How Does Having Deep Subprime Credit Impact You

Having bad credit can have several negative impacts on your personal finances and your ability to borrow money:

Poor credit makes it much more difficult to find a lender willing to offer you a loan or credit card.

People with bad credit receive lower credit limits or loan offers than individuals with higher credit profiles.

A bad credit score means youll receive a substantially higher interest rate on loans and credit cards for credit you can get.

Just how much can a deep subprime credit score hurt you? According to a study by Experian, on the largest major credit bureaus , people with poor credit pay roughly triple the average interest rate of someone with prime credit:

Super-prime credit: 3.65%

Deep subprime credit: 14.39%

What Happens If I Stop Paying My Second Mortgage

If youre in financial hardship and youre not paying second mortgage for 150-180 days from the due date, the lender may foreclose your property or file a lawsuit and seize your personal assets. Read through the section below and find out what happens if you stop paying second mortgage. What happens if I stop paying second mortgage?

What A Fair Credit Score Means For You:

Borrowers within the fair credit score may push interest rates higher for their lines of credit.

Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates.

Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

What Is A Subprime Auto Loan

A subprime auto loan is aimed at borrowers who have credit scores within a certain range, which can vary depending on the source. While the Consumer Financial Protection Bureau considers a subprime score to be between 580 and 619, credit bureau Experian considers subprime to be between 501 and 600.

The CFPB defines five levels of credit scores for people who take out an auto loan.

- Deep subprime

- Subprime

- Near prime

- Prime

- Super prime

Subprime auto loans are sometimes even extended to people who have no credit scores at all.

The Federal Reserve Bank of Kansas City emphasizes that theres actually no universal definition of a subprime loan. More often than not, the borrowers credit scores define whether a loan is subprime. But even the loans interest rate or the specific lender can be used to identify a subprime loan.

How Your Credit Score Affects The Cost Of An Auto Loan

Auto loans are secured: your vehicle serves as collateral for the loan. If you default, the lender can repossess the car. That makes your loan less risky than an unsecured loan would be, so interest rates are lower than they are for most unsecured loans.

Your credit score has a huge impact on the interest rate youre offered and on the cost of your loan. In the table below you can see the average interest rates for both new and used cars by credit score to see just how much of an effect it has.

Read Also: What Credit Score Does Carmax Use

What It Means To Have Prime Credit

If you have prime credit, lenders see you as more likely to make your monthly loan payments and credit card bills on time and in full than someone who is subprime. They have a greater confidence in lending you credit because you pose less of a risk of defaulting.

As a prime borrower, you will receive higher credit limits than those who are subprime, but you may not get offered the most favorable terms, such as the lowest interest rate on your mortgage, like someone with a super-prime score would.

To see an example of this, let’s look at current interest rates on a 30-year fixed mortgage. For context, a 30-year fixed mortgage means a mortgage that is completely paid off in 30 years at an interest rate and monthly payment that stays the same over the life of the loan.

Using FICO credit scores and their home purchasing data from Informa Research Services, we calculated what the national average and monthly payment would be for homeowners of various credit score ranges on a $300,000 mortgage. The far-left column represents borrower profiles based on credit score, as defined by the CFPB Consumer Credit Panel.

Below is the table that breaks down the data:

| Super-prime borrower | |

|---|---|

| 4.432% | $1,508 |

Whats Needed To Get Approved

Though subprime mortgages are designed for borrowers with lower credit scores, lenders wont lend to just anyone. If your credit score is too low, you wont be able to qualify for any type of mortgage. Generally, lenders prefer borrowers with credit scores in the range of 580 to 660.

Applying for a subprime mortgage is pretty much the same as a conventional mortgage. Youll need to provide plenty of documentation to show you can handle the payments, including a list of your bank accounts and other assets, any debts you currently owe, proof of your income via paystubs and tax returns.

Read Also: How Bad Is A 500 Credit Score

The Minimum Required To Calculate A Credit Score

For a credit score to be calculated, your credit report must contain enough informationand enough recent informationon which to base a credit score.Generally, that means you must have at least one account that has been open for six months or longer, and at least one account that has been reported to the credit bureau within the last six months. What are the minimum requirements to have a FICO Score?

