What Credit Score Do You Need For A Personal Loan

The minimum credit score to qualify for a personal loan is typically 610 to 640, according to an anonymized dataset of NerdWallet users who pre-qualified for

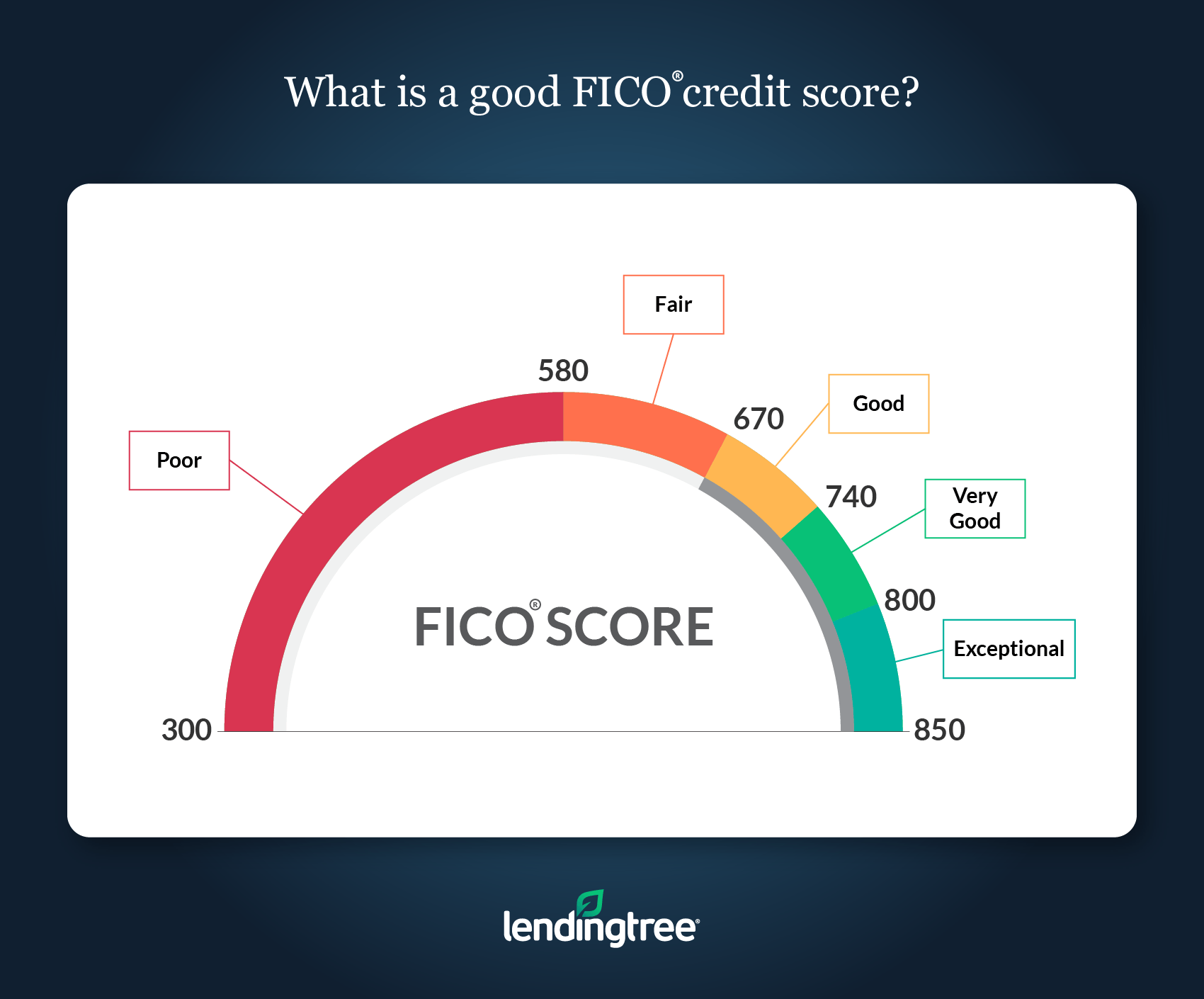

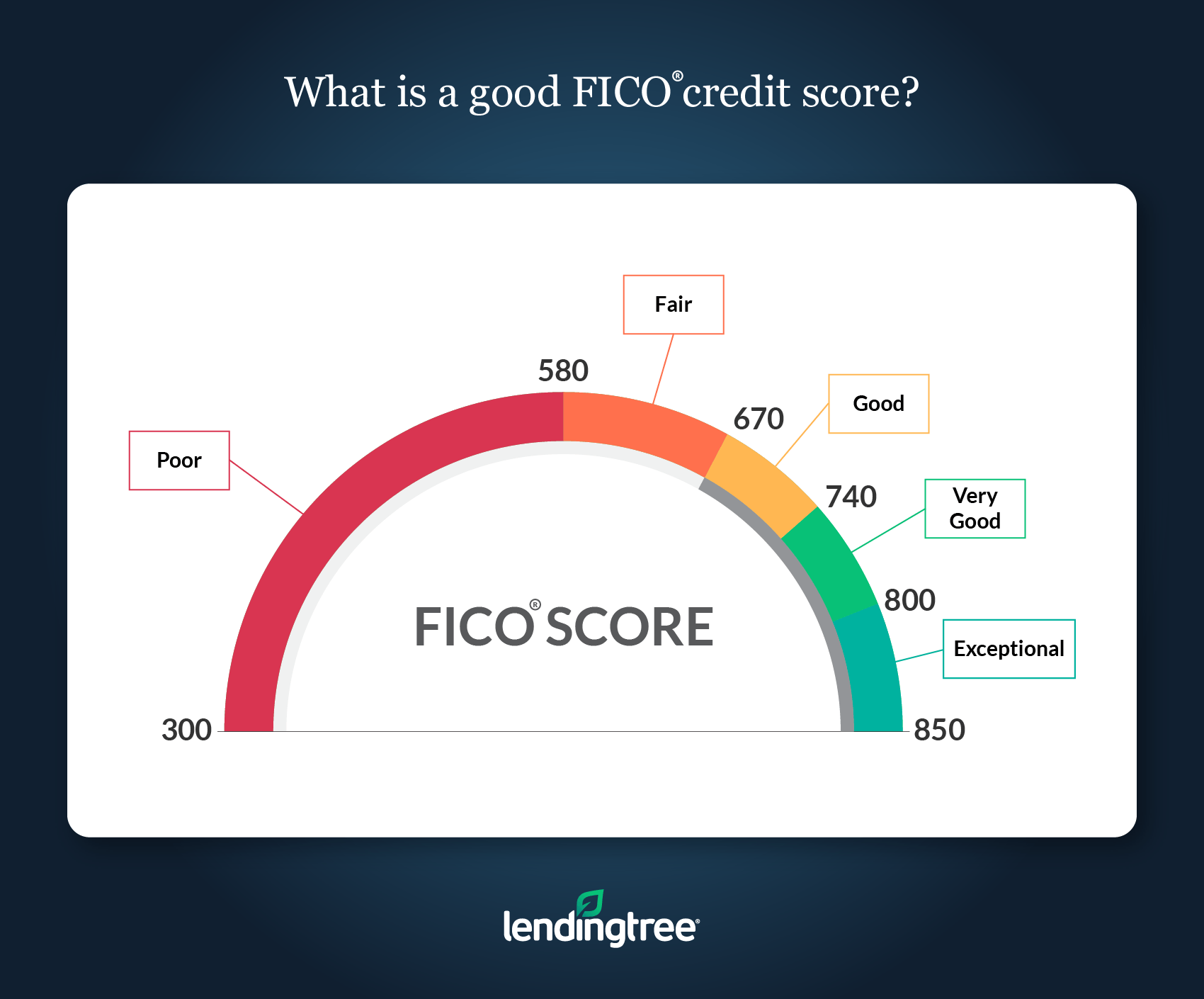

Credit scores typically range from 300 to 850, with 300 considered poor credit and 850 considered exceptional credit. Thankfully, a perfect 850 credit

Fico Score Open Access Program

The FICO® Score Open Access Program, offered by credit counseling partners and lender partners, was developed so that partners may share FICO® Scores for use in credit counseling/education and lender evaluation scenarios for free with consumers.

According to FICO, over 200 financial organizations take part in this program, which effectively grants consumers free access to their FICO®Scores, including a breakdown of elements that affect your credit score.

What Is Credit Score

A credit score is a numerical depiction of a borrowers ability to handle and repay the loan per the loan schedule without default. Usually, a borrowers credit score is represented in three digits starting from 300 to 850 as per the punctuality of loan repayment by the borrower to assess the and creditworthiness.

