How To Report And Fix Any Errors On Your File

If you do spot any mistakes, challenge them by reporting them to the credit reference agency.

They have 28 days to remove the information or tell you why they dont agree with you.

During that time, the mistake will be marked as disputed and lenders arent allowed to rely on it when assessing your credit rating.

Its also best to speak directly with the credit provider you believe is responsible for the incorrect entry.

Negative information in your name usually stays on your credit report for six years and cant be removed sooner if its accurate. However, if there were good reasons why you fell behind with payments that no longer apply, such as not being able to work during a period of illness, you can add a note to your credit report to explain this. This note is called a Notice of Correction and can be up to 200 words long

Spend Less Than Your Available Credit

Spending less than your available credit can increase your credit score by up to 100 points. How well you utilize your available credit goes a long way to affect your credit scores.

If you have a certain amount as your credit limit, try as much as possible to spend less, and reduce your credit utilization ratio. Most creditors check for the available credit on your cards and how much youve spent. Its best to spend less than 30% of your available credit.

Do not overuse your credit card. If, for instance, you have $2000 as your credit card limit, try to keep the balance below $600. Try to pay more than the minimum amount on your credit card.

Seek Higher Credit Limits

This is a follow-up to the previous tip about credit utilization. Having a higher credit limit on a card, or any line of credit, means youre using less of the credit available, and that lower utilization will positively affect your credit score. This also can be a way to grow your debt if youre not careful, so be judicious with this strategy.

5 Stocks Under $49Presented by Motley Fool Stock AdvisorWe hear it over and over from investors, I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. Id be sitting on a gold mine!” It’s true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share!

Previous

Next

Also Check: How Long Missed Payment On Credit Report

Protect Your Personal Information To Avoid Fraud

Your credit can be affected by identity theft if fraudsters access your personal information to open accounts in your name. To help keep your data safe, use a password manager to create and store unique passwords and avoid making financial transactions on public Wi-Fi networks, which could be vulnerable to hackers.

Avoid Closing Old Accounts

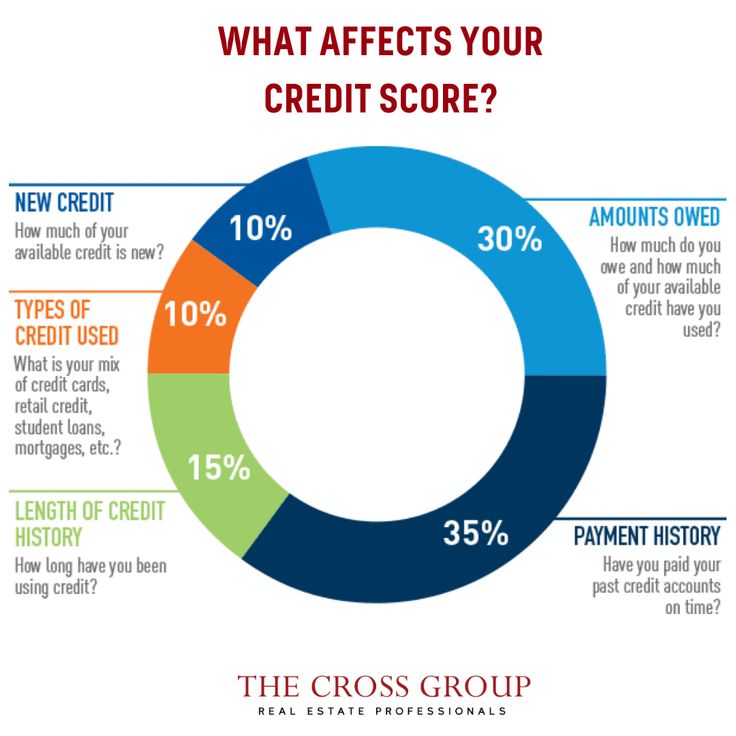

The length of your payment history accounts for 15% of your FICO score the more of it you have, the better, as long as it doesnt include derogatory items like delinquencies, collections, write-offs, bankruptcies, and foreclosures.

FICO examines several aspects of your payment history, including:

- The ages of your oldest and newest credit accounts.

- The average age of all your credit accounts.

- When each specific account was established.

- Any long lapses in the use of certain accounts.

Given these guidelines, FICO advises that you not close old credit card accounts. Rather, use all cards at least once a year, or else some accounts may be considered inactive.

Recommended Reading: How Long Do Credit Inquiries Stay On Your Credit Report

Pay Off Cards With The Highest Balances First

In addition to limiting your future spending, work on paying off your credit cards. If you have several cards with a balance, focus on the highest card balance to reduce your credit utilization ratio.

Paying down your outstanding debt can also improve your debt-to-income ratio, which is not a factor in your credits core but is used by many lenders.

