Why Your Credit Score Matters To Lenders

Along with a low debt-to-income ratio and a strong financial history, youll need a high credit score for the lowest mortgage rates. Why?

Youd probably hesitate to lend money to a friend who usually takes forever to pay you back or doesnt pay you back at all. Lenders feel the same way about mortgages. They want to lend to people who have a record of on-time payments to creditors.

Lenders rely on credit scores as an indication that a borrower will meet obligations. A higher credit score, experts say, reassures lenders that they will be paid back.

Your credit score is calculated most often with the FICO scoring model and is derived from the information on your credit reports, which are compiled by credit reporting companies. Your reports include a history of your payment habits with borrowed money.

» MORE:Check your credit score for free

Your credit score is one of the most important parts to qualify, but it is a part, says Michelle Chmelar, vice president of mortgage lending with Guaranteed Rate in New York. You have to have the whole package: income, sufficient assets and credit.

When To Use A Co

If youre not able to qualify for an auto loan on your own, you may need to find a co-signer with better credit.

However, its usually best to not use this option if you can help it because its a big deal to ask someone to co-sign on your loan. Youre basically asking them to repay your auto loan for you if youre not able to do it for whatever reason. If that happens, you could end up burning your relationship, and no one wants that.

But if you have a loved one who trusts you, is in a better financial spot themselves, and is able and willing to help, it can make the difference between you getting a car or not.

Youve Owned The House Long Enough

So how soon after you buy a home can you refinance? It varies by type of refinance loan and lender.

Generally, your name must be on the title of your home for a minimum of 6 months if you have a conventional mortgage, jumbo loan or VA loan and want to do a cash-out refinance. Youll likely need to wait 6 months to a year for a cash-out refinance after you buy a property with an FHA loan.

Recommended Reading: Does Opensky Report To Credit Bureaus

Finding The Right Mortgage

As we said, if your credit score is below your lenders standards, its possible that your first mortgage application wont be approved but, dont give up right away. If everyone with a score under 680 got rejected for mortgages, the population of homeowners in most cities would be sparse, to say the least. That being said, before applying for a mortgage with any lender, its best to improve your credit score as much as you can, since doing so will help you gain access to better interest rates.

Remember, applying for a mortgage is the same as for any other credit product, in the sense that the lender will have to make a hard inquiry on your credit report, causing your score to drop a few points. So, when youre starting to get serious about buying a house, make sure to do some research in advance to find the best lender for your specific financial needs. Loans Canada can help match you with a third-party licenced mortgage specialist that meets your needs, regardless of your credit.

Note: Loans Canada does not arrange, underwrite or broker mortgages. We are a simple referral service.

Rating of 5/5 based on 87 votes.

How Does Refinancing Affect My Credit Score

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Refinancing is a popular way to get a better deal on a loan or credit account, such as a mortgage, personal loan, or auto loan. Although it has benefits, refinancing affects your , usually causing a small, temporary drop. To help you understand the implications of refinancing a loan, here’s a full guide to the question, “How does refinancing affect a credit score?”

Don’t Miss: How To Get A Bankruptcy Off Your Credit Report

Minimize New Accounts And Inquiries

An inquiry is added to your report when you apply for a credit card or loan, which in turn can affect your credit score. Consider only applying for new credit and loans you intend to use. Remember, activity on joint or co-signed accounts will also affect credit scores. For example, if you co-sign for a relative and they default on their payments, your credit score will also be affected.

What Credit Score Do You Need To Buy A House In 2021

Credit scores can be a confusing topic for even the most financially savvy consumers. Most people understand that a good credit score boosts your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

