The Recommended Credit Score Needed To Buy A Car Is 660 And Above This Will Typically Guarantee Interest Rates Under 6%

The information provided on this website does not, and is not intended to, act as legal, financial or credit advice. See Lexington Laws editorial disclosure for more information.

Buying a car with cash is an incredibly straightforward transaction. However, for most Americans, financing is the more common approach to purchasing a vehicle. And, unfortunately, financing is where the process can get complicated.

Auto lenders use a consumers credit score to determine loan eligibility, interest rates, loan terms and monthly payments. So, what credit score is needed to buy a car? Well, while a score of 660 and above is generally recommended, theres good news even if your score is below this number. Generally speaking, just about any credit score can get approved for an auto loanthe terms will just be less favorable.

How To Check Your Credit Score

Before applying for a car loan, you should familiarize yourself with your credit score to ensure there are no errors, and that your auto loan offers are fair. With so many different credit score formulas out there, figuring out which score you should track can be confusing.

Checking your FICO Auto Score is ideal because it is used by most auto lenders, but this score is usually only available for purchase. On the other hand, many FICO and Vantage credit scores can be obtained for free through institutions like banks, credit unions, and online financial comparison sites. Even base scores like FICO 8 or 9 will give you a good idea of where your credit stands.

You should obtain both your FICO and Vantage score before starting the car shopping process, and check for errors that could be bringing down your score. Some car shoppers are cautious about checking their credit because they’ve heard credit inquires can negatively impact their score. The good news is checking your own credit won’t ding you. There are two classifications of Unlike a hard inquiry , a soft inquiry doesn’t show up on your credit report or lower your score.

Higher Scores Mean Better Rates But People With Poor Credit Also Have Options

If youre planning to buy a new car, youll most likely need an auto loan to help pay for it. With the average cost of a new vehicle exceeding $40,000 today, the great majority of buyers in the United States do. Whether you apply for a loan through the dealership or at a bank, the lender will run a credit check on you as part of the process. Heres what credit score youll need to be approved for a car loanand what you can do if your credit is less than perfect.

Don’t Miss: Free Tri Merge Credit Report With Scores

Other Factors Beyond Credit Score Can Help You Buy

If you have a credit score below 700 and are concerned about approval, prepare by focusing on the positives in your financial life. Remember, people with major blemishes on their credit are routinely approved for car loans. If you have poor credit, here are some positive financial behaviors to highlight in the finance office.

Shortening The Loan Terms

The longer you finance a vehicle, the riskier it becomes you’ll default on the loan at least in most banks’ eyes. If you shorten your loan term, you’ll often get a lower interest rate. Sure, that shorter loan term will increase your loan payments, but you’ll save cash on interest over the entire loan.

Don’t Miss: Ccb Credit Report

How Can I Increase My Odds Of Getting A Low

Before you apply:

When you apply:

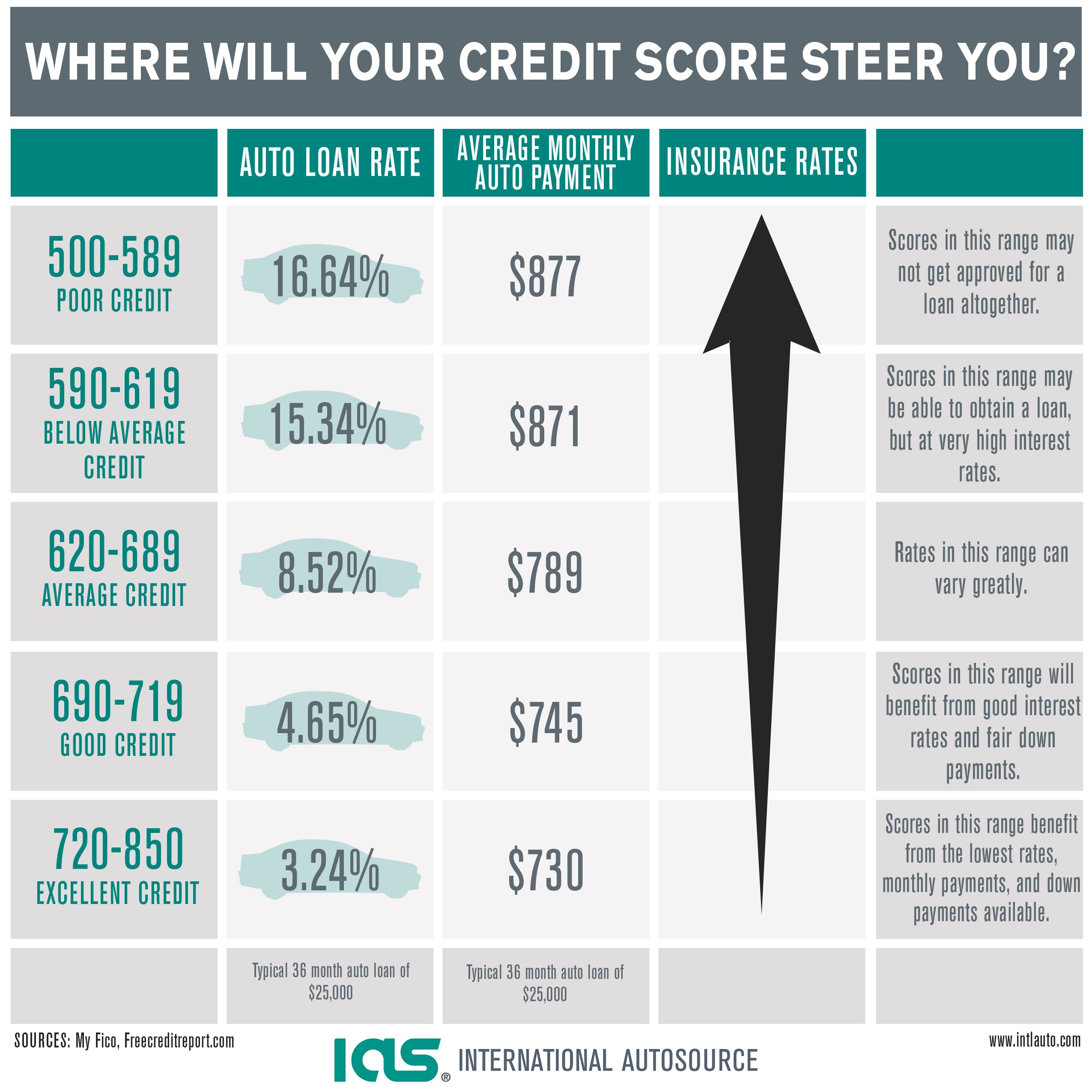

How Your Credit Score Affects Your Car Loan

Your credit score is an important factor in determining your ability to repay debt. But how it affects your auto loan can vary based on the lender you choose and the scoring model or models they use to evaluate your creditworthiness. In general, though, the higher your credit score, the better your chances of scoring a low interest rate and less restrictive loan terms.

For example, if you have a good credit score, you may be able to finance $30,000 for a new vehicle with a 3.99% APR over 60 months. In this scenario, your monthly payment would be $552, and you’d pay $3,120 in interest over the life of the loan.

If you have poor credit and your APR is 15.99% on that same amount, however, your monthly payment would jump to $729, and you’d pay $13,740 in interest over the 60-month term.

In other words, it is possible to get an auto loan regardless of your credit situation, but doing so with poor credit could cost you thousands of dollars, making it less appealing if you don’t need a new car.

One thing to keep in mind, though, is that your credit score isn’t the only factor lenders consider during the application process. They’ll also look at your credit report, your debt-to-income ratio your monthly debt payments relative to your gross monthly incomeyour employment history, and other factors.

If your credit score isn’t in great shape but your financial profile is strong overall, it could potentially improve your chances of getting a lower interest rate.

