Look For Inaccurate Late Payments

These days, many people make their payments online or even automatically, and its possible that a lenders system can make a mistake and not register a payment. If you believe you made your payment on time, make sure you have records in case you need to escalate the issue. This is why its always a good idea to keep a folder or notebook with confirmation numbers or emails when you make payments.

What Can You Do If You Think You’ll Make A Late Payment

When a late loan or credit card payment is inevitable, contact your lender or the credit card company as soon as possible. The creditor may have options to help you avoid a late payment on your credit report. Some options may include:

-

Extended grace period

-

Loan modification

-

Late payment forgiveness

If you tend to forget your payment due dates, prevent this by signing up for text, email or mobile app notifications.

You can go a step further by scheduling automatic payments via the lender’s website or mobile app. If the creditor doesn’t offer autopay, you can schedule automatic payments through your bank account.

How Long Do Late Payments Stay On A Credit Report

Quick Answer

Late payments stay on your credit report for seven years. While your credit score can initially take a significant hit, it will recover over time if you dont make any more late payments.

Through December 31, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

Also Check: How To Get Credit Score From 750 To 800

How Can I Avoid Late Payments

Focus on preventing problems with these strategies:

-

Many credit card issuers allow you to select payment due dates. You may want to stagger due dates to work with your paydays or bunch them up to help you remember.

-

Set up text alerts or calendar reminders about bills due in a few days. If you need more than one, set up multiple electronic nudges.

-

If you can do so without risking overdrafts, consider using automatic payments to pay at least the minimum as soon as a statement issues. You can go online later to pay more, but this way your account is never late.

-

Consider making payments on your credit cards throughout the month. Paying down the balance every week or so protects your credit two ways: You’ve already paid by the time the due date hits. And keeping your balance low relative to your credit limit improves your , which is the second-biggest influence on your score.

Some creditors have hardship programs for people affected by things like natural disasters or a pandemic.

About the author:Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

What Is Considered A Late Payment

Technically speaking, a payment is late as soon as its past the due date, even if its one minute past midnight. If youre looking for the nitty-gritty details, check your contract to see when your payment is specifically due. For example, your payment might be due by 5 p.m. instead of midnight.

However, once the deadline passes, many creditors have whats called a grace period for you to make your payment before charging a late fee. Once the grace period is overor if there is no grace period outlined in your contractyour provider will typically charge a late fee.

Read Also: Is 653 A Good Credit Score

Offer To Sign Up For Automatic Payments

In some instances, a creditor may agree to delete a late payment from your credit reports if you agree to sign up for automatic payments.

This plan works well if youve had trouble making payments in the past but arent significantly delinquent on your account. Youll have better luck negotiating this deal if you can show that youre financially able to make your payments.

It also helps if youve overcome whatever financial hurdle held you back from making payments in the past. Like requesting a goodwill adjustment, this is also ideal for longer-term customers.

How Do Late Payments Impact Credit Score

When you miss a payment, your credit score is affected. When you are late with a payment by 30 days or longer, as much as 100 points can be taken from your credit score. Your payment history is an essential part of the credit score, which is why its taken into account when calculating it. Therefore, one single late payment is enough to drag down your score.

Also Check: What Makes Credit Score Go Up

Why Late Payments Are Bad For Your Credit Report

Although everyone would want to be able to pay their bills on time, its not always possible. People may encounter different issues. They either dont have the time to do so, or they dont have enough money to pay them, so they end up being late. Unfortunately, this will show up on their and affect it.

When it comes to determining your credit score, your payment history is the main factor that allows it to be calculated. This is why its always recommended to pay for everything on time. Depending on factors like your credit history and score, how bad the late payment was, and how long ago it happened, it can seriously harm your credit score.

Your credit score shows your reliability with credit. When you want to borrow money, your score will be calculated by the potential lender to see if you meet the criteria to get a loan. Your credit history comes into play here. There are companies that dont ignore late payments when calculating credit scores, because late payments could be a good sign that the borrower would be too risky. As a result, you may not be able to obtain financing from these companies.

How To Remove Negative Items From Your Credit Report

Amarilis YeraNorma RodríguezAndrea AgostiniTaína CuevasAmarilis Yera26 min read

Your is meant to be an accurate, detailed summary of your financial history however, mistakes happen more often than you may think.

Whether its accounts that dont actually belong to you or outdated derogatory information thats still being reported, incorrect information could be bringing your score down unnecessarily.

Read on to learn how to remove erroneous information from your credit report and some tips on how to handle those negative items that are dragging your score down.