If the borrower is paying their loan on time, their will be high in the bracket of 740-850. However, if borrowers default in their , their score will be less than 300-669. The borrower, the lenders, or financial institutions can generate a credit score by visiting credit bureaus websites like Equifax, Experian, and Transunion.

A good credit score is necessary for obtaining a hassle-free loan from any financial institution. The lender may use a variety of credit scores depending on the needs of the loan. For example, if a borrower applies for a housing loan, the lender may use the credit history of the housing loan. Moreover, the credit score may differ based on the use of the different scoring models, credit bureaus, or the loan criteria in practice by the lender.

You May Like: Is 742 A Good Credit Score

Fico Credit Scores Vs Other Credit Scores

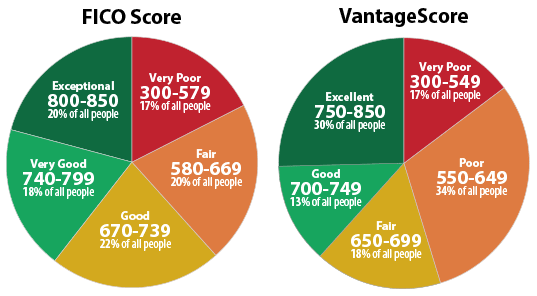

While FICO scores dominate the credit scoring business, theyre not the only product out there. The three major credit bureaus launched a competitor, VantageScore, in 2006. Its scores originally ranged from 501 to 900, but VantageScore 3 adopted the same 300-to-850 range as the FICO score. Like the FICO score, it is calculated using information from your credit reports, but it weights the various factors differently.

As with FICO scores, there are several different VantageScores, the most recent being VantageScore 4.0. Some credit card issuers, such as American Express, and other companies that offer free credit scores to their customers provide VantageScores rather than FICO scores.

If It Doesn’t Say Fico Score It’s Probably Not A Fico Score

“62% of consumers who received a non-FICO credit score mistakenly believed they received a FICO® Score.” BAV Consulting Survey3

There’s simply no substitute for FICO Scores. Remember, before the creation of FICO Scores there was no industry-standard to make sure access to credit was more fair and accurate. When you want to know where your credit stands, it just makes sense to get the scores your lenders will use.

A note of caution: some sites may try to sell a credit score and pass it off as a FICO Score. If it doesn’t clearly say FICO Score, it’s probably not a FICO Score.

Also Check: How Do You Check Your Credit Report

What’s Better Fico Or Transunion

In short, FICO is more transparent than the three credit bureaus and, most times, the least costly for all parties involved. However, reports from the three credit bureaus are vital to monitor your progress on your journey to that ideal credit score so that you can get the best loan rates and credit cards.

Fico Score Vs Credit Score: What Is The Difference

Recapping

In our FICO Score vs Credit Score article, well help you understand the differences between the two and how they are usedwhich will be extremely useful when tracking your credit score or why your credit card application was denied. What is the difference between credit score and FICO score is a question everyone asks when looking into their credit history.

Also Check: What Is A Positive Entry On Your Credit Report

What’s The Difference Between Fico Scores And Non

Not all credit scores are FICO Scores.For over 25 years, FICO Scores have been the industry standard for determining a person’s credit risk. Today, more than 90% of top lenders use FICO Scores to make faster, fairer, and more accurate lending decisions. Other credit scores can be very different from FICO Scoressometimes by as much as 100 points!

What’s in a name? When it comes to FICO Scores versus other credit scores, the answer is “quite a lot.”

FICO Scores are used by 90% of top lenders to make decisions about credit approvals, terms, and interest rates. Chances are when you apply for a mortgage, an auto loan, credit card, or a new line of credit, the bank or lender is looking at your FICO Score.

The reason? Lenders know what they are getting when they review a FICO Score. FICO Scores are trusted to be a fair and reliable measure of whether a person will pay back their loan on time. By consistently using FICO Scores, lenders take on less risk, and you get faster and fairer access to the credit you need and can manage.

FICO Scores use unique algorithms to calculate your credit risk based on the information contained in your credit reports. While many other companies design their credit scores to look like a FICO Score, the mathematical formulas they use can vary greatly.

What Is A Credit Score

A credit score is a numerical representation of financial health, telling lenders at a glance how responsible you are with credit and debt. Generally speaking, a higher credit score suggests that you borrow and pay back what you owe on time. A lower credit score, on the other hand, may hint that you struggle with managing debt obligations.