Building Credit Takes Time And Patience

Thereâs no quick fix when it comes to building and improving your credit score. In fact, trying to rush the process can actually have the opposite effect. Applying for multiple cards in a short amount of time can get you automatically denied, and the repeated hits to your credit report can have a negative effect on your credit score. Instead of looking for a quick solution, try looking at the long term one. Focus on meeting your existing credit card obligations such as paying your bill on time each and every month, staying within a reasonable credit utilization ratio, and using your credit card responsibly. Since your credit report stays on file for years, it takes time and patience to make an impact. But the steps you take today can have a positive effect on your ability to access credit in the future.

When managed responsibly, your credit card can help build and improve your credit score, making it easier to get approval to borrow money for bigger purchases in the future. Are you ready to use a credit card to build credit? Our can help narrow down the choices to find the right credit card for you.

Read this Next

Read Also: When Does Navy Federal Report To The Credit Bureau

Dont Close Old Accounts

If you have an old credit card that youre not using, you may be tempted to close the account. If you do you will reduce the length of your credit history, which can cut your credit score. Its best to keep those accounts open, even if youre not using them.

The exception to that rule would be a card that has an annual fee. The whole point of building credit is to save money, and you shouldnt have to pay to do that.

If your old card has a fee, ask the issuer if they will upgrade you to a no-fee card. If they wont, its probably best to go ahead and close it. Your credit will recover, but the money you pay in fees is gone forever.

Does Checking Your Credit Score Hurt Your Credit

soft pullsoft pullNOT

- Soft pull/soft credit check/soft inquiry occurs when you check your own credit or when lenders check your credit on their own to determine if you qualify for a loan or a credit card offer for marketing purposes. Another scenario is when you go through a pre-qualifying or pre-approval process to see if you are qualified for a credit card. This type of credit inquiry does not affect your credit score.

- Hard pull/hard credit check/hard inquiry occurs when the lender checks your credit because you are applying for a new loan or a credit card. This type of credit inquiry affects your credit score.

Read Also: Will Credit Card Companies Remove Late Payments Credit Report

What Impact Will This Have On Your Overall Debt To Credit Ratio

Your debt to credit ratio is the relationship between the credit you can access and the debt you currently owe.

How is it calculated? Lets say you have access to $5,000 worth of credit on the unsecured, revolving credit accounts listed on your credit report. You have a high credit limit of $5,000. Now, lets say that youre currently in $4,000 of debt on these accounts. Take $5,000 and divide it by $4,000 you have an 80% debt to credit ratio.

You want a debt to credit ratio of LESS than 30%. Ideally, 10% will give you the best results.

The majority of consumer credit scores suffer from a poor debt to credit ratio. Your debt to credit ratio is VITALLY important to your credit score, because it tells the story of how responsibly youre using the credit youve already been granted.

Now, lets say you took my previous advice, and you added another unsecured consumer credit account for an additional credit limit of $5,000.

Your high credit limit will instantly increase, going from $5,000 to $10,000. What happens to your debt to credit ratio? It drops dramatically down from 80% to 40%! Your high credit limit doubled, but your debt stayed the same. This changes the story for the credit bureaus youre using the credit youre allowed in a responsible manner.

These are the FASTEST ways weve seen clients improve their credit scores by up to 100 Points guaranteed.

Your Turn To Take Action

Now that you know what a good credit score is and how to get one its your turn to take action.

You know the exact steps it will take to step away from having bad credit or no credit and build a better credit score.

You have a ton of options so dont waste any time. The sooner you build a better credit score the better your overall financial life will be.

Read Also: How To Pull Your Credit Report

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Pay Down Revolving Account Balances

Even if you’re not behind on your bills, having a high balance on revolving credit accounts can lead to a high and hurt your scores. Revolving accounts include credit cards and lines of credit, and maintaining a low balance on them relative to their credit limits can help you improve your scores. Those with the highest credit scores tend to keep their credit utilization ratio in the low single digits.

You May Like: Why Is My Credit Score Different On Different Sites

Types Of Credit Accounts

Credit scoring models favor consumers that have shown that they can handle multiple types of credit. A good includes a blend of revolving credit and installment credit .

There are several types of accounts:

Maintaining a balance of these types will improve your credit mix and help you build better credit.

Avoid Opening Many New Accounts At Once

Whenever you apply for a new line of credit, youll have a hard inquiry pulled on your credit report. Usually, this only minimally affects your credit score. However, if you have multiple inquiries in a short span of time, your score will be negatively impacted, potentially showing lenders that you may be trying to borrow more than you can afford. Because of this, youll want to exercise caution when applying for loans or credit cards, so your score doesn’t drop. Consider approval odds before applying or only apply when youve been pre-approved

Don’t Miss: Which Credit Score Do Car Dealerships Use

Get A Credit Card If You Dont Have One

Irresponsible use of a credit card can be a negative for your credit score and your finances. But used wisely, a credit card can be one of the fastest ways to improve your credit, as it impacts the most important aspects of your score.

