How Late Payments Affect Your Credit

The FICO scoring model is the oldest and most widely used method for calculating credit scores. Your payment history accounts for 35% of your FICO score, making it the most important scoring factor. It looks at whether youâve ever made a late payment and if so, how late.

Under federal law, creditors canât report late payment information to the credit reporting bureaus unless they are at least 30 days past the due date. Payments that are fewer than 30 days late wonât affect your credit report or credit score, though you may be subject to late fees or other penalties from your lender. Payments that are 30 or more days late, on the other hand, can have a serious impact on your credit score. The higher your credit score is to start, the more points you can lose due to a late payment. Making just one payment 30 days late can lower a 780 credit score by 90-110 points and a 680 score by 60-80 points.

Late payments continue to show up on your credit report for approximately seven years. More recent activity carries more weight when calculating your score than older information. In other words, as time passes, late payments have less of an effect on your credit score.

How Do I Clear My Bad Credit History

How to Clean Up Your Credit Report

Increase Your Credit Score By Paying Down Your Credit Card Debt

I had a credit utilization ratio of 40%. Meaning I was using up 40% of the credit limits on all of my cards. Your credit utilization makes up 30% of your overall FICO score. Only your payment history has a bigger impact.

You want to keep your balances below 10-15% of your credit limits. This will ensure youre maximizing your scores. So I paid all my credit card debt down to 0, along with the removed late payments, my score increased by 84 points in just one month! You, too, can have this level of success by doing what I did.

Recommended Reading: Syncb/ppc Credit Card Login

How To Remove Credit Card Late Payment Records From Credit Report

Financial institutions and lenders provide loans after assessing your credit report. A credit report is a summary of your credit history for the last 36 months and demonstrates your ability to repay your loans on time. Maintaining an accurate credit report and credit score will facilitate quick loan approvals.

A late payment record can have a significant negative impact on your credit report. Late payments bring your credit scores down which can result in denied credit from almost all lenders. While some lenders might sanction loans even if your credit report has late payments, the interest you will have to pay will be substantially high.

Some studies show payments that are overdue for 30 days or more can reduce your credit score by up to 100 points. Therefore, it is crucial to pay your easy monthly instalments on time.

Offer To Sign Up For Automatic Payments

In some instances, a creditor may agree to delete a late payment if you agree to sign up for automatic payments.

This plan works well if youve had trouble making payments in the past but arent significantly delinquent on your account. Youll have better luck negotiating this deal if you can show that youre financially able to make your payments.

It also helps if youve overcome whatever financial hurdle held you back from making payments in the past. Like requesting a goodwill adjustment, this is also ideal for longer-term customers.

Recommended Reading: Aoc’s Credit Score

If The Late Payment Is An Error: Send A Dispute Letter

To dispute a late payment on your credit report, follow these steps:

How long before my credit report will be updated?

If your dispute is successful, your creditor is legally obligated to update your account information in 30 to 45 days. 1However, they might not report your updated information to the credit bureaus for another 30 days, so it could take up to 22.5 months before the late payment is removed from your credit report. 2

Dispute letter example

You dont need to write your own dispute letter from scratch. Its easy to find free templates for late payment removal letters to creditors and late payment removal letters to the main credit bureaus .

How Long Do Late Payments Stay On Your Credit Report

Late payments are considered a part of your payment history and account for 35% of your overall FICO credit score.

Late payments, just like any other types of account information, will remain on your credit report got a period of 7 years. However, initially, a late payment has a bigger negative impact on your credit score. As it ages, the negative impact decreases month after month.

A single 30-day late pay is something you can recover from in a few months as long as you have established long credit history of paying your bills on time with no late payments. Multiple 30 day late pays or 60 and 90 day late pays will have a more significant impact on your credit score and will take longer recover from.

