What Counts Towards Your 595 Credit Score

In essence, your credit score tells you whether YOU have a responsible credit management and a history showing that you have been financially stable. So what factors contribute to showing that you are fiscally responsible and stable?

The first and most critical factor will be your overall payment history. This is simply whether you have paid all of your bills on time. There are also a variety of aspects of your payment history that your credit rating will include, including how late you were on your payments , how many bills you paid and how many you did not, if any of your accounts have gone into collections and if you have a history of foreclosures, bankruptcies, and debt settlements.

The second biggest factor that counts towards your credit score is the total amount of money that you owe. Again, there is a variety of aspects of this that goes into your 595 credit score. One such example is the amount of your allotted credit that you have used up. Heres a piece of advice: the less you owe on the credit, the better your credit score will be.

Another aspect of your amounts owed is how much money you owe on each of your loans, including your credit cards, your car payments, and your mortgage payment. The best way to have a positive credit rating here is to have a variety of credits and loans and to manage each of them in a very responsible manner.

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Don’t Miss: How Often Does Merrick Bank Report Credit Bureau

Can I Rent An Apartment With A 595 Credit Score

You often need a credit score to rent a house or apartment since many landlords run credit checks on prospective tenants. Theres no universal minimum credit score for tenants, but many landlords look for a score of at least 620650, which your score of 595 doesnt quite reach.

If youre looking for a rental and the landlord plans on doing a credit check, its best to be upfront with them about your low score. You may be able to get the landlord to look past it if you can convince them that youll reliably pay your rent on time each month.

Takeaway: A 595 credit score is below average, but there are many ways you can improve it

- Your credit score is a number representing your creditworthiness. A score of 595 means most lenders will be reluctant to loan you money or approve you for credit.

- Your score is calculated based on your payment history, the age of your credit accounts, your credit utilization rate, the types of credit you have, and how many new credit accounts you have.

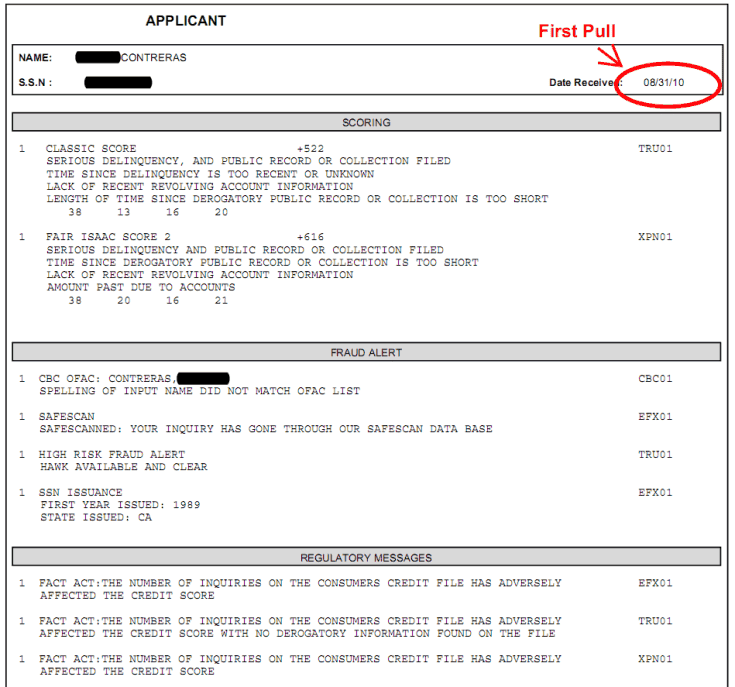

- Your credit score is based on either the FICO or VantageScore scoring system, and you have three credit scores and credit reports: one each from Experian, Equifax, and TransUnion.

- To improve your credit score, review your credit reports for errors and to find out the key areas to focus on. You should then take steps to improve your credit history and maintain the good credit that you have.

