Access Purchase Financing With A Variety Of Affirm Personal Loan Rates

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Affirm Logo

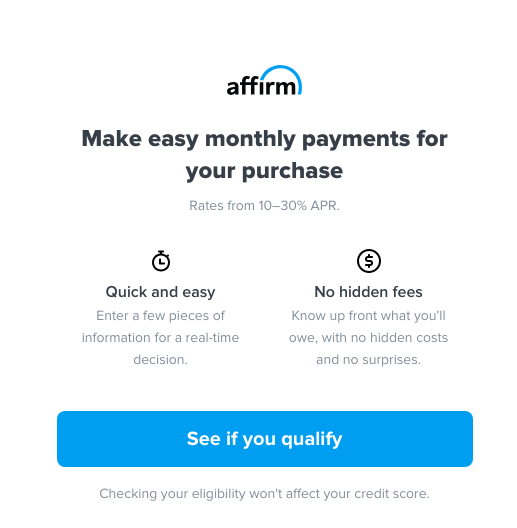

Affirm offers personal loans for online purchases through retailers that are willing to offer payment plans. Payment terms, rates, and other details vary according to the retailer, and purchasers can select their payment schedule. Affirm charges no fees, and theres either simple, fixed interest or no interest on transactions. You can see an estimate of how much you can spend based on your financial information, but there are no loan limits. If youre approved, Affirm grants instant financing for purchases you make online.

We collected more than 25 data points across more than 50 lenders, but Affirm was not one of the best companies we found.

- Product Specifications

-

Not every loan will improve your credit

Affirm doesnt charge any late, prepayment, origination, or other fees.

Affirm Logo

Affirm Funding Valuation & Revenue

According to Crunchbase, Affirm has raised a total of $1.5 billion across 9 rounds of venture capital funding. Notable investors in the company include the likes of Spark Capital, Wellington Management, Founders Fund, Lightspeed Venture Partners, Khosla Ventures, Andreessen Horowtiz, and many others.

The company raised its latest round of funding in September 2020, which netted them $500 million in the process. Unfortunately, no valuation figures were shared publicly. Its prior Series F round, announced in April 2019, catapulted the companys valuation to $2.9 billion.

The firm is set to target a valuation of $10 billion during its IPO. Affirm is going public by the end of 2020. For reference: Affirms European counterpart Klarna gathered a valuation of $10.6 billion during its most recent funding round.

For the fiscal year 2020 , Affirm generated $509.5 million in revenue while posting a net loss of $112.6 million over the same timeframe. In the year prior, the FinTech generated $264.4 million in revenue while loosing $120.5 million.

One noticeable bit about Affirms income statement is that about 30 percent of the companys revenue can be attributed to Peloton, the bike producer taking the world by storm. This consequently poses a major risk for Affirm going forward while giving Peloton some leverage in future negotiations.

Do Affirm Loans Help Your Credit

In theory, Affirm loans could help your credit when you make timely payments. That said, one important factor for your credit sore is your credit utilization ratio. What makes your credit score happy is when you have a lot of credit available to you, but you havent used a lot of it. For example, having a couple of credit cards with over $10k in available credit, but a low balance that you regularly pay off each month. That would give you a good credit utilization ratio. On the other hand, if you have a lot of credit extended to you and you have high balances on that credit, that can actually harm your score. On top of that, when you actually pay off your loan with Affirm, you are essentially closing off a line of credit extended to you, which could in theory harm your score.

Read Also: Can Private Landlord Report To Credit Bureau

What Happens If You Dont Pay Affirm

We donât charge late fees. Even so, partial payments or late payments may hurt your credit score or your chances of getting another loan with us. After you schedule a payment, weâll continue sending reminders by email and text message until any remaining balance is settled, but you wonât receive calls about your loan.

