Takeaways: How To Dispute Credit Reports And Win

- Youre entitled to accurate and verifiable information on your credit report

- You can file a dispute with the credit bureaus by phone, mail, or online

- When filing a credit dispute, include as much information as possible to support your claim

- If your dispute is rejected, you can choose to re-dispute the claim with the credit reporting bureaus

Do you have a credit questions for John Ulzheimer? Head over to the and ask away!

Save more, spend smarter, and make your money go further

What Happens After You Dispute Information On Your Credit Report

Tip

If you suspect that the error on your report is a result of identity theft, visit IdentityTheft.gov, the federal governments one-stop resource to help you report and recover from identity theft.

If the furnisher corrects your information after your dispute, it must notify all of the credit reporting companies it sent the inaccurate information to, so they can update their reports with the correct information.

If the furnisher determines that the information is accurate and does not update or remove the information, you can request the credit reporting company to include a statement explaining the dispute in your credit file. This statement will be included in future reports and provided to whoever requests your credit report.

Is There Anything I Cant Modify On My Equifax Credit Report

You can correct errors, but you wont be able to change what is accurate on your credit report. In fact, you can only delete incorrect information from your credit report, and you cant ask for negative but accurate information to be removed from your credit report because its damaging your credit score.

The majority of bad material on your report can stay on your record for up to six years. In fact, missed payments, judgments, and collection accounts can appear on your credit report for up to six years after theyve been recorded. Similarly, bankruptcies can stay on your credit report for up to 14 years.The silver lining here is that negative information of this nature loses its power over time.

Read Also: Does Klarna Report To Credit Bureaus

Why Is Good Credit Important

Maintaining the best credit score possible is important. In simple terms, a good credit score makes you attractive to lenders, while a bad one makes you look like an unattractive financial liability. The practical effect is that better credit equals more profitable loans, while bad credit means youll have to contend with higher interest rates and undecided lenders.

Some common errors you may have noticed on your credit report include:

- discrepancies between purchase dates.

- accounts attributed to you in error.

- unauthorized purchases.

- requests that in actually never packed out or shipped.

Whatever the error, not only do you have the right to dispute an alleged error, but it is very important that you do so. You can start this process by filing whats called a notice of dispute.

See also:

disputing a discrepancy with equifax is a simple process that requires only two steps:

What Will Happen Once The Complaint Is Filed

Equifax will review and compare the information. If their original investigation fails to resolve the problem, they will approach the source of information to validate its correctness. If the source informs Equifax that the information is false or missing, the source will send the revised data to Equifax, which will make the required modifications to your Equifax credit file.

Equifax will not modify your Equifax credit file unless the source verifies that the information is accurate. In either scenario, you can submit a statement to your Equifax credit file stating any concerns you have in 400 words or fewer. Anyone who has access to your Equifax account will see this statement.

If Equifax makes changes to your credit file in response to your request, you will receive an altered credit report. At your request, Equifax will provide the updated credit report to any borrowers, creditors, or other intermediaries that accessed your credit report within 60 days of the modification.

After youve successfully filed your dispute paperwork, you can expect to get the following:

Also Check: How To Send Credit Report To Landlord

What To Expect After A Dispute Has Been Filed

Once you file a dispute, Equifax has 30 days to investigate and respond.

If the credit bureau rules in your favor, the information will be removed from your Equifax credit report. Youll also receive a written notice detailing the outcome along with an updated Equifax credit report.

You should also know that the negative entry will be removed if the creditor fails to respond to your claim or provide adequate proof that what theyve reported is correct.

But what if they dont rule in your favor? Well, youll also receive a written notice explaining why and stating that your credit report wont be updated to reflect any changes. And at that point, you have the option to include a statement in your credit report, file another dispute or move on.

