Remove A Late Payment

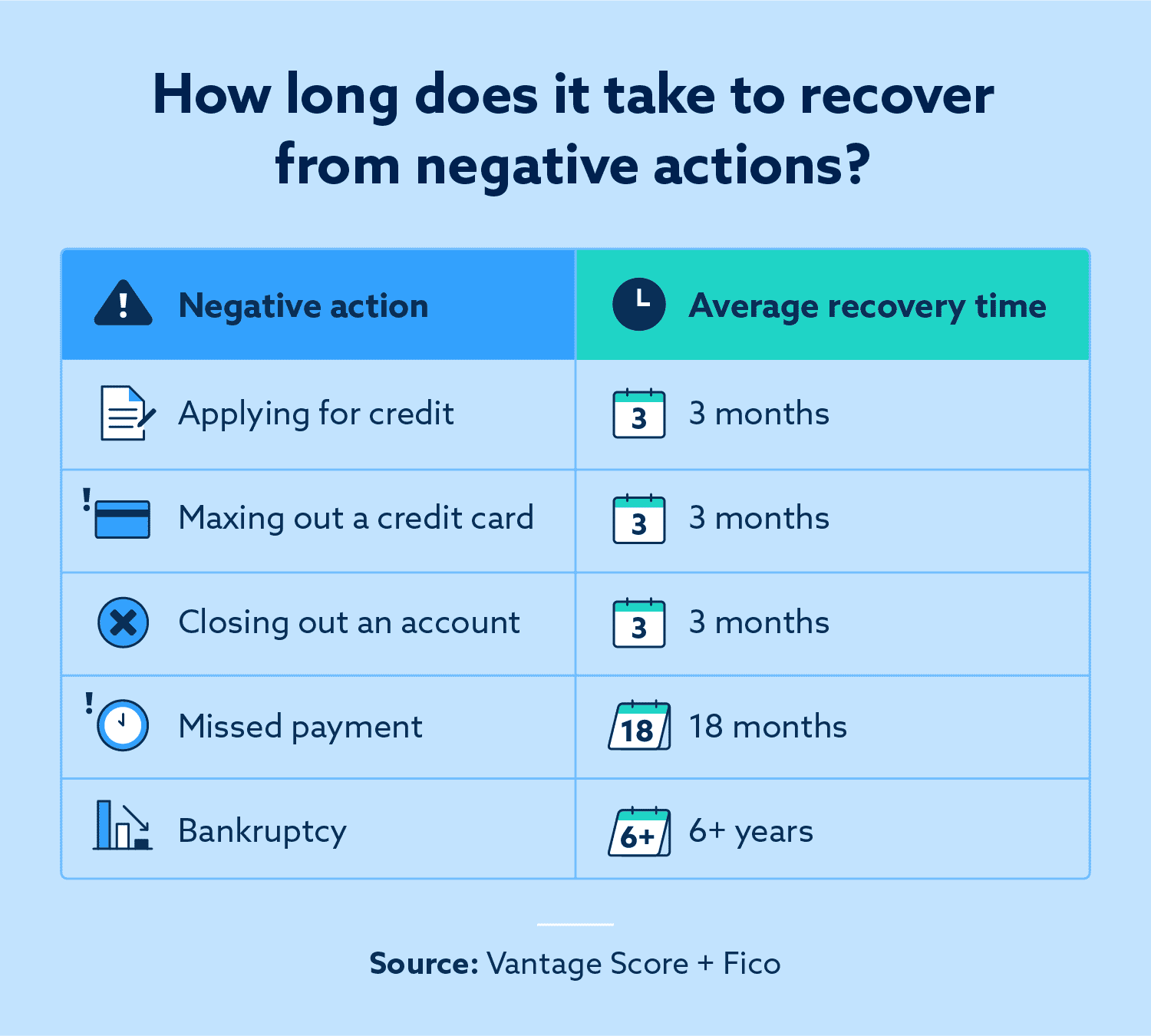

Late payments can reduce your credit score by as much as 125 points. In some cases, you may have paid a bill by the due date, but your creditor did not record the payment until after the deadline passed.

