Should I Check My Score Elsewhere Before Taking Out A Loan

The credit score your bank provides will help you track your personal credit well-being. When it rises, you’ll know you’re going in the right direction, even if it’s not a score that you’re familiar with or that a lender typically uses.

Still, since lenders use credit scores to determine qualification and to set terms such as interest rates, it’s a good idea to check your credit scores with the most common scoring models to take some of the guesswork out of your planning:

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

Making The Minimum Monthly Repayment

If you missed a payment, it may be recorded as missed on your credit report. For a credit card, you need to make at least the minimum repayment to make sure your repayment history information shows that youve paid on time.

Your account statement will show when your repayment is due and when the payment you made was received by us. If the payment was received by us on or before the due date, the payment will be shown on your credit report as being paid on time.

Recommended Reading: How Long Does Credit Check Stay On Report

How Do I Remove Negative Items From My Credit Report

To recap the material already presented, you have several ways to legally remove negative credit report items:

- Dispute erroneous items on your credit reports by doing the work yourself.

- Hire a credit repair service to dispute inaccurate items on your behalf.

- Send a goodwill request.

- Send a pay for removal request.

- Wait for items to age off your reports.

The last item, waiting for bad items to age away, is the easiest method, as you dont have to lift a finger for it to work. The downside is that it may take several years to bear fruit.

You can initiate credit repair yourself without the expense, although youll have to devote some time to the process. Alternatively, you can pay credit repair companies to do the job for you.

are better positioned, have superior knowledge, and can usually complete the job for under $1,000, sometimes considerably less.

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days

- online at AnnualCreditReport.com youll get access immediately

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request

It may take longer to get your report if the credit bureau needs more information to verify your identity.

Also Check: Does Rent A Center Report To Credit

When Can A Bank Pull Or Review A Credit Report

Under the Fair Credit Reporting Act, a bank can obtain a consumer report if it has a “permissible purpose,” which may include the following:

- Review or collection of an account

- Opening a deposit or savings account

- Underwriting of insurance

- Any legitimate business need in connection with a business transaction initiated by the consumer, or to review an account to determine whether the consumer continues to meet the terms of the account

Refer to 12 CFR 1022 “Fair Credit Reporting ” for more information.

Last Reviewed: April 2021

Please note: The terms “bank” and “banks” used in these answers generally refer to national banks, federal savings associations, and federal branches or agencies of foreign banking organizations that are regulated by the Office of the Comptroller of the Currency . Find out if the OCC regulates your bank. Information provided on HelpWithMyBank.gov should not be construed as legal advice or a legal opinion of the OCC.

Types Of Loans For Rvs: Secured Vs Unsecured

For secured RV loans, the lender has the right to repossess the property if a certain number of payments are missed. Even if youre confident about your financial circumstances, its smart to understand the contractual obligations of a secured loan so you can make an informed choice.

An unsecured loan can offer greater flexibility, since you won’t have the inconvenience of having to put up collateral. Unsecured loans include personal loans, a personal line of credit or credit card.

Read Also: When Does Chase Sapphire Report To Credit Bureaus

What Are The Features Of Credit Card

Some basic credit card features are as follows: Credit Card types A credit card issuer may issue several types of credit cards. Credit card balance The total amount you owe to the bank. Credit limit The maximum balance you can have on the credit card at any time. Grace Period The time you have to pay your full balance before a finance charge is applied. Annual Percentage Rate The interest rate charged on any debt that is carried out after the grace period.