You May Like: How To Dispute A Judgment On Credit Report

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

How Do Late Payments Affect Credit Scores

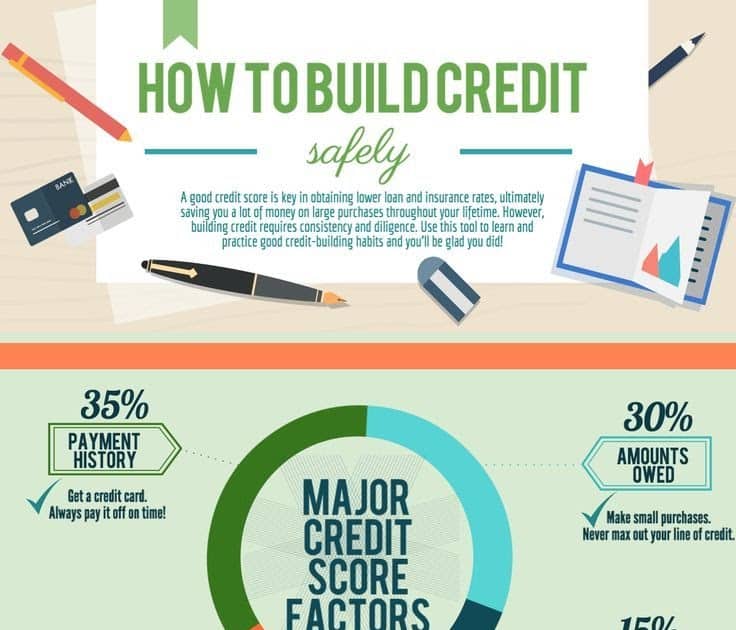

People have multiple credit scores, and everyoneâs situation is different. So itâs impossible to say exactly how a late payment will affect your credit. But payment history is an important scoring factor for two of the most popular scoring companies: FICO® and VantageScore®.

FICO says it uses three criteria to judge late payments: severity, frequency and recency. That means a few things when it comes to its credit scores:

- A payment reported 30 days late could have less impact than one reported 60 days late and so on.

- Being late multiple times, including across multiple accounts, could have a bigger impact than a single delinquency.

- A late payment that happened more recently could have a bigger effect than one from years ago.

Also Check: How To Remove Closed Accounts From Credit Report

Knowing Your Rights Can Help You Negotiate Late Payments

Congress has passed several laws to help consumers negotiate with credit reporting agencies and creditors.

The Fair Credit Reporting Act, for example, gives you access to your credit file for free every year.

Visit annualcreditreport.com to get your free credit reports from the three credit reporting bureaus.

If you discover inaccurate information, the law requires the bureaus to fix this information or remove it.

Be sure to file a complaint with the Consumer Financial Protection Bureau if your attempts to remove inaccurate negative information get no response.

You May Like: Pre Approval Hurt Credit Score

Getting My Credit Back On Track

Several years ago, I went through some tough times financially. I had always made on-time payments, but after I became unemployed, I simply wasnt able to pay my bills on time.

After I told a friend of mine about my issues, he suggested I check out Lexington Law. So, I called them for a free consultation at 800-220-0084. I spoke to a credit professional who told me they believed they could help me.

I decided to sign up and give it a shot. After all, if it didnt work, I could cancel at any time. Then, after only a few weeks, I started getting letters from consumer reporting agencies showing negative credit accounts were removed from my credit reports.

Since then, my FICO credit score has been improving steadily, and I have been getting much better interest rates on credit cards and loans. So it turned out to be a great decision for me .

Recommended Reading: How To Find Your Credit Score

How Can Late Payments Impact Your Credit Scores

As time passes, the late payment will have less of an effect on your creditworthiness. So, if you miss a payment, the most important thing to do is to bring the account current, and then continue to make all payments on time going forward.

Your payment history is the single most important factor in your credit scores. Even one missed payment could have a significant negative impact on your credit scores initially, but that impact will diminish over time.

After a short time, it will become clear that the late payment was an anomaly in an otherwise pristine credit history, and your positive payment history since that time will offset any negative impact it had on your creditworthiness.

Hire A Professional To Remove Late Payments

To make this process easier, you can work with that will help you to challenge inaccuracies on your credit report. Credit repair professionals have the expertise, knowledge and, most importantly, the time available to help you through the dispute process from beginning to end.

You have the will, we have the way. Let us help you fix your credit. Call today to get started

Recommended Reading: What Is A Fair Credit Score

Payments Less Than 30 Days Late

If you miss a payment but catch it before youre 30 days late, youre in luck.

Credit reporting standards dictate that an account, of any variety, has to be a full 30 days past the due date before it can be reported to the credit bureaus, said credit expert John Ulzheimer, formerly of FICO and Equifax.

