Do Food Stamps Hurt Your Credit

As far as credit scores go, your salary doesnt matter. At least, not directly. But will a program for the poor impact your credit?

Credit scores are based on the information in your credit report, and because income information isnt reported to the credit bureaus, it has no bearing on your score. Of course, having little money at your disposal could make it more difficult for you to meet your debt obligations, which could in turn hurt your credit standing.

Just like the number on your paycheck doesnt help or hurt your credit standing, receiving government aid doesnt impact your credit scores, either. For instance, if youre enrolled in the Supplemental Nutritional Assistance Program , it wont show up on your credit report.

In short: If you live in a low-income household thats eligible for food assistance, you shouldnt be worried about what that means for your credit standing. In fact, if enrolling in SNAP allows you to apply your limited resources to paying bills and satisfying financial obligations, it could indirectly help your credit.

Know What Matters & What Doesnt

Among the dozens of out there, different bits of your financial behavior matter more than others, but for the most part, you want to focus on a few things: Pay your bills on time, minimize your debt load, apply for credit sparingly, maintain a good mix of credit accounts and work to establish a long credit history.

More from Credit.com

Also Check: How Accurate Is Creditwise Credit Score

The Three Major Consumer Credit Bureaus Are Equifax Experian And Transunion

A credit bureau is a company that gathers and stores various types of information about you and your financial accounts and history. It draws on this information to create your credit reports, which in turn form the basis for your credit scores.

The three major credit bureaus are often grouped together. But theyre separate companies that compete for the business of , who may use the credit reports and scores from these bureaus to help them make lending decisions. And theyre not the only three bureaus out there.

Keep reading to learn about the data the credit bureaus collect, how credit bureaus get the information they use to create your reports and scores, and how you can contact them if you think somethings wrong.

Also Check: Does Car Insurance Show On Your Credit Report

Can I Use My Fingerhut Credit Card At Walmart

You cannot use your Fingerhut credit card at Walmart. Fingerhut extends credit to people to shop at their store through their online catalog.

It isnt a Visa or Mastercard, so it functions more similarly to a store credit card. However, they do have some partners, and you will receive offers to use your account for purchases from them.

You can find out who these partners are each month on your statement, and if you want to take advantage of an offer, you can use it then.

Don’t Miss: Why Is Credit Karma Score Higher

Rewards Cash Back Low Rate

Whatever you need, we have a card that fits the bill.

And right now, say hello to $150 bonus rewards and up to 4x the points with our new Everyday Rewards+ card!

Frequently Asked Questions

Got questions? Weve got answers. And, if you dont find what youre looking for, call us at .

- What credit score do I need to apply for a credit card?

-

We offer cards for people with all different credit scores. We even have a Secured Visa Card if youre looking to rebuild your credit.

- Why do you need my personal information for my credit card application?

-

The law requires that we must obtain and verify information about everyone who opens an account. We also use your personal information to pull your credit bureau data, which we use with information like your income to determine if a card is right for you, and if so, what your credit limit will be.

- Can I allow a family member or friend to use my credit card account?

-

Yes. If youd like to add an authorized user, wed be happy to help with that, and will send you a second card for their use.

Also Check: What Bank Does Carmax Use

How To Apply For Acima Financing

There are three ways to apply with Acima Credit: online, on your mobile device or in a partner store. Acima says it will issue you an immediate credit decision once you complete a brief online or mobile application.

To apply, youll need to provide the following:

- A U.S. government-issued photo ID and Social Security number or individual taxpayer identification number

- Three months of history with your current employer or current source of income

- At least $1,000 worth of deposits per month in a checking account that has been open for at least 90 days

- A view into your checking account so Acima can check for any history of insufficient funds charges, excessive overdrafts or negative balances

You May Like: Does It Hurt Your Credit To Check Your Credit Report

How Does It Work

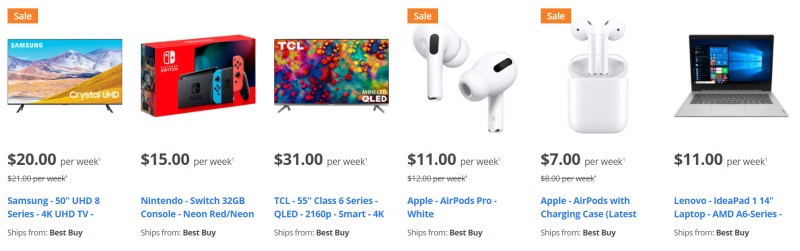

FlexShopper works by leasing goods under a rental-purchase agreement under which the customer either makes 52 weekly payments, or can choose the early purchase option to fully buy the leased goods outright.

Should the product no longer be needed, or should the customer not be entirely happy with it, they may also give the company sufficient notice and return the product.

Does Acima Have An App

You can then use the Acima mobile app to easily check out with your approved retailer or to switch locations if you change your mind and would like to shop somewhere else. See your lease details, make payments, get support, access your agreement, and more. And look for new ways to shop online with the app coming soon.

