Let Negative Information Age Off Your Credit Report

It is difficult to get a good credit score, even if you pay your outstandings on time without any delays. A single negative action can put down your credit score and will affect your credit reports as well. For this reason, be accurate and check your credit reports regularly to avoid such problems.

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

Benefits Of A Good Credit Score

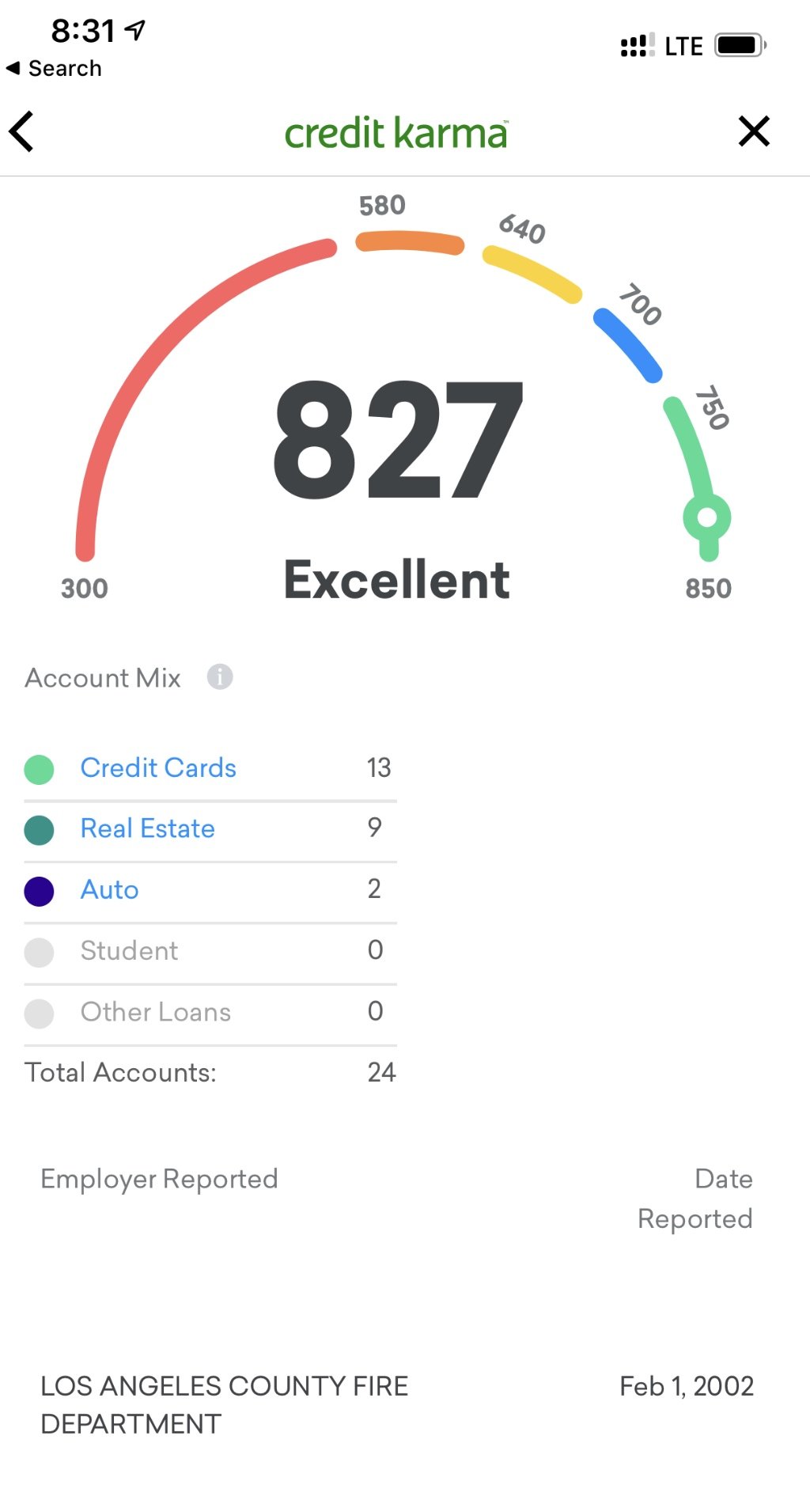

If you consistently have a credit score of 800 and above, it can be highly beneficial to you in the long run. You can enjoy several benefits by having a decent CIBIL score even when you don’t apply for loans. If you consistently have a credit score of 800 and above, it can be highly beneficial for you in the long run.

