How Can I Increase My Odds Of Getting A Low

Before you apply:

When you apply:

Tip #: Pay Off Outstanding Debt

One of the best ways to increase your credit score is to determine any outstanding debt you owe and pay on it until its paid in full. This is helpful for a couple of reasons. First, if your overall debt responsibilities go down, then you have room to take more on, which makes you less risky in your lenders eyes.

Lenders also look at something called a credit utilization ratio. Its the amount of spending power you use on your credit cards. The less you rely on your card, the better. To get your credit utilization, simply divide how much you owe on your card by how much spending power you have.

For example, if you typically charge $2,000 per month on your credit card and divide that by your total credit limit of $10,000, your credit utilization ratio is 20%.

Why Is My Credit Score Lower For A Mortgage

Jul 3, 2019 Which FICO scores do mortgage lenders use? Is your credit score lower or higher? Diamond Mortgage Experts explain what it means for you and;

Aug 6, 2020 Your credit score is one of the most important factors lenders consider when you apply for a mortgage. Typically, the higher your score,;

Read Also: Can You Get A Credit Report Without A Social Security Number

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

Why Do Credit Scores Matter

Ultimately, your credit score is important in many ways. To give just a few examples:;

- Your credit score determines the types of loans you can get

- It determines the mortgage interest rates you pay

- It affects how large of a house or how expensive of a car you can afford

- Insurers in most states use credit scores to set premiums for auto and homeowners coverage. Policyholders with bad credit scores often pay more

- Landlords use credit scores to decide who gets to rent their apartments

- Cell phone companies might require a deposit if your credit is too low

Whether youre looking for a mortgage or any other financial product, your credit score makes a big difference. Thats why its so important to know yours before you apply.

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

Do You Know Your Credit Score Lgfcu

Lenders use credit reports and credit scores to help them determine your you will do with specific types of loans, such as a mortgage or auto loan or;

Managing your credit and FICO Scores responsibly When you get a new loan, make or miss payments on loans or use a credit card, its common for your;

For example, auto lenders typically use a credit score that better predicts the likelihood that you would default on an auto loan. Mortgage lenders use a;

Aug 21, 2021 Are mortgage credit scores different? · Mortgage lenders use FICO scores just like other finance companies · But pull one version from each of the;

Note: The FICO® Score presented is for educational purposes and may differ from the scores that lenders use to make underwriting decisions.

Aug 20, 2021 While it ultimately depends on the loan, the minimum credit score for a mortgage typically ranges anywhere from 580 to 620, says Gina McKague,;

If I already have a high credit score, what else can I do to lower my mortgage rates? If you can afford higher monthly payments, then opting for a shorter loan;

So when youre house shopping, its important to know where your credit stands and how to use it to get the best mortgage rate possible. First, lets talk about;

Mar 23, 2021 1,000+ Credit Scores Are In Use: The sheer number of available of U.S. mortgages recommends that lenders obtain at least two credit;

When It Comes To Getting A Mortgage There Are Enough Numbers Flying Around To Make Any Mathematician Happy Lenders Will Look At A Number Of Items Which Can Include Your Credit History Your Income And How Much Debt You Have Among Other Things

But one number is perhaps one of the most important numbers of all. Your FICO® scores can impact whether you get a loan or not, and if so, at what interest rate. Thats why its important to understand the nuances of your FICO® scores. Luckily, its not rocket science. Heres the scoop on how your FICO® scores can affect your mortgage.

Recommended Reading: Does Barclaycard Report To Credit Bureaus

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How Your Credit Score Affects You

Suppose you want to borrow $200,000 in the form of a fixed rate thirty-year mortgage. If your credit score is in the highest category, 760-850, a lender might charge you 3.307 percent interest for the loan.1 This means a monthly payment of $877. If, however, your credit score is in a lower range, 620-639 for example, lenders might charge you 4.869;percent that would result in a $1,061;monthly payment. Although quite respectable, the lower credit score would cost you $184;a month more for your mortgage. Over the life of the loan, you would be paying $66,343;more than if you had the best credit score. Think about what you could do with that extra $184;per month.