You May Like: What Credit Score Is Needed To Refinance A House

You May Like: Does Mortgage Help Credit Score

What Is The Use Of Flexshopper

What is FlexShopper? FlexShopper is the largest online lease-to-own1 marketplace stocked with an incredible selection of products from top brands. When you dont have the cash or credit available, FlexShopper provides the solution affordable weekly payments so you can rent-to-own your products in 12 months or less.

Active Or Closed Accounts

Elan Financial Services could also appear on your credit reports in the accounts section. If youve been checking your credit reports regularly, dont have any new credit cards and still dont recognize an account, theres a chance that one of your existing accounts was purchased by another bank or company. In that case, the creditor listed for the account wouldve been updated to the new company.

If youve done some digging and you still dont recognize the account, its possible that someone fraudulently used your identity to apply. Learn more about steps to take after identity theft.

Recommended Reading: How Do You Get Your Credit Report

How Do I Cancel My Membership With Club Fitness

We are sorry to hear you have decided to end your membership with Club Fitness. Cancellation notices can be submitted in person by the member with the Manager or Assistant Manager of any open location. Photo ID and an email address are required to fill out the form. A 30-day notice is required for all cancellations.

Can You Transfer Fsa To Bank Account

No, you can use funds only for the purpose for which the election was initially made. IRS regulations do not allow funds to be transferred or commingled between accounts. So, the money in your Health Care FSA may only be used for health care expenses and your Dependent Care FSA may only pay for dependent care expenses.

Also Check: Is 816 A Good Credit Score

What Does Cash Price And 90 Days Same As Cash Mean

Cash price equals the retail price you must pay in order to own a leased item. This price is usually $50 or more over the price listed by merchants selling the item without a leasing agreement. FlexShopper reduces the cash price amount by $50 for each additional item you order when renting multiple items at once. Multiple item orders do increase rental costs however, this option is cheaper than purchasing items separately.

Instead of committing to a long lease term, you can take advantage of the 90 days same as cash option. This involves paying off the entire amount you owe for one or more items within a 90-day period. You own the item free and clear and there are no further financial obligations.

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

Recommended Reading: How To Delete Closed Accounts On Credit Report

What Happens If I Stop Paying Progressive Leasing

If you wish to terminate or terminate your Progressive Leasing agreement within five days of purchasing the item and you qualify for an entire refund. If you opt to end your contract more than 5 days following the date you signed it, then you can receive a credit, or even a reimbursement in the event that you return the item that you purchased.

Wrapping It Up: What Is The Best Website Like Flexshopper

Katapult is the best website like FlexShopper. It can give you an automatic spending limit higher than what FlexShopper will give you, and its network includes both in-store and online shopping options.

No credit is required, and Katapult has excellent ratings from consumers and an A+ rating with the BBB.

Benjamin Levin is a digital marketing professional with 4+ years of experience with inbound and outbound marketing. He helps small businesses reach their content creation, social media marketing, email marketing, and paid advertising goals. His hobbies include reading and traveling.

Recommended Reading: How To Save Credit Report On Experian

Can You Use Flexshopper On Amazon

FlexShopper breaks with the old stereotypes regarding brick-and-mortar rent-to-own showrooms and brings the lease-purchase model into the 21st-century with an online shop filled with more than 140,000 items customers can choose from many from top retailers like Best Buy, Overstock.com, Amazon, and Walmart.

Read Also: How To Remove Late Payments From Credit Report Sample Letter

Is The Flex Card A Good Deal

On their own, each of these benefits is impressive, but the Freedom Flex has them all, making it one of the best cash back credit cards on the market. However, like other cards with rotating bonus cash back programs, quarterly categories may not be the best fit for you based on your spending habits.

Read Also: How Does Credit Score Go Up

Re: How To Get Approved For Elan Financial Business Credit Card

Hi I just recently got approved for a card with Elan. I got it thru my bank Flagstar. I have had my business account with them for several years. My personal Experian score was 693. I have SEVERAL inquiries. And SEVERAL cards utilization about 10%. Card doesnt report to personal credit. I have a few business cards: AmEx Delta Gold, Costco Citi, Webstaurant, Capital One, Menards, Home Depot.

You are approved for the Visa® Business Cash Card.

Here are a few things to know about your new card:

Your credit line is $9,000.

Your card should arrive via U.S. Postal Service in approximately four days.

If you requested a balance transfer, you will receive a letter in the mail with information regarding your request.

Thank you for being our customer!

Thanks for replying! This is very good information to know. Sounds like you have a long-established business relationship with Flagstar. I wonder if Elan actually checked with Flagstar to investigate your business banking activity and determined that for your approval, or if they simply based your approval on your personal credit and business credit.

wrote:

Very well written Janus!!