Honda Foreman 450 Pickup Coil Test

Ensuring a correct match reduces the likelihood of false or inaccurate data reporting. To report a consumer’s debt to the three major bureaus, the following information is required: Full Name Full Address Full Social Security Number, or Date of Birth Date of Delinquency. Aug 31, 2022 · Financial institutions like banks interact with credit reporting agencies in two ways. 1. Reviewing Your History First, they use the information available on your report to make lending decisions. This can range from deciding whether to offer you a card with a good interest rate to whether to offer you a home mortgage.. In a world where so much can be shared, self-reporting your good information to the bureaus Equifax, Experian, and TransUnion isnt allowed. However, services that track your bank accounts for recurring payments that are not part of the traditional information collected by bureaus can report the information for you.. According to the federal Consumer Financial Protection Bureau, 20% of U.S. households have medical debt, and medical-debt collection issues appear on 43 million reports. As of the second quarter of 2021, 58% of debts that were in collection and which appeared on records were tied to medical bills. Your card may not be reporting to the bureaus because it is a new account. It can take card companies up to 60 days to report a newly opened card account to the bureaus. Once a new card has been reported, it can take a few days to show up on your report.

Don’t Miss: What Credit Score Is Needed For An Amazon Credit Card

Why Late Payments Matter

Your payment history is the most significant factor in your FICO credit score, with a 35% weighting. Even if your credit reports are in good shape, one late payment can damage your credit.

The impact of one late payment depends on several factors, including whether or not your lenders ever report late payments to credit bureaus.

Who Can’t Access Your Credit

Unless youre posting pictures of your credit reports on social media, your credit information shouldnt be available to the public. It wont show up as a search engine result, and your loved ones cant request it, regardless of your relationship.

If an individual does use your personal information to obtain your credit history, you can sue for actual damages or $1,000 whichever is greater according to legal website Nolo.

You May Like: What Is An Ideal Credit Score

Repairing And Managing Credit

A low credit score can translate into higher loan and credit card interest rates. It can also inhibit your ability to secure insurance, school loans, rental housing, utilities and even elective medical procedures.

If you have credit problems, work to repair your credit on your own or use a credit-counseling agency. Ask several agencies about services, fees and repayment plans before signing a contract. Beware any that ask you to pay up front or promise a quick fix it may take years to repair credit legitimately.

If you find errors on your credit report, correct them as soon as possible. To dispute an error, contact the financial institution that reported it or go directly to the credit agency. Provide all necessary details in writing. They then have 30 days to investigate, submit any corrections needed to credit agencies, and provide a written response. Learn more about disputing information reported by TD Bank

To protect your credit in the future, create a budget and pay bills on time, every time. Consider fees, interest rates and monthly payments before obtaining new credit. The sooner you begin to re-establish good credit, the sooner you’ll improve your credit score.

You Can Get It For Free Thanks To The Fico Score Open Access Program

One easy way to get your credit score may be from your bank. Your is a numeric valuation that lenders use, along with your , to evaluate the risk of offering you a loan or providing credit to you.

You can get a free credit report from each of the three big credit agencies: Equifax, Experian, and TransUnion. With the exception of Experian, you will be charged a fee if you want to see your actual credit score. The good news is that you may be able to get your score for free from a bank or credit card issuer. Heres how to check your credit score.

Also Check: Does Affirm Go On Credit Report

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

What Happens When You Open A Checking And Savings Account

Opening a checking and savings account requires that you have proof of a few things: your age , your identification and your current address. But you don’t have to worry about where your credit score stands.

According to Experian, one of the three main credit bureaus, banks and credit unions don’t check your credit score when opening these two bank accounts. They may instead run a ChexSystems report.

A ChexSystems report shows banks a potential customer’s past activity with deposit accounts. It shows any unpaid negative balances , frequent overdraft fees, bounced checks and suspected fraud.

Access a free copy of your ChexSystems report once every 12 months by going to the consumer reporting agency’s website or by calling 800-428-9623. Note that your ChexSystems report has no direct impact on your credit score.

Read Also: How To Remove A Inquiry From Credit Report

Pay For Delete Defined

First, its helpful to understand what it means to pay to have bad credit report information removed. According to Paul T. Joseph, attorney, CPA, and founder of Joseph & Joseph Tax and Payroll in Williamston, Mich., Pay for delete is essentially when you are contacted by your creditor, or you contact them, and you agree to pay a portion or all of the outstanding balance with an agreement that the creditor will contact the and remove any derogatory comments or indications of late payment on the account.