Read Also: Does Speedy Cash Report To Credit Bureaus

What Options Do I Have If Im A First

If you have limited or no credit history, and you havent taken out a car loan before, you might qualify for a first-time car buyers program. These programs can enable buyers to purchase a vehicle on a monthly payment plan. They also might decrease the APR and the amount of the down payment you have to make compared to other loan options.

For example, Ford offers a program you can apply to if you meet the following criteria:

- You havent had previous car credit

- There are no issues with your credit report

- Your income is $2,000 a month or more

Note that these programs will typically have an income and/or employment requirement, so youll likely need to demonstrate that you are either currently employed and earning above the required minimum or show a written job offer for a position you will be starting soon.

What Can I Do To Improve My Credit Score

When you get your credit score, you might get information on how you can improve it. Improving your score a lot is likely to take some time, but it can be done. Under most scoring systems, focus on paying your bills in a timely way, paying down any outstanding balances, and staying away from new debt.

Also Check: Cbcinnovis Inquiry

How Can You Get Your Credit Report For Free

You are entitled to a free credit report once a year from each of the credit bureaus. This report can be requested directly or through AnnualCreditReport, the only permitted website for distributing the free annual credit report.

You might want to pull your Innovis credit report to make sure its not a mess. While each of the three major bureaus reports are available through AnnualCreditReport, your free report from Innovis must be requested by mail or phone. Still, its advised that you make an effort to get a copy of your Innovis report at least once a year if not for borrowing purposes, at least to protect yourself from identity theft.

To get a copy of your Innovis credit report, call Innovis toll-free at 1-800-540-2505. If you request your report by mail, you can use the printable request form.

What Is A Credit Bureau

A credit bureau also referred to as a consumer credit reporting agency, is a business that gathers and compiles information regarding consumers from banks, financial institutions, and other organizations, like courthouses and the Office of the Superintendent of Bankruptcy. A credit bureau uses the information theyve gathered about individual consumers and creates a credit report and score which then becomes available to a variety of lenders and other financial institutions. In Canada, there are two credit bureaus, Equifax and TransUnion, that lenders refer to when analyzing your creditworthiness.

What is the average credit score by province? .

There is a common misconception that make lending decisions, however, this is incorrect. A credit bureau is an independent third-party company that relays information between the consumer and the lender. The consumers information is made available to lenders by credit bureaus but, at the end of the day, the final lending decision lies with the creditor.

Don’t Miss: Paypal Working Capital Requirements

Why Your Mortgage Credit Score Is Lower Than You Think

Aug 13, 2021 VantageScores are the ones that most consumers see available on free websites. But most mortgage lenders only consider FICO scores. VantageScore;

Feb 27, 2020 Mortgage lenders tend to use all three of your scores from Experian, TransUnion and Equifax to evaluate you for a home loan. As mentioned,;

Why Lenders Use Credit Scores

Before credit scores, lenders looked directly at your credit report. A lender may have denied credit based on a biased judgment. This method was also time-consuming. Lenders used personal opinions to make a decision about an applicant that had nothing to do with their ability to repay the loan.

Today, credit scores assess risk more fairly because they are consistent and objective. Consumers also benefit. No matter who you are, your credit score reflects only your likelihood to repay debt.

Read Also: Does Klarna Affect Your Credit Score

Continue On Your Credit Score Journey

- If you have a loan or a credit card with us, sign into Member Connect to view your credit score.

- Review complimentary Personal Finance articles that can help guide you toward an improved financial future and great credit score.

- with your credit score questions, tips and tricks!

Stay tuned for more credit score tips and advice from the Credit Score Mentor!

The advice provided is for informational purposes only. Contact a financial advisor for additional guidance.;

- Website

Which Credit Score Is The Most Important

You may think that you have just one credit score, but you actually have many. In fact, FICO®;is just the name of a brand. Under that brand there are many types of credit scores under two main categories: base FICO®;Scores and industry-specific FICO®;Scores.

