Q: Can You Improve Your Score

A: If youve made mistakes, get back on track as soon as possible, says Careen Foster, director of scoring product management at FICO. The longer you wait, the longer it takes to improve your scores. In todays brave new world of tighter credit standards, you need at least a 700 to qualify for a card you once could have gotten with a 600, says Adam Jusko. Improving your score can even save you hundreds.

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

Student Loan Balances Saw Highest Increase

- 14% of U.S. adults have a student loan.

- The average FICO® Score for someone with a student loan balance in 2020 was 689.

- The percentage of consumers student loan accounts 30 or more DPD decreased by 93% in 2020.

Student loan balances saw the most significant spike in 2020, with consumers average debt growing by 9%. Much of this is attributable to the suspension of federal student loan repayment that was included in the CARES Act and subsequently extended through January 31, 2021. With fewer people actively paying down student debt, average balances will grow as others add new loans.

Student loans saw delinquency rates plunge, with the percentage of accounts 30 or more DPD decreasing by 93% in 2020. Its important to view this number in context, however, as the automatic accommodations put in place obviously played a major role in the drop.

The CARES Act paused all federal student loan repayment, effectively placing these accounts in limbo. While paused, student loan accounts are being reported as current, although no payments are required. Once repayment begins, delinquencies may begin to climb again.

Read Also: Does Debt Consolidation Show Up On Credit Report

Does Your Fico Score Matter

If youre applying for a credit card, yes. Getting a car loan? Sure, youll want a credit score.

But hold on to your seats. Were about to make a really bold statement: You dont need a credit score.

Cue the shock, the awe and the horror! People who need a credit score are people who plan to take on more debt. Thats not what we want for you. The goal here is to become completely debt-free, and debt-free people dont need a credit score. Why? Because they arent taking on more debt!

Around here, we like to say a credit score is just an I love debt score. Think about it. A credit score doesnt reflect your salary increases, the amount of money in your savings account, or how well you budget each month. If you inherited a million dollars tomorrow, your credit score wouldnt change one single point.

In other words, a credit score has nothing to do with how well you handle your money. Your credit score rates how much you juggle debt . . . which would be great if debt was a bunch of soft, squishy juggling balls. But when it comes to your financial future, those juggling balls are actually flaming chainsaws that could cause a ton of damage if you ever dropped one!

But waitdont you need a credit score to buy a house?

Nope.

Despite what your real estate agent might say, you can buy a home without having a credit score. There are other ways to prove you pay your bills that dont require you to have debt or a credit score at all.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Also Check: How To Repair Your Credit Report Yourself

What Credit Scores Do I Need To Get Approved For A Credit Card

Theres no universal minimum credit score needed to get approved for a credit card. Credit card issuers have different score requirements for their credit cards, and they often consider factors beyond your credit scores when deciding to approve you for a card.

In general, if you have higher scores, youre more likely to qualify for most credit cards. But if your credit is fair or poor, your options will be more limited and you may receive a lower credit limit and higher interest rate.

Check Your Credit Score For Free

FICO® and VantageScore create the most widely used credit scoring models in the U.S., and each company creates multiple scoring models. Fortunately, consumer credit scores tend to move together, as they’re using the same underlying information to try and predict similar outcomes.

If you have a good credit score generated by FICO® and based on your Experian credit report, you’re unlikely to then have a bad score generated by another scoring model based on a credit report from one of the other bureaus. With Experian, you can check your FICO® Score 8 for free, track it over time and get a breakdown of the factors that are most impacting your score.

