Dispute Your Credit Reports Errors

Under the Fair Credit Reporting Act, both the credit reporting bureau and the company that reports the information about you to the credit bureau are required to accept disputes from consumers and correct any inaccurate or incomplete information about you in that report.

The U.S. Federal Trade Commission recommends taking these actions:

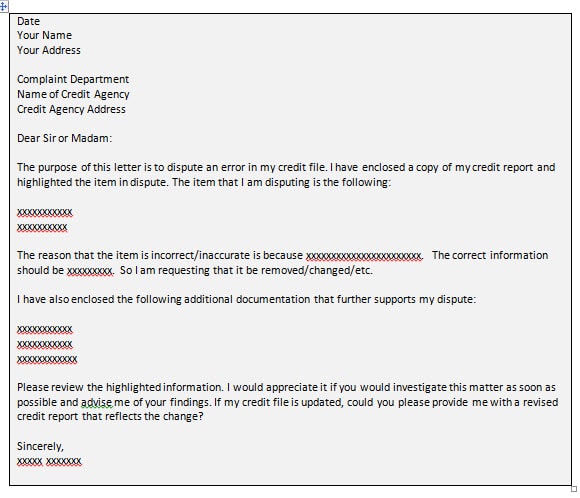

- Tell the credit bureau, in writing, what information you think is inaccurate. The Federal Trade Commission provides a sample dispute letter that makes this step easier. The letter outlines what information to include, from presenting the facts to requesting that the error be removed or corrected.

- Include copies, not originals, of materials that support your position.

- Consider enclosing a copy of your credit report with the errors circled or highlighted.

- Send your letter by certified mail with return receipt requested to ensure the letter is delivered. Keep your post office receipt.

- Keep copies of everything you send.

Dispute Credit Report Errors

All three bureaus have an online dispute process, which is often the fastest way to fix a problem, or you can write a letter. You can also , but you may not be able to complete your dispute over the phone. Here’s information for each bureau:

How to dispute Equifax credit report errors

-

Write to Equifax, P.O. Box 740256, Atlanta, GA 30374-0256.

-

See our guide on how to dispute your TransUnion credit report for details.

What If A Mark On My Credit Report Is Negative But Accurate

If a mark on your credit report is accurate, a credit bureau cannot remove it. You could try contacting the company that issued it, requesting that it remove the mark as a courtesy. For instance, if you made one late payment and have years of on-time payments, a credit card company might be willing to look past this error. However, companies aren’t obligated to delete factual information.

Read Also: When Is Your Credit Score Updated

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender finds that the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request, which can help the bureau evaluate any information it might have missed the first time around.

Make Sure Your Disputes Are Legitimate

Be sure you dont do anything to make the credit bureaus think your credit report disputes are frivolous. Dont dispute everything on your credit report and do not send all your disputes at once. If you dispute the same item more than once, you should give a different reason for each dispute so the credit bureau doesnt think youre sending duplicates. The credit bureau has the right to reject your dispute if you don’t have solid evidence.

Also Check: When Does Bank Of America Report To Credit Bureaus

Sky Blue Credit Repair

Sky Blue Credit Repair is another credit repair company that has been in business since 1989. They have an A+ rating by the Better Business Bureau and have high customer satisfaction.

Just like Credit Saint, Sky Blue Credit Repair can help you dispute eviction from your credit report. They also offer a money-back satisfaction guarantee on all of their services.

Both Credit Saint and Sky Blue Credit are reputable companies with a long history of helping people repair their credit. If youre struggling to remove an eviction from your credit report, hiring one of these professionals may be the best step for you.

Fixing Credit Report Errors

To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

Keep in mind that all three of the credit bureaus now accept the filing of disputes online, with Experian now only accepting online submissions.

Find out how to initiate a dispute online.

Begin by telling the credit bureau what information you believe is inaccurate. Credit bureaus must investigate the item in question-usually within 30 days-unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your communication should:

- Clearly identify each disputed item in your report.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may also want to enclose a copy of your report with the items in question circled. Your communication may look something like this sample.

If mailing a letter, send it by certified mail, return receipt requested, so you can document that the credit bureau did, in fact, receive your correspondence. Also, keep copies of your dispute letter and enclosures. If you want help disputing mistakes on your credit report, myFICO can help you write a free letter in minutes.

Recommended Reading: How To Get Rid Of Closed Accounts On Credit Report

Do Credit Bureaus Really Investigate Disputes

The credit bureaus hand off investigations to the original .