You May Like: Usaa Auto Refi Rates

Why Isnt The Affirm Payment Option Showing Up During Checkout

Certain criteria must be met in order to complete a purchase with Affirm. Most likely, you have a subscription product in your cart or the order total does not meet a certain threshold. In order to proceed with Affirm as the payment method, please remove the subscription product from your cart and ensure that your order meets the minimum threshold.

Recommended Reading: What’s The Difference Between Fico Score And Credit Score

How Returns Work When Using Affirm

If you have an issue with a purchase or need to return an item, Affirm advises customers to contact the merchant directly. You’d then have to follow the store’s policies for returns.

In terms of what happens to your Affirm loan after making a return, there are a few possibilities. For instance, Affirm can cancel your loan completely if the merchant has finalized the return. If the amount that’s returned to you is more than the loan, then Affirm can return this overpayment to you.

But the result may be different if the merchant only issues a partial refund or issues store credit in lieu of a refund. In that case, you would still be responsible for paying any remaining balance due on your Affirm loan, even if you’ve returned the item you purchased.

If you’re not able to resolve a return or refund issue with a merchant, you can initiate a dispute with Affirm. If you win the dispute with the merchant, Affirm will refund the full amount of the purchase along with any interest paid. But if the dispute goes in favor of the merchant, you’d still be responsible for paying your Affirm loan in full.

Why Does Affirm Need My Ssn

How does Affirm approve borrowers for loans? Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number. Affirm verifies your identity with this information and makes an instant loan decision.

Read Also: Usaa Used Car Loan Rate

Don’t Miss: Who Is Syncb On My Credit Report

Affirm Vs Afterpay: Other Products

In addition to buy now, pay later financing, many of these companies offer additional products to meet their customers’ needs. These additional products provide additional sources of revenue and help them become the financing option of choice when it is time to make a purchase.

Affirm offers a variety of payment options beyond the typical pay-in-four loan services. During checkout, customers are provided multiple financing options so they can choose which payment amount and term work best for them.

Customers can also earn a higher rate of interest on their money with the Affirm Savings Account. This account is FDIC-insured up to $250,000 and has no monthly fees or minimum balance requirements. You can open an account with just one penny. While the interest rate is subject to change, the current rate offered is 0.65%, which Affirm advertises is 13 times the national average.

Affirm will soon release a credit card, and you can join the waitlist to be notified when it becomes available. The Affirm credit card will offer pay-in-four financing for purchases over $100 at any eligible retailer. This means that you can split your purchases into four easy payments without incurring any interest or fees. There will be no annual fees, no late fees, and no prepayment penalties when using the card.

Does Using Affirm Hurt Your Credit Score

Anytime you’re applying for financing, it’s important to consider how it may impact your credit history. There are two components to consider: the credit check and how your account activity is reported to the credit bureaus.

Affirm does check your credit, but it’s a soft pull, rather than a hard pull. That means you can get pre-qualified for Affirm financing without impacting your credit and there’s no obligation to use buy now, pay later financing until you actually make a purchase.

Most BNPL services don’t report to credit bureaus. Specifically, Affirm says it will not report a loan to the credit bureau Experian if the loan is 0% and four biweekly payments, or you were only offered one option at the application of a three-month payment term with 0%. It may report longer-term or other loans.

Also Check: Does Discover Report To All 3 Credit Bureaus

Klarna Vs Affirm: Credit Requirements

Neither Klarna nor Affirm advertise a minimum credit score required.

Klarna will perform a soft credit check when you are deciding to use the Pay in 4 interest-free installments as well as with the Pay in 30 option. A soft credit check will not impact your credit. However, when it comes to the longer-term financing options, hard credit checks will be performed by Transunion and Experian.

Affirm does not include a minimum required credit score. Affirm uses a soft credit check during the pre-qualification process. Simply creating an Affirm account to see if you prequalify will not affect your credit score.

What Credit Score Do I Need To Qualify For An Affirm Loan

You need to have a credit score of at least 550 to qualify for an Affirm loan. But other factors like income, employment and your debt-to-income ratio can also affect loan applications.

