A Temporary Hit To Your Credit Score Is No Reason To Avoid Paying Off Debt

If you have five credit cards, a mortgage, and an auto loan, you have a good mix of different types of credit. Paying off one of those loans may reduce your variety of credit.

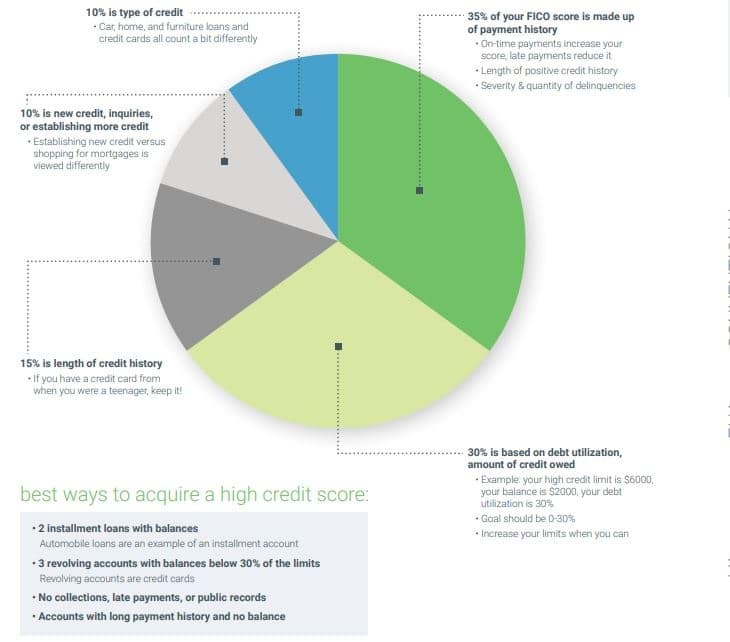

All that said, anticipating a temporary hit to your credit score is no reason to avoid paying off debt. Current debt balances including debt you owe and debt you pay off each month account for some 30% of your overall credit score, so paying them off has a much greater benefit in the longer run. Plus, the longer you drag out your debt, the more you’ll hand over in interest payments.

Editor’s note: An earlier version of this story erroneously stated that paying off an installment loan will immediately remove the account and its history from your credit report. It has been updated to clarify that a loan account may remain on a credit report for up to 10 years.

You Have Blemishes On Your Credit Reports

While some other reasons that your score has dropped may not be as obvious, there are more obvious credit implications if you have blemishes on your credit report.

For example, there may be negative marks on your credit reportoften referred to as derogatory. These can include:

- Bankruptcy. Discharging debt through bankruptcy can have a lasting impact on your credit. A bankruptcy is likely to stay on your credit report for seven to 10 years, depending on the type of bankruptcy, says Shetye. And while a bankruptcy can wipe off your debt almost immediately, youll continue to be perceived as a risky borrower for a long time.

- Liens. A lien ensures the legal right to a particular asset that can be used as collateral to secure a debt. So, for example, a mortgage lien can give the lender the right to recover costs and seize someones home if they dont make mortgage payments. Since 2018, tax liens are no longer included as part of your credit reports. According to Experian, liens arent on your credit reports but any missed payments might be and would affect your score.

- Foreclosure. If you skip out on mortgage payments, you may end up in foreclosure. Through this process, the lender takes ownership of the home as collateral to recover the costs of missed payments. This could stay on your credit report for a period of seven years.

- Lawsuits or judgments. According to the Consumer Financial Protection Bureau , lawsuits and judgments can be on your credit report for seven years.

Change In Credit Utilization Rate

Your is another important factor in determining credit scores. VantageScore says that its extremely influential, and FICO® says that it accounts for 30% of your overall score.

If you spent more than usual last month , it will increase your credit utilization rate. How far will your scores drop because of it? The effect will vary, depending on how much your ratio of credit used versus available credit went up. To keep your credit scores steady, the Consumer Financial Protection Bureau, or CFPB, recommends that consumers keep their credit utilization rate below 30%.