Comparing Auto Loans For Borrowers With Subprime Credit Scores

By David Low

Americans owe auto lenders well over a trillion dollars. Consumers with subprime credit scores i.e. scores that are significantly lower than average are especially likely to need loans to purchase vehicles. But they also pay the highest interest rates and are the most likely to default on their loans. Because interest rates and default risk can matter so much for consumers, our latest Data Point report takes an in-depth look at how they vary across different types of subprime auto lenders. It finds that some types of subprime lenders charge their borrowers significantly higher interest rates than others, and that differences in default risk are unlikely to fully explain these differences.

But do differences in default risk fully explain the differences in interest rates across subprime lender types that we see? Our statistical analysis suggests they do not. For example, adjusting for many factors in our data that we observe , we estimate that the average borrower in our data with a 560+ credit score would have the same default risk with a loan from a bank as with a loan from a small buy-here-pay-here lender. But their estimated interest rate would be 13 percent with a loan from a small buy-here-pay-here lender, while it would be 9 percent with a loan from a bank. In our data, a typical borrower at a small buy-here-pay-here lender would save around $900 over the life of a loan if they could reduce their interest rate from 13 percent to 9 percent.

You May Like: Paypal Credit Report To Credit Bureaus

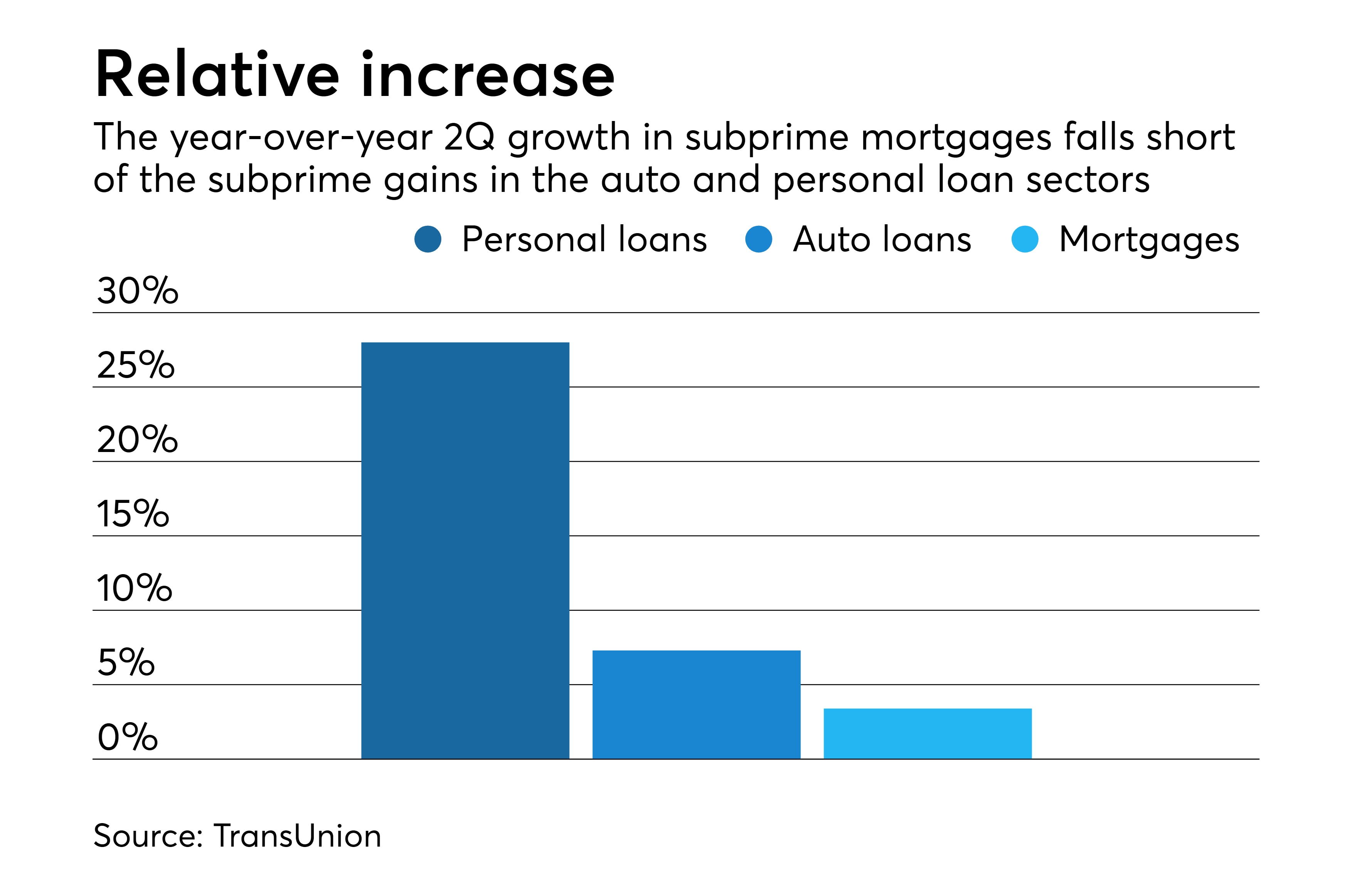

Borrowing Opportunities Expand As Subprime Population Shrinks

An increase in the number of U.S. consumers moving from the subprime to prime group is a positive phenomenon. Not only does it show that consumers are improving their scores, but it shows they are improving them enough to move to higher score tiers.

Some lending decisions are based on which score group an applicant is in, and those in the subprime category may face challenges in being approved and face higher costs in borrowing. As these consumers transition into the prime tier, it’s possible they’re able to expand their borrowing opportunities.

In addition to more consumers moving into the prime range, the data shows that consumers in the subprime group are also improving their underlying credit factors. There will always be newcomers to the credit space who start out with lower scores, and those who see their credit scores decrease for one reason or another, but this movement from subprime to prime is generally promising. This trend could lead to expanded borrowing opportunities for a larger growing portion of Americans.

An Example Of The Effect Of Subprime Mortgages

The 2008 housing market crash was due in large part to widespread defaults on subprime mortgages. Many borrowers were given what were known as NINJA loans, an acronym derived from the phrase no income, no job, and no assets.

