What Do Credit Score Changes Mean

Your as you make on-time payments and pay down your debt. Keeping your accounts open and in good standing goes a long way toward building good credit health. The older your accounts get, the better. On the other hand, if your debt is growing, youre missing payments or your credit utilization goes up, you might see your . Your scores also might drop a bit temporarily if you apply for new accounts or take out new loans.

Types Of Information On Your Credit Report

According to myFICO.com, there are essentially four types of information on a credit report.

- Personally identifiable information â your name, address, Social Security number, date of birth, employment information

- â mortgages, credit cards, auto loans, etc.

- â a list of everyone who accessed your credit report within the last two years.

- Public records and collections â foreclosures, bankruptcies, and debts that have been sent to a collection agency

Dont Miss: What Credit Score Is Needed For Best Buy Credit Card

Check Your Credit Report For Fraud

Look for accounts that dont belong to you on your credit report. Accounts that you dont recognize could mean that someone has applied for a credit card, line of credit, mortgage or other loan under your name. It could also just be an administrative error. Make sure its not fraud or identity theft by taking the steps to have it corrected.

If you find an error on your credit report, contact lenders and any other organizations that could be affected. Tell them about the potential fraud.

If its fraud, you should:

- report it to the Canadian Anti-fraud Centre

The Canadian Anti-Fraud Centre is the central agency in Canada that collects information and criminal intelligence on fraud and identity theft.

You May Like: Is 702 A Good Credit Score

Also Check: Is Rental History On Credit Report

Changes To Your Credit Mix

Lenders like to see that you can handle different types of credit.

If you were recently approved for a new revolving account or personal loan, you might notice a positive impact on your credit.

Balancing your credit card bills with a mortgage or car payment can help you demonstrate a healthy credit mix. But remember: We dont recommend opening a new account only to improve your credit mix.

Paid Accounts But Dont See A Change In Score

There are a lot of factors that go into calculating your score. There could be several reasons you dont see a change:

- The new information has not yet been reported.

- There may be other changes in your credit history that are offsetting the positive steps, such as other outstanding debt affecting your debt-to-income ratio.

- You may have had other items go into collection.

Also remember that its at the lenders discretion when and if they report changes to your credit history. Lenders that have a lot of borrowers may stagger the dates when they report, doing so in batches versus all at once. Though most updates are made within 30 days, if you havent seen a change in 60 days, review your credit report to determine why. If you are expecting a change and planning to apply for new credit, get a report first to make sure the updates are reflected. You can use Rocket HomesSM to check on your status and get a credit report, or visit our and personal finance pages for more informative articles.

Also Check: How To Boost Credit Score 100 Points

When And How Often Are Credit Scores Updated

They are updated monthly. As the receives new information from a credit-reporting agency, it gets added immediately to your credit report. This new information could impact your overall credit score positively or negatively depending on how it affects your finances.

Data from your current and previous financial lenders are used to form your overall credit report. These reports are typically updated as new lenders provide the nationwide credit reporting agencies with new information. This occurs on a monthly basis or every 45 days. Although your credit score isnt included in the general free reports you can sign up for online, having the information and understanding it can help you better determine your credit movements.

Getting into the habit of making more consistent payments as well as keeping your overall balances low are examples of ways you can keep your credit in check. Your score should gradually improve over time if you make use of the examples listed above.

Read Also: Which Credit Score Is Used Most

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Also Check: How To Get Medical Collections Off Credit Report

What Is The Credit Score Update Process

Each month, your creditors provide new information to credit bureaus about your credit usage and financial activities. The credit bureaus take that information and update your credit report, which causes your credit score to update. The information that creditors share with credit bureaus includes:

-

Whether you made on-time payments towards your credit accounts

-

Your current credit balances compared to your credit limits

-

How long your credit accounts have been open

-

Whether youâve opened any new types of credit accounts

-

Whether you applied for any new loans or credit accounts

Whenever information is added to your credit report, it can impact your credit score. This is because the main factors that are used to calculate your credit score are:

How Credit Karma Makes Money

Credit Karma’s business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you targeted advertisements.