Imagine that you have a $10,000 credit limit, of which you typically only use $1,500 . If your spending one month increases to $2,500, your utilization ratio will still be solid overall at 25%. But if your spending suddenly increased to $5,000 , your scores could start showing a decline.

Read Also: How To Check Credit Rating

Shouldn’t Paying Off Debt Help My Credit Score

To be sure, creditors want you to repay them when they lend you money, so it seems reasonable that paying off debt would help your credit score. But that’s not exactly how credit formulas work.

the portion of your credit limits that you are currently using is a significant factor in credit scores. It is one reason your credit score could drop a little after you pay off debt, particularly if you close the account. Having low credit utilization is good.

Other factors that credit-scoring formulas take into account could also be responsible for a drop:

-

The average age of all your open accounts. If you paid off a car loan, mortgage or other loan and closed it out, that could reduce your age of accounts. That’s also true if you paid off a credit card account and closed it.

-

The types, or “mix,” of credit you have. Scores reward you for having both installment accounts and revolving accounts .

Let’s say you just made the final payment on your car loan. Your payment history is perfect and you keep credit card balances low. But now you have one less account, and if all your remaining open accounts are credit cards, that hurts your credit mix. You may see a score dip even though you did exactly what you agreed to do by paying off the loan.

Your Credit Report Has Wrong Information

If your identity has been compromised and someone fraudulently applies for new credit using your personal details, this could result in a drop in your score for both the hard inquiry and perhaps defaulted payments.

Also, incorrect account information, such as an error in bill payment history, could harm your score. Make a point to check your credit reports using annualcreditreport.com. By law, youre entitled to one free credit report from each credit bureau per year, and through April 2022, the bureaus are offering free weekly reports.

How to fix it:

Also Check: How To Get A Closed Account Off Your Credit Report

How Long Does It Take For Your Credit Score To Update After Paying Off Debt

It generally takes about one to two billing cycles for your credit score to update after youve paid off debt. Your updated balance has to be reported to the three major credit bureaus , which usually happens monthly when statements go out. Your credit score essentially reflects your credit report.

Depending on how much debt youre paying off and how you respond, this could have a significant impact on your credit score, but dont get your hopes up for a huge surge. The best way to boost your credit score is to consistently make on-time payments every monthpreferably more than the minimumand if youre really going for the gold, paying the entire balance.

You Applied For A New Credit Card

Card issuers pull your credit report when you apply for a new credit card because they want to see how much of a risk you pose before lending you a line of credit. This credit check is called a hard inquiry, or “hard pull,” and temporarily lowers your credit score a few points. Hard inquiries remain on your credit report for two years, but FICO only considers inquiries from the last 12 months when calculating your credit score.

But hard inquiries on your credit report aren’t necessarily bad when they happen in moderation. After all, applying for credit cards is a great first step in building credit. When you use credit cards correctly by charging purchases and paying them off in full by the due date they can help increase your credit score. If you’re looking to build credit, consider the Petal® 2 “Cash Back, No Fees” Visa® Credit Card, which offers cash back, or the Capital One Platinum Credit Card that is designed for average credit applicants.

To reduce the number of unnecessary hard pulls on your credit report, check if you qualify for a new card by using issuers’ preapproval or prequalification offers. These won’t guarantee that you’ll be approved for the specific credit card, but they’ll give you a good idea.

When it comes to actually applying for new credit products, be sure to spread out your credit card applications over time. Only apply for a new credit card every three months, and maybe wait even longer between applications if you have a lower credit score.

Recommended Reading: Does Navy Federal Report To Credit Bureaus

Scores Aside Paying Off Debt Is Good

Whether your credit scores rise, drop or stay the same when you pay off a loan, you should still celebrate the fact that you have one fewer debt to repay. You can now use the extra money to pay down other debts or save it for one of your financial goals. Or, if you’ve got your financial bases covered, you’ll now have extra money in your monthly budget to spend as you please.

