Personal Loans With A 592 Credit Score

You might find it challenging to get approved for a personal loan with poor credit scores.

Given your current scores, you might not have the luxury of shopping for the best personal loans with the lowest interest rates. Instead, you may have to settle for a personal loan with a high interest rate not to mention other fees, such as an origination fee.

This could make a personal loan seem very unappealing to you, especially if your intention with the loan is to consolidate high-interest credit card debt. The APR on your personal loan could be just as high, if not higher, than the interest rate youre currently paying on your credit cards.

On the other hand, if your goal with a personal loan is to finance a major purchase, you should ask yourself whether its something you need right now. If it can wait until after you spend some time building credit, you may qualify for a personal loan with a lower APR and better terms later down the line.

If youre really in a pinch for cash and youre having a difficult time finding a personal loan you qualify for, you might be considering a payday loan. While everyones situation is unique, you should generally be wary of these short-term loans that come saddled with high fees and interest rates. They can quickly snowball into a cycle of debt thats even harder to climb out from.

Personal Loans For Fair Or Bad Credit

Some lenders do approve people with bad . In such cases, the lenders often look at alternative factors such as your free cash flow to approve you for the loan.

However, such loans often come in low amounts and have higher interest rates. Interest rates on loans for borrowers with bad credit may be as high as 36%.

Also, when you already have a low credit score, applying for a loan may drive it even lower. So, it is best to focus on building your credit score and pre-qualifying before you send in a loan application.

To build your credit, you should generally focus on making payments towards your current debts on time. You can meet with a certified financial professional to get advice on how to build credit in your particular situation.

If you are taking out a loan with fair credit, you will also face higher interest rates than those with good credit. Try to pay back your loan as quickly as possible to avoid paying too much interest.

When you have bad credit, you dont just risk paying a higher interest rate. You may also have to pay higher origination and pay-off fees. If you still want to take a loan on bad credit, choose a company that does not charge an early pay-off fee. One such company is Upstart.

Instead of taking a loan on bad or fair credit, you can consider the following alternatives:

-

Get Your Loan in 3 Easy Steps Request up to $2,500 in minutes

Please enter your ZIP Code.

How Long Does It Take To Get A 592 Credit Score

It depends where you started out.

If you have poor credit starting out, this score may be easy to reach, once you remove any bad marks on your credit. Three collection accounts, for example, could drop a 800 credit score well below 600.

If you started out with weak credit , a single negative mark could lower you well below the 500s.

Read Also: What Is A Business Credit Score

Usda Loan With 592 Credit Score

The minimum credit score requirement for a USDA loan is now a 640 . Fortunately, you can still get approved for a USDA loan with a 592 credit score, but it will require a manual approval by an underwriter. In order to get approved with a 592 credit score, expect to have strong compensating factors, such as conservative use of credit, 2 months mortgage payments in cash reserves , a low debt-to-income ratio, and/or long job history.

Other requirements for USDA loans are that you purchase a property in an eligible area. USDA loans are only available in rural areas, which includes the outer areas of major cities. You can not get a USDA loan in cities or larger towns .

You also will need to show 2 years of consistent employment, and provide the necessary income documentation .

Why Your Credit Score Matters

There are real benefits to staying on top of your credit score.

Thats because a strong credit score can translate into real perks, like access to a wider range of products and services including loans, credit cards and mortgages. You could also enjoy better interest rates and more generous credit limits. Meanwhile, if your credit score isnt quite where you want it to be, knowing the score is the first step to improving it.

Either way, it pays to know your credit score. Its your financial footprint the way companies decide how financially reliable you are. A higher credit score means lenders see you as lower risk.

Don’t Miss: Why Does Credit Score Go Down

Is 592 Credit Score Good Or Bad

Short Answer: If you have a 592 Credit Score, then 592 is a Poor Credit Score! Most of the applications that have 592 Credit Score are usually rejected by lenders and insurers. If your credit score is 592, it will undoubtedly be very difficult for you to obtain credit even though you try without a co-signer or large down payment. Luckily if your loan got approved with this score, it will most definitely be a high interest/ credit line.

This grand score is on account of several late or pending payments, numerous defaults on products from different lenders. This score can also be due to bankruptcy which is a scar that will remain on your record for a whole decade. Getting a new credit is near to a miracle for such individuals. It would be advisable for them to look up a professional finical advisor that will aid them in repairing their credit.

What Makes Up Your Credit Score

The FICO credit scoring model interprets the information found in your credit report. Some parts of your credit history are more important than others and will carry more weight on your overall score.

Your FICO score is made up of the following:

- Payment history: 35% of your total score

- Total amounts owed: 30% of your total score

- Length of credit history: 15% of your total score

- New credit: 10% of your total score

- Type of credit in use: 10% of your total score

Based on this formula, the largest part of your credit score is derived from your payment history and the amount of debt you carry versus the amount of credit available to you. These two elements account for 65% of your FICO score.