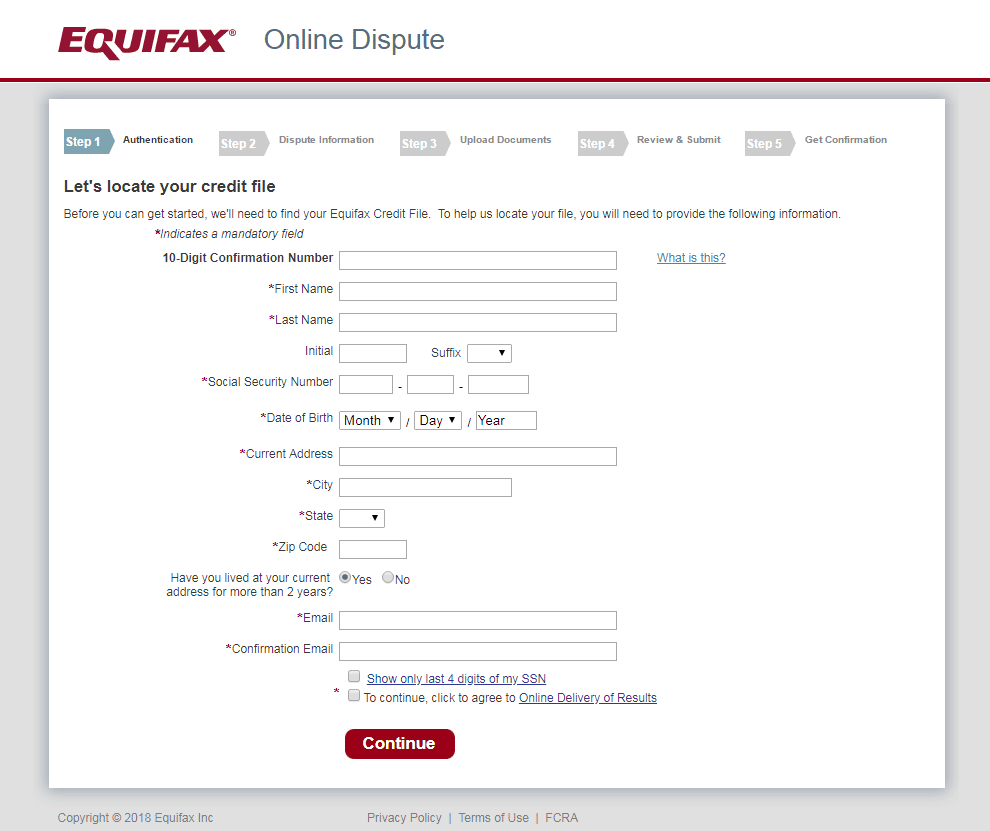

Filing A Credit Dispute Online

The first thing to do is fill out the online form. You can start an online dispute with Equifax by giving your full name, email address, phone number, and reason for the dispute. After submitting this initial form, you will receive emails confirming the creation of a ticket.

Then, youll then need to fill out an online Consumer Credit Report Update Form. This form will ask for personally identifiable information, public record details, credit banking information, and your signature, depending on what youre disputing. Youll need to scan and upload the necessary paperwork as well.

To confirm your contact information, Equifax requires two pieces of documentation:

- One government-issued photo identification sucha as a passport or drivers license

- One supplementary document such as phone bill, internet bill, or financial statement.

Read Also: How To Get Inquiries Deleted From Credit Report

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

How Do I Reach A Live Person At Equifax

Equifax

Is it better to dispute online or by mail?

While the credit bureaus offer online and telephone access to the dispute process, most often mail is a better means of disputing. With paper disputes, consumers can retain an exact copy of what they sent and have proof that their dispute got to the place where it was sent, all without waiving rights.

How to check the status of your Equifax dispute?

You can check the status of your dispute online at any time. Youll just need the 10-Digit Confirmation Number associated with your dispute to look up your particular credit file. Enter your 10-digit confirmation number to check the status of your dispute online.

How to check the status of a credit report dispute?

If you are checking your status by mail or phone, please make sure you have the confirmation number that was provided to you when you submitted your dispute. If you disputed information by phone, you have the option to receive the results via email or U.S. mail.

Recommended Reading: How Do Banks Check Your Credit Rating

Should I Send My Disputes Directly To Equifax Or Talk To My Creditor

It depends on the nature of your dispute. You should dispute personal details, like your address or date of birth, directly with Equifax.

If your disputes relate directly to creditors, attempt to contact them first. Let them know youve found incorrect information on your credit report. Describe the details of the mistakes. In some cases, you may be able to resolve the issue over the phone. However, you may need to provide evidence if they disagree with your findings.

If your creditor is still unwilling to remove the adverse reporting after you provide documentation, youll need to go directly to Equifax and file a dispute. Equifax will review the contents of your dispute and the evidence you provide.

Equifax will also reach out to your creditor to obtain information. Once the investigation is complete, Equifax will either remove the incorrect details or explain why they cant be deleted.

Let’s consider an example.

Example: Janet is getting sued for a debt she doesn’t owe, and her credit score has taken a huge hit because of it. After some investigating, Janet discovers she is a victim of identity theft and that someone has opened up a credit card account in her name. She uses SoloSuit to respond to the lawsuit with an Answer document, which helps her avoid a default judgment. Next, Janet reaches out to the creditor to report the fraudulent account. If the credit card company doesn’t do anything, Janet may need to reach out to Equifax and the other credit reporting bureaus.

Is It Wrong To Dispute Correct Information

Im not the morality police, and you can do what you want to do, but you do have the right to challenge any information on your report whether its correct or not.

Its your right to have correct and verifiable information on your credit reports. I cant speak for them, but I imagine theyd also want your credit report to be fully accurate and verifiable.

Don’t Miss: Is 721 A Good Credit Score

How To Correct Your Equifax Credit Report

It is simple to file a Dispute Investigation with Equifax to rectify errors in your CIR. If you discover any discrepancies in your credit report, file a dispute immediately to get it corrected.

You can file a dispute on the Equifax website online in three easy steps:

Step 1: Log on to the Equifax website and download the Dispute Resolution Form. State your question/problem in the space provided. Be clear and accurate as this will help quicker processing of your complaint.