That is, when you dispute a late payment on a credit card, the credit reporting agency will forward your dispute to the credit card issuer for investigation. All this must be completed within 30 days of the disputes submission date.

The bureaus notify creditors of your dispute, and they, in turn, must provide evidence of the items legitimacy.

Perhaps there could be cases in which a credit reporting agency investigates a dispute directly. These cases may arise, for instance, if data was correctly distributed by a creditor but was corrupted in the systems of the credit agency.

Add A Consumer Statement

If the credit bureau confirms the information is accurate but you’re still not satisfied, submit a brief statement to your credit report explaining your position. It’s free to add a consumer statement to your credit report. TransUnion lets you add a statement of up to 100 words, or 200 words in Saskatchewan. Equifax lets you add a statement of up to 400 characters to your credit report.

Lenders and others who review your credit report may consider your consumer statement when they make their decisions.

You May Like: What Credit Score For Best Buy Card

What You Will Learn:

- You’re entitled to a free copy of your credit report every 12 months from each nationwide credit bureau by visiting www.annualcreditreport.com

- Check your personal information carefully on your credit reports

- The information you are disputing should be incomplete, inaccurate or the result of fraud

- Once you file a dispute, you should receive a response within 30 days

To file a dispute with Equifax, you can create a myEquifax account. Visit our dispute page to learn other ways you can file a dispute. By creating an account, you will get six free Equifax credit reports each year.

What Happens If You Are A Victim Of Fraud

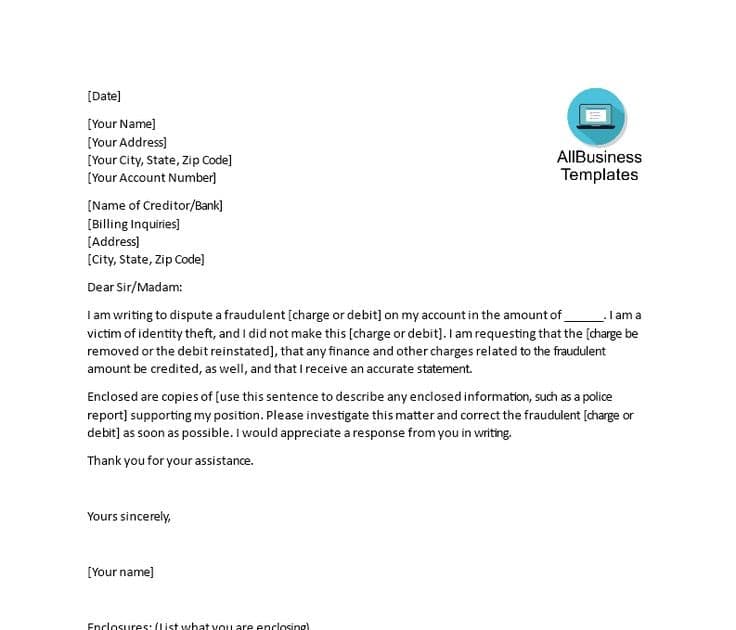

If you notice accounts listed on your credit reports that have been fraudulently opened in your name, here are steps to take to resolve the issue:

Also Check: Why Would My Credit Score Drop 50 Points

Dispute Inaccurate Items Yourself

You can embark on DIY credit repair by ordering your three credit reports from AnnualCreditReport.com, a source of free credit reports authorized by the federal government. You need all three reports because creditors may report transactions to only one or two credit bureaus.

After receiving the reports, review the four sections for errors:

- Identification: Information identifying yourself, including your address, date of birth, and Social Security number. Incorrect information may be a tip-off that the report covers accounts that dont belong to you.

- Tradelines: This contains your account data, which includes your use of credit and your borrowing activity. The data includes loan and credit account balances, payment history, and a collection account or charge-off.

- Public records: Court information regarding adverse legal judgments, bankruptcies, liens, foreclosures, vehicle repos, and money owed for child support.

- Inquiries: Hard inquiries are those you authorize a credit provider to make when you apply for a credit card or loan. These can lower your credit score. Unauthorized soft inquiries have no impact on your score.

The hardest part of DIY credit repair is combing through your report data for accounts or account activity you dont recognize, incorrectly reported negative credit file items , and liens and judgments you have already paid. You also should check for hard inquiries you didnt authorize.

How To Fix Errors On Your Credit Reports And How They Occur

To err may be human, but if that human error negatively affects your credit worthiness, you’re not alone. The number one complaint received by the Consumer Financial Protection Bureau involved incorrect information listed on consumers’ credit reports. Of those complaints, errors on a credit report were at the top of the list.