Read Also: Auto Buying Program Navy Federal

Can Paying Off Debt Remove A Late Payment From A Credit Report

Instead of letting a late payment stay on your credit report and become a charge off, you can pay it off. Paying off the debt may be your best course of action if the late payment is your fault and your creditor refuses to negotiate or consider your goodwill letters.

If your creditor agrees to you paying off your late payment, expect to pay a late fee. However, your credit card company may waive this requirement if you have a good track record and relationship with the company.

Note that paying off your debt wont automatically erase it from your credit report. It will stay there for seven years, but it wont become a charge-off and severely damage your credit score and reputation among lenders.

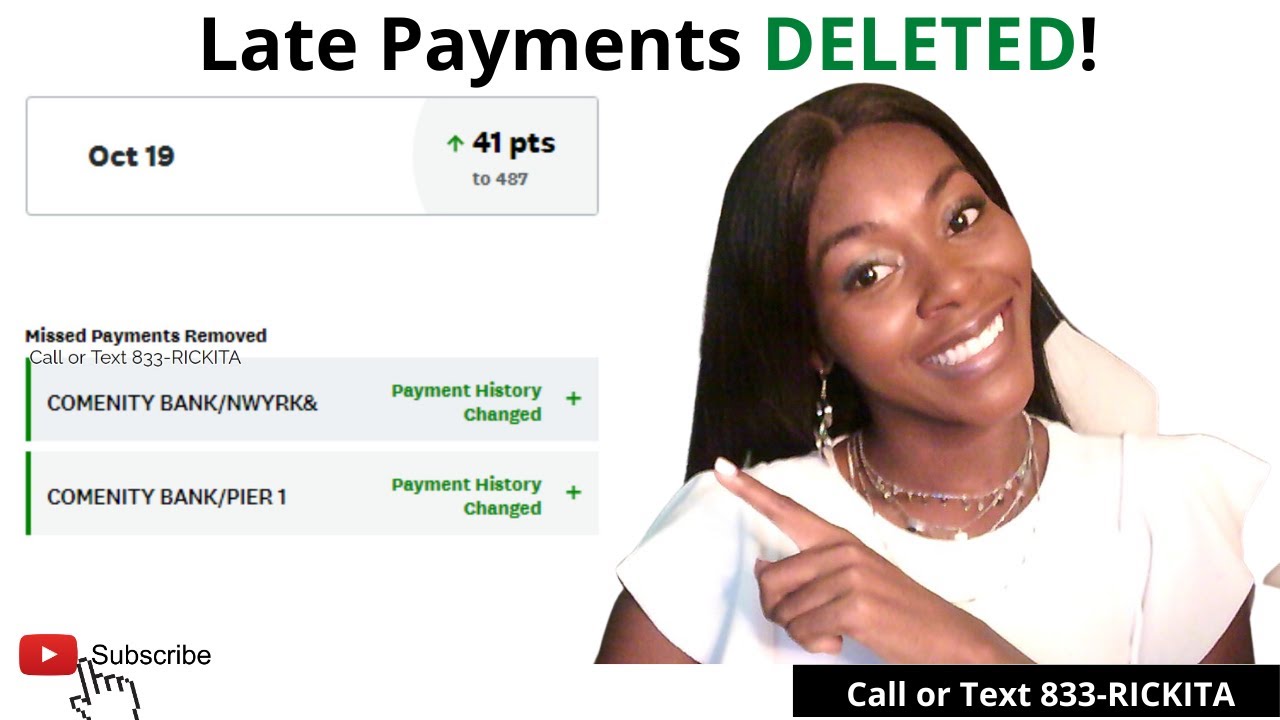

The Late Payments Dropped My Credit Score By 80 Points

Thats right my FICO score dropped 80 points! Although I really didnt care as much as I usually would, I just bought a new house and car. I wasnt going to be using my credit file again for a while. I knew whenever I needed my credit I could probably get them deleted.

Before I wrote this article, I wanted to try the methods I posted here to see if I could get my own late payments removed from my credit report.