Base FICO® Scores are the most commonly used type of FICO® Score. You have three different base FICO® Scores made up of credit reports from the three major credit bureaus. When applying for a bank loan or credit card, lenders will use your base credit score.

Industry-specific FICO®;Scores are used when purchasing specific items such as auto loans and credit cards. Types of industry-specific scores include the FICO®;Bankcard Score and the FICO®;Auto Score

If you are unsure what FICO®;Score your lender will look at, contact your creditor and ask which one they use to evaluate applicants. Dont worry though, the basic scoring criteria is similar for most FICO®;Scores. So, if one of your FICO® Scores is considered to be in the good range, your other scores may also be in the good range.

Read Also: What Is Cbcinnovis On My Credit Report

The Credit Score Used By Mortgage Companies Will Surprise

Sep 30, 2016 But what credit scores do mortgage lenders actually use? The answer might surprise you. Much Older Versions Of FICO.

Aug 13, 2021 For example, if you plan to apply for a mortgage, bank loan, or new credit card, youll need to know how to access your FICO® credit scores;

bureaus data, meaning you have different FICO scores for Equifax, Experian and TransUnion. While many lenders use FICO scores to help them make lending;3 pages

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Don’t Miss: Can You Remove Hard Inquiries Off Your Credit Report

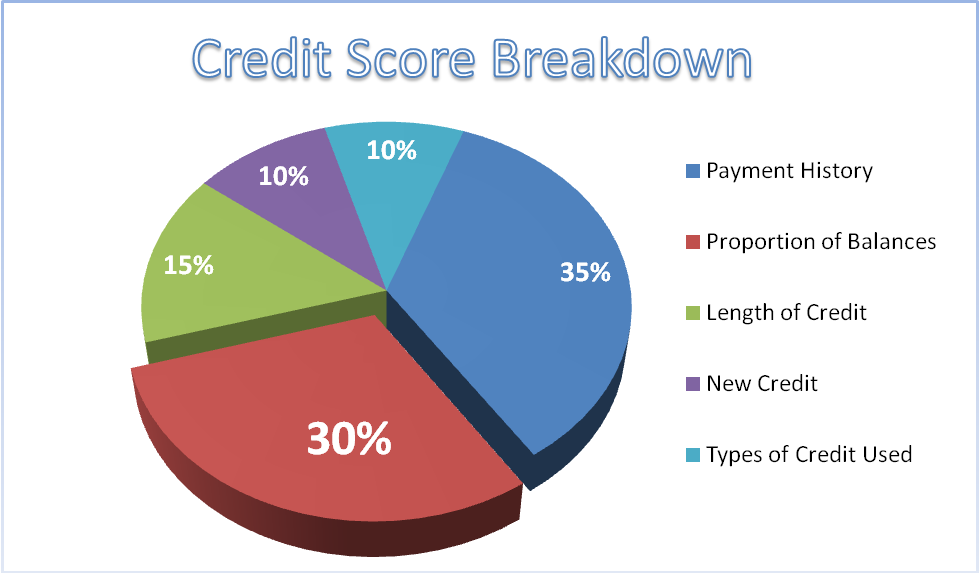

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, ExperianTM and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

- Types of credit you use

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Why Is It So Important To Get A Low Interest Rate On My Mortgage

You probably already know that a lower interest rate means a smaller monthly payment. But do you know just how big of an effect a smaller monthly payment can have?

Lets look at an example. According to the U.S. Census Bureau, in March 2018 the average sales price of a new home sold in the United States was $366,000. If you were to go to the closing table with a 20% down payment and opted for a 30-year fixed-rate mortgage, heres how much it would cost you over time depending on your interest rates.

| ; | |

| $3,408 | $102,183 |

In this example, boosting your credit before you get a mortgage could save you $284 per month, $3,408 per year, and $102,183 over the life of your loan! What would you do with all of that extra cash?

Pro tip: Use our to learn more about what could impact your credit scores.