By signing up for a credit card and paying on time each month, you build a positive payment history. Then, by keeping spending on the card low, you create a low utilization ratio. Credit cards also positively impact your credit mix and new account aspects of your credit score.

If you are nervous about overspending with a credit card, consider getting a card with no annual fee and using it only for one or two recurring expenses. Get a credit card, place a small, recurring payment on it, then set the credit card to auto-pay and put it in the drawer. You wonât have to worry about missing a payment or racking up a big bill, but youâll be building your credit history fast.

Sneaky Ways To Improve Your Credit Score

There are certain times when it pays to have the highest credit score possible. Maybe youre about to refinance your mortgage. Or maybe youre recovering from a bad credit history, and you want to get approved for a credit card.

Its always good to have a healthy score, of course.

But if youre in a place where you really need to up that score as soon as possible, there are a few under-the-radar ways to speed up the process.

Don’t Miss: What Credit Score For Lowes Card

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Make Your Payments On Time

Lenders look closely at payment history to make sure youâll pay your loans on time and in full. With payment history making up approximately 35% of your credit score, a history of late payments can have a significant impact on your credit rating. Using RBC Online Banking or the RBC Mobile app makes it easy to pay your bill immediately or set up recurring payments. Payments can also be made via phone or mail, and in-person at a branch. RBC makes paying your credit card bill easy, so you can focus on things that matter most to you.

You May Like: How To Boost Your Credit Score Fast

How Long It Takes To Raise Your Score

The length of time it takes to raise your credit score depends on a combination of multiple aspects. Your financial habits, the initial cause of the low score and where you currently stand are all major ingredients, but theres no exact recipe to determine the timeline. Thanks to studies done by CNBC and FICO, weve compiled the typical time it takes to bring your score back to its starting point after a financial mishap. The following data is an estimate of recovery time for those with poor to fair credit.

| Event | |

|---|---|

| Applying for a new credit card | 3 months |

Here Are Some Simple But Effective Steps To Take On That Task

There are three major credit bureaus — Experian, Equifax, and TransUnion — that play a huge role in determining the availability and cost of consumer loans for everything from low credit limit credit cards to jumbo mortgages. You need to keep up with what their reports say about you.

They use your payment history to determine your creditworthiness, giving you a score that goes a long way toward determining how much you can borrow and how much interest you’ll pay for the credit you get.

A major kind of credit score is the FICO score, which ranges from 350 to 850. Its a brand so widely used that its become synonymous with “credit score,” but there are other brands, too. The bottom line is that most people need good credit to afford life in these here United States, and here are some best practices around how to improve yours.

5 Stocks Under $49Presented by Motley Fool Stock AdvisorWe hear it over and over from investors, I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. Id be sitting on a gold mine!” It’s true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share!

Previous

Next

Don’t Miss: Can Medical Bills Be On Credit Report

How Do Credit Repair Companies Work

Credit repair companies will engage with the credit bureaus and creditors to help get misleading, incomplete, or inaccurate information removed from your . The goal is to clean up your credit history and improve your credit score.

While a credit repair company typically doesnt do anything you cant do on your own, these services can be helpful if you need significant assistance with your credit. For instance, if you have several accounts to deal with or lots of errors on your credit reports, a credit repair company could be a good option for you. Disputing all of the issues on your own may be too time-consuming or overwhelming, especially if youre dealing with significant financial stress.

Implement Several Strategies For The Fastest Results

For maximum impact, exercise several of our recommended fastest ways to raise your credit score so they occur at the same time. Some strategies require positive action, while others would have you refrain from harmful behaviors.

You dont necessarily need excellent credit. With a little time and effort, you can once again enjoy the fruits of a good credit score, including a nicer lifestyle and increased financial security.

You May Like: Do Hospital Bills Affect Credit Score

Best Customer Experience: Creditrepaircom

- Monthly disputes: 19 per 4560 days

- Lowest monthly fee: $24.95

-

Only 19 disputes per 4560 days

-

No money-back guarantee

Similar to several competitors, CreditRepair.com offers tiered service packages. Its Direct package costs $69.99 and comes with bureau disputes, inquiry interventions, goodwill letters, and quarterly credit score updates. With a $99.95-per-month Standard package, you get the features of the Direct plan plus FICO Score inquiry assistance, which lets you dispute items on your own. Its highest-tier Advanced package costs $119.95 per month and comes with Direct plan features, monthly credit scores, and more dispute options.

Along with those offerings, we were told by CreditRepair.coms customer service that there is another plan that has a first work fee and a monthly fee of $24.95, but there are no details about this plan on the company website.

For more information, see the full .