These mortgages were often issued with no down payment required, and proof of income was not necessary either. A buyer might state earnings of $150,000 a year but did not have to provide documentation to substantiate the claim. These borrowers then found themselves underwater in a declining housing market, with their home values lower than the mortgage they owed. Many of these NINJA borrowers defaulted because the interest rates associated with the loans were teaser rates, variable rates that started low and ballooned over time, making it very hard to pay down the principal of the mortgage.

Wells Fargo, Bank of America, and other financial institutions reported in June 2015 that they would begin offering mortgages to individuals with credit ratings in the low 600s, and the nonprofit, community advocacy, and homeownership organization Neighborhood Assistance Corporation of America continued its Achieve the Dream tour in 2018, hosting events nationwide to help people apply for non-prime loans, which are effectively the same as subprime mortgages.

Recommended Reading: How To Remove Repossession From Credit Report

Can I Refinance With Deep Subprime Credit

It is possible to refinance with a credit score of 300 to 500, but it is almost never a good idea. The whole point of refinancing is to get a better deal than you had on your original loan. That will be difficult or impossible to do with deep subprime credit.

Do not apply for a refinance car loan if your credit score is lower than it was when you got your original loan.

If your current monthly payment is too high, you could consider refinancing with a longer-term loan. That could lower your monthly payment considerably. You will pay more in interest and you may end up owing more than your car is worth.

See the Best Refinance Rates

Compare multiple auto lenders at one time, pick the best option, and get approved for your loan.

How Do I Raise My Subprime Credit Score

People with the best credit scores arent there through sheer luck. Having excellent credit takes patience and hard work.

The best way to raise your credit score is by ensuring you make your payments on time each month. Payment history accounts for 35% of your FICO credit score by far the largest factor. Nearly as important is keeping your overall credit use low. Credit use accounts for 30% of your FICO score.

To move from subprime to prime, pay your credit card bills in full every month. If thats not possible, try to pay as much as you can. You should make every effort to at least pay your required minimum payment and keep your credit usage below 30%. For quicker results, keep credit use below 10%.

If your credit score is well-below par consider getting a secured credit card, like the OpenSky Visa, to boost your payment history. Another option is a catalog card, such as the Group One Platinum, Horizon Gold, or Fingerhut Cards. These cards come with an unsecured line of credit and regularly report payment activity to the major credit bureaus.

Related Article: 7 Tips to Quickly Build Your Credit Score

About: Cory

Cory is BestCards.com’s “Jack of all trades” and resident credit expert, covering all facets of the credit card space. In addition to credit cards, Cory finds that jogging, cats, and memes are essential parts of a balanced day.