So where do credit scores come from? They’re generated by companies like Equifax, Experian, and TransUnion based on information that’s included in your credit reports. A is a collection of information about your financial life, including:

- Your identity

- Existing credit accounts

- Public records, including judgments, liens, or bankruptcy filings

- Inquiries about you from individuals or organizations that have requested a copy of your credit file

Credit reports are maintained by . Equifax, Experian, and TransUnion are the biggest in the U.S. These companies compile credit reports based on information that creditors report to them as well as information that’s available as part of the public record.

Read Also: What Is My Mortgage Credit Score

What Score Matters Most To Your Lender

According to leading financial industry analyst Mercator, FICO® Scores are used in over 90 percent of credit lending decisions in the United Statesbut that doesnt mean your lender is guaranteed to evaluate just your credit score to approve you for a loan. Lenders use a variety of information and tools in addition to credit scores when evaluating your creditworthiness. It is important to track your credit score, understand the different versions available and confirm which one your lender is using for your application to prevent any surprises.

FICO, in particular, offers a range of scores depending on the type of loan youre requesting . This helps ensure lenders accurately evaluate your creditworthiness, in turn providing you with the line of credit you require. You can learn more about these scoring variants on myFICOs FICO Score Versions page.

Why Do I Have Different Scores From Different Credit Bureaus

FICO and other credit bureaus all use different mathematical algorithms and criteria to determine their scores. In addition, not all lenders send reports to the same credit bureaus. If you pay a credit card bill late, and that credit card company only sends its report to one bureau, your score would be lowered on just that bureaus credit report.

Recommended Reading: How Often Does Your Fico Credit Score Update

Is Your Fico Score Your Credit Score

Yes. And also, it’s complicated.

“Credit score” and “FICO score” are usually used interchangeably, but your FICO score is one of many credit scores. As mentioned earlier, FICO is just one brandone type of credit scoring model. While different credit reporting agencies may use proprietary algorithms and weigh contributing factors differently, they all have the same goal: to measure your financial health.

To get a clearer picture of how lenders view you as a borrower, it’s crucial to review your FICO score, as well as any other credit scores outside of the FICO brand.

At this point, you might be wondering what the difference is between your FICO score and other credit scores.

Are Fico Scores And Vantagescore Different

Reading time: 3 minutes

- FICO and VantageScore are two different companies

- Both companies create credit scoring models

- Their models give different levels of importance to different information in your credit reports

Did you know you dont have only one credit score? There are many different credit scoring companies and credit scoring models, or differing methods of calculating credit scores. Credit scores are calculated based on the information in your credit reports.

Depending on which model, or even which credit bureau furnishes the information used in calculations, your credit scores may vary. Lenders and creditors may use your credit scores to help determine whether to approve your application for credit. Before approving you, they want to know: Whats the likelihood youll pay your bills on time? Lenders generally also have their own lending criteria, which may include other factors, such as your income.

Two of the biggest companies when it comes to credit scoring models are Fair Isaac Corporation, or FICO, and VantageScore. VantageScore is the result of a collaboration between the three nationwide credit bureaus Equifax, Experian and TransUnion.

Both FICO and VantageScore assign higher credit scores to consumers deemed as lower-risk borrowers, and both currently range from 300 to 850.

FICO scores are generally calculated using five categories of information contained in your credit reports, with varying weight given to each:

Also Check: What Credit Score Is Needed For A Home Depot Card

The Same Behavior Can Help All Your Scores

There are many differences between VantageScore and FICO® credit scores, and each companies’ various credit scoring models. However, all the scoring models try to predict the same thing using the same underlying data. As a result, if you focus on building a good credit history, you can improve all your scores. One way to do that is to monitor your credit regularly. Experian’s free credit monitoring service provides access to your Experian FICO® Score, credit report and other information that can help you better understand how credit scores work and actions you can take to improve all your credit scores.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

Also Check: How To Get A Copy Of My Credit Report

If It Doesnt Say Fico Score Its Probably Not A Fico Score

62% of consumers who received a non-FICO credit score mistakenly believed they received a FICO® Score. BAV Consulting Survey3

Theres simply no substitute for FICO Scores. Remember, before the creation of FICO Scores there was no industry-standard to make sure access to credit was more fair and accurate. When you want to know where your credit stands, it just makes sense to get the scores your lenders will use.

