Va Loan: Credit Score Evolution

Prior to the introduction of credit scores, a VA lender would review a credit report line item by line item to manually evaluate a credit report. The credit report contains information about a tradeline, how much is owed, the monthly payments and whether or not the payments were made more than 30, 60 or 90 days late. The report also listed any outstanding or paid collection items, charge-offs and judgments. If the underwriter saw any derogatory credit, unless it was a missed payment or two, the loan would likely be declined.

Then, the FICO company devised a complex analysis of payment patterns to produce a three-digit number reflecting a borrower’s credit past as a way to predict the future. This number ranges from 300 to 850 and the higher the number, the better the credit. The three main credit agencies, Experian, Equifax and Transunion all use the FICO model and report their scores to a VA lender when asked. The numbers will be similar to one another but rarely exactly the same.

Next step: Get no-obligation VA loan quotes from an actual lender

Because information can be reported differently and at different times to the credit agencies by creditors, the three-digit numbers will be slightly off. For example, a VA loan lender might receive three scores of 734, 746, and 752. The lender will use the middle score and throw out the lowest and highest.

Related: Here’s the truth about VA home loan costs

What Are The Rules For Down Payment Mortgage Insurance And Other Fees

VA loans do not require you to put down any money to obtain a loan, and dont require you to pay mortgage insurance. However, youll owe a funding fee, with the amount based on

- Whether youre in the military, are in the national guard, are a qualifying spouse, or are a veteran of the military or national guard

- The amount of your own down payment, if any

- The type of loan

- Whether youre a first-time borrower or youve had a past VA loan

Funding fees vary depending on whether youre buying or refinancing and other factors. This funding fees table on the VA website will help you figure out what youll owe.

Surviving spouses of deceased veterans who died because of their service dont have to pay a funding fee, nor do certain eligible veterans entitled to compensation for service-connected disabilities. When owed, the funding fee can be paid upfront or financed.

Lenders may also charge additional fees, including any of the following:

- Discount points to reduce your interest rate

- Loan origination fees

Fees and costs vary by lender.

Who Sets Va Loan Credit Score Requirements

It’s important to understand the VA’s role in the VA loan process. The VA doesn’t set a minimum credit score requirement but instructs lenders to make sound judgments.

The VA’s role is to oversee the program and guarantee a portion of each loan in case of default. But the VA does not issue loans, and the agency does not enforce credit score minimums. Private lenders handle both of these duties.

Most VA lenders use credit score benchmarks. Applicants with scores below a lender’s standard usually can’t be approved for VA financing. That minimum will vary from lender to lender.

Also Check: How To Remove Repo From Credit

What Va Loan Credit Score Do I Need

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

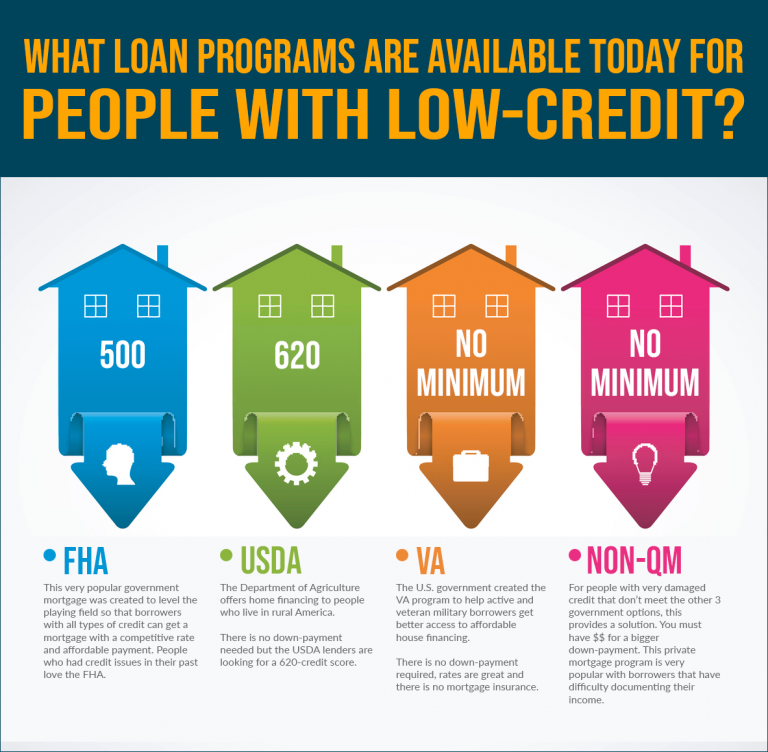

Lending guidelines for loans backed by the U.S. Department of Veterans Affairs dont set a VA loan credit score requirement. However, most lenders require a 620 minimum credit score for a VA loan and tend to offer lower interest rates to borrowers with higher scores.

A Backup Plan: Fix Your Credit And Then Refinance

If you find problems in your credit history after applying for a mortgage loan, it may be too late to increase your credit score. If you continue the home buying process, expect a higher monthly payment especially on a conventional loan.

But you may be able to refinance your mortgage in a few months or years after your credit score improves.