Read Also: How Much Does Overdraft Affect Credit Rating

Fewer Subprime Consumers Across Us In 2021

While the most commonly used credit scoring systems range from 300 to 850, many lenders categorize borrowers into broad groups that identify where their score lands on the spectrumprime and subprime. These designations indicate whether a consumer’s score meets a certain threshold, with prime used to describe scores above that cutoff, and subprime meaning the opposite.

In the U.S., nearly 1 in 3 consumers have a subprime scorebut this population has shrunk by 12% since 2020, according to Experian data. Among the consumers who have subprime scores, many improved aspects of their credit over the past year.

As part of our ongoing review of consumer credit in the U.S., Experian reviewed credit report data from the past year to see how the number of subprime consumers has changed. This analysis compares data from the first quarter of 2020 with data from the same period in 2021. Read on for our insights and analysis.

Different Scores At Each Credit Bureau

Because each credit bureau could have different information on file about you, your credit scores will most likely differ for each of the three credit bureaus: Equifax, TransUnion and Experian.

Sometimes the difference is just a few points. Other times, the difference in your credit scores from each bureau can be vast due to an error or mistake in your credit report. These differences can cost you thousands over the life of a loan. Be sure to check your reports regularly or sign up for alerts to be notified when your score changes.

Also Check: Experian Boost Paypal

How Subprime Lending Works

Many non-traditional lenders operating today offer subprime lending services. To apply for a loan with a subprime credit score, you need to meet basic age and income requirements, among other things.

The application process for subprime loans is easy, and you can either apply in-store or online, which is even more convenient. At CreditNinja, we perform soft credit checks, so applying for a subprime loan wont affect your credit score. The approval process is quick, and you can get your money as soon as the next business day.

Considering Credit Changes During The Covid

Though the trends in subprime credit have been promising over the past year, it’s important to remember this data is a snapshot taken during a turbulent period. Average credit scores rose across the U.S. in 2020, fueled in large part by a shift in consumer spending and saving and changes to how lenders worked with borrowers during the COVID-19 pandemic.

Since the onset of the pandemic, certain COVID-19 relief programs have ended or will before long, which could mean that consumer finances might change markedly in the months to come. As time goes on and consumers continue to manage the impacts of the COVID-19 pandemic, Experian will continue to monitor the data and provide updates as they become available.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO® Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

FICO® is a registered trademark of Fair Isaac Corporation in the U.S. and other countries.

What Is the Difference Between a Prime Loan and a Subprime Loan?

Resources

Get the Free Experian app:

Read Also: Does Lending Club Hurt Your Credit

Other Benefits Of Prime Credit

Other noteworthy benefits of prime scores include:

- Retaining your credit limits in recessions: Many banks lower cardholders credit limits in times of financial uncertainty. This practice improves the banks balance sheets and reduces their exposure to risky borrowers.

- Excellent signup bonuses: Prime borrowers get exclusive signup bonuses when they receive a new credit card. These bonuses include lucrative travel points, 0% intro APR periods, and more. They may even receive retention bonuses when they keep their card after one year.

- Getting the best refinance rates: People with good credit have no trouble finding the best refinancing rates from mortgage lenders, or for things like auto or personal loans.

What Is Prime And Subprime

What Does It Mean to Be a Prime or Subprime Borrower? Prime borrowers are considered the least likely to default on a loan. Subprime borrowers, meanwhile, are viewed as higher default risks due to having limited or damaged credit histories. Lenders use several FICO® Score ranges to categorize loan applicants.

You May Like: Is 766 A Good Credit Score

What Factors Impact My Score

If your credit score falls into the subprime range, your credit history might not be long enough for lenders to make an astute judgment about your ability to repay a loan. Using credit responsibly by making payments on time and keeping a low balance on the cards you do have may slowly improve your score.

Other common characteristics of subprime borrowers include:

- A high , which is the amount of your available credit youre currently using. Lenders generally like to see a ratio of less than 30% with 10% being ideal.

- A history of late paymentsMost lenders report late payments to the three major credit bureaus after 30 days, with additional reporting at 60 and 90 days late.

- A history of defaulting on debtThese debts may be written off by the lender because they were not repaid after several years or sent to collections.

- A history of legal judgments or bankruptcyThese are seen as serious black marks by lenders and remain on your credit report for seven to 10 years.

Learn more about What Is a Good Credit Score? and Just How Bad Is My Credit Score?