To put yourself in the best position to qualify for a mortgage, focus on these areas first. Pay your bills on time whenever possible, and try to reduce your credit utilization ratio.

Your credit utilization ratio compares the total amount of credit available to you against your current balances try to keep it under 30%.

This will improve your FICO scores and mortgage loan terms measurably.

Also Check: How Long Will Debt Stay On Credit Report

Get A Secured Credit Card

As mention earlier, getting a secured credit card is a great way to establish credit. Secured credit cards work much the same as unsecured credit cards. The only difference is they require a security deposit that also acts as your credit limit. The credit card issuer will keep your deposit if you stop making the minimum payment or cant pay your credit card balance.

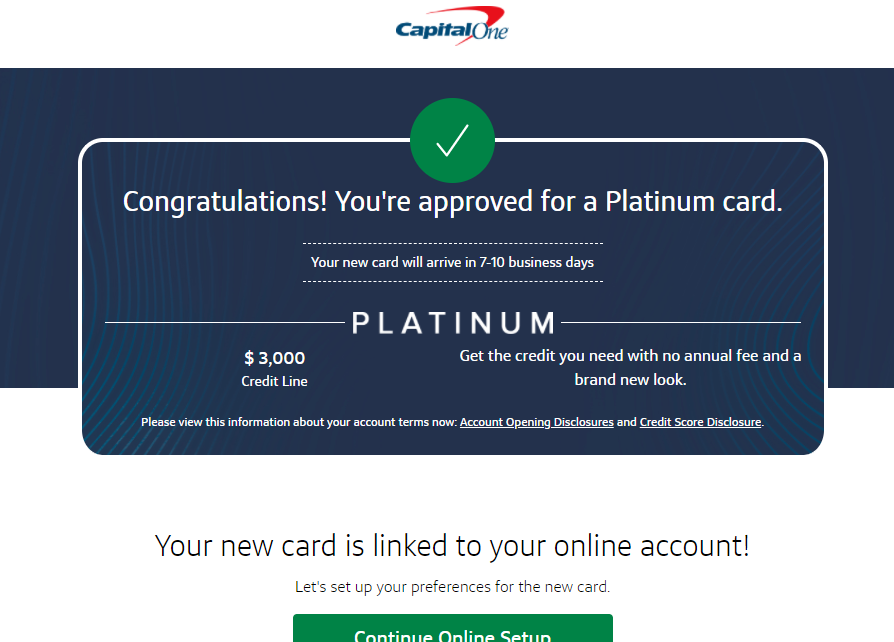

Credit Score Credit Card

By Sanjida Mollick – 6 September 2022

592 credit score credit card. Are you looking for 592 credit score credit card? Calculator with convert Payment Update 592 credit score credit card.

Table Of Content:

Your score falls within the range of scores, from 580 to 669, considered Fair. A 592 FICO® Score is below the average credit score.

Read Also: How Long After Paying Off Debt Does Credit Score Change

Credit Score What Does It Mean & How To Improve It

Achieving and maintaining a good score is a perfect way of keeping your finances in check. By improving your 592 credit score, you will be able to take a loan when planning to make big purchases such as buying a car or a home or even starting a business. Thats why its important to understand if its good or bad. A good credit score also gives you negotiating power, banks will consider you a sure bet and give you low interest rates thus saving you money eventually.

How To Get A Credit Card With Bad Credit

If your credit score is 500 or below, you wont be able to find credit cards in the places people typically look. A credit score that low is determined to be bad credit. Options for credit cards will be extremely limited.

To find a credit card for you, youll have to do two things:

- Ignore the many advertisements for low interest rate cards, with perks like rewards and 0% introductory APRs. You wont qualify for those, but you can get seriously distracted trying.

- Focus on the card providers who specifically offer cards for people with bad credit. They are available, and we have them listed in this article.

Also Check: How To Find Credit Score Free

Is Your Credit Score High Enough To Buy A House

If your credit score is above 580, youre in the realm of mortgage eligibility and homeownership. With a score above 620, you should have no problem getting credit-approved to buy a house.

But remember: Credit is only one piece of the puzzle. A lender also needs to approve your income, employment, savings, and debts, as well as the location and price of the home you plan to buy.

To find out whether you can buy a house and how much youre approved to borrow get pre-approved by a mortgage lender. This can typically be done online for free, and it will give you a verified answer about your home buying prospects.

Buying A House With Bad Credit

Having bad credit is different than having no credit.

If your low credit score comes from collections, write-offs, and late and missed payments, bad credit will get your loan denied.

If your credit score is low because youve failed to make loan payments on time, or you keep all your credit card balances maxed out, a lender isnt likely to overlook these issues.

