How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

What Are Some Common Warning Signs Of Identity Theft Or Fraud

- Bills that do not arrive as expected

- Unexpected credit cards or account statements

- Denials of credit that you did not apply for

- Charges on your financial statements that you don’t recognize

- Incorrect information on your credit reports – accounts or addresses you don’t recognize or information that is inaccurate

The Federal Trade Commission’s website has additional information regarding the warning signs of identity theft, the Consumer Financial Protection Bureau’s website also provides information on common identity theft warning signs.

Do I Have To Pay For My Credit Report

It depends. There are many free credit report resources available, but there are several that also charge fees. With so many free resources available, there really isn’t any need to pay for your credit report. Just make sure you access your credit report through a verified site, such as those listed in this guide and sites that start with “https.”

Also Check: How Long Does Information Stay On Your Credit Report Uk

What Is A Credit Score

A credit score is a number. It is based on your credit history. But it does not come with your free credit report unless you pay for it.

A high credit score means you have good credit. A low credit score means you have bad credit. Different companies have different scores. Low scores are around 300. High scores are around 700-850.

How Do I Run A Credit Check Without Hurting My Credit

Some places may charge you to check or monitor your credit. But you donât have to pay to use . You can use it to access your TransUnion credit report and weekly VantageScore 3.0 credit score for free anytimeâwithout negatively impacting your score.

You can even see the potential impacts of financial decisions on your credit score before you make them, with the CreditWise Simulator.

Recommended Reading: How Long Does Stuff Stay On Your Credit Report

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

You May Like: How To Check Experian Credit Score

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Consumer Financial Protection Bureau

For additional protection, consumers can opt out of unsolicited inquiries. An inquiry means that someone looked at your credit report. This could be a creditor you have asked for a loan, or an unsolicited offer of credit such as those you may receive in the mail for credit cards. This is known as prescreening. Creditors may view numerous inquiries as negative since they could mean that you are overextending yourself. If you do not want to receive unsolicited credit offers based on your credit report, contact the credit bureaus individually or call the Opt Out line at 1-888-567-8688 to remove your name from the three major credit bureaus with one call.

Recommended Reading: When Do Credit Cards Report To Credit Bureaus

How To Get Your Free Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Steps

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until the end of the year, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report Is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Read Also: How To Get Credit Score Report

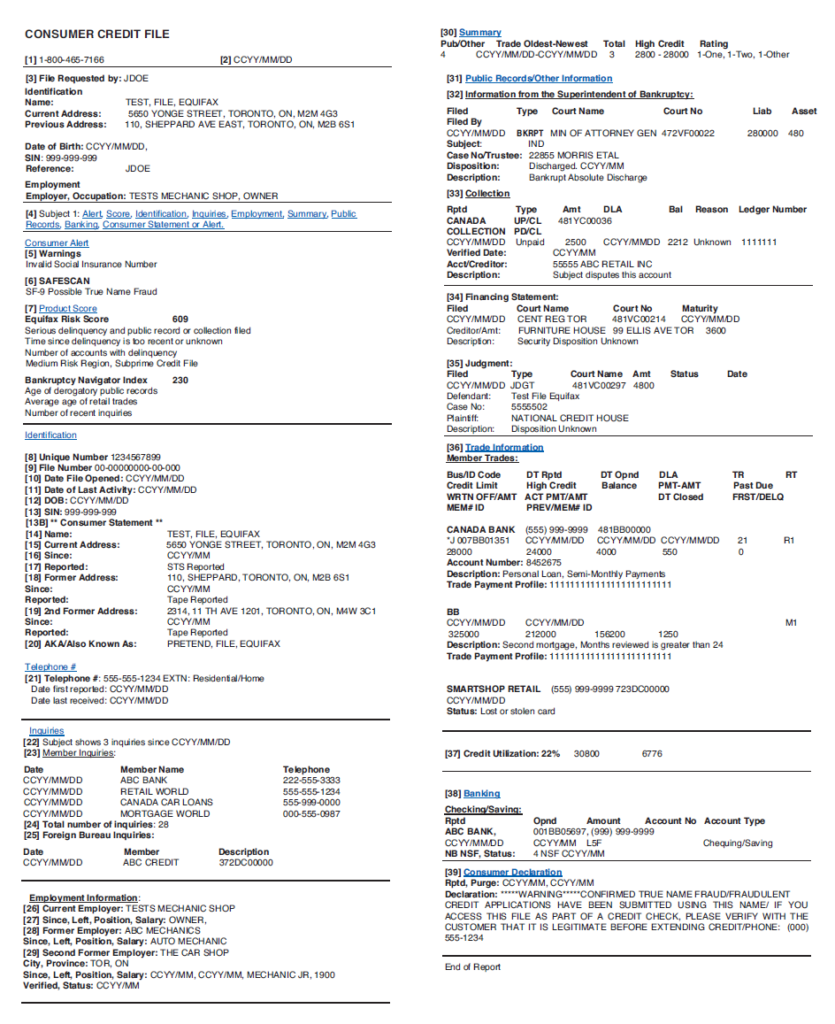

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Obtain Your Credit Report

OBTAIN YOUR CREDIT REPORT

The Fair Credit Reporting Act requires each of the nationwide credit reporting companies Equifax, Experian, and Transunion to provide you with a free copy of your credit report, at your request, once every 12 months. The three nationwide credit reporting companies have set up a central website, a toll-free telephone number, and a mailing address through which you can order your free annual report.