The significant benefits that you can enjoy are:

- Firstly, you can apply for several loans and credit cards when you have a good credit score. A good credit score indicates that you have been handling your expenses well and making repayments timely.

- A decent credit score will help you receive multiple rewards and benefits from your lenders. You can pay lower interest rates if you maintain a good credit score.

- You will also have higher credit limits to spend than others with lower credit scores. It will help you have a better lifestyle as per your choices.

- Most lenders offer pre-approved loans to those who have a long and good credit history. Even in general cases, your loans will get approved sooner if you have a credit score of 850 and above.

- Your credit score can also impact when you apply for a visa. With a good credit score, you can have additional momentum while applying for the visa.

- Even if you think you do not need to apply for any loan or at present, maintain a good credit score for the future. Emergency loans such as home loans, wedding loans, home remodelling loans will also be affected by your

You May Like: How To Increase My Credit Score Fast

What Is Your Credit Score Why Is It Important

Your credit score may be defined as a rating that reflects your creditworthiness. Think of your as a batting average. If your batting average is above 50, then it means that you have a consistent scoring record of 50, and you are a good player. Similarly, when your credit score is high, it shows that you have borrowed and repaid credit responsibly in the past.

Your credit score is important because it showcases how dependable or risky you are as a borrower. Thus, it directly impacts how eligible you are for a loan, what the lender will offer you as a loan amount, and the rate of interest you will be charged. Your credit score allows lenders to judge the potential risk in lending you money. Your credit score is critical when it comes to unsecured or collateral-free loans and can affect your eligibility for personal loans to a great extent.

While you as an individual have a score, even businesses are given credit scores. For a business, the CIBIL score impacts how creditworthy a lender will find the company. A business credit score could also impact its ability to attract investment.

Additional Read: Save 45% on personal loan EMI

Does Anyone Have A 850 Credit Score

The truth is, Americans with a perfect 850 FICO® Score do exist. In fact, 1.2% of all FICO® Scores in the U.S. currently stand at 850. Think of it as the alternateand perhaps slightly less glamorous1 percent. Of course, you don’t need a perfect score to access credit at the best terms and lowest interest rates.

You May Like: How To Dispute Collections On My Credit Report

Is 800 A Good Credit Score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Whats A Utilization Ratio Or Debt

According to Equifax, your debt-to-credit ratio, also known as your utilization ratio, is the amount of your debt compared to your credit limit.5 Your debt-to-credit ratio is important because if your ratio is high, it can indicate that youre a higher-risk borrower.5 Thats because lenders see borrowers who use a lot of their available credit as a greater risk.5

For example, imagine you have a couple of credit cards and a line of credit with a total debt of $14,000 and a combined limit of $20,000. Your debt-to-credit ratio would be 70%.

According to the Government of Canada, a ratio of 35% or below on credit cards, loans and lines of credit is recommended.3

Also Check: What Can You Do To Improve Your Credit Rating

What Hurts Your Credit Score

Your CIBIL report will be examined by the lenders when you apply for loans. It will help them understand whether or not you are a compatible customer who makes their repayments on time, have no history of missing out on deadlines, and have an overall good credit image. Several factors can affect your credit score. To maintain a good CIBIL score range consistently, you need to make sure you consciously make an effort to follow a few steps.

Some of the most essential yet straightforward steps that you need to keep in mind are as follows:

- Make sure you pay your monthly bills, EMIs, credit dues on time. Do not delay making payments, for it can have a massive impact on your overall credit score.

- Keep your monthly expenses within 30% of your credit card limit. Do not cross 40% every month to make sure you have a good CIBIL score range consistently.

- Do not apply for multiple credit cards in a short span. Take at least a medium gap before you go ahead and apply for two or more credit cards. Having credit cards can make you look desperate.

- Do not miss out on making repayments timely. Even a single let payment can hamper your credit score immensely. Your lenders may send out requests to for enquiry purposes, eventually decreasing your credit score.

Additional Reading: What is Equifax credit score?

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Also Check: Is 715 A Good Credit Score

Can You Buy A House With A 500 Credit Score

Yes, it is possible to buy a house with a 500 credit score.

