What Is A Credit Score

Just about everyone knows they have a credit score, but do you know what this really is?

A credit score is a score assigned to you by the various credit reporting bureaus to determine the level of risk in lending to you.

The higher your score, the more likely you’ll get approved for new credit.

Plus, the lower your interest rates will be. (Since interest rates are not just a way to earn profit, but also a form of protection in case of default.

If you default, at least the lender was able to earn some more money back in the process to mitigate against what they lose if you default.) Here are some examples of differences you’ll see in interest rates based on different credit scores:

Generally Closing A Bank Account Doesnt Affect Your Credit

The mere act of closing a bank account doesnt have a direct impact on your credit. The Consumer Financial Protection Bureau confirms that the three major credit bureaus – Experian, Equifax and TransUnion – dont typically include checking account history in their credit reports. But your credit could suffer if youre not careful when you close an account.

Closing A Credit Card Can Raise Your Credit Utilization Ratio

When an installment loan, for say a car or furniture, gets paid off that account is closed. However, I want you to think twice before closing a revolving account just because you havent used it in a while.

Dont get me wrong there are good reasons to close revolving accounts, like a high annual fee or poor customer service but generally speaking, I recommend not closing accounts especially for someone with a limited credit history.

While the closed account will still count toward your credit age in that part of the equation, if you close a credit card you may lose points in the credit utilization scoring factor, which counts for 30% of your FICO score.

Closing an account reduces your overall available credit, which is used in the utilization calculation. Utilization is figured two ways. First, the ratio of balance to credit unit is used, and second, the ratio of all your credit limits on all your cards to all your balances is factored in. Closing an account reduces the value of the second ratio.

You May Like: Is 725 A Good Credit Score

How Do You Dispute An Item On Your Credit Report

To dispute an item on your credit report, you’ll need to contact each credit bureau and file a dispute. You can file your dispute online, which is typically the fastest option. If you have supporting documentation, you can upload that as well. You can also make a dispute by mail be sure to use certified mail if you do.

Through Credit Card Utilization Ratio

The first way that canceling a credit card affects your credit score is by lowering your credit card utilization ratio. Your utilization ratio is the total amount of available credit that youre actually using. If you have a credit card with a $10,000 limit and you regularly spend $5,000 on that card each month, youd have a utilization ratio of 50% .

Having a low utilization ratio is generally considered a positive factor in determining your credit score.Lenders prefer when youre not using all of your available credit, since doing so can be an indicator of financial distress. When you cancel a credit card, you lower the total amount of your available credit line, which will generally raise your credit card utilization ratio.

You May Like: How To Build Up Credit Score

Read Also: Is 688 A Good Credit Score

How Closing A Credit Card Could Hurt Your Credit Score

Your credit history and score reflects your past behavior with credit and loans, demonstrating to future lenders the likelihood that youll repay borrowed funds. Closing a card impacts two important components of your credit score: the overall age of your accounts and your credit utilization ratio.

In the past, people who had too many open credit accounts were penalized as they were viewed as being high-risk with so much credit available to them however, this has changed considerably over the years. As long as a borrower has handled all of their accounts responsibly by keeping balances low and paying on time, lenders no longer negatively weigh having multiple credit cards as a bad thing.

However, juggling multiple credit cards can become cumbersome, and if youre paying an annual fee for a card you rarely use, decluttering your wallet can be a smart move if done wisely.

How Closing An Account Could Affect Your Credit Score

Your is an intangible asset that exhibits your financial credibility. The better your score, the more you can do.