To order your report, you can:1. Visit annualcreditreport.com, or2. Call 1-877-322-8228, or3. Complete the Annual Credit Report Request Form and mail it to: Annual Credit Report Request Service, P. O. Box 105281, Atlanta, GA 30348-5281.

The information above is provided in summary. For complete details, please refer to the Federal Trade Commissions consumer information on Free Credit Reports.

A Warning About Imposter WebsitesOnly one website is authorized to fill orders for the free annual credit report you are entitled to under the law annualcreditreport.com. Other websites that claim to offer free credit reports or free credit monitoring are not part of the legally-mandated, free annual credit report program.

Also Check: Why Would An Employer Be Added To Your Credit Report

Get Your Credit Score

Your credit score comes from the information in your credit report. It shows how risky it would be for a lender to lend you money.

Learn more about how your credit score is calculated.

You can access your credit score online from Canadas 2 main credit bureaus.

Your credit score from Equifax is accessible online for free and is updated monthly. If you live in Quebec, you can also access your credit score from TransUnion online for free.

Other companies may also offer to provide your credit score for free. Some may ask you to sign up for a paid service to get your score.

Checking Your Credit Report

Experts recommend that consumers request a credit report at least once a year from each of the three major bureaus to check for inaccurate information and evidence of identity theft. If you stagger your requests , you are pulling a credit report more frequently to check for errors and evidence of identity theft. People with negative information in their credit file also want to check that it has been removed after 7 years from the delinquency date or 10 years after bankruptcy. It is also a good idea to check your credit report before applying for a substantial loan, like purchasing a house or car, so you are not delayed if it contains incorrect information.

Below are some common errors to look for in a credit report:

- Accounts that are not yours. Perhaps they belong to a family member living at your address or even to a stranger with the same name. Unrecognized accounts could also provide evidence of identity theft

- Incorrect information such as late payments when bills were paid on time or multiple collection agency notations for a single debt and

- Negative information remaining after the seven-year drop-off period.

Some errors you might find on your credit report include:

|

Also Check: How Do You Raise Your Credit Score

How Often Should I Check My Credit Report

Its generally recommended that you check your credit reports a minimum of one time a year, but you can check them as often as you like. Before you apply for credit, it can be a good idea to review your reports for errors to increase your chances of securing more favorable terms, such as lower interest rates.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Read Also: How To Increase Credit Score With Credit Card

Reasons You May Not Have A Medical History Report

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

How Do I Order My Free Annual Credit Reports

The three nationwide credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three nationwide credit bureaus individually. These are the only ways to order your free credit reports:

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service P.O. Box 105281 Atlanta, GA 30348-5281

You May Like: When Does An Account Come Off Credit Report

What Is Identity Theft

Identity theft is when someone uses your personal information without your permission. They may open a credit card account, get a loan, or rent apartments in your name using your personal information. They also might access your bank or retirement accounts. You may not know that identity theft has happened until you see your credit report, are notified when trying to apply for credit, or get called by a debt collector.

For more information about identity theft, visit the Federal Trade Commission’s website or the Consumer Financial Protection Bureau’s website.

Have Your Personal Information Ready

In order to request a credit report, you will have to provide several pieces of personal information, specifically your full name, date of birth, mailing address, Social Security number , and your previous mailing address. Additional information may be required to process your request, in which case the consumer credit reporting company you requested your credit report from will contact you by mail. As this information is used to identify you for the request process, omission of any information when filing by mail may delay your request.

Although most of this information should be known to you, some details may be harder to recall. While you can simply pause when filling out a mailing request form or an online application, failing to have all of this information on hand while making a request by phone could result in a slower application process or having to start over at a later time.

When requesting your credit report online, you will be asked several security questions about your finances that only you should be capable of answering . As these questions will vary from person to person, it can be difficult to adequately prepare for them. Note that, should you request your credit report by mail or phone, you may not be required to answer any security questions.

You May Like: What Is 11 Sprint On My Credit Report

As A Victim Of Fraud Or Identity Theft You Have The Right To:

- Request the credit reporting company to block information from your credit report that was the result of identity theft. You must provide an identity theft report from a law enforcement agency to request a block

- Dispute information you believe is incorrect

- Request a fraud alert be placed on your credit report

What Do Lenders See On Your Credit Report

What you see on your credit reports may be slightly different from the things lenders who are reviewing your credit might see. But generally, if a lender is reviewing your credit, they might see your:

- Personal information, such as your name, current address and previous addresses.

- Credit and loan accounts, including information about your payment history.

- Employment history.

Recommended Reading: Is 676 A Good Credit Score

What Is Fraud Alert

A fraud alert is used to inform creditors that you may be a victim of fraud. A fraud alert can make it harder for an identity thief to open accounts in your name. The fraud alert requires creditors to verify that you are the person adding new credit accounts or changing limits on existing credit accounts by contacting you at a phone number you have provided.

There are three types of alerts you can place on your file:

- Initial fraud alert – if you suspect that you have become or are about to become a victim of fraud or identity theft

- Extended fraud alert – if you are a victim of fraud or identity theft requires a copy of the identity theft report

- Active duty military alert – if you are in the military and want to minimize your risk of fraud or identity theft while you are deployed .

Contact any one of the credit reporting companies to place a fraud alert. They will share your request with the other credit reporting companies.

How We Chose The Best Free Credit Reports

We evaluated and selected the best free credit reports based on a few factors, including the number of credit reports you can access, the frequency of updates, the ease of understanding the information, the ease of signing up for a new account, and whether a free credit score or analysis was also included. We excluded any companies that required credit card information to sign up or that only offered a free credit report on a trial basis.

Recommended Reading: What Affects Credit Score Negatively