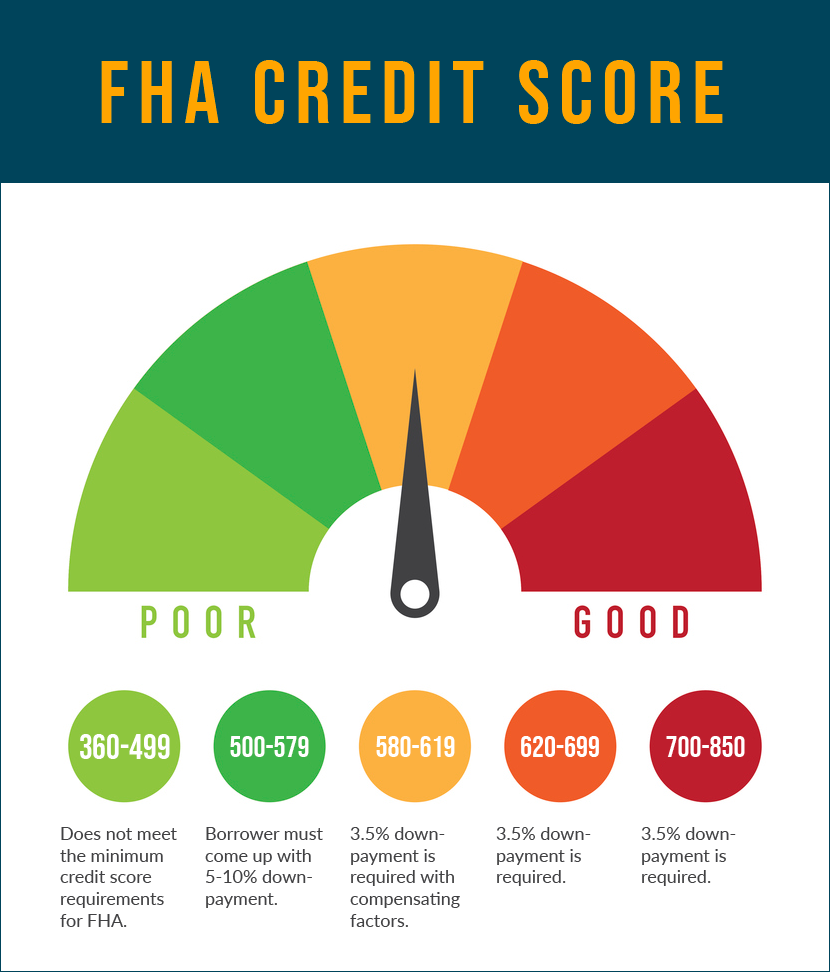

But do you know the minimum credit score you need to qualify for a mortgage and buy a house? And did you know that this minimum will vary depending on what type of mortgage you are seeking?

The Importance Of FICO®: One of the most common scores used by mortgage lenders to determine credit worthiness is the FICO® Score . FICO® Scores help lenders calculate the interest rates and fees youll pay to get your mortgage.

While your FICO® Score plays a big role in the mortgage process, lenders do look at several factors, including your income, property type, assets and debt levels, to determine whether to approve you for a loan. Because of this, there isnt an exact credit score you need to qualify.

However, the following guidelines can help determine if youre on the right track.

You May Like: Does Paypal Credit Report To Credit Bureaus

Your Options For Refinancing A Mortgage With Bad Credit

There are different requirements to qualify for a refinance and a lower interest rate depending on what type of loan you apply for. Many borrowers with bad credit can refinance with programs backed by the federal government or loan programs with more relaxed credit score requirements in your area. For example, South Carolina-based Peoples Bank Mortgage offers a fresh chance portfolio loan that allows you to get mortgage financing if your credit has been negatively impacted in the last two years.

But you also have to meet certain requirements to qualify for program support. For example, a common requirement is there must be a net tangible benefit for you to refinance, such as obtaining a lower rate by at least 0.5% or choosing a shorter term. If you cant meet a programs standards, the loan application will not go through.

Its possible refinancing could leave you better off. Still, you should explore what refinancing options are out there and compare them closely before you decide.

What Are Todays Mortgage Rates

If your partner has low credit scores, it doesnt mean you cant get approved for a mortgage.

Get todays live mortgage rates. Your social security number isnt required to get started, and all quotes come with access to your live mortgage credit scores.

Popular Articles

Resources

You May Like: Experian Boost Paypal

Understand What ‘bad Credit’ Means To Banks

The first step in refinancing your mortgage is to understand what banks are looking for in order to give borrowers the best rates.

The minimum credit score you need to be eligible for the most accessible mortgage programs, such as the Federal Housing Authority loans for first-time homebuyers, is 580 .

But for refinancing, you want a better score than 580, says English.

“There is no desire right now to lend to subprime candidates,” he tells CNBC Select. English defines such candidates as having a score below 580 and at least two missed payments on their credit report especially on an installment loan in the past 12 months.

Those requirements make sense. Refinancing, or refi, loans are meant to give borrowers with positive credit history a chance to leverage their creditworthiness and compel lenders to compete for their business. People normally refinance after they’ve built a good track record and built up equity in their home. When banks see this, they’ll think of you as less of a risk and will be more likely to give you a better loan with good rates.

“When it comes to refinancing, 620 is the minimum number that you really need to have in order to be able to leverage one lender against another,” says English. Hitting this mark opens up more access to loan programs and gives you the chance to shop around. And the real “sweet spot,” says English, is 680 or above.

Learn more: Here’s what credit score is required to buy a house

What Is A Good Credit Score

When you apply for a mortgage, Citi lookswe look at your credit score from the three major credit agencies , and use the middle score for your application. If you are applying with another person, Citiwe will take the lower, middle score of the two. All FICO scores fall somewhere between 300 and 850 . Generally, a score over 700 is considered good, while 620 or lower could make it harder to qualify for certain loans. If your score isn’t the greatest, don’t worry there are plenty of things you can do to improve it.

Also Check: Paypal Credit Soft Pull

Does Refinancing Hurt Your Credit Score

However, the credit hits from applying for and opening a refinance loan are very small often less than five points, according to FICO.