These situations are frustrating but fixable. Contact your creditor, and explain the situation. As long as you’re not a frequent offender, they may extend grace and change the status of your past payments. You can also ask about setting up automatic payments to show you’re committed to keeping up with monthly payments.

Assuming you can eliminate the late payment, you can avoid this deduction and raise your score by as much as 125 points.

Does Avoiding Hard Inquiries Raise Your Credit Score

Yes, having hard inquiries removed from your report will boost your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

Dispute Inaccurate Information On Your Credit Reports

Sometimes, your credit score might suffer because something wound up on your credit reports that shouldnt have been there. Of course, you wont know unless you check them.

Under normal circumstances, consumers are entitled by federal law to one free credit report every year from each of the credit bureaus Equifax, Experian and TransUnion accessible through annualcreditreport.com. However, during the coronavirus pandemic, the bureaus are allowing consumers to access their reports weekly through April 2021.

If you spot legitimate, incorrect information while reviewing your reports, such as accounts that arent yours, a name mix-up with another person or incorrectly reported payments, you can file a dispute. The Consumer Financial Protection Bureau, a federal agency responsible for protecting consumers and offering financial education, provides dispute instructions for each bureau.

Its worth taking a look at your reports, even if you have no reason to suspect there might be a problem. According to a report from the Consumer Financial Protection Bureau, 68% of credit or consumer reporting complaints received by the bureau in 2020 dealt with incorrect information on peoples credit reports.

How much will this action impact your credit score?

Whether your credit score changes and how much it changes depends on what you are disputing.

Recommended Reading: What Does Transferred Closed Mean On Credit Report

Dont Waste Your Money

Many debt relief companies make big promises. But you should be wary. The CFPB issued a consumer advisory warning people about paid . The fees these companies charge are often high, and you can accomplish the same results on your own. If someone promises a quick fix, go somewhere else because theres no such thing as a quick fix, advises Griffin.

Despite what some companies might claim, accurate negative information cant be removed from your credit reports, says Griffin. So you could end up paying your hard-earned money for nothing. Instead, focus on keeping up with your payments, keeping your credit card balances low, and avoiding new credit lines to improve your credit.

Pay Down Revolving Account Balances

Even if you’re not behind on your bills, having a high balance on revolving credit accounts can lead to a high and hurt your scores. Revolving accounts include credit cards and lines of credit, and maintaining a low balance on them relative to their credit limits can help you improve your scores. Those with the highest credit scores tend to keep their credit utilization ratio in the low single digits.

You May Like: How To Unfreeze Your Credit Report

Understanding Your Fico Score

Your FICO score is based on the following:

- Payment history: 35%

- New accounts/hard inquiries: 10%

The VantageScore, another consumer credit rating system, uses similar criteria, in a slightly different formula developed by three .

Clearly, the most important factors are establishing a history of on-time payments to all creditors and keeping debt low in relation to the amount of credit available to you .

You May Like: Coaf Credit Inquiry

What Is A Fico Score

Your FICO score is a number that represents your creditworthiness. Lenders use it to determine whether or not to give you a loan, and at what interest rate. The higher your score, the better.

FICO scores range from 300 to 850, and are based on five main factors:-Payment history -Length of credit history -New credit -Credit mix

Payment history and amounts owed have the biggest impact on your scorein other words, paying your bills on time and keeping your balances low. Length of credit history and credit mix are also important, but to a lesser extent.

You can get your FICO score from all three major credit bureausExperian, TransUnion, and Equifaxbut you might have to pay a small fee.

Don’t Miss: Does Increasing Credit Limit Hurt Score

Limit The Number Of Credit Applications You Complete

Every time you fill out an application for credit, creditors make requests call hard inquiries or hard pulls. These credit checks affect your credit score and remain on your report for two years.