Refinancing could help you replace your existing mortgage with a new one that has a lower rate and better terms, once your finances are looking better.

Recommended Reading: Usaa Free Credit Report

What Credit Score Do I Need For A Conventional Loan

Lenders issuing conventional mortgages have considerable leeway in determining credit score requirements for their applicants. Lenders may set credit score cutoffs differently according to local or regional market conditions, and they may also set credit score requirements in accordance with their business strategies. For example, some mortgage lenders may prefer to deal only with applicants with credit scores above 740considered very good or exceptional on the FICO® Score scale range of 300 to 850, while others may specialize in subprime mortgages aimed at applicants who have lower credit scores. Many lenders offer a catalog of mortgage products designed for applicants with a range of credit.

All that considered, the minimum FICO® Score required to qualify for a conventional mortgage is typically about 620.

Other Construction Financing Options

If you dont qualify for a VA construction loan or cant find a participating lender, youre not out of luck. There are other financing options you can pursue for your new home.

For example, you could obtain a separate lot loan to buy the land and a traditional construction loan to pay for the construction expenses, followed by a separate VA home loan to finance the permanent finished residence.

The drawback with this approach is that you will have separate underwriting, appraisals, closings, and fees, and your nonVA construction loan will probably require a down payment, says Duncan.

Or, you can pursue an FHA constructiontopermanent loan, which combines the lot purchase, construction costs, and permanent mortgage financing on the completed house into one loan with one appraisal and a single closing. However, you likely have to put down at least 3.5% to 10% and pay private mortgage insurance upfront and annually.

Alternatively, if you choose a USDAapproved rural area to construct a home in, you may be eligible for a USDA constructiontopermanent loan. These also require no down payment and combine the lot purchase, construction costs, and permanent mortgage loan into one loan product.

Lastly, instead of building a new construction home, home buyers might consider purchasing a fixerupper.

Also Check: How Long Will A Repo Stay On My Credit

Is It Possible To Obtain A Va Loan With Bad Credit

Bad credit and thin credit can make home loan approval difficult, whether you need a VA purchase loan or a mortgage with an Energy Efficient Mortgage option. Your participating VA lender will review your assets, debts, income, payment history, and employment history. Your credit score does matter, but it isnt the only deciding factor.

What Are Va Loans

The Veterans Administration makes mortgage loans available to U.S. veterans who meet the VA Loan guidelines.

They do not lend money directly but guarantees the loans, making it more desirable for lenders to make loans to veterans.

Because VA requires no down payment and no minimum credit score, it offers many veterans with poor credit or limited resources the opportunity to become homeowners.

Also Check: Does Wells Fargo Business Credit Card Report To Bureaus

Can I Use A Mortgage Calculator Based On Income +

You can gauge how much of a mortgage loan you qualify based on your income with our Mortgage Required Income Calculator. You will need to work backward by altering the mortgage cost and supplying details of your other financial commitments. The calculator will then reply with an income value with which you compare your current income.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: Increase Credit Score By 50 Points

What Credit Score Do You Need For Approval

For the most part, the minimum credit score needed for a personal loan approval will depend on the lender. Some lenders will tell you upfront what their minimum requirements are. Payoff Personal Loan, for example, requires a FICO score of 640 or higher for approval.

While lenders might approve loans to consumers with a wide range of scores, the terms will likely be better for those with higher scores.

“If you have a 760 credit score, they’ll give you different terms versus if you have a 580 credit score,” Droske says. “If you have a 580 credit score, a lender may still give you a loan, but they’ll adjust the terms accordingly because you’ll be seen as a riskier borrower.”

Having a higher credit score usually means you can be approved for lower interest rates and more favorable loan terms.

But while your credit score is an important piece of the puzzle, keep in mind that you’ll also need to provide some other crucial pieces of information like your annual income, employment status, social security number and details on how you’d like to use the loan.

“Before you have a bunch of different lenders run your credit, ask if they have a credit score requirement and what it is,” Droske says. “You can also ask what scoring model they use so you can see for yourself if your credit score currently falls in their required range.”

A Lender May Have Credit Requirements

VA doesnt stop lenders from having overlay requirements if they think that this is imperative to ensure that the borrower can truly afford a VA IRRRL. Furthermore, some lenders may require a credit score of 580.

Remember, though, that overlay requirements arent mandated by the VA. There is still a large number of lenders who dont have overlay requirements for a VA IRRRL. They just stick with the VA guidelines. So long as you meet these minimum requirements, you can qualify for this refinancing program.

However, there are a few exceptions to this rule. Taken from the VA pamphlet, no credit information or underwriting is required unless:

- the loan to be refinanced is 30 days or more past due or,

- the monthly payment will increase 20 percent or more.

There you have it, Veterans Affairs doesnt have any credit requirement except for two scenarios. A lender may or may not have credit overlays. Its highly encouraged that a borrower shop for a lender whos willing to process the IRRRL without any overlays.

Do You Know if You Qualify?