Recommended Reading: When Does Capital One Report To Credit Bureaus

Factors That Affect Your Credit Scores

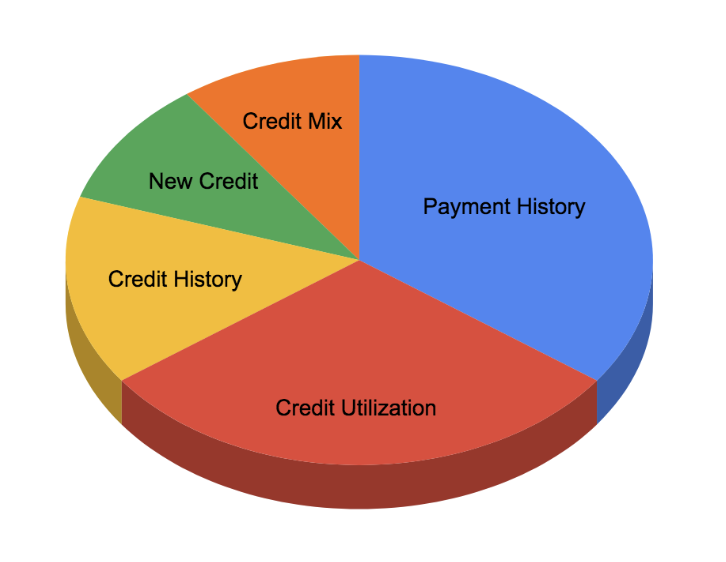

The individual components vary based on the credit-scoring model used. But in general, your credit scores depend on these factors.

Most important: Payment historyFor both the FICO and VantageScore 3.0 scoring models, a history of on-time payments is the most influential factor in determining your credit scores. Your payment history helps a lender or creditor assess how likely you are to pay back a loan.

Very important: Credit usage or utilizationYour is calculated by dividing your total credit card balances by your total credit card limits. A higher credit utilization rate can signal to a lender that you have too much debt and may not be able to pay back your new loan or credit card balance.

The Consumer Financial Protection Bureau recommends keeping your credit utilization ratio below 30%. This may not always be possible based on your overall credit profile and your short-term goals, but its a good benchmark to keep in mind.

Somewhat important: Length of credit historyA longer credit history can help increase your credit scores by showing that you have more experience using credit. Your history includes the length of time your credit accounts have been open and when they were last used. If you can, avoid closing older accounts, which can shorten your credit history.

How To Improve Your Score

Making timely payments in full is key in establishing, or improving, a good score. And since details about your payment history, including late or missed payments, are considered public record and can stay on your credit report for years, you should aim to pay as much of their monthly balance as you can, on time, every time.

The snowball method, in which you pay off the smallest of your debts first, then move on to the next largest, is a popular way to do that. Redd Horrorcks, a self-employed voice actress, using this method, paid $39,000 in credit card debt in five years.

Aside from paying in full and on time, look to reduce your credit utilization rate, too, which is the ratio of how much you’ve spent on your credit card versus the card’s limit. “The smaller that percentage is,”according to Bankrate, “the better it is for your credit rating.”

“Even if you pay balances in full every month, you still could have a higher utilization ratio than you’d expect. That’s because some issuers use the balance on your statement as the one reported to the bureau.” The ideal utilization rate is less than 30 percent of your available credit.

Then, he says, choose one or two go-to cards for most of your purchases: “That way, you’re not polluting your credit report with a lot of balances.”

Don’t Miss: Does Free Credit Report Hurt Your Score

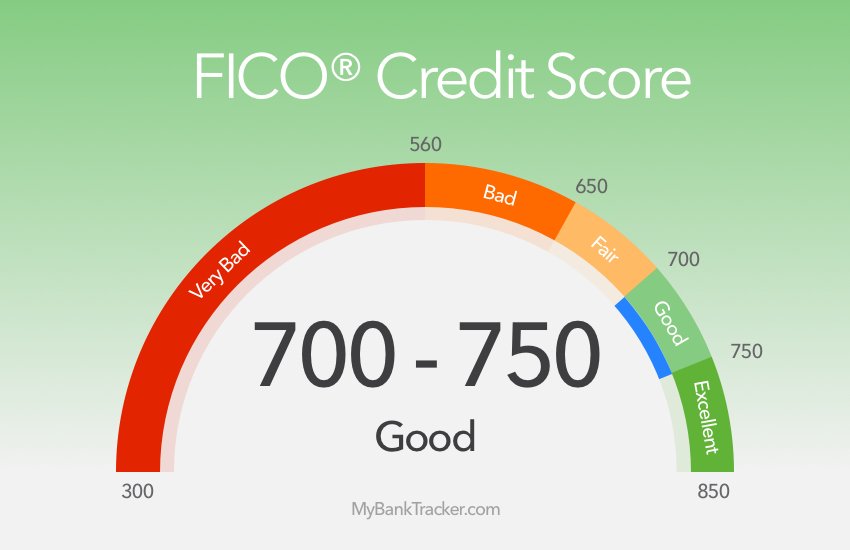

What Do My Credit Score Numbers Mean

550? 725? 680? What does your credit score mean? In this chart, we take a look at what goes into having excellent, very good, good, fair, bad and very bad credit.

