Do Mortgage Lenders Care About Debt Management Plans

If your credit score and payment history are in their wheelhouse, and your debt-to-income ratio is acceptable, most mortgage lenders dont care if youre in a debt management plan.

Neither Fannie Mae nor Freddie Macs underwriting guidelines specifically mention credit counseling or DMPs for conforming loans that are processed through their automated underwriting systems.

But if a human manually underwrites your loan, the decision may be different. Underwriters use their best judgment, and opinions vary. In addition, mortgage lenders can overlay stricter requirements than program minimums.

What Is A Good Credit Score Out Of 1000

We provide a score from between 0-999 and consider a ‘good’ score to be anywhere between 881 and 960, with ‘fair’ or average between 721 and 880. Before you apply for credit, it’s a really good idea to check your free Experian Credit Score, so you can make more informed choices when it comes to applying for credit.

Think Carefully Before Closing Old Credit Card Accounts

If you dont use an old credit card much anymore, you might be tempted to close it.

To this we say: Not so fast. Keeping an old credit card account open can increase your age of credit history as well as your credit mix, which could help you build credit.

You might be better off keeping that old account open, assuming you dont have to pay an annual fee. You may even consider putting a small recurring charge like a monthly subscription on the card to ensure the account stays active and the credit card company doesnt close it for you.

Also Check: Can Checking Your Credit Score Lower It

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Dont Apply For Too Many New Credit Cards At The Same Time

A hard inquiry typically occurs when you apply for a new credit card. This just means that the card issuer has requested to check your credit as part of the approval process.

A hard inquiry can have a small negative impact on your credit, but just one hard inquiry is usually not a big deal. But multiple hard inquiries in a short period of time might lead lenders to assume that youre a potentially risky borrower. Whether thats true or not, it isnt something you want weighing down your credit!

You May Like: Do Student Loans Show On Your Credit Report

Credit Score Credit Card & Loan Options

Some lenders choose not to lend to borrowers with credit scores in the Fair range. As a result, your financing options are going to be somewhat limited. With a score of 622, your focus should be on building your credit history and raising your credit scores before applying for any loans.

One of the best ways to build credit is by being added as an authorized user by someone who already has great credit. Having someone in your life with good credit that can cosign for you is also an option, but it can hurt their credit score if you miss payments or default on the loan.

Strategies To Build Your Credit In The Long Run

You should also look into methods for building your credit in a sustainable way over time. The methods listed above are great for removing negative marks that are artificially lowering your score, but theres more to achieving a healthy credit score than that.

Try to:

- Use your credit accounts regularly and responsibly to add positive information to your credit reports. If you dont have any credit accounts, you may want to look for ones that are targeted at people who are trying to build credit, such as secured credit cards and . However, your score is good enough that you can also get a normal credit card or loan if you prefer.

- Practice good credit habits in the future. Use your credit in moderation and pay off your credit cards in full each month before your due date.

- Do your best to get out of debt. Theres no easier way to tank your score than to let your debts spiral out of control.

- Add alternative data to your credit report with Experian Boost or a third-party service that reports your rental payments, such as PayYourRent or eCredable.

Boost your credit for FREE with the bills you’re already paying

5.0/5

No credit card required. Results may vary, see website for details.

Boost your credit for FREE with the bills you’re already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost

- Daily Experian credit monitoring and alerts

You May Like: Who Can Check My Credit Report

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

What Is A Credit Score Anyway

Whenever you finance a purchase, you’re using credit rather than paying for it outright. This includes everything from your favorite store credit card to your car loan. Your credit score, which reflects the information on your credit report, directly impacts your ability to take out new credit.

Before lenders start handing over cash, they want to feel confident that the borrower can be trusted to repay the loan as promised. A stronger score basically tells lenders that you’re good for it, making you more likely to get approved.

Your credit score also affects the interest rates available to you . Higher rates equal higher costs.

Also Check: Does A Background Check Show Up On Your Credit Report

Fha Loan With 622 Credit Score

FHA loans only require that you have a 580 credit score, so with a 622 FICO, you can definitely meet the credit score requirements. With a 622 credit score, you should also be offered a better interest rate than with a 580-619 FICO score.

Other FHA loan requirements are that you have at least 2 years of employment, which you will be required to provide 2 years of tax returns, and your 2 most recent pay stubs. The maximum debt-to-income ratio is 43% .

Something that attracts many borrowers to FHA loans is that the down payment requirement is only 3.5%, and this money can be borrowed, gifted, or provided through a down payment assistance program.

Protect Your Exceptional Credit Score

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

Mortgage fraud occurs when a borrower, broker or an appraiser lies about information on the application for a mortgage loan. During the mortgage crisis, Experian estimated that first-party fraudlike loan stackingmay have accounted for more than 25% of all consumer credit charge-offs at the time.

Credit-monitoring and identity theft protection services can help ward off cybercriminals by flagging suspicious activity on your credit file. By alerting you to changes in your credit score and suspicious activity on your credit report, these services can help you preserve your excellent credit and Exceptional FICO® Score.

Don’t Miss: When Does Capital One Report Credit

Can I Get A Personal Loan Or Credit Card W/ A 622 Credit Score

Like home and car loans, a personal loan and credit card is difficult to get with a 622 credit score.

A secured card with Discover or Capital One might be an option, but you may have to pay $500-$1000 just for a deposit. The fine print is confusing and more often than not youâll end up in a worse situation than before you got your secured card.

You can save a ton of headache by repairing your credit and waiting a few short months until your score improves.