A person with a 500 credit score may find it difficult to qualify for a mortgage and have to put down a large down payment, but it is still possible to get a mortgage. In order to qualify for a mortgage with a 500 credit score, you will have to be prepared to put down a large down payment.

In addition, your lender may charge you a higher interest rate, and you may be required to pay for private mortgage insurance. You will also have to show that you have a steady income and a good amount of savings in your bank account.

On top of putting more money as a down payment, another way to boost your chances of approval is to try to get a cosigner. Having a cosigner with a high credit score will help you get approved.

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Also Check: A Credit Score Tells A Lender How

Paying Your Bills On Time

While paying each of your bills on time may seem like the most obvious way to improve your credit score, its also the most important one. There is nothing that will harm your credit score as much as having a series of late payments on anything from car loans to mortgage loans. This is why it is extremely critical that you always make the minimum monthly payments by the determined date each month WITHOUT ANY EXCEPTIONS.

Even skipping just one mortgage payment is going to have a detrimental effect on your credit score. Sorry if that sounds cruel, but its the truth, and it should serve as your primary source of motivation for making your payment on time.

Heres an important fact to keep in the back of your mind: every time that you fail to make a monthly payment when you are required to do so, whether it be on a car or your home or anything else, it will be on your credit history and thus impact your credit score for up to seven years. Seven years. Think about that.

Now, one primary benefit to using a credit card here is that you can choose how much money you spend while using them, and then also determine how much you pay back each month, so long as that amount is equal or greater than the minimum payment you owe.

The reason why this is a benefit to you is because it allows you to budget your money accordingly and make the smartest financial decisions you can. In other words, you can avoid going into serious debt.

How Does Outstanding Debt Affect Your Credit Score

The amount of outstanding debt impacts your credit score. Lenders normally check this in the form of the credit utilisation ratio. This refers to the amount of money you are using out of the total credit available to you. The higher the ratio, the lower your credit score. However, this doesnt mean debt is bad for you. In fact, you will be able to build your credit score only when you take on debt. The key is to pay it off in a timely fashion and not go over your credit cards or bank accounts limit.

Recommended Reading: Is 590 A Bad Credit Score

Steering Clear Of Bankruptcy

Bankruptcy is a highly feared word in the world of finances. Its something that we all hope we will never have to endure the mere thought or possibility of it is enough to make us quiver in fear.

Bankruptcy is definitely not something that should be underestimated. It will be one of the biggest blows not only to your finances, but to your state of mind and well-being as well. Plain and simple, a bankruptcy is something that you want to avoid at all costs. And as you may have guessed, a bankruptcy is not going to look good on your credit report .

But while it is universally acknowledged that bankruptcy is something that you should try to avoid at all costs, there are still many mistaken beliefs that surround how to avoid it, too. A bankruptcy will immediately lead to a huge drop in your credit rating and will be visible on your report for over ten years at least. This means that if your credit score has already fallen thanks to late/missed payments or defaults, with a bankruptcy, things arent exactly going to look so sunny.

What if you are forced to file for bankruptcy? Is it still possible to rebuild your credit?

Yes, it still is. Even though your bankruptcy will be listed on your report for ten years, you can still slowly but steadily rebuild your credit by paying each of your bills when you need to. In this scenario, however, its vitally important that you repay each of those bills without exception.

Keeping Your Credit Card Balance Low

The very act of having credit cards will impact your credit rating. Regardless of whether its positive or negative, it has an impact.

But something else that you want to ensure you do is keep the balance on your credit card low. The balance on your credit cards can influence over one third of your total credit score. The higher your balance is, the lower your score will be.

What you want your credit card history to show is that you have been reducing your balance on an active basis by making your minimum monthly payments on time and using your credit cards responsibly.

A good rule to follow is for your balance on your credit card to be 35% of the total limit on that card. So if you have a limit of $1,000 on your card, you want your balance to be $350 at the very highest. This holds true regardless of whether you have one credit card or multiple cards. In the long run, this will not only prevent your overall credit score from dropping, but it could also cause it to increase.

The reason why this is so important is because most lenders these days want you to stay as far away from the limit as possible in order to have the best credit scores. In fact, most experts would recommend that you never use more than fifty percent of your total available credit. If you use any more than that, or if you max out your limit, your overall credit score will drop.