Additional Credit Scores

Can I Get Approved For A Credit Card With A 600 Credit Score

A credit score of 600 is high enough for you to be considered for a credit card. But dont have any illusions a 600 score is still subprime, and the cards you qualify for are likely to come with high fees, a high APR, and a low credit limit.

However, any card company that gives you an unsecured credit card will report to the credit rating agencies, so using your card wisely and making on-time payments is likely to boost your credit score. This will make approval for credit cards easier in the future.

Read Also: Does Asking For Credit Increase Affect Score

Catch Up On Your Bills

Payment history has the biggest impact on your credit score. If you are behind on any bills, you should call the creditor and arrange to pay the past due amounts. After making your payments, you can request that the creditor rescind any reported delinquencies so they will no longer show up on your credit report. While this may be the slowest step, it is essential to improving your credit score. Finally, your more recent activity weighs more heavily, so those on-time payments are priceless.

Auto Loan Rates For Poor Credit

Theres no specific minimum credit score required to qualify for a car loan. Still, if you have poor credit, it could be difficult to get approved for a car loan. Even with the best auto loans for poor credit, watch out for high interest rates, which can make it very expensive to borrow money.

If you have time to build your credit before you apply for a car loan, you may be able to eventually get better rates. But if you dont have time to wait, there are some strategies that can help you get a car loan with bad credit.

- Consider a co-signer if you have a trusted family member or friend with good credit who is willing to share the responsibility of a car loan with you.

- Seek out alternative lenders, such as a credit union or an online lender.

- Ask the dealership if theres a financing department dedicated to working with people with poor credit.

- Use buy-here, pay-here financing only as a last resort.

If your credit could use some work, its especially important to shop around to find the best deal for you. Our auto loan calculator can help you estimate your monthly auto loan payment and understand how much interest you might pay based on the rates, terms and loan amount.

Compare car loans on Credit Karma.

Don’t Miss: Does Argos Card Affect Credit Rating

Get A Secured Credit Card

As mention earlier, getting a secured credit card is a great way to establish credit. Secured credit cards work much the same as unsecured credit cards. The only difference is they require a security deposit that also acts as your credit limit. The credit card issuer will keep your deposit if you stop making the minimum payment or cant pay your credit card balance.

Strategies To Build Your Credit Over Time

If you arent able to remove the negative marks bringing down your credit score to 595 , youll need to explore long-term, sustainable strategies to build your credit.

In fact, even if you are able to achieve a quick boost in your score, you should still brush up on thesetheyre general credit-building best practices that you should continue following even once your score improves.

Try to:

- Add positive information to your credit reports by using credit regularly and responsibly

- Practice good credit habits going forward use your credit in moderation and try to pay off your credit cards in full every month

- Do your best to get out of debt

- Add alternative data to your credit report with Experian Boost or a third-party rent-reporting service, such as PayYourRent or eCredable

Boost your credit for FREE with the bills you’re already paying

5.0/5

No credit card required. Results may vary, see website for details.

Boost your credit for FREE with the bills you’re already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost

- Daily Experian credit monitoring and alerts

Recommended Reading: What Is A Closed Account On Your Credit Report

Credit Score: Good Or Bad

At a glance

595 is a below-average credit score. Its considered fair or poor by every major credit scoring model. Scores in this range are high enough to get a mortgage, but any loans or credit you’re eligible for will come at relatively high interest rates. Well explain how to get financed with a score of 595 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or book a FREE 5-minute credit repair consultation.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Pay All Your Bills On Time From Now On

Whether youre about to apply for a credit card, or you just got a brand new one, resolve to pay all your bills on time from now on.

That applies not just to your credit card, but to all obligations. Though landlords and utility companies dont report your good payment history to the credit bureaus, they will report delinquencies. This is particularly true of unpaid balances.

Make sure that doesnt happen. Unpaid balances, like collections and judgments, will drive your credit score even lower.

Also Check: How To Get An 850 Credit Rating

How To Improve A 595 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

Do Mortgage Lenders Care About Debt Management Plans

If your credit score and payment history are in their wheelhouse, and your debt-to-income ratio is acceptable, most mortgage lenders dont care if youre in a debt management plan.