This means if you pay the bill before its 30 days late, it shouldnt affect your credit score at all. However, youre likely going to be hit with a late fee and a penalty APR .

Be aware that payments can process as quickly as the same day, but with other lenders, it can take much longer. To avoid encountering processing delays, try not to wait to pay until the 29th day your payment is late.

What If I See Something On My Report That Shouldnt Be There

When you get and read your credit report from Borrowell, you might see something that doesnât look right! If itâs regarding a specific item, we recommend contacting the credit grantor or collections agency. If itâs regarding incorrect personal information, such as your date of birth or your address, please contact Equifax directly. You can reach them here: +1-866-828-5961. Here at Borrowell, we canât change or modify any information on your credit report.

Don’t Miss: When Does A Bankruptcy Come Off Credit Report

How Long Will A Late Payment Stay On A Credit Report

Once a late payment is recorded on your credit report, you should know that it will be there for six years. Fortunately, as time passes, the impact on your score will decrease, because lenders care more about your recent credit history instead of the old one.

Therefore, its always important to keep up with future payments even though you were unable to make one payment on time. Your score will also improve over time, so it will be easier to get approved for credit.

Do I Still Have To Pay A Debt That Fell Off My Credit Report

Your debt isnt simply erased once it falls off your credit reports, but your liability for owing it might vary if the debt is past its statute of limitations.

If you never paid off the debt and the creditor is within the statute of limitations, youre still liable for it and . The creditor can call and send letters, sue you or get a court order to garnish your wages.

If you never paid off the debt, but its past its statute of limitations, the debt is now considered time-barred. How you choose to act on a time-barred debt thats fallen off of your credit report is your choice. According to the FTC, you can do one of the following:

- Pay part of the debt

- Pay the total outstanding debt

Regardless of which option youre considering, talk to an attorney about your best path forward before contacting a debt collector.

Depending on the state you live in, debt collectors might be allowed to call you to try to collect on a time-barred debt. However, creditors and debt collectors cant sue you or threaten a lawsuit to collect on a debt thats outside of the statute of limitations.

If youre looking to put your debt behind you and move on with a clean slate, a surefire way is to pay what you owe, or at least an agreed-upon part of what you owe. Before making the phone call, make sure you know:

- That the debt is legally yours

- The date of the last payment on the account

- How much you owe the creditor

- What you can realistically afford to pay per month or in a lump sum

You May Like: What Credit Score Is Needed For Care Credit

How To Rebuild Your Credit After A Late Payment

Categories

Uh-oh. Youve missed a payment. Maybe the cable bill slid down behind the desk or the postal strike meant you didnt receive your cell phone statement. Maybe an emergency expense popped up and you didnt have the cash to pay your utilities last month. Whatever the reason, you didnt make a payment on time. Do you know how this will affect your credit rating?

Cant make your loan payments on time? Read this.

To answer that question, lets look at how our creditworthiness is measured in Canada.

Read Also: How To Report To Credit Bureau As Landlord

How Long Does A Late Payment Stay On Your Credit

As weve mentioned, once a late payment is considered delinquent and reported to the major credit bureaus, it can take up to seven years to fall off and no longer appear on your credit report.

Your lender reports to the credit bureaus on a regular basis, so the seven-year clock will start from the original delinquency report date. On your credit report, youll typically be able to see when the late payment was reported, and this is the date to keep in mind.

For example, if your credit card payment was due on June 15, 2021, but you were late, and it was reported on July 28, this would be the start of the seven years. Even if you bring the account current after it was reported, that delinquency may still show up on your credit report until July of 2028.

Recommended Reading: Which Gives Credit To Sources In A Research Report

Ask The Lender To Remove It With A Goodwill Adjustment Letter

This is a straightforward way to get a late payment removed from your credit report. In some cases, creditors are willing to make a if your payment history has been good or if you have a good relationship with them.

The process is easy: simply write a letter to your creditor explaining why you paid late. Ask them to forgive the late payment and assure them it wont happen again. If they do agree to forgive the late payment, your creditor will adjust your credit report accordingly.

Write A Goodwill Letter

A goodwill letter might be helpful in your situation and may encourage your lender to remove the late payment from your credit report. If you want to write a goodwill letter, its important to be apologetic and explain that youll do what you can to avoid late payments in the future. Also, keep in mind that your chances may be better if the late payment wasnt a large amount or if you usually make your payments on time.

You May Like: Can Public Records Be Removed From Credit Report

File A Dispute With The Credit Reporting Agency

Once you have your report, look through each account and see if there are creditors or accounts you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, dispute them directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.