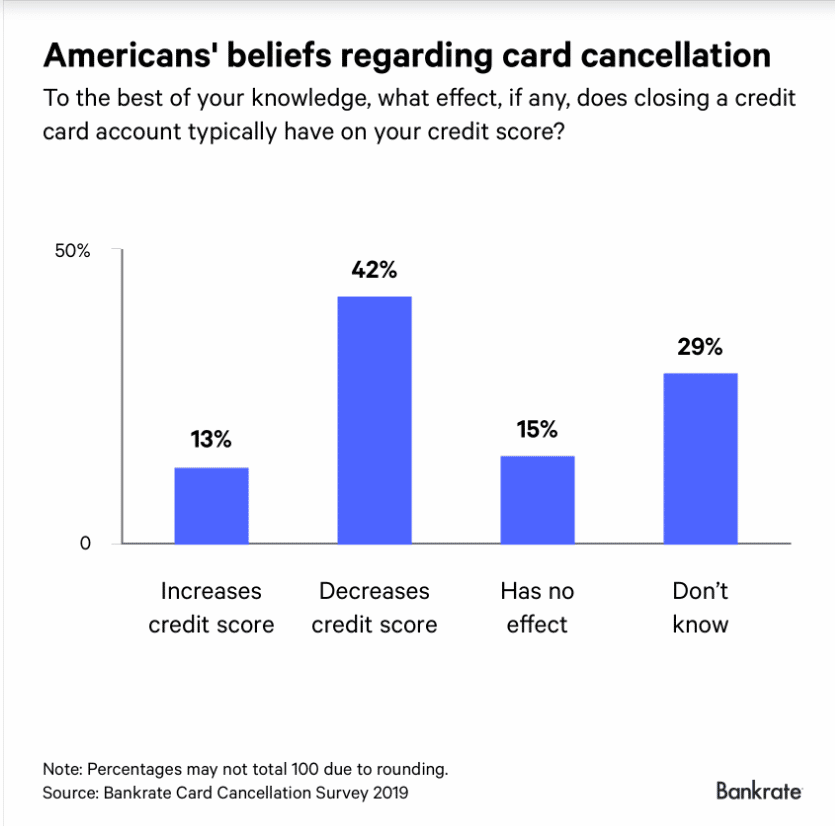

But credit scores also tend to be shrouded in mystery.

This leaves many consumers unsure of how to handle situations that might be good for them but also might be bad for their credit scores.

It can be extremely difficult to strike the balance between what you want and need financially and how those things will impact your score.

Closing accounts is one of the biggest questions people have in this sense.

It seems unnecessary and even financially harmful to leave unused accounts open.

But closing accounts could cause problems as well.

Here’s how you can decide if cleaning the clutter in your financial accounts will be helpful or harmful for your particular situation.

You May Like: How To Keep Your Credit Score High

Alternatives To Closing Down An Account

If youre considering closing down your account because the interest rate is too high, you should contact your card issuer and ask them to lower your interest, some card issuers are more likely than others to assist you with this task, so maybe your card issuer will assist you with lowering the interest rate.

If you want to close down your account because your credit card comes with a hefty annual fee, you should contact them to see if they can waive the fee for you. Youd be surprised at how many times this has worked for me.

In the event that the card issuer is unable to or refuses to waive your annual fee, you should ask them about converting your credit card into another card that does not have an annual fee. Converting your credit card into a different credit card will allow you to retain the credit history youve built with your original card.

If you want to close down your account because youre afraid that youll get into debt if you leave your credit card open, you should ask your loved one to store it in a secure place that you dont know about instead of closing down the account.

Regardless of the reason why you want to close your account, you should always consider alternative ways to solve your problem instead of closing down your account, especially if youve had the account for a very long time and has a positive credit history behind it.

Wait For The Accounts To Fall Off

If disputing inaccuracies doesn’t work, the next best thing to do is be patient. How long do closed accounts stay on your credit report? Negative information typically falls off your credit report 7 years after the original date of delinquency, whereas closed accounts in good standing usually fall off your account after 10 years. Whether an account is open or closed, your credit score can benefit from an account in positive standing that stays on your report for a long time. Once the account is removed from your report, you lose that piece of your credit history.

Recommended Reading: How To Report Rent Payments To Credit Bureau

Does Closing An Account Hurt Your Credit

If you’re considering closing one of your credit cards because you don’t use it anymore, think twice before contacting your card issuer. While it might seem like holding fewer credit cards could help your credit, losing the available credit limit on the closed account can increase your utilization rate, which can hurt credit scores. If you’re considering closing a bank account, however, be assured that it will have no direct effect on your credit. Here’s what to know about how closing an account can affect your credit.

Closing Bank Accounts Vs Closing Credit Card Accounts

Closing an old credit card can affect the calculation of your credit scores because it affects your credit history, which is a common factor used to calculate credit scores. The length or age of your credit accounts generally reduces when you cancel a credit card account . This could negatively impact the calculation of your credit scores.

Moreover, lenders generally prefer borrowers with a long credit history as it gives them a better idea of how theyve handled debt in the past.

Bank accounts, on the other hand, work a lot like utility bills where information isnt reported to the credit bureaus unless its in bad standing. While the act of closing a bank account doesnt affect credit scores, it can if you still owe money on the account and your bank sends your debt to collections.

Recommended Reading: Does Lending Club Show On Credit Report

How To Safely Close A Credit Card

If you believe closing your credit card account is the best move for you, its important to take certain steps to ensure the cancellation goes smoothly. Lets go through those steps now:

Since closing your card will inevitably hurt your credit score, its best to follow up by taking steps to improve your credit.

Read Also: Do Insurance Companies Report To Credit Bureaus

Why Closed Accounts May Be On Your Credit Report

There are several reasons an account might be reported as closed. Some may need your attention, while the rest arent cause for alarm.

- You requested it. If you wrote to your creditor, canceled your account and got acknowledgement that the account was closed, it should come as no surprise that it shows up as closed on your credit reports. Closed accounts in good standing will typically remain on your report for 10 years.

- You paid off or refinanced a loan. Paying off a loan usually closes the account. Since youve finished paying off your debt, youve fulfilled your obligation and the loan no longer needs to remain active. On the other hand, refinancing involves paying off your current loan with a new one, so you might see that your old loan is closed .

- Your creditor closed it because of inactivity. If you dont use your card for a long time, your credit card issuer may close your account. To prevent this from happening, you could try keeping one small monthly payment on accounts you want to keep active.