Step 2: Once you have filled in the form, you need to attach a valid, self-attested copy of a) Identity Proof and b) Address Proof

Step 3: You need to send the form along with the self-attested documents through courier, regular post or speed post to the address mentioned on the Equifax website:

Equifax Credit Information Services Private Limited

Unit No. 931, 3rd Floor

Building No 9, Solitaire Corporate Park,

Andheri Ghatkopar Link Road,

Some Equifax guidelines for sending the dispute from and supporting documents:

Typically, it takes up to 30-45 days for the error to be corrected and to reflected in your Credit Information Report. The credit bureau cannot make any changes independently and it can update the status only after it gets the requisite authorization from the lender concerned.

General guidelines for sending the above documents:

All photo copies should be self-attested

Please ensure that ID card numbers and photographs are clear and visible.

The address should be clear and visible

Getting A Free Credit Report

According to the Fair Credit Reporting Act, you are entitled to get one free credit report per year from each of the credit reporting agencies. You can ask for them all at the same time or you can choose to spread them out over the entire year, asking for a different one every four months. To request your free credit report by mail, fill out the Annual Credit Report Request Form and mail it to Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-528. According to the Federal Trade Commission, this is the only authorized source for free credit reports.

You May Like: How To Dispute Collections On Credit Report

Equifax Dispute: 3 Ways To Remove Errors

Amber Brooks is a longtime lifestyle editor and blogger who has authored thousands of articles on topics ranging from debt consolidation apps to budget-friendly date ideas. With a background in writing, she’s uniquely suited to diluting complex financial jargon into terms that are easily understood. When not obsessively budgeting out her days, Amber can often be found with her nose in a book.

Edited by: Lillian Guevara-Castro

Lillian brings more than 30 years of editing and journalism experience, having written and edited for major news organizations, including The Atlanta Journal-Constitution and the New York Times. A former business writer and business desk editor, Lillian ensures all BadCredit.org content equips readers with financial literacy.

Building credit takes patience, diligence, and time. Its easy to get tripped up by a few small missteps , but its even worse when the mistakes hurting your credit score arent even yours.

When theres an error on your credit report, youre lugging around someone elses blunder as you try to get a loan or a line or credit. And thats just unfair.

Well take you through three do-it-yourself methods available at Equifax online, by mail, or by phone or you can use a professional service to dispute a credit report error. To jump ahead to the section most helpful to your needs, use these links:

| | | | |

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

You May Like: Is 706 A Good Credit Score

How Do You Send A Credit Report To Equifax

If your statement is 400 words or less, it will added to your credit file, and will be included each time your credit file is accessed. Please send your statement in writing to Equifax, along with your name, address, date of birth and phone number. You will also need to provide photocopies of two valid pieces of identification.

Contact The Collections Department:

Under federal regulations, you can dispute your credit report directly with the original company. To submit the dispute, send a letter containing your identifying information , a description of the dispute, and any supporting evidence to the collections department at the address they provide on your credit report , or the notice address provided in your contract.

Send your letter by certified mail so you can prove that they received it. In most cases, the company has 30 days from receiving your letter to finish a reasonable investigation and send you the results. If they agree that youre right, then they have to notify the credit bureaus to delete the information!

You May Like: Does Closing A Credit Card Hurt Your Score

Equifax Dispute: How To Correct A Mistake On Your Equifax Credit Report

Your is an essential aspect of your financial profile, and its critical to dispute any errors you find on your credit report as early as possible. You can dispute your credit report by mailing or submitting the necessary documentation to Equifax, one of Canadas two major credit bureaus the other credit bureau is TransUnion. These bureaus are required to keep correct details on your credit report and resolve any disputes.

Your credit score may suffer due to errors in your credit report. This is because your credit score is calculated using the information on your Equifax credit report. It will worsen if there are inaccuracies in your report, and you may have difficulty obtaining extra credit or qualifying for loans in the future.

Before submitting a credit report dispute, collect as much information as possible. You should also note that your credit report from each bureau may differ. And if your Equifax credit reports include inaccuracies, you must file a complaint with both agencies.

Sample Letter To A Credit Bureau To Dispute Inaccurate Information:

Date

Your City, State Zip Code

To Whom it May Concern,

This letter is to inform you that you are reporting inaccurate credit information about me, and to officially ask that you open an inquiry into the matter and update my credit profile with the correct information.

It would be detrimental to any future credit applications if this incorrect information persists , so I would appreciate this being taken care of as quickly as possible.

The error is xxxxx .

I am attaching the following proof, xxxxx .

The error is with

Please investigate and delete this detrimental information. Thank you in advance for your efforts.

Sincerely,

Your City, State Zip Code

To Whom it May Concern,

I recently received a copy of my credit report from xxxxx , and was surprised to see that you reported xxxxx .

Not only is this not the case, but according to the Fair Credit Reporting Act , you are required to notify me when negative information such as this is listed, and I have not received this notification.

I am disputing your claim with the credit bureau and am officially requesting you to open an investigation into this matter.

Attached please find the following proof, xxxxx

According to the FCRA, you have 30 days to look into this and respond to my request. If you dont respond within that time, you must remove this negative information.

Thank you in advance for your efforts.

Sincerely,

Recommended Reading: What Does Your Credit Score Start At