Applied For A New Loan Credit Card Or Mortgage Recently

Applying for a new loan, credit card or mortgage likely will lead to a hard credit inquiry, also known as a credit check. One hard inquiry isn’t much to worry about, but if you apply for several credit card accounts at once, the hard inquiries could pile up. Recent credit is considered low impact on the VantageScore® 3.0 model.

You May Like: Can Medical Bills Affect Credit Score

You Were The Victim Of Identity Theft

Finally, lets address what might be the most frightening reason for a drop in credit scores: Someone could have stolen your identity and applied for credit accounts in your name.

If you discover that an impostor is using your identity, dont panic. There are actions you can take to help reverse the damage it may have caused to your credit scores.

But how do you spot identity theft in the first place? One step to consider is . Keeping a close eye on your credit scores and credit reports may help you catch suspicious activity faster than if youre not regularly monitoring your accounts. Youre entitled to one free credit report periodically from each of the three major consumer credit bureaus at annualcreditreport.com.

If youve been a victim of identity theft, youll likely want to make a recovery plan. Placing a fraud alert on your credit file could be a good place to begin. You only need to place the alert with one of the national credit bureaus. The other two bureaus will be automatically notified.

After youve added your fraud alert to your credit profile, you may want to fill out an identity theft report with the FTC. Then you can begin the process of disputing inquiries on your report if necessary.

You Applied For A New Loan

Any time you apply for a loan even if you get rejected or dont even use the account after your approval your score generally will take a small hit. Your credit inquiries get reported on your credit report for two years and, although the effect diminishes over time, every hard credit check counts against you in the credit scoring model. This is why its a good idea to apply only for credit that you absolutely need. You also should try to avoid making too many inquiries over a short period of time.

You May Like: How Long Are Missed Payments On Credit Report

How Does Paying Off A Loan Help Credit

Even though paying off a loan or credit card can cause your credit score to decrease, the good news is that the drop should be minimal and temporary. Ultimately, paying off a debt is great for your credit score for a few reasons.

For one, making on-time payments toward your debt helps boost your payment history. Remember, this is the most heavily weighted factor in your credit score calculation. So building a track record of making payments on time is the best thing you can do to build good credit.

Once youve paid off a debt, the account and its positive payment history also stay on your credit report for 10 years. Thats even longer than negative items, such as a late payment oraccount in collections, which stick around for seven years.

Finally, paying off debt reduces the total amount of debt you owe. This can significantly improve your credit, especially if you pay off revolving debt such as a credit card. Just remember: keep the account open, even if you dont plan to use it.

Why Paying Off Debt Can Hurt Your Credit

It seems counterintuitive, but paying off debt can hurt your credit. Here are a few scenarios for you to consider:

Does your Amex account have a set credit limit? Some Amex cards work like traditional revolving credit cards offering a set credit limit and affecting your credit utilization ratio as such. But other Amex cards dont have a set credit limit Without a predetermined limit, these cards wont affect your utilization ratio. If this applies to your Amex card, the 41-point drop could be from something else.

Did you close your account? If you close a revolving account once you pay it off, it could hurt your score because it will lower your credit limit. If you did that would account for the drop.

Do you have a very high score to begin with? Any changes in your credit behavior can adversely affect a high score, at least in the short term. If you dropped 41 points from an 840 to a 799 there is actually no practical difference between the scores.

There could be additional reasons why your score dropped that dont necessarily mean your credit is in trouble. For instance, it could take 30 days for your lower balance to show up on your credit. If its not been that long, give it time. The 41-point drop could be a result of your previous 84% credit utilization ratio.

See related: VantageScore vs. FICO: Whats the difference?

