Dispute Credit Report Errors

Under the Fair Credit Reporting Act, you have the right to an accurate credit report. This right allows you to dispute credit report errors by writing to the relevant credit bureau, which must investigate the dispute within 30 days.

Errors, which can stem from data entry snafus by creditors, easily interchangeable Social Security numbers, birthdays, or addresses, or identity theft, can all hurt your credit score.

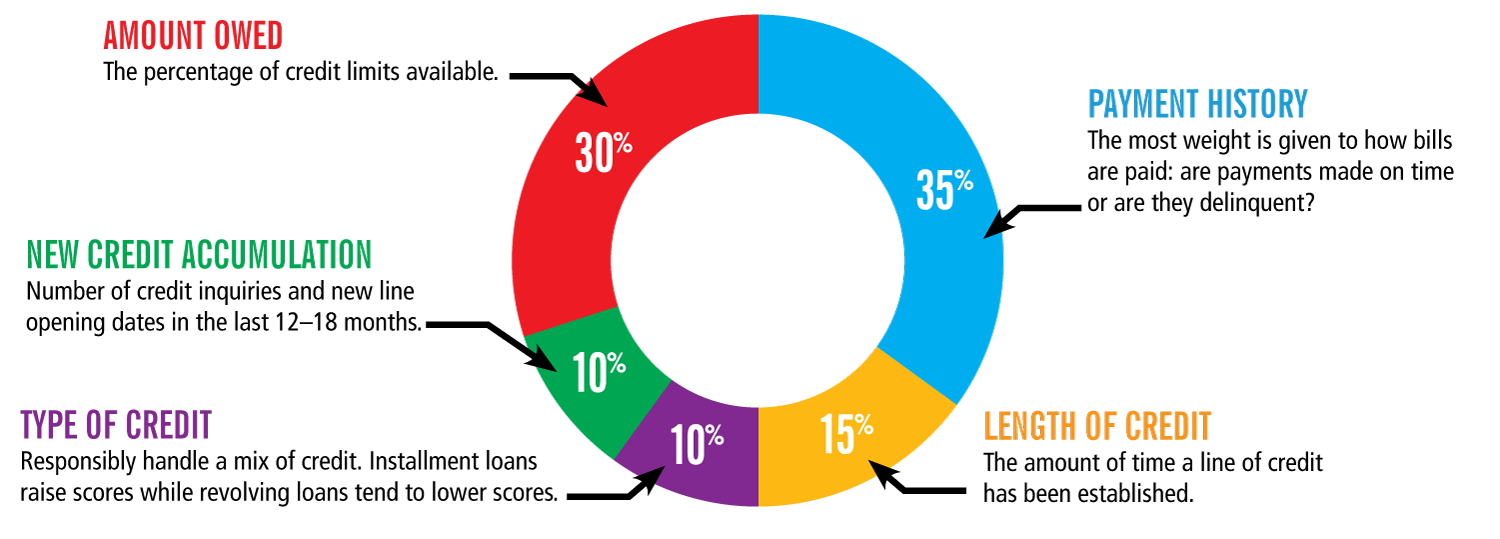

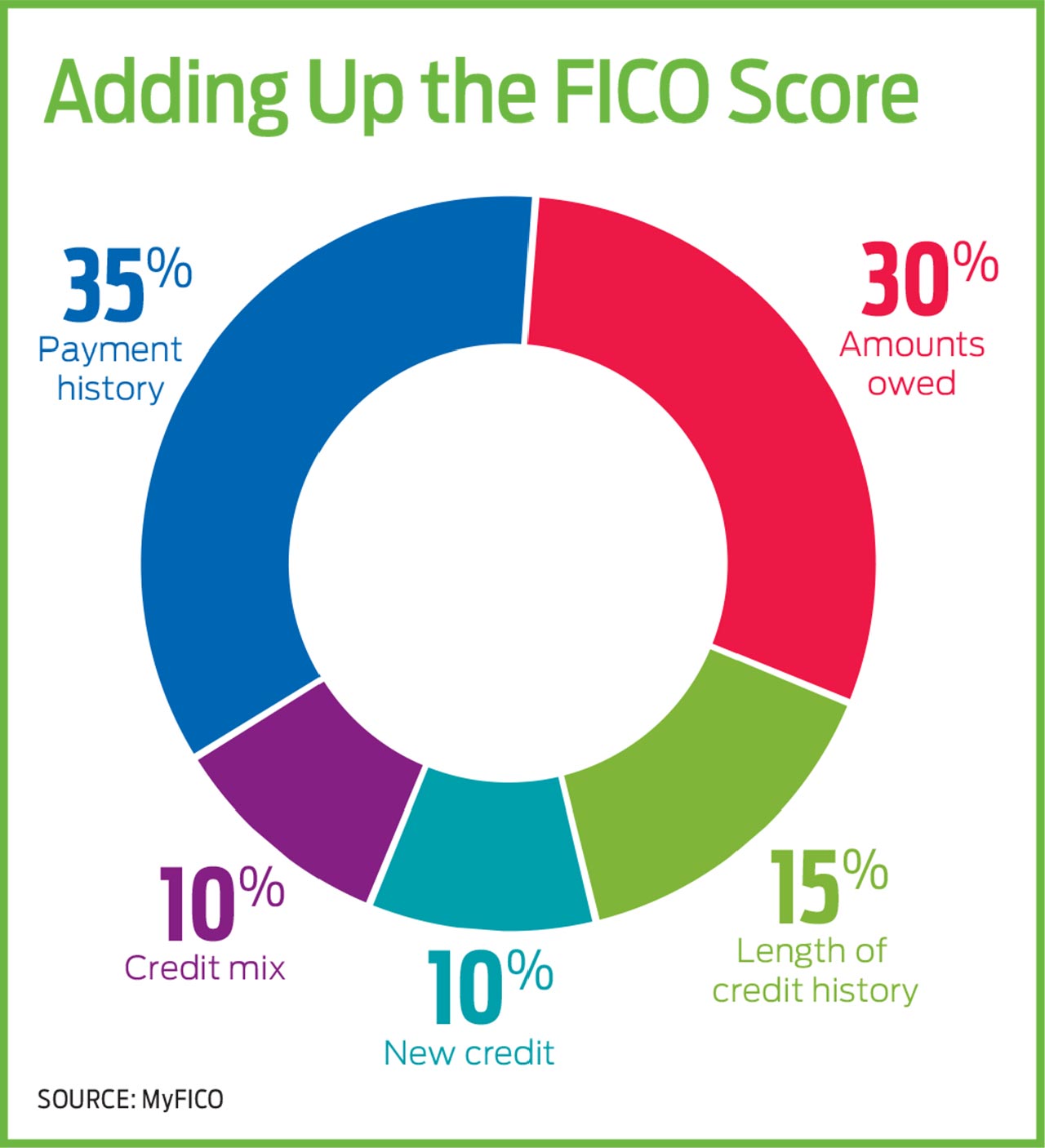

For example, if you already have a history of late payments, an inaccurately reported late payment on the report of someone could have a dramatic and fairly immediate negative impact on your score because late payments represent 35% of your credit score. The sooner you dispute and get errors resolved, the sooner you can start to increase your credit score.

Small Business Loan Disbursals Increased 40% In Fy21

The latest edition of the Sidbi TransUnion Cibil MSME Pulse Report has been published and it shows that loans worth Rs.9.5 trillion have been disbursed by the lenders to micro, small, and medium enterprises for the current financial year.

This number is 40% more than the previous years disbursal of Rs.6.8 trillion. The report suggests that the interventions from the government such as Emergency Credit Line Guarantee Scheme have played a major role in the surge of the credit disbursement to the MSMEs.

11 August 2021

Improving Business Credit Scores

Once your company obtains a DUNS number, the following are some suggestions that will help your business establish a good credit score:

- As a sole proprietor, your personal financial information is combined with your business’s financial information. As a result, any missteps in your personal credit could damage your company’s credit score. Structuring your business as an LLC or corporation will help separate your personal credit from your business credit.

- Pay vendors and suppliers in a timely manner. Use your EIN when applying for credit trade accounts with your vendors and pay the amount in full prior to the due date.

- Build your company’s credit scores by using your EIN to apply for a business credit card. Make any necessary purchases and repay the amount in full prior to the due date. Alternatively, you can use your EIN to apply for a small business loan, which you should repay in full prior to the due date. As another option, you can use your EIN to apply for a small business loan, which you should repay in full prior to the due date.

- Contact any businesses that your company has credit with and ask where they report that your company has made its payments on time. This lets you know which business credit reports you need to monitor. If you discover that not many of these businesses are reporting your good credit, consider opening accounts with companies that do report your business’s good credit to reporting agencies.

Also Check: What Credit Score Do I Need For Amazon Visa

Faq #: Does Your Credit Score Go Down If You Apply With More Than One Lender

When a mortgage lender pulls your credit score, this counts as a hard inquiry that can cause a temporary drop in your score . The minor drop shouldnt be a concern, as credit scoring models recognize shopping for a mortgage as a positive financial move.