On average, each hard inquiry can reduce your credit score by 5-10 points.

Therefore, too many inquiries cause your credit score to plummet, so you could pay higher interest rates for loans and credit cards.

In a worst-case scenario, a lender could reject your request for credit.

#DidYouKnow When you apply for a loan with Camino Financial, we do a soft pull of your credit that doesnt affect your credit score at all.

How Paying Off A Car Loan Could Affect Your Credit Score

With the categories of FICO information in mind, there are a few reasons why paying off yourcar loan could adversely affect your score.

The amounts you owe category is the biggest one that is affected. Specifically, your loans never have as much positive impact on this part of your credit score than when theyre almost paid off. In other words, if you only owe 1% or 2% of your original balance, its a major positive factor . After you pay the loan off, you lose this positive factor the status changes to paid loan on your credit report.

Your length of credit history category could also possibly suffer, especially if your car loan was originated more than a couple of years ago. After all, paying off your loan can eliminate an established account from the calculation. Among other things, this portion of your score considers the average age of all of your reporting credit accounts, so if a paid-off loan causes your average to decrease, it could certainly be a negative factor.

Also Check: Does Paypal Credit Report To The Credit Bureaus

Read Also: How To Create A Credit Score

Dont Rely On Just One Type Of Credit

Your credit score is a mix of many different things: its not just your credit card utilization but business loans, mortgages, car loans, etc.

You have a lot of ways to improve your credit score, so if you can afford a new type of credit, having a diverse credit mix can help your credit score be healthier.

My Credit Score Is 550 How Do I Raise It

You can do several things to raise your credit score, including disputing false information, paying off collection accounts, and lowering your percentage of credit used. If you haven’t got your credit report yet, you can get it from all three credit bureaus – Experian, Transunion, and Equifax for free. Free copies of credit reports are available either through their websites or through AnnualCreditReport.com.

Now that you know where your credit history stands, let’s get started and find out what you may need to do. Here are some ways to help you raise your credit score depending on different factors:

Recommended Reading: Is 663 A Good Credit Score

Get A Handle On Bill Payments

More than 90% of top lenders use FICO Scores. These are determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to raise your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and boost your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

How Much Will My Credit Score Go Up If I Pay Off All My Debt

If you’re already close to maxing out your credit cards, your credit score could jump 10 points or more when you pay off credit card balances completely. If you haven’t used most of your available credit, you might only gain a few points when you pay off credit card debt. Yes, even if you pay off the cards entirely.

Don’t Miss: What Do Credit Rating Agencies Do

Will Paying Off Debt Improve The Credit Score

One common credit score myth is that you will keep an outstanding balance on your credit card. Actually, the sooner you clear your debt the good. Your credit score will advantage as well as you will pay less interest. You can improve your credit score by paying off your debts on time and paying them off with a lump sum of cash. Either way, it shows lenders that you are a reliable borrower who may be trusted to make repayments.

The length of time it takes for your credit score to improve depends on many factors. For instance, how good your credit history is to start with, and how rapidly you clear your debts. You will be amazed to know that clearing credit cards will have a more positive effect on the credit score than your loans.

How Credit Scores Are Calculated

Credit scores are determined by computer algorithms called scoring models that analyze one of your credit reports from Experian, TransUnion or Equifax. Scoring models may use different factors, or the same factors weighted differently, to determine a particular score. However, consumer credit scores generally share a few similarities:

- Scores are calculated based on the information in one of your credit reports.

- Scoring models try to predict the likelihood that a borrower will be 90 days late on a bill in the next 24 months.

- A higher score indicates a person is less likely to fall behind on a bill, and vice versa.

The vast majority of lenders use credit scores calculated by FICO and VantageScore® scoring models. The most recent versions of their generic credit scores use a score range of 300 to 850and a score in the mid-600s or higher is often considered a good credit score. .

Considering how different credit scores use the same underlying information to try and predict the same outcome, it might not be surprising that the steps you take to try to improve one score can help increase all your credit scores.