Read Also: What’s A Perfect Credit Score

Does Paying Off A Loan Early Hurt Credit

If youre trying to build good credit, you might not want to pay off an installment loan early. Once a loan is repaid, it is marked as closed on your credit report. Open, active accounts that are in good standing, on the other hand, have a stronger positive effect on your credit. So in some cases, it can be worth keeping a loan active and sticking to your repayment schedule vs. paying it off ahead of time. That is, as long as you can afford the payments, have plenty of emergency savings and the loans interest rate is fairly low.

Keep in mind that there may be other costs to paying off a loan early, too. Some lenders charge prepayment penalties, which are fees for paying part or all of your loan off before the repayment term is up. So before you pay off a loan early, be sure to review your original contract or ask your lender whether youll be charged a penalty. If so, youll need to crunch the numbers and see if paying the penalty is worth it compared to the interest savings.

If you have credit card debt, however, its a good idea to keep your balance as close to $0 as possible. Theres no benefit to carrying a balance month-to-month youll simply rack up interest and maintain a higher credit utilization ratio.

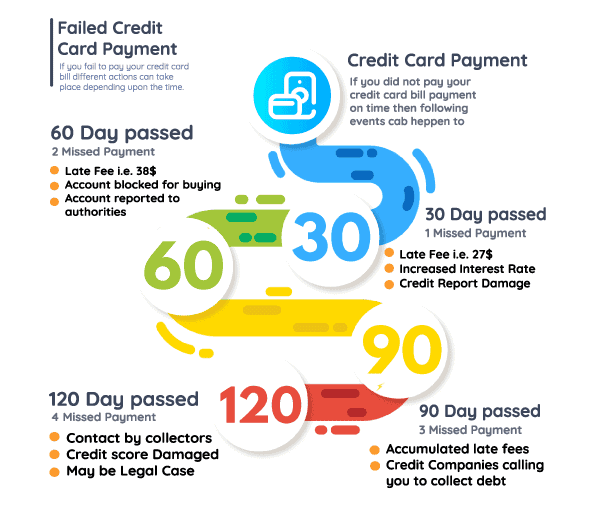

Why Is My Credit Score Going Down If I Pay Everything On Time

Theres a missed payment lurking on your report A single payment that is 30 days late or more can send your score plummeting because on-time payments are the biggest factor in your credit score. Worse, late payments stay on your credit report for up to seven years.

Why is my Experian score so much lower?

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

Also Check: Does Spectrum Report To Credit Bureaus

What To Consider When Your Credit Score Changes

The next time your credit score changes, ask yourself the following questions:

- Have you spent more or less money this month compared to previous months?If so, your credit utilization ratio may have changed.

- Did you miss a payment in the past few months?If so, you could have a delinquent payment thats hurting your score.

- Did a missed payment or derogatory mark from several years ago fall off your credit report?If so, your credit score may be going up.

- Have you applied for credit?An inquiry may have been placed on your report, which can negatively impact it.

- Have you recently paid off a loan or closed a credit card?If so, your credit history may have been impacted.

After looking closer, you may find something has changed that could influence your credit score that you werent initially aware of. The best way to monitor changes in your score is to check your credit report monthly, so youre up to date on all the changes that impact your score.

How To Keep Your Credit Score From Dropping

The top ways to keep your credit score from decreasing are:

- Make payments on time. It can help to set up reminders to pay your bills or set up autopsy, so you never miss a payment.

- Monitor your score and credit report. Keep an eye out for inaccuracies and if you do see an error, report it.

- Avoid applying for multiple credit products in a short period of time. This will trigger multiple hard inquiries, which can result in drops in your score.

- Keep your credit utilization rate low. This may take additional budgeting but avoid accumulating large balances on your credit cards. Only spend what you need and pay your card off in full each month.

- Keep credit cards open. Unless you have a strong reason for closing them, such as an annual fee, you can keep the account open but just not use it. This will prevent your average account age or available credit from being affected.

One thing to avoid is keeping an installment account open just so it doesnt decrease your score. This can quickly lead to missed payments, and youre costing yourself unnecessary interest. If youre able to pay off the loan, do so.

You May Like: How To Remove Delinquency From Credit Report