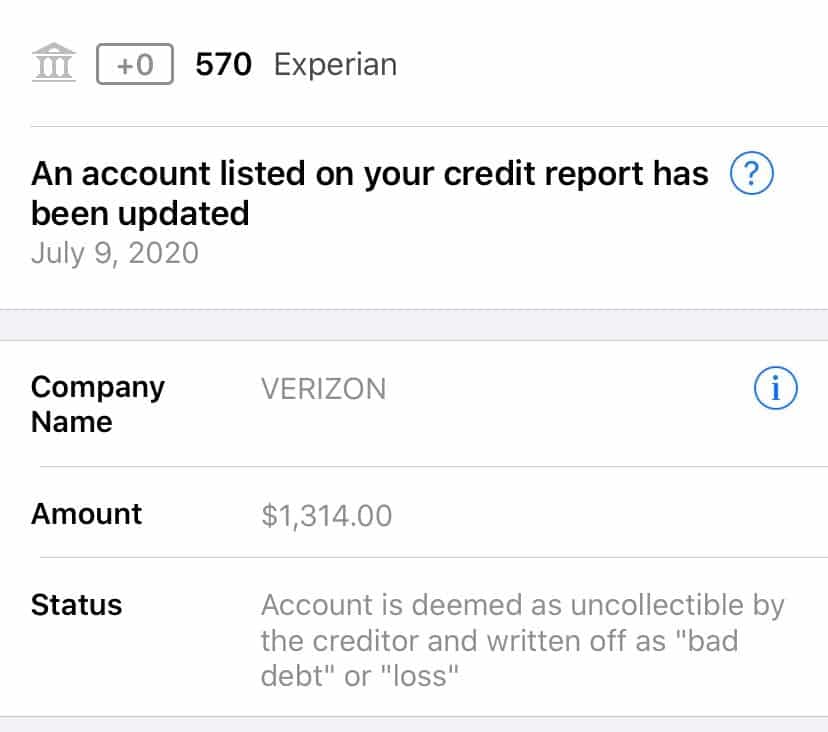

A 622 score means you likely have negative items on your report. Removing those negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Also Check: How To Instantly Raise Your Credit Score

Understanding Auto Loan Credit Scores

Your credit score is how lenders measure your financial stability and determine how well you can pay back debt. Credit scores are broken into tiers. Experian gives the following tiers and score ranges for auto loans.

Your FICO Auto Score, which most lenders use to evaluate car loan applications, may be lower or higher than your regular credit score depending on your previous auto loans – how much you borrowed and how well you made the payments.

Your exact FICO Auto Score can even vary from lender to lender. Each lender reviews your credit report information and weighs it according to what they think is the most important.

How Do You Get A 900 Credit Score

Recommended Reading: How To Get Fico Credit Score

It May Be Difficult For You To Obtain A Loan Or Card

It may be difficult for you to obtain a loan or card with a 622 credit score, but there are still ways to improve your score.If you have a 622 credit score, it’s considered to be fair. This means it may be difficult for you to obtain a loan or credit card. However, there are still ways to improve your score. You can do this by paying your bills on time, maintaining a good credit history, and using a credit monitoring service.

Approximately four out of ten Americans who have a FICO Score of 622 have at least one instance of late payment on their credit report.

What Is A Good Credit Score For My Age

Your age doesnât directly influence your credit scores. But as FICO and VantageScore show, the age of your credit accounts is one factor that affects how scores are calculated.

That could be one reason peopleâs credit scores tend to increase as they get olderâtheir accounts have simply been open longer. But credit scores can rise or fall no matter how old you are. And having good credit scores comes down to more than just the age of your accounts.

Read Also: How Long Until Late Payments Fall Off Credit Report

Can I Get Financed For A Car With A 620 Credit Score

To be clear, you can get a car loan with a low credit score. While the exact definitions of these terms vary depending on who you ask, the Consumer Financial Protection Bureau, or CFPB, defines subprime as borrowers with credit scores of below 620 and deep subprime as borrowers with scores below 580.

How To Improve Your 622 Credit Score

Think of your FICO® Score of 622 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.

78% of U.S. consumers’ FICO® Scores are higher than 622.

You share a 622 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Recommended Reading: Does Credit Journey Affect Credit Score

Other Factors That Can Help You Qualify For A Car Loan

Weve already gone over some factors: purchasing a less expensive car, having a large down payment, getting a preapproval and having a cosigner. Here are other things that you could provide a lender to show that youre financially stable and able to repay a car loan.

- Proof of income : Pay stubs are typically an easy way to prove your income. If your employer dont provide them or you have income from other sources, such as child support, alimony or a pension, you could provide three to six months of bank statements.

- Proof of residence : Paperwork showing your name and your address can satisfactorily prove where you live: utility bills, cell phone bills, mortgage or lease agreement.

- References: By providing references, youre giving the lender a list of people they can contact if you stop making payments. This can be seen as useful if you move frequently.

Above all, talk to the lender. Talk to a customer representative and ask what you can do to get approved or to get a better interest rate. They may be able to provide a clear answer, such as saying that you need $300 more on your down payment.

Check Your Credit Report

The credit records of an individual are the ones that are used to calculate the credit score. People should, therefore, check if the reports have a problem that may hinder the correct score from being obtained. Many errors tend to be noted in the credit scores. The most common error encountered is late payments incorrectly listed. When you find any error, it is recommended to file a dispute immediately. The dispute is submitted to the credit bureau, so that fix the problem. Regular monitoring of the credit report also helps to guard against unlawful activities. It also gives one an opportunity to make changes to the wrong information provided or may have changed to avoid trouble.

The credit score within this range is considered good. However, there is need to continually monitor the credit records to identify any issues that may be there. This means the ability to raise a dispute. Also, you are able to identify any errors that may negatively affect the score in the future such as fraudulent activity.

Also Check: How To Get Transunion Credit Score