- No credit check required by the VA

- No employment verification required by the VA

- No home appraisal required by the VA

- Switch your ARM to a fixed-rate VA loan

- Lower your interest rate, save money

If you are a veteran with an existing VA loan or mortgage, you may qualify to save with a VA Interest Rate Reduction Refinance Loan, or VA IRRRL.

Recommended Articles

Don’t Miss: Can A Closed Collection Account Be Reopened

What If I Fall Short On Credit Requirements

Potential VA loan borrowers needn’t abandon their dreams of homeownership due to a low credit score. The best feature of credit is its fluidity. Your credit changes constantly.

Improve your fiscal habits, and your credit score will gain positive momentum. But knowing what improvements to make can be tricky. Should you pay off high-interest debt? Should you cancel certain credit cards? How should you handle that bankruptcy looming over your credit report?

If you’re considering a VA loan but need help navigating your credit options, get some free help from the Veterans United credit consultant team.

Our credit consultants work on behalf of service members who fall short of VA loan requirements. Working with a credit consultant is a no-cost process, but not necessarily an easy one. Improving your credit requires commitment and hard work. If you’re ready to make the necessary changes to pursue a VA home loan, partner with a helpful advocate.

Tips To Improve Your Credit Report Before Home Buying

Bad credit doesnt necessarily mean you wont qualify for a mortgage. But borrowers with good to excellent credit have the most loan options. They also benefit from lower rates and fees.

If you can polish up your credit report before shopping for a mortgage, youre more likely to qualify for the best loan terms and lowest interest rates.

Here are a few tips to improve your credit report and score before applying:

Removing inaccurate information can increase your credit score quickly. Developing better credit habits will take longer to produce results.

If youre looking to buy or refinance and know you may need to bump your credit score, it can be helpful to call a loan advisor right now even if youre not sure youd qualify.

Most lenders have the ability to run scenarios through their credit agency providers and see the most efficient and/or costeffective ways to get your scores increased. And this can be a much more effective route than going it alone.

Also Check: Syncb Inquiry

What Are Todays Mortgage Rates

The VA IRRRL is among the simplest, fastest ways to refinance a U.S. home loan. With mortgage rates down, then, consider your eligibility to refinance.

Get todays live mortgage rates now. Your social security number is not required to get started, and all quotes come with access to your live mortgage credit scores.

The Va Construction Loan Process

The VA construction loan process involves a series of steps, according to , CEO and founder of the Julie Aragon Lending Team:

Note that, for VA construction loans, disbursement of the funds to pay for the building of the home occurs in a series of installments, or draws, at certain milestones as the construction progresses, explains Aragon.

You May Like: 688 Credit Score Credit Card

What Credit Score Do You Need For A Va Home Loan

There are lots of benefits that come with VA loans, especially if you have full entitlement no down payment, no mortgage insurance, and no loan limits for qualifying veterans, just to name a few.

Theres also no minimum VA home loan credit score set by the U.S. Department of Veterans Affairs , which insures VA mortgages.

The private lenders who loan those mortgages, on the other hand, do set minimums. But these can vary significantly from one company to the next.

This guide will break down the general score requirements and how you can increase your chances of qualifying for this 0% down loan program.

Va Home Loan Credit Score Hack: Make A Down Payment

When you apply for a VA loan, the loan officer puts your application through a computerized system that analyzes all your financial indicators not just credit score.

One factor the system puts a lot of weight on? Thatd be the down payment.

Its true: The VA approval system really likes down payments. And while VA loans dont technically have a down payment requirement per se, the system favors applicants who make a voluntary one even if its just a mere 1 or 2%.

Recommended Reading: Average Credit Score For Care Credit

Va Refer/eligible Purchase Or Refinance

If for some reason the VAs algorithm doesnt approve you, you may still be able to get a loan under the refer/eligible route. These loans undergo the human scrutiny of manual underwriting. An underwriter will go through your documentation and see if you qualify.

Loans that dont qualify for automated approval are usually those with certain negative credit items in their past. This could include late mortgage payments, past bankruptcies or foreclosure.

To qualify based on manual underwriting at Rocket Mortgage, you need a minimum median FICO® Score of 640 or better. Your DTI can also be no higher than 45%. If you are refinancing, you have to leave at least 10% equity in the home.

What Are The Va Loan Terms For 2022

As of 2020, VA loan no longer have value limits for qualified borrowers. That means first-time VA loan borrowers will have no cap on the size of $0 down VA loans. The VA funding fees, which most borrowers have to pay when they close on their mortgage, remain the same as they were in 2020.

The funding fees range from 0.5 percent on some refinances to 3.6 percent for some home purchases. The exact fee varies depending on the value and type of your loan, how much you put down, and whether its your first VA financing.

These one-time fees help keep the loan program running. However, some borrowers may have to pay slightly more than the published rates in 2021. Veterans and service members will be charged the higher rates though National Guard and Reserve members will have their funding fee lowered to the same level as other military borrowers.

Veterans with service-related disabilities and some surviving spouses dont have to pay a funding fee. Purple Heart recipients on active duty are also exempt from the fee.

Recommended Reading: Report A Death To Credit Bureaus