For example, making on-time payments can help all your credit scores, while missing a payment will likely hurt all your scores. There are several factors that can affect your credit scores. Here, we’ll focus on the actions you can take to help improve your credit scores.

Recommended Reading: Does Checking Credit Lower Score

Keep Old Credit Cards Open Even If You Dont Use Them

Not only does an unused credit card help your credit utilization rate, but it also helps establish your record of maintaining long-term relationships with credit card companies. Age of credit relationships counts toward 15% of your FICO credit score, so resist the temptation to close old credit cards, if possible.

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Also Check: What Are Collections On Credit Report

Six Ways To Raise Your Credit Score By 40 Points

Raising your credit score by 40 points can make a big difference. Imagine that you buy a house for $305,000. You put down 20%, which means your mortgage loan totals $244,000 . With a credit score of 685, you’ll qualify for an APR of 4.546%, spending $203,000 in interest over the course of a 30-year loan.

But if you bump your credit score up to 725, you’ll qualify for an APR of 4.369% and spend $194,000 in interest, a difference of $9,000. That saves you $300 a year over a 30-year term, enough to supplement your summer vacation savings.

Here are six ways to quickly raise your credit score by 40 points:

Get Late Payments Removed

Before disputing late payments you should contact your creditors and tell them you have a late payment on your credit report on your account and you believe its inaccurate. They may remove it as an act of goodwill for customers who have been with them for awhile.

I had a creditor remove a late payment from my credit report by calling and coming up with an excuse for why it was late. They removed it as an act of goodwill because I had been a customer for several years. If that doesnt work, you can start disputing it with the three major credit reporting companies.

I had four late payments with two different creditors at one point. I contacted the creditors and got one removed and disputed the other 3 with the Credit Bureaus. I was able to get another one removed, and my credit score jumped up by 84 points.

Don’t Miss: What Is The Government Credit Report Website

How Do Student Loans Affect Your Credit Score

Student loans can positively or negatively affect your credit score, depending on how theyre used. If you consistently make your loan payments on time for the full amount, you might see a positive impact on your credit. If you miss payments or make late payments, it could negatively impact your credit.

Pay Down Credit Card Debt

After your payment history, your amounts owed are the most important part of your credit score calculation. But this doesnt just mean how much debt you have overall. Creditors also want to know how much of your available credit youre using . This is called your .

Your utilization is determined by dividing your credit card debt by your credit card limits. For example, lets say you have a credit card with a $1,000 balance and a $5,000 limit. The utilization rate for this card would be: $1,000 ÷ $5,000 = 0.2 = 20%.

Credit score calculations look at both your overall utilization ratio and your ratio for individual cards. A lower utilization rate is better. In fact, an ideal credit utilization is below 10%.

When you pay down your credit card debt your utilization rate decreases.

For most people, the number one way to improve credit score fast is to pay down credit card balances. Once your lower balance is reported to the credit bureau, your credit score should improve. This is how to build credit fast if you have high utilization. However, this can help build credit even with moderate utilization.

If youre unsure how to get started, check out our guide to paying off debt.

Also Check: Aargon Agency Hawaii

You May Like: Is 818 A Good Credit Score

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Apply For A Credit Builder Loan

What if youre starting from scratch? If you have no credit history at all, you may want to consider a credit builder loan.

When you open a credit builder account, the lender moves the loan amount into a locked savings account. You make installment payments toward the lender over a period of six to 24 months. As you make payments, the lender reports your activity to the credit bureau. At the end of the loan term, the lender releases the funds to you.

Just keep in mind that making payments late can hurt your credit even further, as late or missed payments are reported to the credit bureaus, too.

According to the CFPB, participants that didnt have existing debt when they took out the loan saw their credit scores rise by 60 points enough of an improvement that a borrower could enter a better score range. For example, someone with a 620 score could rise to 680 , helping them qualify for better rates.

Also Check: What Is The Highest Equifax Credit Score