Worse yet, 26% of participants in a study by the Federal Trade Commission identified at least one error on their credit report that could make them appear riskier to lenders. The potential negative impacts those errors can have on your credit report can be catastrophic on your ability to get loans, new lines of credits, or better lending terms and interest rates.

That’s why staying on top of the content of your credit reports is so important. In this section, we’ll reveal some of the most common mistakes found in credit reports, how to fix them, and what to do if you disagree with any of the information in your report.

Recommended Reading: Do Checking Accounts Affect Credit Score

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

Don’t Miss: What Happens If You Freeze Your Credit Report

What Happens If A Credit Dispute Is Denied

If you dont agree with the resolution of your dispute, you can take additional steps.

- Contact the source of the claim: If your dispute is rejected, you can go back to the original source of the credit claim and provide information that the claim is incorrect. The source could be a lender or even a debt collection agency. You can find their contact information on your credit report.

- Resubmit a claim: You can refile an error claim with additional information that might ensure a different outcome.

- Add a statement of dispute: You can request that a note detailing why you dispute the claim be added to your credit report. This note will be displayed to anyone viewing your credit report.

- Contact a lawyer: If all else fails and your credit is seriously affected by an error, you could contact a consumer protection attorney to see what steps could be taken to remove the information from your credit report.

Avoid Frivolous Credit Report Disputes

As any mathematician can tell you, any claims you make without logical proof to back them up are often not worth the paper theyre printed on. And mathematicians arent the only ones who believe the proof is important the credit bureaus are likely to agree. Without enough information to substantiate your dispute, it will be quickly rejected by the bureaus.

Furthermore, despite the fact that the internet is awash with reports of consumers getting rid of thousands in unpaid debts through credit repair, be cautious about filing frivolous credit report disputes. While the Fair Credit Reporting Act requires credit bureaus to investigate consumer disputes in a timely manner, the law does give them some leeway to stop consumers from abusing the process.

Specifically, the credit bureaus do not have to investigate any or irrelevant in nature. So, if you file disputes for every negative item listed on your report, regardless of your ability to back up those disputes, the bureau may flag your disputes as frivolous. This can also be the case when refiling disputes repeatedly for the same item.

Recommended Reading: When Does Mortgage Report To Credit Bureaus

Experian Credit Dispute Contact

Online: 1-888-EXPERIAN P.O. Box 4500, Allen, TX 75013. Youll need to include your full name, date of birth, Social Security number , all of your addresses for the last two years, a copy of a government issued ID , and a copy of a utility bill, bank, or insurance statement. List each item on the report that you think is wrong, the account number, and the reason you feel the information is incorrect.

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

You May Like: What Affects Your Credit Score

If Youve Spotted An Error On One Of Your Credit Reports You Should Take Immediate Steps To Correct The Inaccuracy

Around 25% of U.S. consumers found errors that could affect their credit scores in one of their credit reports, according to a 2012 study by the Federal Trade Commission. The same study reported that one in five consumers had an error that a credit bureau corrected after the consumer disputed the mistake on at least one report.

An error on your credit reports could lead to lower credit scores and impact your ability to open a new credit account or get a loan. Here are steps you can take to ask the credit bureaus to remove incorrect derogatory marks from your credit.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: What Credit Score Do You Need To Get An Apartment

Is It Wrong To Dispute Correct Information

Im not the morality police, and you can do what you want to do, but you do have the right to challenge any information on your report whether its correct or not.

Its your right to have correct and verifiable information on your credit reports. I cant speak for them, but I imagine theyd also want your credit report to be fully accurate and verifiable.

Common Mistakes That Cause Credit Report Errors

To begin, it’s important to know if the person responsible for the error is you. Often, a person may have applied for credit under different names . Make sure you’re consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person with a similar name. Likewise, apply the same consistency and care with things like your Social Security number and address.

Or it could be a case of what you didn’t put in your report. If you were denied credit because of an “insufficient credit file” or “no credit file,” it may be because your credit file doesn’t reflect all your credit accounts. Though most national department store and all-purpose bank credit card accounts will be included in your file, not all creditors voluntarily supply information to the credit bureaus, nor are they required to report consumer credit information to credit bureaus.

If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different creditor who does report regularly to credit bureaus.

Other common errors to look for:

You May Like: What Is Resident Verify On My Credit Report