A note of caution: some sites may try to sell a credit score and pass it off as a FICO Score. If it doesnt clearly say FICO Score, its probably not a FICO Score.

Also Check: What Happens When Credit Score Dropped During Underwriting

What Are Fico And Credit Scores Used For

Three main loans are common with both FICO and credit scores in evaluating creditworthiness:

- Personal Loansloans that you receive from a lending institution for personal usages, such as medical bills, education, etc.

- Mortgagesloans taken out to buy property or land.

- Auto Loansloans from lending institutions for the purpose of buying a vehicle.

Read Also: Does Affirm Affect Your Credit Score

What Is More Important Fico Or Credit Score

Asked by: Bette Johnson

“For years, there has been a lot of confusion among consumers over which credit scores matter. While there are many types of credit scores, FICO Scores matter the most because the majority of lenders use these scores to decide whether to approve loan applicants and at what interest rates.”

What Factors Contribute To The Fico Credit Score

Most credit rating companies use five main factors to build their credit score, each having a different level of impact. Here are the factors and their weights for the FICO Classic Credit Score®:

-

Payment history .

What it looks at: Especially within the past two years, but up to the past seven years, how often do you meet your credit payments on time and in full?

What it means: If lenders see a strong history of positive payments, they are more likely to see you as a trustworthy borrower.

-

Amounts owed .

What it looks at: What is your credit utilization rate? Divide the total amount of credit you have been given by the total amount you currently owe.

What it means: When your credit utilization rate is less than 30%, you are seen as a responsible manager of credit.

-

Length of credit history .

What it looks at: What’s the average age of your credit lines?

What it means: When lenders see a long average age, they can be confident that you have strong relationships with your creditors.

-

What it looks at: How many different lines of credit are currently open in your name?

What it means: When lenders see a diverse mix of credit, they can feel confident that you are good at managing your credit lines.

-

New credit .

What it looks at: How often are credit checks made for your credit score to open new lines of credit?

What it means: When lenders see many new credit inquiries, they assign a higher level of risk to the borrower.

You May Like: How Long Can A Negative Stay On Credit Report

Why Are Fico And Other Credit Scores Important

When you apply for a loan, such as a mortgage or auto loan, the lender examines your credit score to assess risk and determine how likely youll be able to repay your loan. Credit scores allow lenders to quickly make decisions based on data that is both impartial and consistent, and reduces their chance of losing money to unreliable borrowers.

Borrowers with good credit scores are rewarded with access to loans and favorable interest rates. Borrowers with bad credit scores are often unable to get a loan or receive loans with high interest rates.

What Is My Real Credit Score

Companies can choose which score to purchase and use when reviewing applications and managing customers’ accounts, which is one reason there’s competition in the credit scoring world. With this in mind, there isn’t a single, “real” credit score.

For example, when you’re shopping for an auto loan, you may try to get offers from several lenders. One lender might use a FICO® Score 8, another a FICO® Auto Score 2, and a third a VantageScore 4.0. Your scores may vary, but each is very real in the sense that the lender is using it to determine if you qualify for a loan and the rates and terms to offer you.

Generally, you won’t know which of your three credit reports or which credit score a lender will use. However, because credit scores all rely on the same underlying data, building positive credit can help you get good credit scores regardless of the model. Conversely, negative items, such as late payments or a bankruptcy, could hurt all of your credit scores.

Don’t Miss: What Credit Score Do Lenders Use

What Is A Fico Score Fico Score Vs Credit Score

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A FICO score is a three-digit number, typically on a 300-850 range, that tells lenders how likely a consumer is to repay borrowed money based on their credit history.

The Fico Predictive Scoring System

FICO stands for Fair Isaac Corporation. FICO was founded in 1956 by engineer William R. Fair and mathematician Earl Judson Isaac. Together they created a scoring system designed to rate consumers based on their financial behaviors. After pitching the system to the top fifty lenders, it became a successful and popular way for institutions, landlords, and more to evaluate a consumers financial fitness.

FICO® Scores range from 300 to 850, which differs from industry-specific scores that range from 250 to 900.

A credit score is considered a FICO® Score when it uses the proprietary scoring system developed by Fair and Isaac.

The version of the FICO scoring systems used today was developed in 1989. Fannie Mae and Freddie Mac began using the system in 1995. Today 90% of lenders use FICO® Scores to decide credit approvals, terms, and interest rates.

Read Also: How To Get Your Credit Rating Back