Don’t Miss: How Can I Check My Credit Score With Itin Number

Accurate Or A Mistake

Late payments appear in your credit reports when lenders report that you paid late. That can happen in one of two ways:

If the report is accurate, it can be difficult and time-consuming to get the payment removed from your reportsand it likely won’t be removed for seven years.

If the late payment is incorrect, it can be relatively easy to fix the error. You need to file a dispute explaining that your report contains a mistake and demand that the payment be removed. If you mail the letter, then you should send it by certified mail with a return receipt request.

Lenders must correct errors, and failing to do so is a violation of the federal Fair Credit Reporting Act .

Fixing the error may take several weeks, but you may be able to accelerate the process using rapid rescoring, in which you pay for a faster update of your report. Doing this typically only makes sense if youre in the middle of a home purchase or another significant transaction.

What Are Late Payments And Why Is One On My Credit Report

At times, you may see a late payment show up on your credit report. However, many individuals arent entirely sure what constitutes a late payment for instance, when a late payment will show up on your credit report, or why it is there. Understanding this is important, as being able to identify if the late payment remark on your report is legitimate is the first step in filing a dispute with your creditor, at need.

Late payments, in most cases, are payments that are more than 30 days past due. However, this does not mean that if you are two or three days late on your monthly credit card payment that this will show on your credit report. Creditors do not report your account as past due to major creditors until you have gone 30 days past your first missed due date meaning that while you will still accrue late fees and interest charges, your account is typically not reported as past due until you have missed your second payment.

If you see a late payment on your credit report, it typically means that you have gone past your initial due date on a credit account by at least 30 days. In many cases, these claims on your credit report are correct it may have been an oversight on your part, or due to financial hardship. However, it is exceptionally important that you address this as early as possible, as derogatory remarks can drastically lower your credit score.

Don’t Miss: Suncoast Credit Union Credit Card Approval Odds

How Long Late Payments Stay On Your Credit Report

Late payments typically stay on your credit report for up to seven years and can negatively impact your credit score as long as they remain in your credit history. Thats seven years of struggling to get new credit or facing higher interest rates. However, there are things that you can do to remove negative late payments from your credit report.

What If Its Not A Mistake

If you made a late payment and it shows up correctly on your credit reports, your chances of getting it removed are slim.

According to a TransUnion spokesperson, If late payment information is indeed accurate and properly reported by a lender, then it cannot be removed from a consumers report by the credit-reporting agency.

You may hear about ways to get an accurately reported late payment removed from your credit reports, but you should know that these methods are probably a scam.

Ultimately, you can avoid late payments on your credit reports by making sure you pay your bills on time and in full. One tip is to set up automatic payments for your credit accounts.

If you do pay late and a late payment ends up on your credit reports, you may be stuck for seven years until the late payment falls off. But its likely that the longer its been, the less impact a late payment can have on your credit, especially if youve since been working on building your credit with responsible use.

Also Check: Aargon Collection Agency Bbb

If You Havent Paid Off The Debt Yet: Send A Pay

If youve incurred late payments for a debt thats still outstanding, then you can try sending a pay-for-delete letter. Pay for delete is a negotiation strategy where you promise to repay the debt in exchange for having the corresponding negative item removed from your credit report.

This strategy is most often used with older debts, particularly for removing collection accounts. Pay for delete is less likely to work with late payments, since you have to contact your original creditor before they transfer or sell your debt, which means it probably isnt that old. However, theres no harm in trying.

Your letter should specify the total amount youre willing to pay and your conditions . Also say how long your offer will be valid, including the date by which youd like your creditor to respond.

Pay-for-delete letter example

Your pay-for-delete letter should be polite and professional, but you should be careful not to imply youll pay the debt if they dont agree to your conditions. Again, it can be helpful to use a pay-for-delete letter template, modifying it to fit your circumstances.

Pay for Delete Letter to Creditor

Use this pay for delete letter template to ask your original creditor to remove another type of negative mark, such as a late payment or a charged-off account that they havent sold to a debt collector yet. Creditors tend to be less receptive to pay for delete letters than debt collectors.

