Ccp Consumers Likely To Have Medical Collections Removed In 2022/2023

|

Consumer Census Tract is |

|

|---|---|

|

11.7 |

13.0 |

Turning to the second part of Table 2, we see that although consumers in the CCP overall are distributed roughly evenly between the median income categories, with about a quarter of all consumers in each, reported medical collections are concentrated disproportionately among consumers who reside in census tracts with lower median income. For instance, while 13 percent of consumers in the CCP reside in a census tract with median income below $40,000, more than 21 percent of consumers with medical collection tradelines reside in those census tracts. At the same time, consumers whose medical collections will likely all be removed by the Medical Collections Reporting Change are slightly more likely to reside in higher income census tracts compared to all consumers with a medical collection. Residents of census tracts with median income above $90,000 represent 11.6 percent of consumers with medical collections but 13 percent of consumers who are likely to have all their medical collections removed by the Medical Collections Reporting Change.

Also Check: What Is A Vantage Credit Score

How Long Does A Collection Stay On Your Credit Report

Most negative items will fall off reports after 7 years, including:

- Collection accounts

*Chapter 7 Bankruptcies have a shelf life of 10 years from the date of filing.

Because lenders charge off accounts after 180 days, collections accounts should be removed in 7 years and 180 days from the first date the account became overdue.

A collections account will have less impact on scores the more it ages. For instance, a 5-year collections record will not have the same impact as a 6-month old record.

Major credit reporting bureaus also ask customers to ensure that collections accounts dont stay on reports for more than seven years. You can always review your credit report and submit a dispute to have errors removed.

When you pay off collections, how long should you wait until its reflected in the score? If the lender uses newer scoring models that dont consider paid collections, you should see an improvement in 30 days. Alternatively, you can request rapid rescoring. It allows creditors to report to bureaus ahead of the standard 30-day schedule.