- Your creditor canceled your account because of delinquencies. If you fall behind on your payments, your lender may close your account. Keep in mind that negative payment history for these accounts may remain on your report for seven years.

- The credit bureau made a mistake. If this is the case and you have proof that the account should be listed as open, file a dispute to fix the error.

Also Check: Does Credit Limit Increase Affect Credit Score

How Does Closing A Credit Card Affect Your Credit Score

Your credit score might be hurt if closing the card changes your credit utilization ratio. Credit utilization measures how much of your total available credit is being used, based on your credit reports. The more available credit you use, the worse the impact will be on your score. Aim for a ratio of around 30%.

How Long Will A Paid

It can take one or two billing cycles for a loan or credit card to appear as closed or paid off. Thats because lenders typically report monthly. Once it has been reported, it can be reflected in your credit score.

You can check your free credit report on NerdWallet to see when an account is reported as being closed.

About the authors:Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Don’t Miss: Does Tmobile Report To Credit Bureaus

Closing An Unused Credit Card Without Hurting Your Score

Depending on your situation, you may be able to close an unused without impacting your credit score. For example, if you have multiple credit cards with the same issuer, they may let you transfer your balance from a closed card over to your remaining card.

Consider this hypothetical: You have two credit cards with the same issuer, one with no annual fee and a $3,000 credit limit, and one with an annual fee and a $5,000 credit limit. You want to close the card with the annual fee to save money. You can request that your issuer transfer the $5,000 credit limit to your other card before closing the account. That way you end up with a single credit card with an $8,000 limit.

Transferring your credit limit to another card conserves your total available credit, which keeps your utilization rate the same. So long as the card you close isnt one of your oldest accounts, this can help your credit score remain the same after you close an unused credit card.

That being said, if the main reason youre thinking of closing an unused credit card is the annual fee, you may have other options. First, try negotiating with your issuer to waive the annual fee. Depending on how long youve had the account and how much the issuer wants to keep your business you may get a waived or reduced annual fee.

Should You Keep Old Credit Cards Open

Keeping old credit cards open and active will help preserve your credit score, but holding onto old cards isnt always the right choice: For example, you may decide to shut down a credit card that carries a high annual fee.

However, to avoid the loss of that credit limit, you could ask the credit card company to convert your card to a no-fee card, if available, and ask that the issuer move the old credit limit to the new card.

Too many credit cards may also pose a security risk. If you have a lot of credit accounts that you never use or check on, a thief could steal the account details without your knowledge. Even though youre generally not liable for unauthorized credit use, youll still have to devote some time to report and resolve issues related to identity theft.

Another reason to cancel a credit card is to remove the temptation to overspend and rack up debt.

However, if you choose to avoid credit cards entirely, you risk a severe credit score drop after the closed card account falls off your credit reports in 10 years. Unless you have other loans reporting activity to the credit bureaus, you may risk becoming credit invisible. You have to have some type of account reporting to the credit bureaus to generate a credit score.

Also Check: What Credit Score Do Auto Lenders Use

What Is Credit Utilization

You can calculate your credit utilization ratio using the following formula:

Maintaining a credit utilization ratio of 0% to 10% is best if you want to maximize your credit scores. But unless youre planning to apply for financing in the near future, a utilization rate of less than 30% may be sufficient.

Either way, youll want to pay your full statement balance by the due date every month to avoid expensive and to protect your credit score from late payments. If youre trying to keep the credit utilization on your credit report as low as possible, then the best time to pay your credit card is prior to the statement closing date.

Choosing To Keep Your Card Open

There are some important reasons to consider when deciding to keep accounts open:

- Managing credit utilization. If the card youâre considering closing has available credit, keeping it open could help lower your credit utilization ratio.

- Keeping a solid credit history. If your credit card is one of only a few sources of credit, closing the account could give you a thin credit file. This means you may not have enough credit history to be scored. In this case, you may want to keep your card open to continue building your credit while paying the balance in full.

- Maintaining a mix of credit types. Your credit scores can also benefit from having more than one credit type. This can include things such as revolving credit, personal loans or mortgages. If your credit card is your only form of revolving credit, you may want to keep it open to diversify your active credit.

- Preparing to make a big purchase. If youâre planning to purchase something such as a house or a car, it helps if your credit is at its bestâespecially when it comes to applying for a loan. In this situation, keeping your credit card open could be in your best interest.

Although keeping your card open and paying it off could be the right move, it also depends on your unique circumstances. Therefore, before deciding to close an account, itâs important to look at the pros and cons of your situation and determine whether there may be any negative impact on your credit.

Also Check: How To Remove Cancelled Debt From Credit Report

How To Get Rid Of Closed Accounts On Your Credit Report

If your credit card has been closed, you can try calling your credit card issuer to ask if the account can be reopened, but dont wait too long.

If a closed account on your credit report is reporting inaccurately, then you can dispute it and have the update the account with the correct information or remove it.

Contact each credit bureau or check their websites for instructions on how to dispute accounts on your credit report.