See what your credit score tells lenders and where you can improve. This useful guide to credit scores, compiled by Credit.coms Credit Experts, is based on the most common credit scoring range used by FICO.

Of course these are generalizations with almost as many exceptions as rules, but it provides a useful guide for any consumer.

If youre trying to build or maintain your credit, it helps to monitor it regularly, along with your credit reports, to check your progress and look for areas you need to work on. You can obtain your credit reports for free from each of the three major credit reporting agencies once a year through AnnualCreditReport.com. And you can get your credit score for free once a month using Credit.coms free Credit Report Card.

|

Quality |

Also Check: Will A Sim Only Contract Improve Credit Rating

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lenders decision to offer you credit. For example, people with credit scores below 640 are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or higher is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO Score range is often used.

- Excellent: 800850

- Fair: 580669

- Poor: 300579

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit that you take out.

A persons credit score also may determine the size of an initial deposit required to obtain a smartphone, cable service, or utilities, or to rent an apartment. And lenders frequently review borrowers scores, especially when deciding whether to change an interest rate or on a credit card.

What Is A Credit Score?

Read Also: How To Remove Santander From Credit Report

What Is A Fico Score

11 Min Read | Jun 21, 2022

Youve been playing the game for years now. Youve had it for so long, its almost like a buddy. You live and breathe those three life-altering digits.

Thats rightwere talking about your credit score. And its time to start thinking about it in a whole new light.

But what is a FICO score anyway? What is this thing youve allowed to rule your life? And when did everyone start using it as the ultimate measure of how successful you are? Its time to break down everything you need to know about the FICO scoreand why you dont really need one.

How Your Credit Score Is Calculated

Learn what your credit score is based on and the many ways you can improve it.

Your credit score is one of the most important measures of your creditworthiness. For your FICO® Score, it’s a three digit number usually ranging between 300 to 850 and is based on metrics developed by Fair Isaac Corporation. The higher your score is, the less risky you are to lenders. By understanding what impacts your credit score, you can take steps to improve it.

You May Like: What Credit Score Does Synchrony Bank Require

Better Score Cheaper Car

A buyer puts $3,000 down on a $25,605 2009 Honda Accord EX-L sedan and finances the rest over 60 months. Heres his true bottom line.

Score Rate Payment Cost 690719 7.88 $457.05 $30,423660689 9.86 $478.73 $31,724620659 12.79 $511.91 $33,715590619 17.64 $569.60 $37,176500589 18.43 $579.32 $37,759

Less than 500: It will be tough to get a loan at all.

Understanding Credit Score Factors And Improving Your Credit Scores

The elements from your credit report that shape your credit scores are called credit score factors. Some factors that may affect credit scores are:

- Your total debt

- Number of late payments

- Age of accounts

Factors indicate what elements of your credit history most affected the credit score at the time it was calculated. They also tell you what you must address in your credit history to become more creditworthy over time. Monitoring your credit on a regular basis can help you keep a close eye on how these factors are affecting your score and what you may be able to do to improve your score.

You May Like: What Credit Report Does Paypal Pull

Also Check: How To Dispute Items On Credit Report

What Does A Credit Score Mean

A credit score is a number which can range from a low near 300 to a high of 850 or 900 .

If someones score is 580, it means that 580 people out of 850 are likely to repay their debt. If someones score is 780, it means that 780 people out of 850 are likely to repay their debt.

The number represents the odds that a lender will get the money back that they lend someone. The higher the number, the better the odds.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Recommended Reading: What Is Cbna On Credit Report

What Does Your Credit Score Measure

A credit score number measures the likelihood that a borrower will be severely past due on at least one account in the next 18 months. Both the popular FICO and Vantage risk models share this objective.