To create an account directly with Affirm:

To create your account with Affirm, follow these steps.

Once you have an account, you can apply for a loan through Affirm for purchases at its partner merchants. Each inquiry begins with a soft credit check, and you’ll learn whether you’re approved shortly after.

Affirm might ask for additional information about your checking account to verify your identity and ability to pay. If you’re offered a loan, confirm it to finalize your purchase.

Recommended Reading: Does Capital One Report To Credit Bureaus

Why Was I Prompted For A Down Payment

Affirm isnât always able to offer credit for the full amount you request. In these cases, Affirm asks you to make a down payment with a debit card for the remainder of your purchase. The down payment amount canât be changed and must be made upon confirming your loan and before the loan offer expires.

Also Check: Usaa Pre Qualify Auto Loan

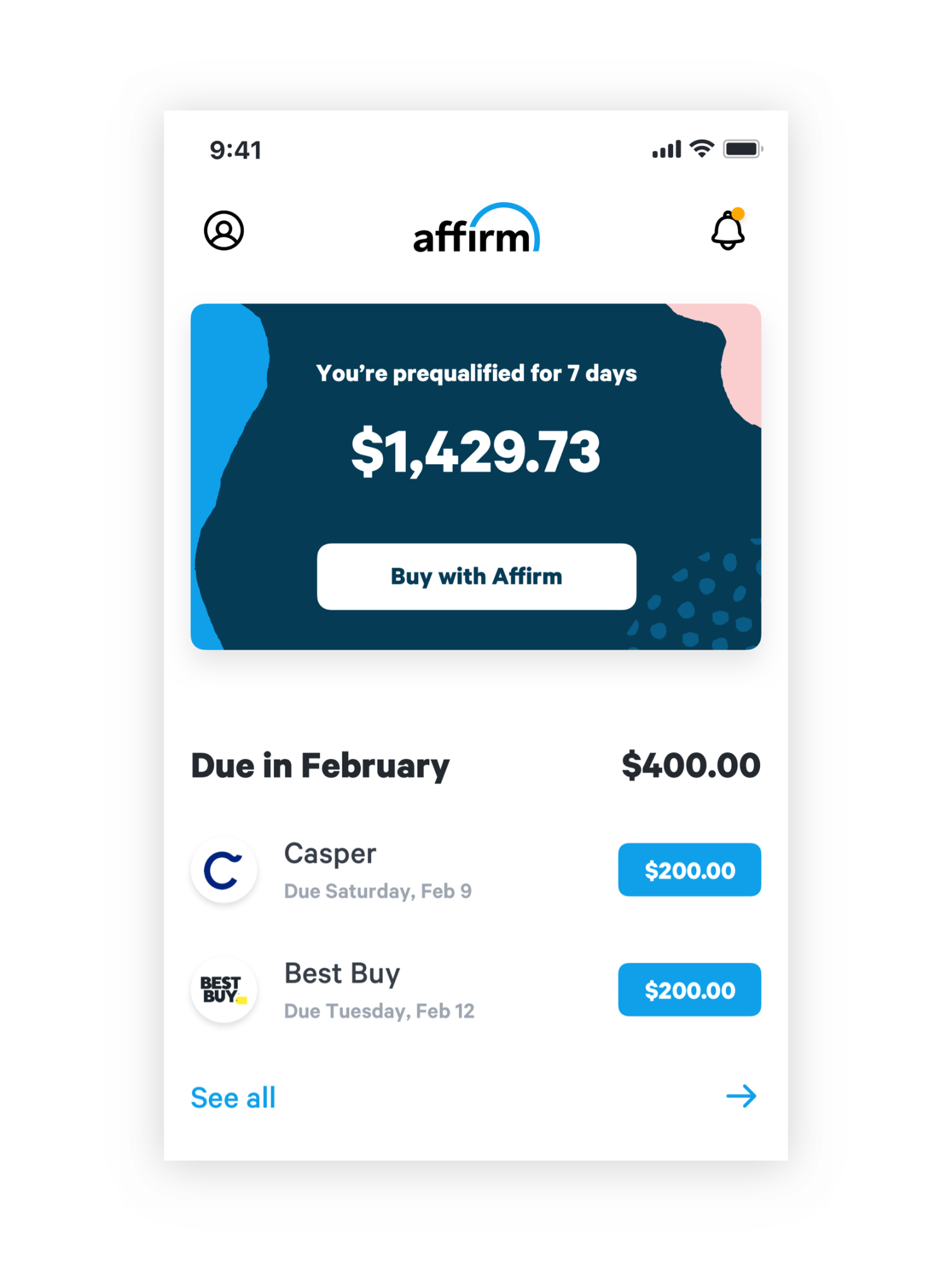

Its Got An Awesome App

Affirms easy-to-use app makes purchasing flights on mobile a completely seamless experience. Not only can you use the app to spread the cost of your flights with Alternative Airlines, but you can also make any other Affirm purchase. The app is also a great central platform where you can manage your account and view and make payments on any existing loans.

Read Also: How Long Does Credit Card Collections Stay On Credit Report

Buy Now Pay Later Services Offering No Hard Credit Checks

Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Buy now pay later no credit check loans are increasing in popularity. Youve probably seen it on your favorite retailers websites. When you checkout theres the option to buy now and pay later, allowing you to pay in four equal installments and usually for no interest or fees and with no hard credit check.

If you have no credit or bad credit, these can seem like a great optionbut only if you know how they work, and which companies are the best options for those in search of no-credit-check online financing.

In This Post:

How Do Returns & Refunds Work With Affirm

All returns and refunds are subject to the merchantâs return and refund policies. If you want to return an item or get a refund, you will have to reach out to the store, not Affirm.

