Best Credit Score On The Scale

Having a credit score of 850 is the final benchmark on a 550-point scale. The following table will give you a sense of just how much such a score distinguishes you from the rest of the consumer population.

| 300-619 | 31% |

Note: The average persons credit score is 669, which falls in the good credit range. Population percentages add up to more than 100, as perfect credit is within the excellent credit range.

What Is The Average Credit Score

Data provided by Experian revealed that the average FICO credit score for Americans was 716 in 20212.

According to Experian, this average FICO score may be a result of credit scoring factors such as fewer late payments or delinquencies on credit cards, shrinking debt , and a decrease in credit utilization.

There are other credit scoring models such as VantageScore, but the majority of lending decisions are made using FICO scores, so this review is focused only on FICO scores.

Hire A Credit Repair Company

You can correct your credit reports yourself, but many consumers hire a credit repair agency to do the work on their behalf.

The credit repair agency will typically lodge a specified number of challenges each month. The goal is to have a bureau and/or lender or merchant validate or remove the disputed data. Below are our top-three recommended credit repair companies:

| $79 | 9.5/10 |

Credit repair companies work on a monthly subscription basis, usually for about six months, although you can cancel at any time. Weve found that the agencies we evaluate charge reasonable fees for the work they do.

Recommended Reading: What Have You Heard About Building Your Credit Score

What Does A Credit Score Of 800 Mean

Youre still well above the average consumer if you have an 800 credit score. The average credit score is 704 points. If you have a credit score of 800, it means that youve spent a lot of time building your score and managing your payments well. Most lenders consider an 800 score to be in the exceptional range.

If you have a score of 800 points, you should be proud of yourself. You wont have any trouble finding a mortgage loan or opening a new credit card with a score that high. Here are some things your 800 FICO® Score says about you:

An 800 credit score isnt just good for bragging rights. Some of the benefits youll enjoy when you have a higher score include:

Does Income Play A Role In Having A Perfect Fico Score

Income is not a factor in determining your FICO® Score. While access to some credit products can be restricted by your income and financial situation, when it comes to achieving a perfect credit score, income is not a barrier.

In fact, in the fourth quarter of 2018, a little over 38% of perfect FICO® Scores were held by people with an estimated average annual income of $75K or less, according to Experian data.

Obviously, having more money can help you pay your bills, but building a healthy credit score really comes down to the basics of paying your bills on time every month and maintaining low , or the amount of debt you carry compared with total credit available.

Recommended Reading: How Is Your Credit Score Determined

Limit Your Hard Credit Inquiries

When you apply for credit of any kind, it generates a hard credit inquiry. Since applying for new credit can be an early sign that someone is dealing with financial troubles, hard inquires will have a slight negative effect on your scores temporarily.

If you want to get a really high score, youll want to limit your hard inquiries meaning you should only apply for new credit when necessary.

In The News: Experian Launches Go A Tool To Build Your Own Credit Report

If youve boosted your credit score to the fair-credit range, youve come a long way. Your efforts have opened the door to more opportunities, making it easier for you to borrow money if you ever need to. Not everyone is as fortunate.

A lot of people still struggle to get their credit score as far as you have. In fact, 28 million have no credit score or credit report and are credit invisible. And because of this, they struggle to gain access to valuable financial resources. This makes it easier for them to fall prey to predatory lending options like payday loans.

If you know anyone who is credit invisible, let them know they have resources available to them. This includes a new tool by Experian that helps people who are credit invisible establish credit records. Instead of relying on lenders to provide the data that determines a credit score, Experians Go program lets users create an Experian credit report using recurring bills that are not usually reported to credit bureaus. John Egan has the details on Experians new DIY credit report tool.