Read Also: Lemberg Law Complaints

Which Lenders Use Which Fico Scores

With the exception of the mortgage market, which is heavily regulated, lenders can generally choose which FICO score they use when running a credit check. However, they tend to use certain versions depending on the kind of credit for which youre applying. Heres a look at the most common FICO scores used for each type of credit.

Don’t Overthink Your Credit Scores

While your credit scores can be important, there are three reasons that it makes more sense to focus on general healthy credit habits rather than a specific score:

Building a positive credit history can help increase all your credit scores, and you won’t need to worry about which score the lender uses.

Read Also: Does Carmax Have Good Financing

Bring Documents Showing Financial Stability

If your credit score is low, potential lenders are less likely to see you as a risk if they can see you have stability in other areas of your financial life. Bringing documentation like your most recent pay stubs and proof of address to show lenders how long you have lived at your current address and worked at your employer could help you seem more reliable.

The Difference Between Fico Score And Credit Score

Different types and versions of credit scores can enter the car credit report lenders will pull to determine your creditworthiness.

The name FICO comes from the name of the company that issues these scores, called Fair, Isaac, and Company. Other companies, too, give credit scores that may look similar to FICO. Still, the formulas they use vary significantly, leading to scores that can differ from your FICO score by as much as 100 points. This can sometimes create problems as it can give you a false sense that your credit is in good standing and that youre likely to get approved for a loan.

Other Credit Scores

Besides FICO, what other credit scores do car dealers use? While these are not nearly as popular, its good to know about alternative credit scores.

VantageScore versions 3.0 and 4.0 were also used by every most used credit reporting agency in auto loan checkups. This credit scoring model calculates the influence of multiple variables on your credit history. Payment history is most influential, followed by the length and type of credit, credit utilization, while credit debt has the lowest impact. VantageScore was created jointly by Equifax, TransUnion, and Experian.

Versions of FICO Score

The most used versions of FICO scores are models 8 and 9. Auto lenders will most likely look at your recent credit history, information about bankruptcy, previous auto loans, and late payments.

The FICO Auto Score

Also Check: Is Ic Systems A Legitimate Company

How To Access Your Fico Auto Scores

While some credit scores can be monitored for free, you may have to hand over some cash if you want access to your FICO® Auto Scores. When you pay $39.95 a month through FICO, you can monitor a handful of your credit reports and scores, including your FICO® Auto Scores.

Before you pay for credit monitoring though, note that there are several versions of the FICO® Auto Score model. Monitoring just one doesnt guarantee youll see the same version your lender pulls. Consider calling your prospective lenders financing department to see which version they use, and check to see which scores youll get through the monitoring service, before paying for your scores.

Down Payment To The Rescue

Putting a down payment on an auto purchase can be important to auto lenders because they reduce the lenders risk. They also reduce the chance that youll end up owing more on the car than it is worth shortly after making the purchase.

Zero down payment auto loans have become extremely common in recent years for

Many auto lenders dont have specific down payment requirements. However, they will limit the amount of the loan, based on both your credit and your income. If the loan is insufficient for the car that you want to purchase, then youll have to make up the difference with a down payment.

It can often help your application if you offer to make even a small down payment, say 10%. Increasing your down payment to 20% is even more convincing, since few people make a down payment that large on a car purchase anymore.

The trade-in on your current vehicle can also represent a down payment. So can a cash rebate from the dealer.

According to a recent report on Cars.com, the average rebate on a new car as of March of 2017 was $3,563. If youre purchasing a new car with a $30,000 purchase price, a rebate of that size would represent nearly 12% of the purchase price. A trade-in or any cash that you want to put down will make the overall down payment even larger.

Unfortunately, cash incentive rebates are not available on used cars. However, you can still use either a trade-in or good old-fashioned cash for a down payment.