If you and the merchant agree to a return or refund, then Affirm will go ahead and process the request. If a refund or cancellation is for the entire amount of the loan you borrowed, you might still be on the hook to pay a credit/cost of borrowing charge.

Also Check: Will A 2 Day Late Payment Affect Credit Score

Affirm Reviews And Complaints

Affirm has a mixed online reputation as of November 2020. It scores slightly over 1 out of 5 stars on the Better Business Bureau, based on over 160 customer reviews. Several customers cited unprofessional staff and trouble closing an account as the main source of complaint.

It does better on Trustpilot, scoring 4.6 out of 5 stars based on more than 3,375 reviews, with some shoppers complaining about customer service while others complimented the service for an efficient overall process.

Make A Point To Regularly Review Your Credit Report

Everyone should make a point to get into a habit of regularly reviewing their , especially if you’re opening new financial products, whether that’s a POS loan or a new credit card.

Due to the pandemic, each of the three credit bureaus Experian, Equifax and TransUnion now offer one free credit report weekly. Just go to annualcreditreport.com, a website authorized by federal law, to request your credit report from one of the bureaus. If you have an Affirm loan, you’ll want to request your Experian credit report.

There are also a number of free services that allow you to keep track of your credit score. Most credit card companies allow you to check your score on their apps or website. You can also use a free credit monitoring program like or Experian free credit monitoring.

While signing up for a POS loan won’t necessarily improve your credit score, there are a few quick ways to improve it. *Experian Boost, for example, is a free service that offers consumers the ability to connect their utility and streaming accounts to their Experian credit report. This means that if you’re timely about paying off your internet, water or Netflix® bill, you could see your FICO® score improve.

You May Like: How To Send Credit Report From Experian

Creating And Using An Affirm Account

Before you can make purchases through Affirm, you will need to have an account with the lender. You can do this easily through their website.