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

Also Check: Is 631 A Good Credit Score

Why Should You Apply For An Indusind Bank Credit Card

At IndusInd Bank, we understand that every customer has a different financial need. Considering this, we have designed the best credit card range that comes with endless benefits and privileges to meet the specific needs of our customers. The credit card range offered by IndusInd Bank maximises everything starting from rewards, cashbacks, entertainment deals, dining offers, and more. You can easily apply for a credit card online and select a card that best matches your requirements.

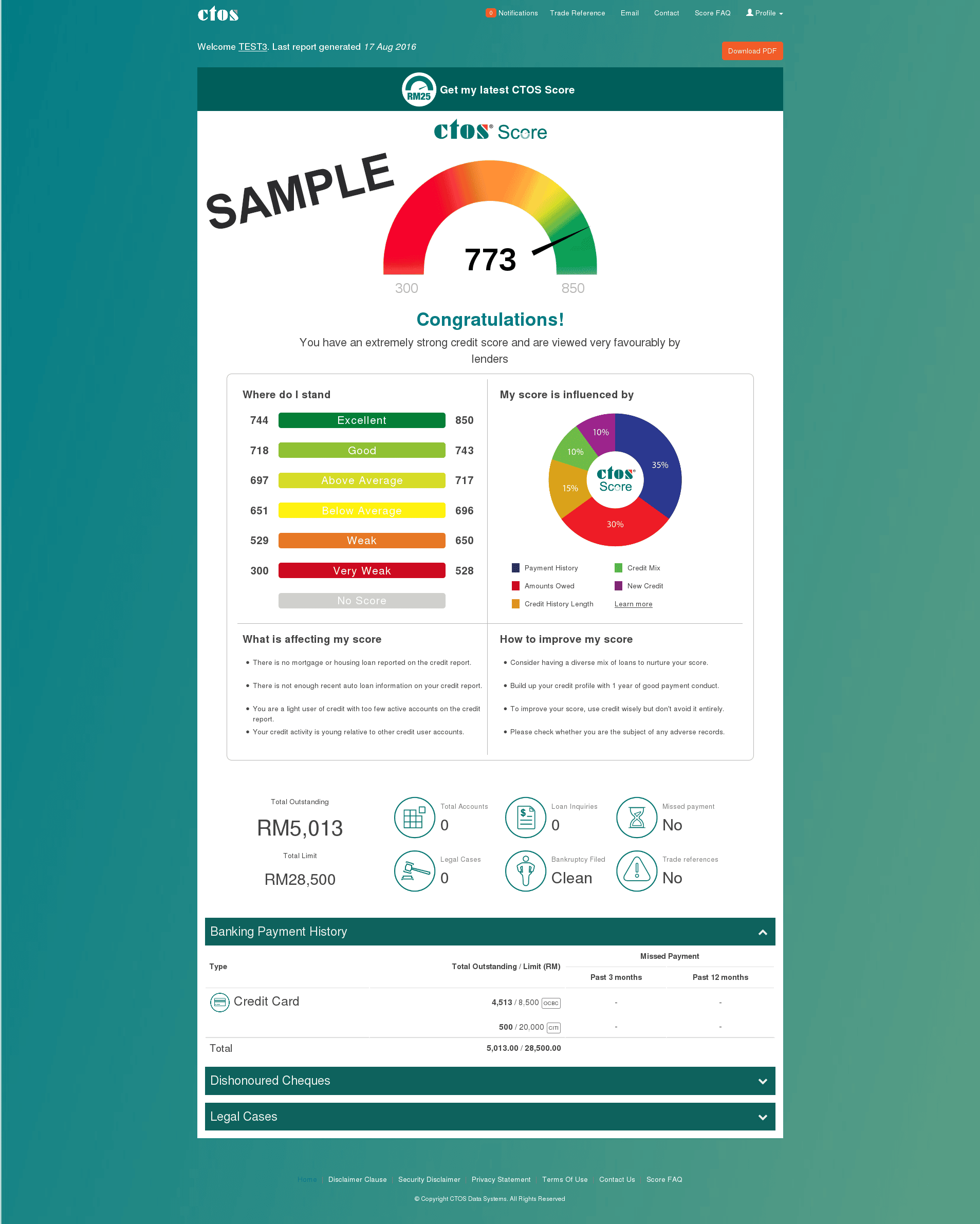

How Your Credit Score Is Calculated

The FICO score is the most commonly used type of credit score. It is calculated by using different pieces of data from your credit report, including:

- Payment history Regular on-time payments and no bankruptcies or defaults are evidence of good financial management.

- Amounts owed An important figure is your , the amount of debt that you are carrying relative to your .

- Length of credit history The longer it is, the better.

- It helps to have both revolving and installment credit.

- New credit Too many recent credit applications, which trigger a hard credit check, can lower your score for several months.

Your credit score affects your ability to qualify for different types of creditsuch as car loans and mortgagesand the terms that youll be offered. In general, the higher your credit score, the easier it is to qualify for credit and obtain favorable terms. Because a lot could be riding on your credit score, it pays to keep track of itand to work toward improving it when necessary.

Also Check: What Does Your Credit Score Mean

Generate Your Report Online

Once you access your credit reports, download them to your computer or print them before you exit out of the window for later review.

If you have trouble requesting an online copy of your credit reports, you can also request to receive a free copy by mail or phone. To receive a free copy by mail, fill out the mail request form and send it to this address:

Annual Credit Report Request ServiceP.O. Box 105281

The form asks you the same questions as the online form.

If you prefer calling instead, dial 877-322-8228.

How Often Should You Check Your Credit Report