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links.

Your personal data is valuable stuff to advertisers, and they pay more to target it. With more than 100 million users,

Recommended Reading: How Does A Charge Off Affect Your Credit Report

How Often Is Your Credit Score Updated Folha Da Terra

A credit score is supposed to represent your creditworthiness. However, this may vary depending on your unique financial . Most creditors report to credit bureaus monthly. What exactly is a credit score and why is it important?

Your credit score could change as often as daily depending on how often your information providers are updating your credit report. Reports are seldom made to all three bureaus . Check out these 10 tips that will help you improve your credit score. Struggling to get your credit score from poor to excellent?

However, they report data at different times throughout the month, and . How often are credit scores updated? What exactly is a credit score and why is it important? And your scores could change every time new informationlike new accounts or changes .

What Day Of The Month Does Your Credit Score Update

Again, your credit score could potentially update on any day of the month, and possibly more than once a month. It depends on how many creditors you have and when they report.

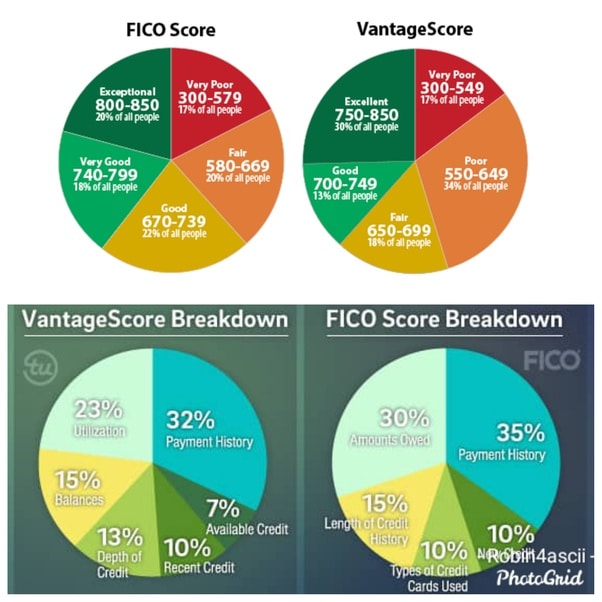

In other words: You canât always time your credit card or loan payments to a specific day of the month for maximum impact. What you can do is make sure you donât miss the deadline, since on-time payments make up 35% of your credit score. This way you can avoid having to search for ways on how to remove late payments from a credit report as a penalty.

Make payment in full whenever possible contrary to popular belief, carrying a balance is not good for your score and could eventually get you into a tough situation where you might be going. You should use no more than 30% of your available credit.

Read Also: How To Remove From Credit Report

How Often Do Creditors Report To Bureaus

Each creditor reports to the bureaus according to its own scheduletypically every 30 to 45 days. Reports are seldom made to all three bureaus at the same time for example, a given creditor might send a report to Experian this week but not get it to TransUnion until next week .

Every new report from a creditor brings potential adjustments to your credit report, which are reflected in changes in your credit scores. Depending on how many credit accounts you have, it’s possible for your credit score to change weekly or even daily.

Exactly how much your score will change with each update depends on how much your credit card balances fluctuate, how often you apply for and open new accounts, and whether you’re keeping up with bill payments. Some score differences are also attributable to the specific used to calculate the scoreFICO® Score or VantageScore®, for instanceand even which version of the specific scoring system is used.

Other Services Credit Karma Offers

Credit Karma will access your credit information from TransUnion and Equifax, two of the three major consumer credit agencies. It will come up with its own independent rating based on VantageScore. You will then receive your current VantageScore rating and the more detailed credit reports behind it.

In addition to this free service, Credit Karma has other related services, including a security monitoring service and alerts for when someone has conducted a credit check on you. This is not unique to Credit Karma: Many of the best credit monitoring services provide similar alerts and services.