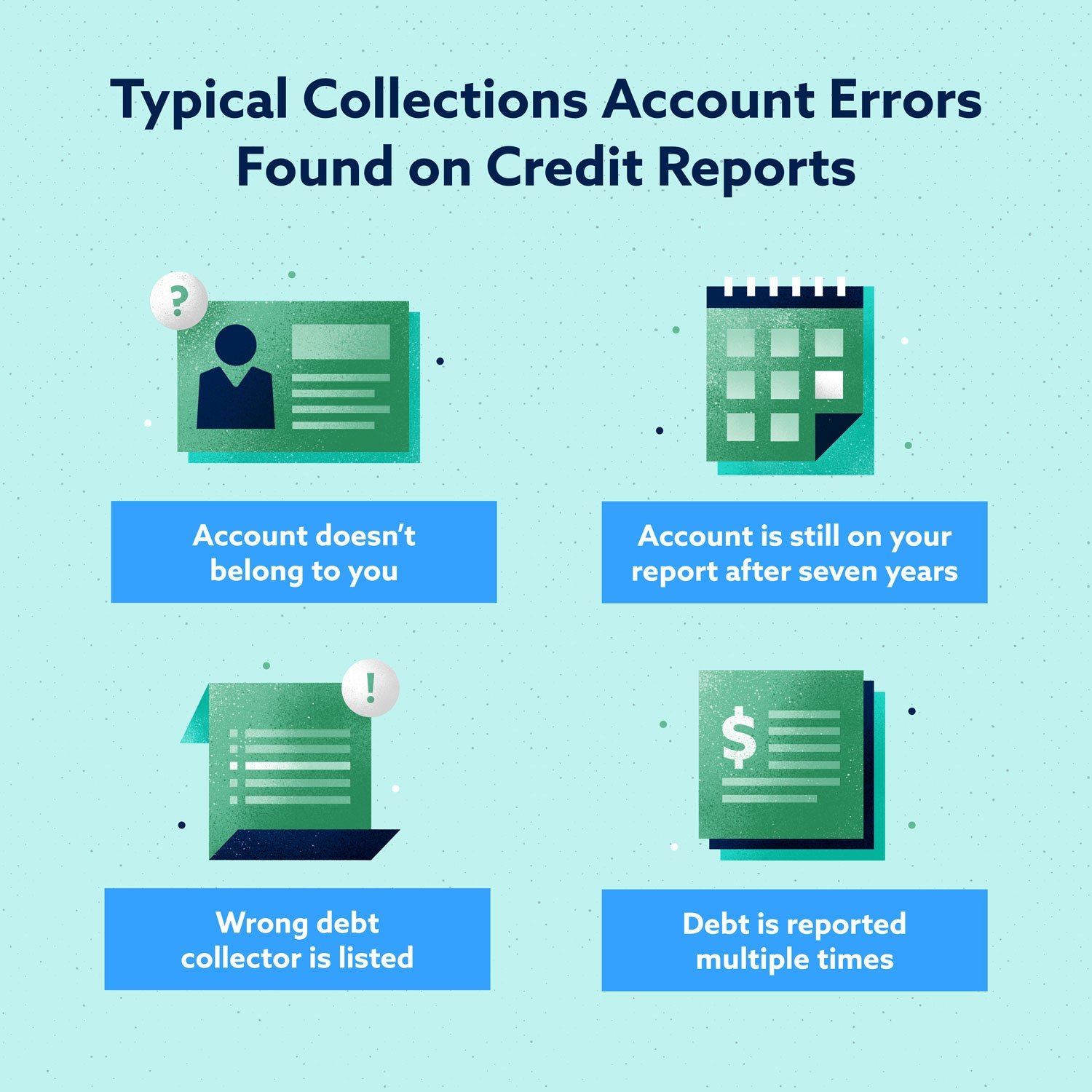

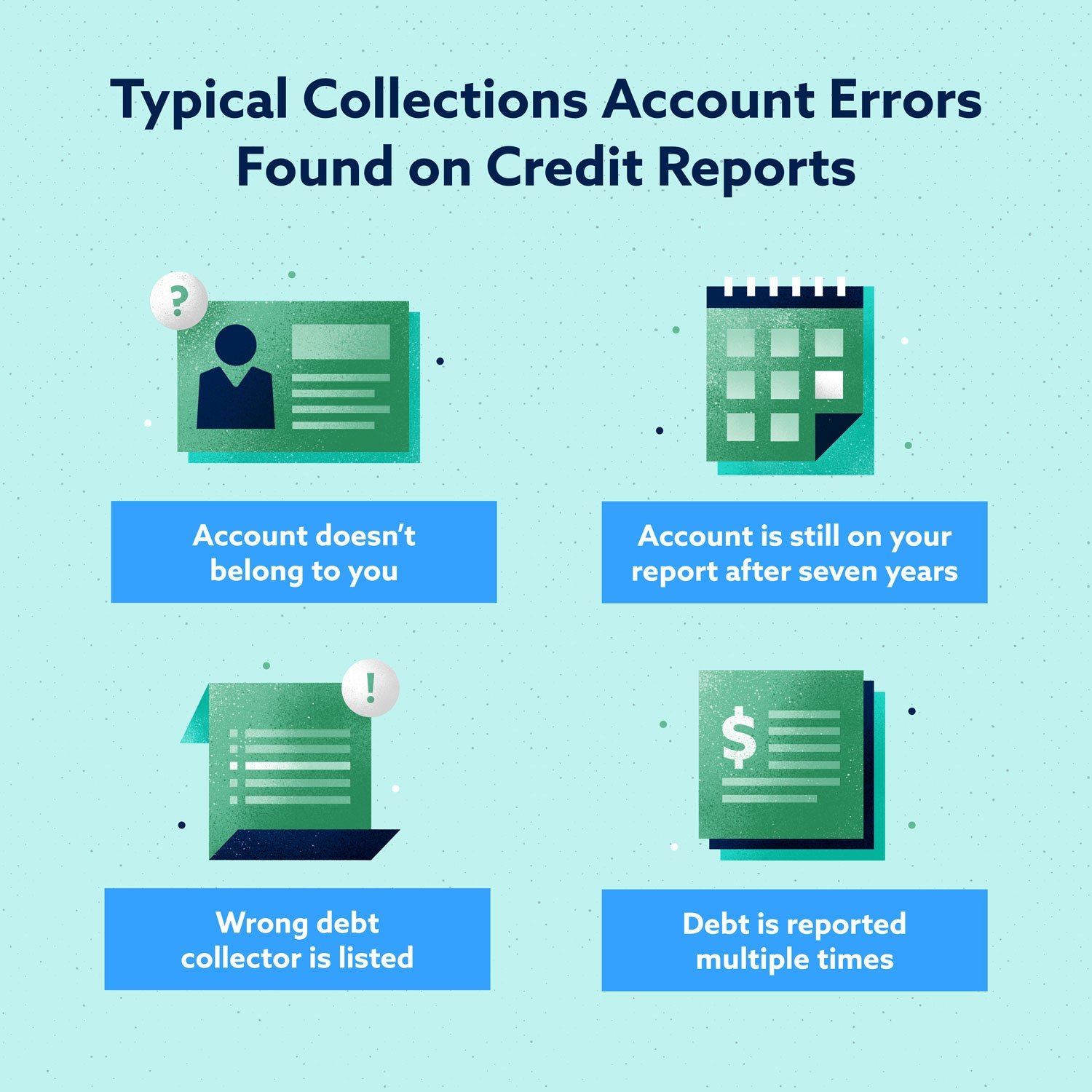

Dispute When Collectors Sell

Collection accounts often change hands. Debts are assigned and sold to other collectors, so theres a strong possibility the collection agency listed on your credit report isnt the agency that’s currently collecting on the debt. When this happens, you can have the older collection removed by disputing it with the credit bureaus. If the debt collector fails to respond to the dispute, the credit bureau should remove the account since it has not been verified.