Read Also: Which Information Is Found On A Credit Report Brainly

Keep Old Credit Alive

The length of your credit history influences your credit score. Do not cancel old credit cards in good standing even if you rarely use them now. Keep these cards and use them every now and then to show some activity on your credit profile.

Cancelling old lines of credit also lowers your total credit limit and this hurts your credit utilization ratio.

Related: KOHO Visa: Earn 2% Cash Back on Debit Purchases

Pay Your Bills On Time

The first step to improving your credit score is to pay your credit card balances on time all of the time. Payment history is the most important factor for ranking your score.

Late payments register on your credit as negative information. The later the payment is, the more damage you can expect to your credit score.

Even if you have missed paying your bills on time in the past, the only way to revive your score is to start making payments before they are due. Automate your bill payments so you do not forget!

Related: How To Dispute Errors on Your Credit Report

Don’t Miss: How To Get Hard Inquiries Off Credit Report

What Is The Highest Credit Score Can You Get A Perfect Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

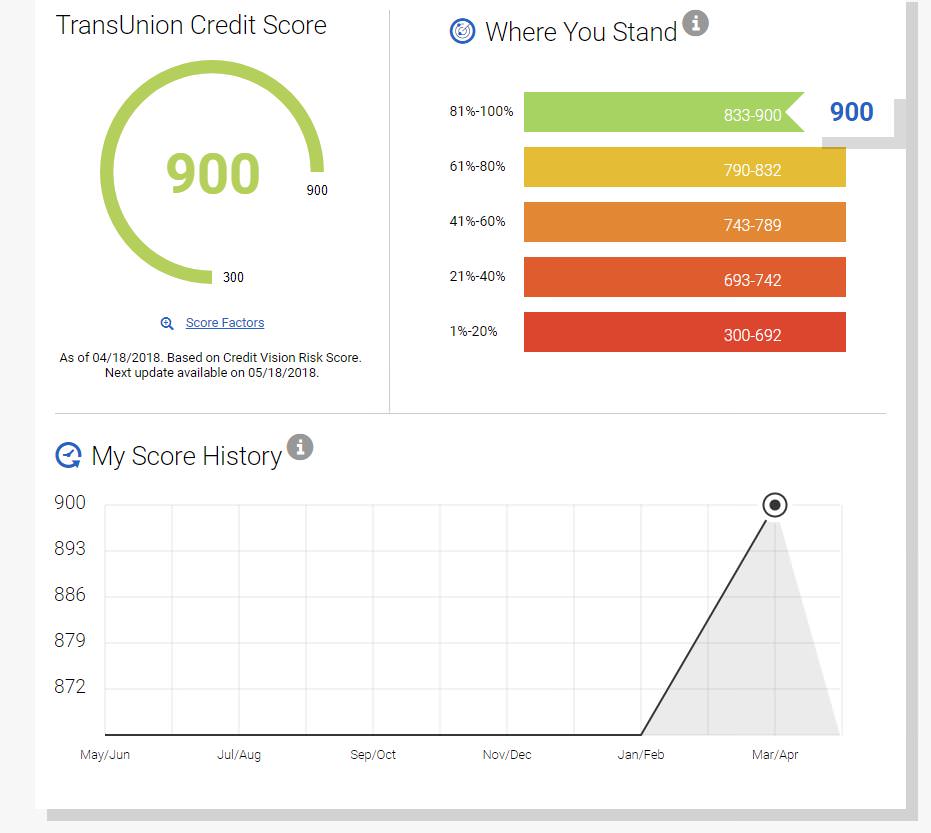

The highest credit score you can have on the most widely used scales is an 850. For common versions of FICO and VantageScore, the scale ranges from 300 to 850 and lenders typically consider anything above 720 excellent credit.

Even if you succeed in getting the highest credit score possible, you’re unlikely to keep it month after month. Scores fluctuate because they are a snapshot of your credit profile, which changes over time.

The widely-used FICO 8 scoring model and the VantageScore 3.0 are both on a 300-850 scale. Credit scoring company FICO says about 1% of its scores reach 850. VantageScore spokesman Jeff Richardson says fewer than 1% of its credit scores are perfect.

The way people get perfect scores is by practicing good credit habits consistently and for a long time. As you might expect, older consumers are more likely to have high scores than younger ones.

But scores fluctuate because they are a snapshot of your credit profile. Even if you succeed in getting the highest credit score, youre unlikely to keep it month after month.