When you share your personal information with Credit Karma, you can search for personalized offers for a credit card, a car loan, or a home loan, and your search won’t pop up in your credit report on Credit Karma or anywhere else. A standard section of credit reports is “inquiries,” which lists requests for your report from lenders you’ve applied to for a loan. Credit Karma allows you to limit the number of inquiries you make.

You May Like: How Much Does A Loan Affect Your Credit Score

How Often Does Credit Karma Update

Your credit score impacts your ability to borrow money, get a mortgage, or secure a rental agreement. Therefore, checking your score regularly is a vital part of your personal financial management and planning. It enables you to address any issues promptly and maintain good standing.

Considering that, were going to answer the following question in this guide:

How often does Credit Karma update?

But before we get there, lets cover some basics and see how this service works!

How Often Does My Credit Report Update

Written by: Shannon McNay Insler

Because of this, anyone looking to apply for credit might take a sudden interest in their credit reports to ensure that theyre being scored on accurate information. But how up to date are these reports, really? Lets find out.

______________________

SPONSORED: Find a Qualified Financial Advisor

1. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

2. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals get started now.

______________________

Recommended Reading: What Affects Your Credit Score

So What Does That Mean

What that means is that your credit report can be constantly changing, especially if you have a lot of accounts. And since your credit report can change often, so can your since scores are based off the data from your credit report.

Lets put this into a real world example. Lets say you had a really rough month with your kitchen appliances and they all broke beyond repair at the same time.

You decide to buy new appliances for $7,000, and pay with an existing credit card account with a $10,000 limit. Also hypothetically, say this particular credit card company reports data to the credit reporting companies immediately after you make your purchase. For a period of time, your account will have a high credit utilization ratio, meaning that your spending is close to the credit limit.

Of course, once you start paying down the balance on the account, your will decrease, and your credit scores will reflect that positively.

Does Having Your Credit Card Declined Hurt Your Credit?

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Resources

How Quickly Will Paying Off Debt Affect My Credit Score

You were finally able to zero out that credit card balance, thanks to a holiday cash gift and income from your side hustle. Go you!

A week later, you check the credit score posted on your credit card statement â and it doesnât look any different. How long should it take for your credit score to go up after paying off debt?

That depends. Again, it can take up to 45 days for a creditor to give that info to a credit reporting agency. Try not to obsess over seeing the number change right away. Instead, wait at least one month to check, and prepare to wait up to an extra couple of weeks. If youâre not able to pay back your debt as quickly as youâd like, check out a as an alternative to building your credit.