Recommended Reading: How To Raise Credit Score Quickly

Why Does Your Credit Score Matter When Applying For A Personal Loan

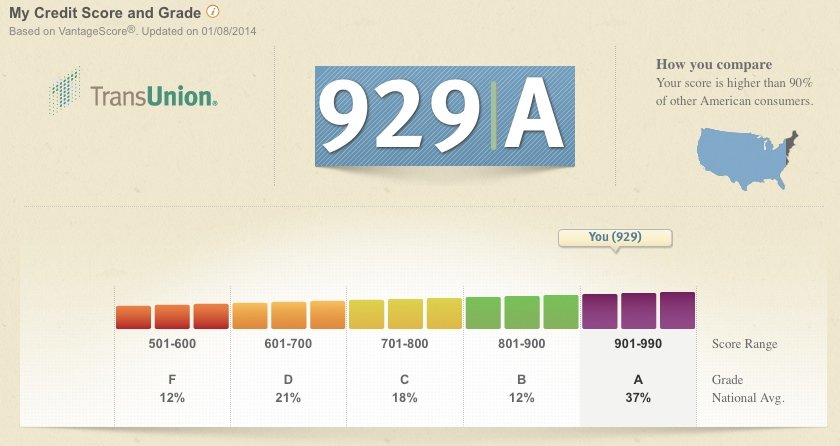

You’ll need a few things before you apply for a personal loan, but the first thing you should do is take a look at your and review your credit reports. Equifax, Experian and TransUnion, the three main credit bureaus, each report a different score based off of different scoring models.

Your are important because they provide lenders with clues to determine whether they think you’ll be a responsible borrower who will pay back the loan on time and in full.

“Lenders want to ask themselves, ‘if I lend you money, will you pay me back?'” said Jim Droske, the president of Illinois Credit Services.

Plus, the better your credit, the more likely you are to get favorable terms like lower interest rates on your loan. You can use a number of services to check your Equifax and TransUnion scores, which use the VantageScore model, or use Experian to check your score based on the FICO 8 model. Note, the FICO 8 model gets used in about 90% of lending decisions in the U.S.

What Credit Score Do You Need To Buy A House

Your credit score is a very important consideration when youre buying a house, because it shows your history of how youve handled debt. And having a good credit score to buy a house makes the entire process easier and more affordable the higher your credit score, the lower mortgage interest rate youll qualify for.

Lets dive in and look at the credit score youll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit.

Don’t Miss: How To Check My Credit Score Bank Of America

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Chase Freedom Student Credit Card: Best For No Credit History

Why we picked it: Chases first credit card for college students rewards responsible spending: For the first five years, cardholders receive a $20 bonus after each account anniversary year if their account is in good standing . Plus, theres no annual fee.

Pros: The Chase Freedom Student credit card lets students earn rewards: 1% cash back on every purchase. Plus, theres a sign-up bonus: Cardholders earn $50 after making their first purchase with the card in the first three months. They also receive 5% total cash back on Lyft rides through March 31, 2025 and a complimentary three-month subscription to DashPass, DoorDashs subscription service that provides free deliveries on eligible orders over $12. You must activate this benefit by Dec. 31, 2024, and after three months, youll be automatically enrolled in DashPass at 50% off for the next nine months.

Cons: Depending on their spending habits, students could arguably earn more over time with other cards in this category. For instance, the Journey Student Rewards from Capital One offers 1% cash back on general purchases but also lets cardholders earn a 25% bonus when they pay on time . Learn more about the best student credit cards.

Who should apply? This cards great credit-building tools and college-friendly rewards opportunities make it an ideal starter card for students.

Read our Chase Freedom® Student credit card review.

Don’t Miss: What Does Debt Consolidation Do To Your Credit Score

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

Make Your Payments On Time

Missed payments definitely arent a huge problem for you if you have an 800 credit score. However, the best way to continue working toward that perfect 850 score is to stay on top of all your payments. A single missed or late payment can seriously throw off your score.

If you add a new credit card or loan to your account, make sure that you write down your payment due date. You can also enable autopay, which deducts your minimum payment from your bank account on the day its due.

Also Check: How Long Does Information Stay On Credit Report

Mission Lane Cash Back Visa Credit Card: Best For Building Credit + Earning Rewards

Why we picked it: The Mission Lane Cash Back Visa is an unsecured card, meaning no deposit required. Its also an instant approval credit card. So youll know right away whether you qualify with no impact on your credit score.

Pros: You can earn unlimited cash back rewards on all purchases. And as soon as you make your first six payments on time and youre in good standing, youll be eligible for a higher credit limit.