Experts recommend that you check your credit report at least once a year. Taking a full deep dive with a credit report to ensure no inaccuracies, make sure you know where you stand and use a monitoring service that keeps you informed. We can help you stay informed with a credit monitoring service. Sign up for Chase Credit Journey to help monitor your credit.

If you’re planning to make a major purchase soon, or even in the somewhat distant future, you should regularly check up on your credit report. You want to make sure your report is as accurate as possible to get the best interest rates.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

You May Like: When Do Closed Accounts Fall Off Your Credit Report

Financing Your Purchase With An Rv Loan

After youve decided on the RV, determine your best financing option. One choice is an RV loan. These products are available from online lenders, banks, credit unions and RV dealerships.

To qualify for an RV loan, the lender will assess your credit reports and credit scores, income and debt-to-income-ratio. While they’re similar to auto loans, RV loans tend to have more stringent qualification standards and are usually secured with the property, which acts as collateral. Smaller RV loans, though, may be unsecured. Repayment terms can last 10, 15 or even 20 years, whereas most auto loan terms are six years or less.

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Also Check: How To Dispute A Name On Your Credit Report

Accurate Or A Mistake

Late payments appear in your credit reports when lenders report that you paid late. That can happen in one of two ways:

If the report is accurate, it can be difficult and time-consuming to get the late payment removed from your reportsand it likely won’t be removed for seven years.

If the report of a late payment is incorrect, it can be relatively easy to fix the error. You need to file a dispute explaining that your report contains a mistake and demand that the payment be removed. If you mail the letter, then you should send it by certified mail with a return receipt request.

Consumer reporting agencies must correct errors, and failing to do so is a violation of the federal Fair Credit Reporting Act .

Fixing the error may take several weeks, but your lender may be able to accelerate the process using rapid rescoring, in which you pay for a faster update of your report. Doing this typically only makes sense if youre in the middle of a home purchase or another significant transaction.