Read Also: Who Is Checking My Credit Report

You May Like: Is 736 A Good Credit Score

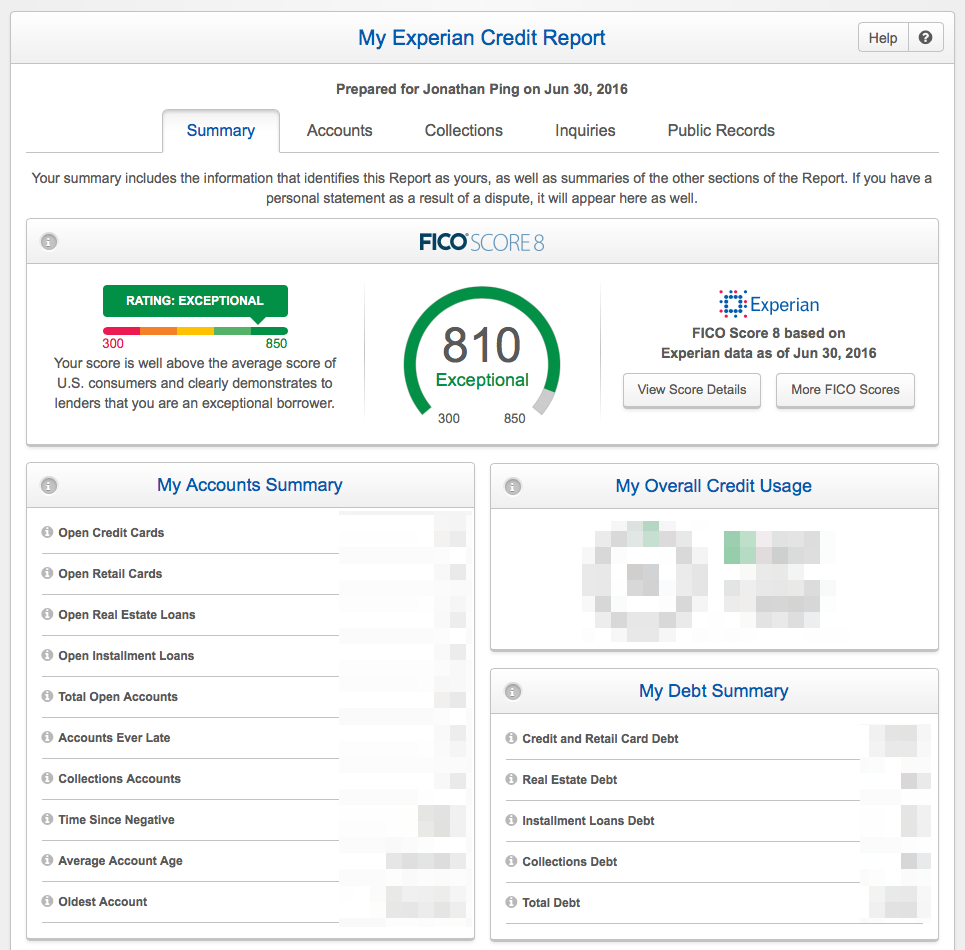

How Often Does Experian Update Your Credit Score

Banks Editorial Team

Banks Editorial Team

If you check your credit score often, you may notice that it hardly remains the same. But what causes the frequent changes? It boils down to when lenders and creditors report new information to the three major credit bureausExperian, TransUnion and Equifaxthat ends on your credit report. Each time new data is reported, your score could change. Heres why.

Your Credit Scores Can Change Frequently Thats Why Credit Karma Is Now Checking Your Credit Reports Daily For Any Changes From Equifax And Transunion

Now that Credit Karma is checking your TransUnion and Equifax reports every day, youll be able to keep a closer eye on your progress as you build credit. Daily checks mean you can know sooner if your scores have changed and that could help you make more-timely decisions when it comes to applying for new auto loans, credit cards and mortgages.

Also Check: Does Argos Card Affect Credit Rating

How Often Do Data Furnishers Report To The Bureaus

In general, creditors and other data furnishers report to the bureaus either once a month or every 45 days. 1

Keep in mind that each creditor may report your data at different times each month, and that some lenders update more frequently than others. Credit reporting is also completely voluntary, so its possible theyll miss a month here and there.

Remember When It Comes To Your Credit Scores Updating

- Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation.

- It’s normal for your credit score to change over time based on your financial behavior.

- It’s up to each individual lender to decide if and when they will report information as well as which of the CRAs they report to, if any.

- Be sure to request a new copy of your credit score in order to see any changes.

Don’t Miss: How To Update Credit Report Quickly

Try And Pay Your Balances In Full

Paying your balances in full will keep you out of many financial hardships. You wont accumulate interest, and youll strengthen the two most crucial credit score categories: payment history and credit utilization. You can review income and expenses to find opportunities to pay down more debt each month. Every extra dollar adds up.

How Often Is My Credit Score Updated Borrowell

Reports are seldom made to all three bureaus . However, this may vary depending on your unique financial . As mentioned previously, you should expect your credit report to update at least once a month, which means your credit score will automatically adjust depending . Depending on how many accounts you have, and when each lender reports your information to the credit bureaus, your credit scores could change .

How often do credit reports update? Depending on how many accounts you have, and when each lender reports your information to the credit bureaus, your credit scores could change . However, this may vary depending on your unique financial . While most lenders and credit card companies update their records .

Most creditors report to credit bureaus monthly. Credit bureaus don’t require the information to be reported at . You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. How often are credit scores updated?

Also Check: What To Dispute On Credit Report