Cons: Your starting credit limit may only be $300. And if you dont pay off your balance each month, youll get stuck paying a high variable interest rate of 26.99% to 29.99%.

Who should apply? Anyone looking to earn rewards while working to improve their credit score should consider this card, especially if they dont want to tie up funds in a secured credit card.

Who should skip? This isnt the card for you if you tend to carry a balance from month to month. If thats the case, youll be better off with a credit card with a lower APR.

Determining A Qualifying Credit Score

Before we get into the credit score you need to qualify, you might be wondering how lenders determine your credit score. After all, your FICO® Score is reported by three different bureaus.

If you’re applying for a loan on your own, lenders get your from each of the three major credit rating agencies and use the middle or median score to qualify you.

If there are two or more borrowers on a loan, the lowest median score among all clients on the mortgage is generally considered the qualifying score. The exception to this is a conventional mortgage with multiple clients being backed by Fannie Mae. In that case, they average the median scores of the borrowers on the loan.

If you have a median score of 580 and your co-borrower has a 720 credit score, the average credit score would be 650. Because the minimum qualifying score for conventional loans is 620, this can mean the difference between qualifying for a mortgage and not.

One thing you should know is that for the purposes of your rate and mortgage insurance, the lowest median score is the one that gets reported, so your rate might be slightly higher. There are also certain situations in which Fannie Mae still uses the lowest middle score for qualification. We recommend speaking with a Home Loan Expert.

Also Check: How Long Can A Creditor Report On Your Credit Report

Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

What Credit Score Is Needed To Buy A House

Ah, the dreaded . Its one of the biggest criteria considered by lenders in the mortgage application process three tiny little digits that can mean the difference between yes and no, between moving into the house of your dreams and finding yet another overpriced rental. But despite its massive importance, in many ways the credit score remains mysterious. If you dont know your number, the uncertainty can hang over you like a dark cloud. Even if you do know it, the implications can still be unclear.

Is my score good enough to get me a loan? Whats the best credit score to buy a house? What’s the average credit score needed to buy a house? Whats the minimum credit score to buy a house? Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated than that? These are all common questions, but for the most part they remain unanswered. Until now.

Today, the mysteries of the credit score will be revealed.

You May Like: How Does A Credit Rating Relate To Shopping For Insurance

What Credit Score Do You Need For Approval

For the most part, the minimum credit score needed for a personal loan approval will depend on the lender. Some lenders will tell you upfront what their minimum requirements are. Payoff Personal Loan, for example, requires a FICO score of 640 or higher for approval.

While lenders might approve loans to consumers with a wide range of scores, the terms will likely be better for those with higher scores.

“If you have a 760 credit score, they’ll give you different terms versus if you have a 580 credit score,” Droske says. “If you have a 580 credit score, a lender may still give you a loan, but they’ll adjust the terms accordingly because you’ll be seen as a riskier borrower.”

Having a higher credit score usually means you can be approved for lower interest rates and more favorable loan terms.

But while your credit score is an important piece of the puzzle, keep in mind that you’ll also need to provide some other crucial pieces of information like your annual income, employment status, social security number and details on how you’d like to use the loan.

“Before you have a bunch of different lenders run your credit, ask if they have a credit score requirement and what it is,” Droske says. “You can also ask what scoring model they use so you can see for yourself if your credit score currently falls in their required range.”

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Read Also: Can You Get Student Loans Off Your Credit Report

Who Should Get A Credit Card For Fair Credit

- The credit builder. If youre someone with average credit who could benefit from improving your score, a card for fair credit can be a great choice. With options that let you prequalify and features that are designed to help boost your credit, you may avoid things like hard inquiries and take advantage of built-in assistance like regular reporting to the major credit bureaus.

- The simple rewards earner. Many cards for fair credit come with easy-to-understand rewards structures, featuring strong cash back across all categories and other worthwhile incentives. Some choices here may require a little extra legwork, but you can even find cash back rates as high as 5% to 10% on select purchases with the right credit card for average credit.

- The credit newcomer. Someone brand new to credit cards, students looking to get started and other credit rookies can be a good fit for cards for fair credit. Many of the choices here will give you a good idea of whether youll be approved ahead of time and have perks specifically designed to help students and other new users get acclimated to their card.