Neither Fannie Mae nor Freddie Macs underwriting guidelines specifically mention credit counseling or DMPs for conforming loans that are processed through their automated underwriting systems.

But if a human manually underwrites your loan, the decision may be different. Underwriters use their best judgment, and opinions vary. In addition, mortgage lenders can overlay stricter requirements than program minimums.

Read Also: Is 500 A Bad Credit Score

Shopping For The Best Rates On Loans And Credit Cards For A Credit Score Under 595

If you are ever on the market for high-priced items, such as home appliances, it is very common for people to walk into the store and get offered a discount or an otherwise excellent financing deal.. .but only if they open up a credit card account with that store.

Why do stores offer these credit cards? The reason why is because theres usually a high interest rate or multiple fees that go along with them. Those rates and fees can be found on the small fine print of the credit card deal, but of course, the store doesnt tell you.

A golden rule of credit cards is that you should only apply for credit that is a necessity for your financial life. When applying for a credit card from a retail store, youre probably only going to use it once, twice, or three times maximum. You could just as easily be using an existing credit card that you already have.

Heres why this is so critical: applying for multiple credit cards within a few months of each other will be very harmful to your overall credit score. Never apply for a credit card that you dont need.

Now, when you do decide to apply for credit cards and loans in general, there are a few factors that you will want to remember, including:

Personal Loans With A 595 Credit Score

You might find it challenging to get approved for a personal loan with poor credit scores.

Given your current scores, you might not have the luxury of shopping for the best personal loans with the lowest interest rates. Instead, you may have to settle for a personal loan with a high interest rate not to mention other fees, such as an origination fee.

This could make a personal loan seem very unappealing to you, especially if your intention with the loan is to consolidate high-interest credit card debt. The APR on your personal loan could be just as high, if not higher, than the interest rate youre currently paying on your credit cards.

On the other hand, if your goal with a personal loan is to finance a major purchase, you should ask yourself whether its something you need right now. If it can wait until after you spend some time building credit, you may qualify for a personal loan with a lower APR and better terms later down the line.

If youre really in a pinch for cash and youre having a difficult time finding a personal loan you qualify for, you might be considering a payday loan. While everyones situation is unique, you should generally be wary of these short-term loans that come saddled with high fees and interest rates. They can quickly snowball into a cycle of debt thats even harder to climb out from.

Don’t Miss: Which Information Is Found On A Credit Report Brainly

Why A Very Good Credit Score Is Pretty Great

A credit score in the Very Good range signifies a proven track record of timely bill payment and good credit management. Late payments and other negative entries on your credit file are rare or nonexistent, and if any appear, they are likely to be at least a few years in the past.

People with credit scores of 795 typically pay their bills on time in fact, late payments appear on just 15% of their credit reports.

People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms. These may include opportunities to refinance older loans at better rates than you were able to get in years past, and chances to sign up for credit cards with enticing rewards as well as relatively low interest rates.

Buying A House With Bad Credit

Having bad credit is different than having no credit.

If your low credit score comes from collections, write-offs, and late and missed payments, bad credit will get your loan denied.

If your credit score is low because youve failed to make loan payments on time, or you keep all your credit card balances maxed out, a lender isnt likely to overlook these issues.

Youll probably need to take a year or so and work on improving your credit score before you can get serious about buying a house.

Don’t Miss: How Often Is Your Credit Report Updated

Dont Let Your Credit Card Balances Balloon

If youve fallen into credit card debt, you may already know that carrying a high balance can result in hefty interest charges. But what you might not have realized is that a high credit card balance can also hurt your credit by increasing your credit utilization rate.

Your credit utilization rate is the percentage of your available credit that youre using at any one time. The standard advice is to keep that percentage below 30% if at all possible, but using even less than 30% of your available credit is preferable.

This can be easier said than done. But every little bit helps. Even if you cant afford to pay off your whole account balance right away, try to chip away at it until its at or near 30% of your total credit limit.