Is Flex Card A Credit Card

A Flex Card is a stored value card that reflects the balance of your medical and/or dependent care reimbursement account or flexible spending account. Since there are no transaction fees or pin numbers, the card should be swiped through the provider location scanner using the credit/credit card option.

You May Like: Is 653 A Good Credit Score

Effectively Monitor Transactions With Payment Analytics

Payment Analytics is an easy-to-use, web-enabled tool that lets you monitor adherence to commercial card payment policies. It also provides the necessary audit functionality to mitigate your control-related risk. Using customizable rule templates, organizations can automatically review all card transactions and flag suspected card misuse and out-of-policy spending.

With Payment Analytics you can:

- Automatically monitor 100% of card transactions and flag suspected card misuse or out-of-policy spending

- Streamline your audit process and gain greater spend visibility and control with less effort

- Get up and running quickly and easily with our simple web-based interface no hardware, software or extensive training required

- Access your commercial transaction data online, anywhere, anytime

| Reasons we can share your personal information | Does Elan Financial Services share? | Can you limit this sharing? |

|---|---|---|

| For our everyday business purposessuch as to process your transactions, maintain your account, respond to court orders and legal investigations, or report to credit bureaus | Yes |

Getting Badcock Deleted From Your Report

Applying for a Badcock store card or financing may result in a hard credit check.

While your score might be hit as a result of the inquiry, you dont need to be too concerned.

Inquiries only stay on your report for 2 years and typically only have a minor impact.

But no matter how small the effect is on your score, if you ever suspect identity fraud or a reporting error, you shouldnt let it go unchecked.

At the very least, you should follow up with Badcock about the entry and file a quick dispute with the credit bureaus.

And if you need help, consider working with one of the top .

If you did apply for Badcock financing and were approved, the best thing you can do moving forward is to make timely payments.

Your payment history has a far bigger impact on your credit than a hard inquiry does.

4.6/57-10 daysthis is here

Account DetailsSimply log in to your Stoneberry account to check the status of your order here or call one of our friendly customer service representatives at 1-800-704-5480.

Additionally, how do you use Stoneberry credits? No Formal Application Process Applying for Stoneberry Credit is as easy as placing an order!

Also know, how long does it take Fingerhut to approve credit?

10 days

What does unprocessed credit order mean?

You May Like: Aargon Com

Don’t Miss: How To Get Credit Report From Credit Karma

How Flexshopper Works

FlexShopper is a shopping site that gives customers an opportunity to purchase name-brand products on a lease-to-own basis. Instead of paying for items up front or on credit, you can make small payments for an extended period of time. Its not layaway, though, as you can enjoy your purchases while you pay them off. After completing all payments, you own the item outright.

What Is Mdg Usa Inc

MDG brings leading consumer financing programs to you! As an ecommerce company we understand the importance of being able to buy the products you want at affordable prices. MDG offers customers brand name electronics, televisions, computers, appliances, furniture and mattresses at competitive prices.

Related

Recommended Reading: Does Opening A New Credit Card Hurt Your Credit Score

Read Also: Does Cancelling A Credit Card Affect Your Credit Rating

What You Need To Know

Net purchases are purchases minus credits and returns. Not all transactions are eligible to earn rewards, such as Advances, Balance Transfers and Convenience Checks. Upon approval, see your Cardmember Agreement for details. You may not redeem Points, and you will immediately lose all of your Points, if your Account is closed to future transactions .

1 Max Cash Preferred Card: Cardmember must initially enroll into categories of their choice, or all net purchases will earn no more than 1% cash back. Categories are subject to change. You will earn 5% cash back on your first $2,000 in combined net purchases each calendar quarter in your two chosen 5% categories and unlimited cash back in your 2% category. All other net purchases earn 1% cash back. Transactions qualify for 5% or 2% cash back based on how merchants classify the transaction. Upon approval, full details will be provided in your Cardmember Agreement. Cash rewards can be redeemed as a deposit to a checking or savings account with this Financial Institution only, which will be deposited within seven business days, or as a statement credit to your credit card account, which will be deposited within one to two billing cycles or as a Rewards Card . Cash rewards do not expire as long as the account remains active. If there is no reward, purchase, or balance activity on your account for 12 statement cycles, your cash rewards balance will expire.

How Do Credit Bureaus Get Your Information

The information that the bureaus collect comes from a variety of sources.

Information reported to the bureaus by creditors Creditors, such as banks and credit card issuers, may report information about their accounts and customers to the credit bureaus. In this context, the creditors are known as data furnishers.

Information thats collected or bought by the bureaus For some types of information, the credit bureaus buy the data. For example, a consumer credit bureau might buy public records information from LexisNexis, another credit bureau, and use this information when generating your credit report. Examples of information that a credit bureau may buy include government tax liens or bankruptcy records.

Information that gets shared among the bureaus Although they are competitors, sometimes the credit bureaus must share information with one another. For example: When you place an initial fraud alert with one of the bureaus, its required to forward the alert to the other two.

Read Also: What Is The Best Credit Rating Agency