Read Also: Is 500 A Good Credit Score

How Long Can You Legally Be Chased For A Debt

If you do not pay the debt at all, the law sets a limit on how long a debt collector can chase you. If you do not make any payment to your creditor for six years or acknowledge the debt in writing then the debt becomes ‘statute barred’. This means that your creditors cannot legally pursue the debt through the courts.

How Do Collections Affect Your Credit

When a creditor sells a debt to a third-party lender, a collection account appears in the public records section of your credit report. This account remains on your for seven years from the date the debt first became delinquent. So, once you settle a debt to get rid of it. The credit notation about that account sticks around for another seven years after that.

Collection accounts are bad for your credit history, which is the biggest factor used to calculate your credit score. As a result, collection accounts can significantly drag down your credit score.

Find solutions to settle the debt and stop harassment.

Also Check: How To Get Rid Of Bankruptcy On Credit Report

Does Debt Collections Affect Credit Score

Do you know how making late payments on debt can harm your credit score? Having a debt go into collections is worse.

When a debt goes into collections, it means that the original lender has given up on trying to collect payment from the borrower. At this point, they pass the burden off to another agency that has the resources or skills to help a borrower start paying back that debt.

However, passing this debt off to a collection agency shows other lenders that you have a track record of not paying back your debts for a long time. For lenders, your payment history is an important consideration. That fact is why credit score calculations all make payment history such a large part of their evaluation and total scoring system.

Having a debt go into collections also means that your credit score can take longer to recover. Collections stay on your report until you pay back the debt. Depending on the size of the debt, this could take years to pay back the debt and have it removed from your credit report.

What Are Other Ways To Improve Your Credit Score

You canbuild healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

Also Check: Will Closing A Credit Card Hurt My Credit Score

Wait Until It Falls Off

When the debt in question is legitimate and you cant convince the debt collector to delete it from your report, your only remaining option is to wait. After seven years from the date the account first became delinquent, the collection should fall off of your credit report.

Although this means the collection will continue to impact your credit score its impact will lessen as time passes.

Will Collections Go Away After Paying

A paid collection account will not disappear from your credit history just because you’ve paid it off. It will stay there until the statute of limitations has passed, which is at least seven years in most cases. You cannot have it removed by contacting the credit bureaus and requesting it be removed.

Read Also: Who Can See My Credit Report

Write A Goodwill Letter

If you have paid collection accounts and still have the remaining evidence on your credit report, try writing a goodwill letter. A goodwill letter represents good faith for ones regular, on-time payments. The letter can be written to request that the collection agency remove paid collections and explain your circumstances. Explain how your credit score increase is desperately needed, why your credit score took a hit, and the measures you have taken to improve your credit score.

Dispute After 7 Years

According to the Fair Credit Reporting Act , past-due accounts can only remain on your credit report for seven years from the first date of delinquency. Sneaky collectors often try to re-age a debt, making it look like the account became delinquent later than it did. This re-aging keeps the debt on your credit report longer.

Don’t Miss: What Credit Report Does Capital One Use

What Not To Do When Ars Collections Calls

Dealing with debt collectors can be a stressful experience. Theyre often aggressive and pushy, and they may even threaten legal action if you dont pay up.

Here are four things you should never do when a debt collector calls.

How Does Paying Off A Collection Account Affect Your Credit Report

With most collection accounts, if you pay them in full, their impact on your credit doesnt go away immediately. Youll usually have to wait until they reach the end of their seven-year reporting window. The good news is that the older the information is, the less impact it should have on your credit.

While paying off collections may not generally improve your credit scoresee below for an exception to thisthere are still a few ways doing so can benefit you:

- You can avoid a debt collection lawsuit for unpaid medical or credit card bills.

- You can dodge interest fees from debt collectors. Debt collectors constantly buy and sell accounts and can continue to charge you interest and fees on purchased accounts.

- It will show up on your credit report as paid in full or settled. This could positively influence lenders who might look beyond your score to your credit history. A person who pays back a severely past due account shows more financial responsibility than someone who never paid it.

- You can eventually benefit from one of the newer FICO® Score models. FICO 9 is rolling out very slowly, but eventually it should be used by most lenders. This model gives less weight to medical bills and ignores paid accounts in collections entirely.

Don’t Miss: How To Increase Mortgage Credit Score