The modeling equations use historical data found on your consumer report to predict future payment behavior. Lenders base underwriting decisions on these forecasts.

| 1% |

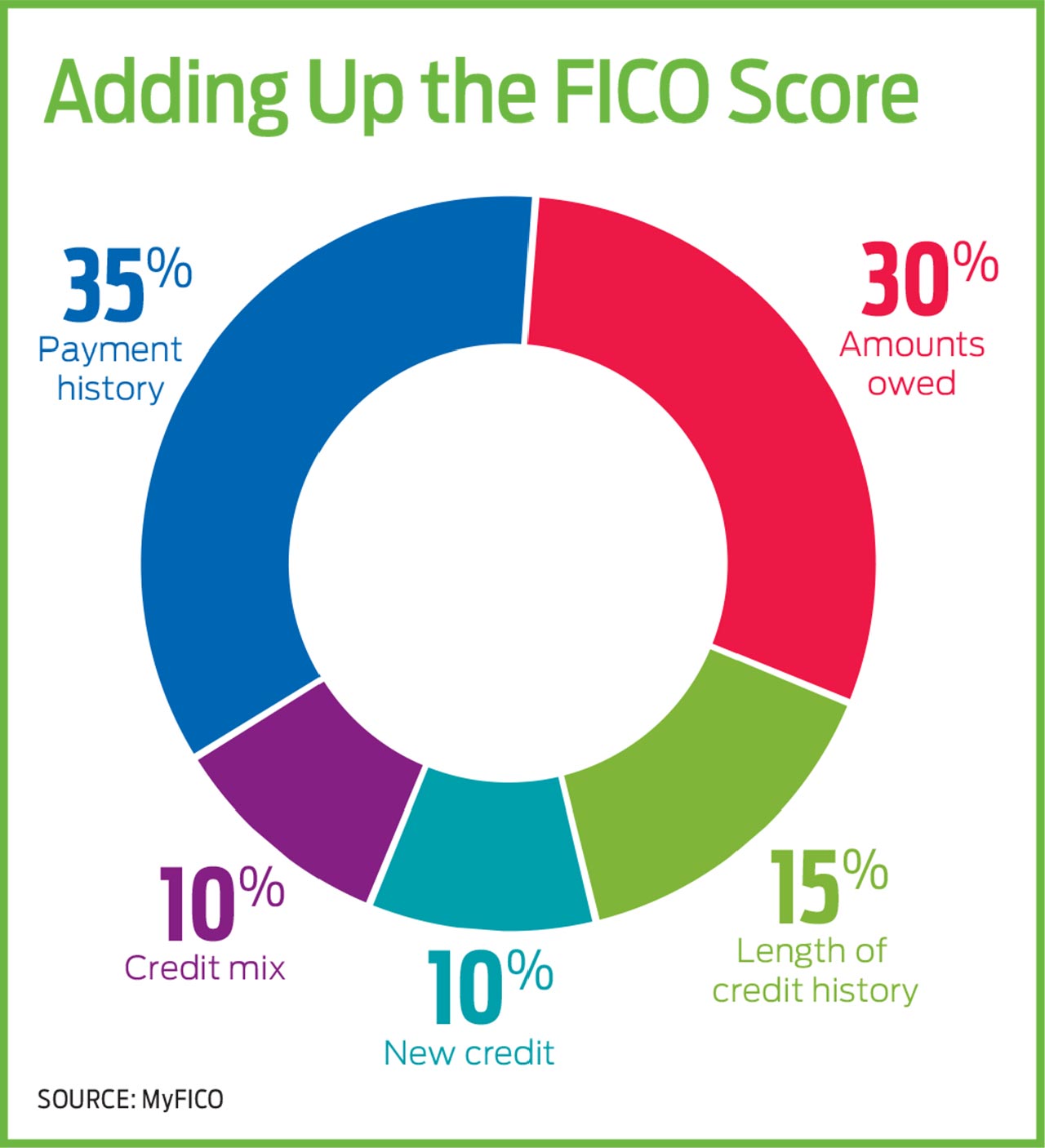

Whats In My Fico Scores

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwell cover that in the next section.

You May Like: Is 584 A Good Credit Score

Recommended Reading: How To Dispute A Judgment On Credit Report

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

You May Like: How Long Does It Take To Fix Credit Score

How Credit Scoring Works

Many creditors use the popular FICO scoring system, which combines financial data collected from major credit bureaus Equifax, Experian and TransUnion. Those credit bureaus also have their own scoring system, VantageScore, which bases ratings on internal financial data.

Your credit score is tied directly to the financial decisions you make, such as paying your loans or on time.