The savings youre likely to see from refinancing should far outweigh any negative impact on your credit. So dont let that be a concern when you apply.

How To Improve Your 709 Credit Score

A FICO® Score of 709 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 709 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

46% of consumers have FICO® Scores lower than 709.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Also Check: Why Is There Aargon Agency On My Credit Report

Should You Refinance Your Mortgage With Bad Credit

Even if you technically could refinance with a credit score in the 600s, whether or not you should is another matter. Someone with worse credit is also going to have a higher interest rate than someone with perfect credit, Goldberg says. If your credit is poor enough, you have to analyze the numbers to see if its worthwhile to proceed.

Figure out what you hope to accomplish by refinancing, whether its a lower monthly payment, changing your loan term, pulling equity from your home, or dropping your PMI . You should weigh the pros and cons of mortgage refinancing and feel certain about your employment situation before moving forward.

What If I Fall Short On Credit Requirements

Potential VA loan borrowers needn’t abandon their dreams of homeownership due to a low credit score. The best feature of credit is its fluidity. Your credit changes constantly.

Improve your fiscal habits, and your credit score will gain positive momentum. But knowing what improvements to make can be tricky. Should you pay off high-interest debt? Should you cancel certain credit cards? How should you handle that bankruptcy looming over your credit report?

If you’re considering a VA loan but need help navigating your credit options, get some free help from the Veterans United credit consultant team.

Our credit consultants work on behalf of service members who fall short of VA loan requirements. Working with a credit consultant is a no-cost process, but not necessarily an easy one. Improving your credit requires commitment and hard work. If you’re ready to make the necessary changes to pursue a VA home loan, partner with a helpful advocate.

Don’t Miss: What Credit Score Does Carmax Use

The Effect Of A Mortgage Refinance On My Credit Score

I worried about the effect of the refinance on my credit score because as Ive mentioned recently, Ive got a SMART goal to grow my real estate empire aggressively over the next five years. I need a good credit score to qualify for loans and be taken seriously by lenders.

So I was perturbed when I saw that my credit score actually dropped by about 35 points after the refinance!

Basically, as soon as the old mortgage was closed, both my Transunion and Equifax estimated scores dropped.

I expected a small drop due to the hard credit inquiry but not the enormous drop that I saw. I obsessively checked my credit score for the next few weeks and Im happy to report that things are back to normal now.

Heres a visual of the effect of the mortgage refinance on my credit score.

And heres how my credit scores looked after they recovered.

Ways To Still Refinance Your Mortgage With A Less Than Perfect Credit Score

Purchasing a home is still one of the main pillars of the American Dream, but for some homeowners, a mortgage can feel more like a heavy anchor. Thankfully, interest rates are riding steady at near historic lows, making it easier and more attractive for homeowners to refinance older and higher-rate mortgages. A refinance can lower your monthly mortgage payments, which is a great option if youre house poorwhen too much of your income goes toward housing costs.

However, the prospect of a refinance is a bit more difficult for homeowners with a less-than-perfect credit score. Being house poor only compounds the problem if youre stuck with a mortgage youre struggling to pay. However, there are ways homeowners with poor credit scores can refinance.

Don’t Miss: Does Paypal Credit Report To Credit Bureaus

Talk To Your Current Lender

You may already have a relationship with your current lender from your original mortgage. So it may be wise to speak to your lender first, explain your situation, and find out your options. Ask your lender what type of loans or programs they offer, particularly for homeowners with bad credit.

If you dont feel good about your options with your current lender, dont be afraid to reach out to other lenders and shop around. Not all lenders offer the same types of loans, and its possible one lender could be a better fit for your situation.

Fha Starts Around 580

The FHA operates a low-paperwork, fast-track refinance program for existing FHA borrowers. Homeowners who qualify for a streamline refinance can replace their FHA mortgage with another FHA mortgage without going through the usual credit checks. In other words, you can qualify for a streamline program with any credit score. Homeowners who aren’t eligible for a streamline must meet the FHA’s minimum credit score of 580. Some FHA lenders will go as low as 500, but with that score, you’re unlikely to qualify for the best rates.

Don’t Miss: How To Get Credit Report Without Social Security Number

Consider A Secured Credit Card

You might not qualify for a loan or traditional credit card. A secured card can allow you to build credit when you need to. You leave a deposit with your lender when you get a secured card. That deposit then becomes your line of credit.

For example, a lender might require a $500 deposit to open a card with a $500 limit. Your lender holds onto your deposit until you decide to close the card.

From there, a secured credit card works just like a normal credit card. You make purchases using your card and pay them off with interest each month. Then, your lender reports your payments to the credit reporting bureaus, which helps you build your score. Your lender keeps your initial deposit if you dont pay your bills.

Secured cards offer a fantastic way to build credit when you might have none, but remember that you must still make your payments on time. Just like an unsecured credit card, missed or late payments will hurt your score.