You will need to be at least 18 years old and be a permanent resident or citizen of the U.S. to qualify. You must have a cell phone number and agree to receive texts from the company. It is also ideal to have a credit score of at least 550.

The company has also launched a mobile app that can be downloaded at the Apple store and Google Play Store to create an account.

Are Payments Automatically Split Into Four Installments With Affirm

With some point of sale loans, your payments are automatically divided into four installments. Specifically, that means an initial down payment at the time of purchase, followed by three additional installments.

Affirm, on the other hand, allows you to choose your payment option. So, for example, you may be able to split purchases up into three payments, six payments, or 12 payments.

Also Check: How To Bring My Credit Score Up

How Does Affirm Approve Borrowers For Loans

- Affirm asks for a few pieces of personal information: Name, email address, mobile phone number, date of birth, and the last four digits of your social security number.

- Affirm verifies your identity with this information and makes an instant loan decision.

- Affirm bases its loan decision not only on your credit score, but also on several other data points. This means that you may be able to obtain financing from Affirm even if don’t have an extensive credit history.

My Experience With Affirm

Affirms website appears to offer a user-friendly catalogue of its partner brands.

If you hover over Shop on the homepage, youll see some shopping categories such as Travel and Electronics. But if you click on any of those categories, the website display is wonky at best. And when you click View all to see a full list of brands, you have to create an account to get to the actual list.

Even once you create your account, the Affirm app is much easier to navigate than the website.

Again, Affirm is wonky. It required me to generate a one-time-use virtual card from the checkout page when I was ready to buy. But it didnt let me complete the transaction from my laptop.

I had to navigate back to the retail brand from inside the Affirm app and relocate my purchase. I had selected two items from the store originally, but I forgot about the second item by the time I switched to the app.

So when I completed that purchase, Affirm told me there was still money left on the virtual card. But when I located the second item and tried to re-input the card details , the transaction failed.

Affirm originally gave me $100 on my virtual card. I paid nothing up front but had payments scheduled for $33.33, $33.33 and $33.34 listed on my account, along with an unused amount of $25.46 on the virtual card.

The app did offer a toggle switch that allowed me to automate my payments, even though that wasnt the default setting.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Don’t Miss: What Is Credit Score Out Of

What Is Required To Have An Affirm Account

To sign up for Affirm, you must:

- Be 18 years or older .

- Not be a resident of Iowa or West Virginia .

- Provide a valid U.S. or APO/FPO/DPO home address.

- Provide a valid U.S. mobile or VoIP number and agree to receive SMS text messages. The phone account must be registered in your name.

- Provide your full name, email address, date of birth, and the last 4 digits of your social security number to help us verify your identity.

Start Raising Your Credit Score Today

An Affirm loan is a quick and easy way to finance large purchases at point-of sale. Offered at over 2,000 companies including Walmart, Wayfair, Casper, and Expedia, Affirm is known for requiring a soft credit check with no hidden fees.

In the sections below, we will discuss the Affirm loan in greater detail as well as how it will affect your credit.

What is an Affirm loan?

An Affirm loan is a point-of-sale payment plan that consists of monthly installments for consumers who are new to credit and want to make a large purchase. The companys point-of-sale financing appeals to many new buyers with since there is no minimum credit score required and no prior credit history requirements.

Affirm uses what is called a soft credit check, a soft credit inquiry that doesnt affect your credit score, to process their borrowers applications for approval.

Lenders at Affirm will also take a look at the extent of your credit and payment history. The company might even ask for a deposit or want to peer over your bank transactions to get a general idea of your spending habits before offering you a loan.

If youve already used a lot of credit and arent the sharpest at making payments, theres a good chance you wont get approved.

Pros and cons of Affirm personal loans

If youre trying to decide if an Affirm loan is the right choice for you, weigh the pros and cons. Here is a quick breakdown:

Pros:

Cons:

A few other things you should know about Affirm loans:

TELL US,

Also Check: How Long Does It Take To Raise Credit Score