File A Complaint With The Cfpb

The CFPB, Consumer Financial Protection Bureau, accepts credit reporting complaints as of September 22nd, 2012. Now consumers have the chance to file complaints against bands and lenders about inaccurate credit reporting on a Federal level.

You can file a complaint against the creditor directly or against the credit bureaus here.

Don’t Miss: Is Opensky Safe

Can I Get Some Help With This

Some of the methods I covered are quick and easy, but some of them require a fair amount of time and effort. If it starts to feel like your situation calls for more than what you are personally capable of handling, you may want to consider procuring the services of a quality credit repair company.

A good credit repair company can help you with any of these options, because they have experts that handle these issues each and every day. Ive used credit repair companies to remove late payments from my report, and Ive found them to be extremely helpful and well worth the cost.

There are several ways to attempt to remove late payments from your credit report, and its ultimately up to you to develop your plan and make it happen. Working to improve your credit always a worthwhile endeavor, regardless of how it all shakes out.

About Rick Miller

Rick is a former US Army Aviator, West Point graduate, and Darden MBA. He owns and operates a successful Real Estate Investment firm, and he enjoys spending time with his wife and three children in Hartford, CT.

How Do Late Funds Have An Effect On Your Credit Score Rating

Having only one late fee in your credit score report could be devastating to your credit score scores.

Whether or not its a late automotive fee, bank card fee, or mortgage fee, a latest late fee could cause as a lot as a 90-110 level drop in your FICO rating.

As time goes on, the late fee will harm your credit score rating much less and fewer till it drops off your credit score report. Nonetheless, potential collectors can nonetheless see that fee historical past so long as its listed in your credit score report.

Late funds seem in your credit score report as both 30 days late, 60 days late, 90 days late, or 120-plus days late. Every of those levels of delinquency has a distinct impression in your credit score scores.

The later you might be, the extra harm it does to your credit score historical past. Newer late funds in your credit score report even have a larger impression than older ones.

Don’t Miss: Usaa Experian Credit Monitoring

Discount For Family Members Couples And Active Military

Lexington Law is now offering $50 off the initial set-up fee when you and your spouse or family members sign up together. The one-time $50.00 discount will be automatically applied to both you and your spouses first payment.

Active military members also qualify for a one-time $50 discount off the initial fee.

Plead With Creditors To Delete Late Payments

If your missed payments are piling up, you might think you waited too long to get a creditor to remove your missed payments.

Believe it or not, your creditors can work with you.

No matter how bad the situation is.

Even if you need a payment plan, are receiving collections calls from companies like Medicredit or Allied Interstate for your past-due debt, or are facing foreclosure on your home, sending a hardship letter can help.

Your letter must describe your circumstances in plain language without making excuses.

And a good hardship letter always asks for a specific resolution, such as:

- Waiving late fees

- Modifying your monthly payment amount

- Setting up a payment plan

- Discussing settlement options

But if stress and anxiety are eating you up and youre not sure where to start, you dont have to do it alone.

Another technique is to try and settle with a pay for delete letter.

Yes, its another letter. And no, your creditor doesnt have any obligation to approve your request.

But youll never know if theyre willing to work with you unless you ask.

Don’t Miss: Which Credit Bureau Does Paypal Use

Negotiate Removal By Offering To Sign Up For Automatic Payments

I have never actually tried this method myself, but from what I understand creditors frequently offer to remove late payment entries if you, in exchange, agree to sign up for automatic payments.

This strategy works well for both parties: the creditor can ensure future on-time payments will be made, and you dont have to worry about remembering to make payments or being charged late fees if you forgot to pay by the due date.

Of course, automatic payments are only good when you have the money in your bank account to cover the transaction.

I would love to hear from those of you who have succeeded with this method!

UPDATE: Several readers have verified that this method did work for them, so try this next if a goodwill letter doesnt work.