Youll probably need to take a year or so and work on improving your credit score before you can get serious about buying a house.

Don’t Miss: How To Look Up Your Credit Score

Faqs About Bad Credit Loans

Getting approved for a loan when you have bad credit can feel like youve just been thrown a lifeline, but dont forget that it also comes with risks. Bad credit loans have higher interest rates and fees, and stricter penalties than do conventional loans, and there is far less room for error such as missing a payment.

Here are some other things you need to know about bad credit loans.

What Is A Credit Score

A credit score is expressed in the form of a three-digit number that ranges between 300 to 900. It is a representation of an individuals creditworthiness. Lenders refer to your credit score before approving your credit application. A good credit score is certainly a winner in every loan or credit application. A credit score of 750 and above is considered a good credit score.

In India, credit scores are generated by credit bureaus like Equifax, CIBIL, Experian, CRIF High Mark, etc. Credit scores from each credit bureau may vary slightly since they have a different algorithm for calculating credit scores.

Read Also: How To Check My Itin Credit Score

Recommended Reading: When Does Capital One Report To Credit Bureaus

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Getting Mortgages With A 592 Credit

Just like with personal loans, a credit score between 550 and 649 will provide you with sub-par rates and terms. In fact, with a 592 credit score, you may not even qualify for mortgages with many lenders. If you will you should anticipate interest rates ranging from five to six percent.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 592 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

What makes an impact on your credit?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

The third factor in play is your length of credit history, which assesses the average age of your accounts and how long its been since those accounts were actually used. The last two, smallest factors are how often you apply for new accounts and how diverse your credit portfolio is. In other words, opening multiple accounts at a time hurts your score, while having different types of accounts improves it.

Recommended Reading: When Does Bankruptcy Clear From Credit Report

Usda Loan With 594 Credit Score

The minimum credit score requirement for a USDA loan is now a 640 . Fortunately, you can still get approved for a USDA loan with a 594 credit score, but it will require a manual approval by an underwriter. In order to get approved with a 594 credit score, expect to have strong compensating factors, such as conservative use of credit, 2 months mortgage payments in cash reserves , a low debt-to-income ratio, and/or long job history.

Other requirements for USDA loans are that you purchase a property in an eligible area. USDA loans are only available in rural areas, which includes the outer areas of major cities. You can not get a USDA loan in cities or larger towns .

You also will need to show 2 years of consistent employment, and provide the necessary income documentation .

Fha Loan With 592 Credit Score

The most common type of loan available to borrowers with a 592 credit score is an FHA loan. FHA loans only require that you have a 500 credit score, so with a 592 FICO, you will definitely meet the credit score requirements.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the minimum down payment requirement is only 3.5%. This money can also be borrowed, gifted, or provided through a down payment assistance program.

Would you like to see if you qualify for an FHA loan? We can help match you with a mortgage lender that offers FHA loans in your location.

Read Also: How To Print Credit Report From Experian

Leverage Loans And Credit Cards To Increase Your Score

A credit score in the 550 to 600 range is low, but its not the end of the world. The factors that got you here arent permanent, and neither is your score.

The actions you take going forward are going to determine which direction your credit score goes from here. By making the most of the loans and credit cards for a 550 to 600 credit score weve outlined, you can take control and work toward increasing yours.

Range of credit scores covered in this article: 550, 551, 552, 553, 554, 555, 556, 557, 558, 559, 560, 561, 562, 563, 564, 565, 566, 567, 568, 569, 570, 571, 572, 573, 574, 575, 576, 577, 578, 579, 580, 581, 582, 583, 584, 585, 586, 587, 588, 589, 590, 591, 592, 593, 594, 595, 596, 597, 598, 599, 600

How Your Credit Score Is Calculated

Although no one knows exactly how your 592 Credit score is calculated, but as per general practices, different details from your credit report are used to formulate your credit score. The data taken from a credit report is usually a combination of five variables, where each variable is the information about credit extended to you through lenders and service providers.

Recommended Article:

Each variable has a percentage that shows its importance in formulating the credit score. If you want your credit score to fall in a Good or Excellent category and not in the Very Poor category, you need to keep these factors in your mind before applying for credit.

The five important variables are:

You May Like: What Does Bankruptcy Petition Mean On Credit Report

Is 592 A Good Credit Score

If you have a 592 credit score, it means that you have a fair credit rating. This is not a bad score, but there are some things you can do to improve your credit rating and make it easier to get approved for loans and credit cards in the future. are used by lenders to decide whether or not to give you a loan. They are also used by landlords to decide whether or not to rent to you. A good credit score means that you’re a low-risk borrower, and a bad credit score means that you’re a high-risk borrower.That being said, a 592 credit score is not necessarily a death sentence. There are plenty of things you can do to improve your score and make yourself a more attractive borrower in the eyes of lenders.

83% of Americans have a credit score above 592.