You May Like: Carmax With Bad Credit

What Credit Score Do You Need For An Auto Loan

Everyone knows that cars are expensive , but rarely do people know how their credit score affects the final price they pay. Affording a new ride often requires us to find financing, usually through a lender in the form of auto loans. The interest rate attached to the loan could cost you thousands of dollars extra. What determines your interest rate? Your credit score.

Why Is Your Credit Score Different With Each Bureau

If youre wondering the differences among the three bureaus, the answer is not much. The main difference, and really the only difference, is how they use the information in your credit report to calculate your score. They each have their own algorithms and ways they weigh your debt to generate your score. Additionally, each bureau might rely on the FICO or VantageScore model to determine your score.

The credit score an auto lender obtains can be different from the like Credit Karma. According to CNBC, your scores can differ for six reasons. First, depending on which scoring model and version are used, along with which bureau is used, your credit score can be different because each model and bureau have slightly different formulas they use.

Additionally, lenders are not required to report information to all three credit bureaus, so one credit report might have information the other does not. Also, the time a lender performs a credit inquiry and any errors on your report contribute to different scores.

Your credit score is a major part of determining whether you can get a car loan and a good interest rate. Dealerships want to buy a car from them, but their lenders have some restrictions for financing based on your score and debt-to-income ratio. For instance, you might get a loan even if you have a low score, but youll likely pay a high annual percentage rate .

Also Check: Does Carmax Pre Approval Affect Credit

What Are Finance Charges On A Car

Category: Cars 1. Finance Charge Definition Investopedia Finance charges allow lenders to make a profit on the use of their money. Finance charges for commoditized credit services, such as car loans, mortgages, and 11 steps1.Learn your credit score. Automobile loans are largely determined by the borrowers credit score the

How Do I Check My Auto Score

You can check your FICO® Auto Score by purchasing your credit reports and scores . However, there are also many ways to check your other credit scores for free.

While each score you receive will depend on the scoring model and the underlying credit report, knowing these other scores can give you a general idea of where you stand before you apply for an auto loan.

Some of the places you can look for a free credit score include:

- Banks and credit unions

- Online financial product comparison sites

- Experian gives you free access to a FICO® Score 8 based on your Experian credit report

- AnnualCreditReport.com offers one free report from each of the credit bureaus each year

Don’t Miss: What Credit Score For Care Credit

How Does Your Credit Score Affect Your Car Insurance Premiums

Car insurance companies use an Auto Insurance Score to determine your insurance premiums and rates. Your AIS is meant to indicate the likelihood of you getting into a car accident and filing a claim. The higher the risk, the higher your insurance rate and premium.

Your AIS is made up of three factors: your driving record, your auto claims history and your credit score. It surprises most people to know that the credit score is given the highest priority in the calculation. However, multiple studies have found that theres a correlation between driving risk and credit history. In particular, insurers are looking to see how much financial liability the consumer has taken on in the past and how theyve managed it.

So, a low credit score can cost you more in buying a car, and it can drive your insurance premium up as well. In fact, some car insurance companies may deny you coverage if your credit score is too low. Note that not all car insurers use AIS, but the majority do.

Tips For Improving Credit

Here are some simple steps to get you started.

Use Navy Federals Mission: Credit Confidence Dashboard to see tips and resources to build, rebuild or manage credit. Use our tools to:

Read Also: Experian Viewreport

How Do I Get A Car Loan

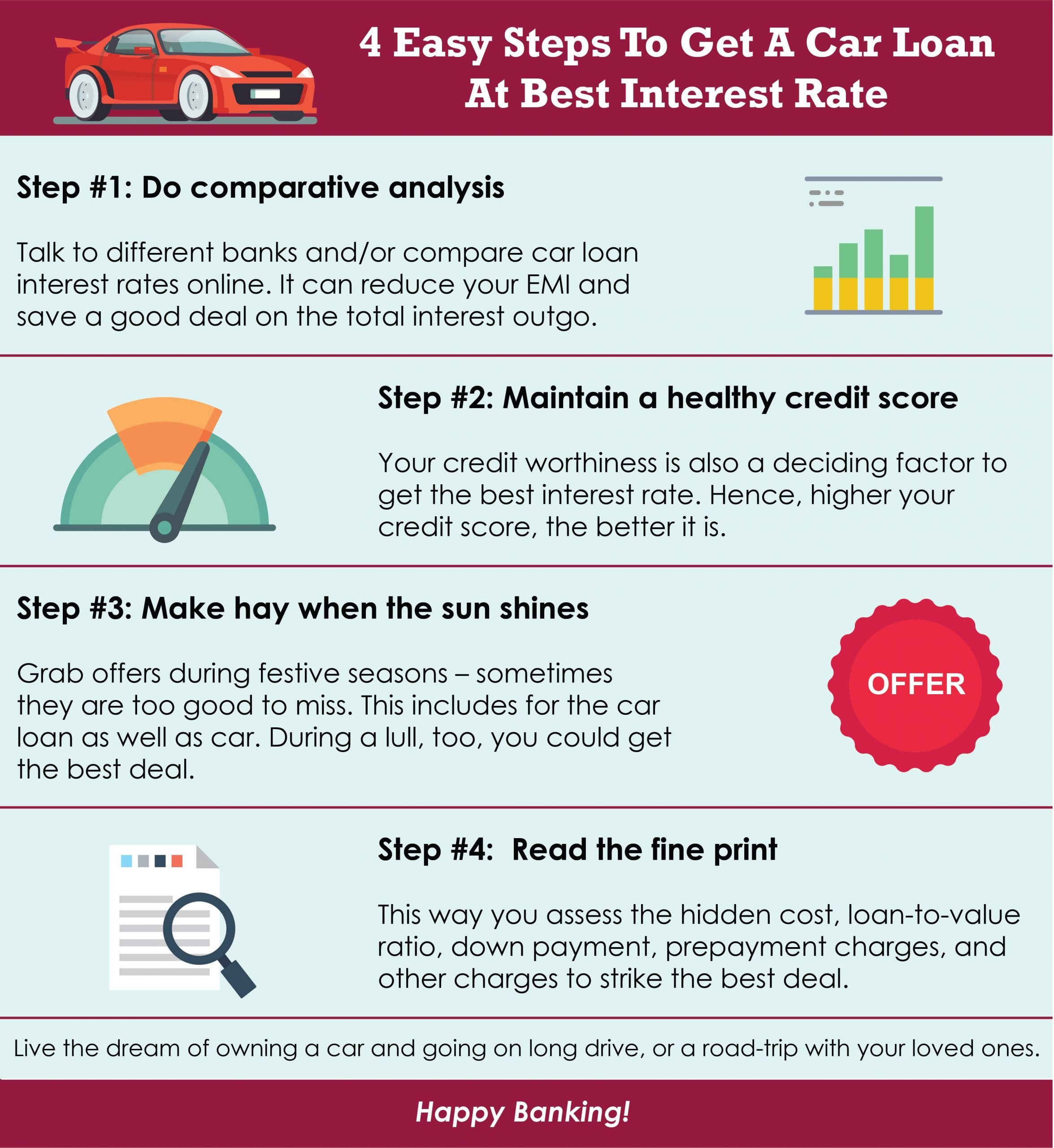

The process of getting a car loan is similar to that of getting any other type of loan. Here’s how to start:

- Shop around: It’s usually best to compare rates and terms from at least three lenders before moving forward with an auto loan. Try to find lenders that have APRs and repayment terms that will fit your budget.

- Prequalify: Prequalifying with lenders is often the first step of the application process, and it lets you see your potential rates without a hard credit check

- Complete your application: To complete your application, you’ll likely need details about your car, including the purchase agreement, registration and title. You’ll also need documentation like proof of income, proof of residence and a driver’s license.

- Begin making payments on your loan: Your payment schedule will start as soon as you receive your auto loan. If needed, set up a calendar reminder or automatic payments to keep you on track with your monthly bill and avoid late payments.