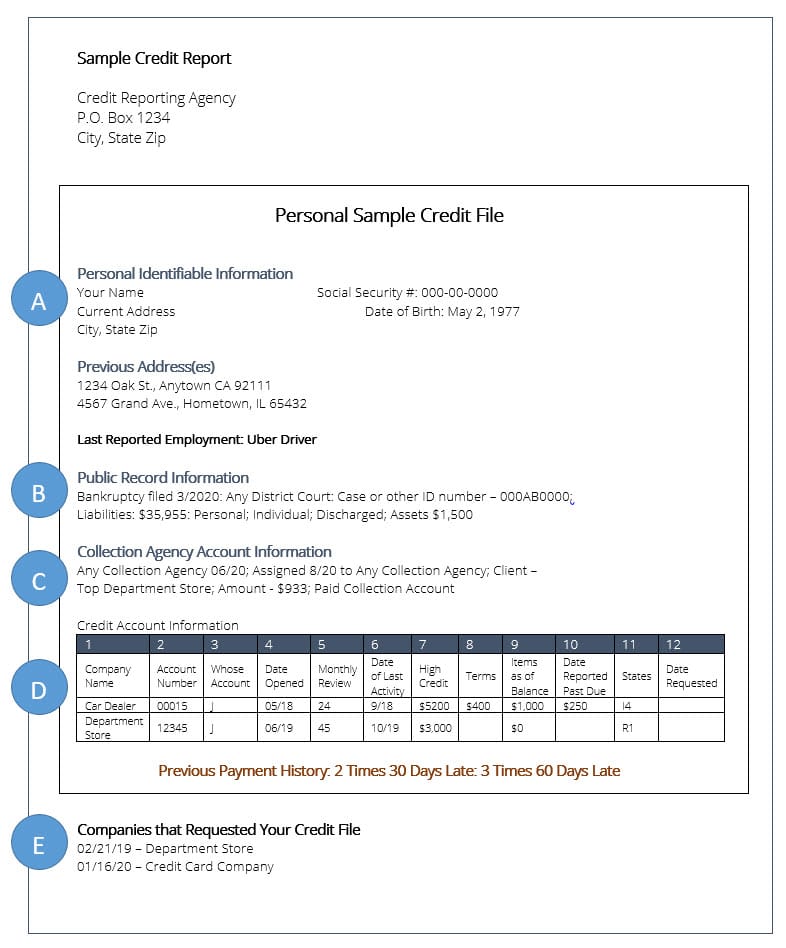

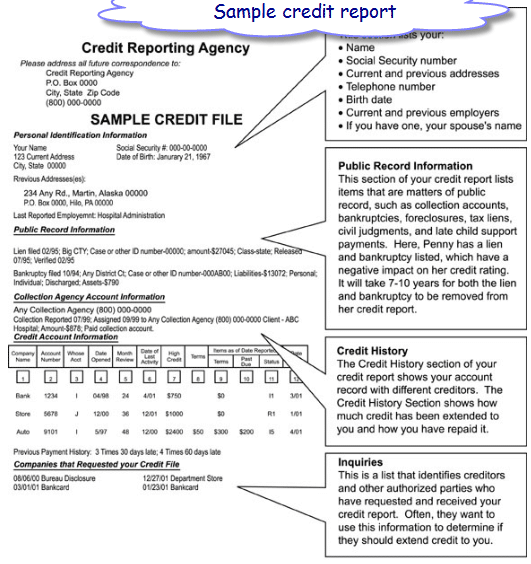

How Your Credit Report Works

Your is primarily a record of your payment history on your various credit accounts. These accounts include , car loans, mortgages, student loans and similar debts. Credit reports also include reports on things like bankruptcies and tax liens, and can even include rent or bill payments.

Essentially, your credit report encompasses everything reported to the consumer credit reporting agencies, from payments made to requests for new credit. The three principal credit reporting agencies are Equifax, Experian and TransUnion.

The information in your credit report is used to come up with your credit score. Without a credit history, theres no credit score. However, your creditors arent required to report your payment history to every credit reporting agency. Thats why a credit score can vary depending on which credit reporting agency provides the score.

Read Also: How To Remove Cancelled Debt From Credit Report