Plus, there’s usually a grace period that allows you to apply with as many lenders as possible without lowering your score further. That said, the grace period doesn’t mean you should apply for credit you don’t strictly need, like a new car or credit card, as it typically applies to multiple mortgage applications.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

You May Like: How To Remove Hard Inquiries From Credit Report Fast

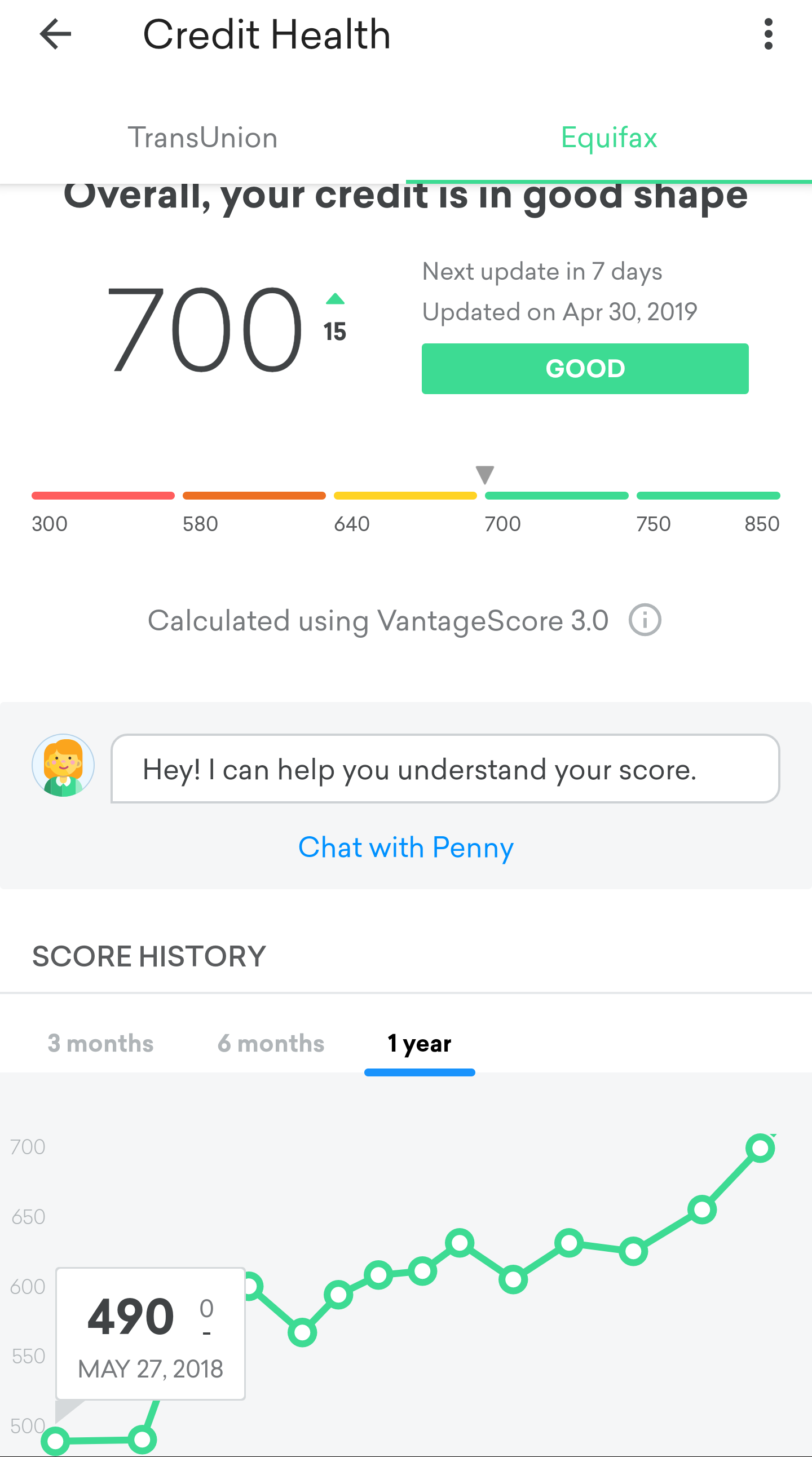

How Often Should You Check Your Free Credit Scores

Checking your free credit scores on Credit Karma isnt a one-time set-it-and-forget-it task. Your scores may be updated frequently as your changes, so checking them regularly can help you keep track of important changes in your credit profile.

Since you can check your free credit scores without hurting your credit, feel free to check as often as you like. If you see your credit scores steadily growing, it can help motivate you on your credit-building journey. And when youre ready to submit a credit application, getting a better idea of your overall credit health beforehand can give you a better sense of where you stand.

Loan Restructuring May Affect Credit Score And Eligibility

The Reserve Bank of Indias had permitted financial institutions to provide a loan restructuring scheme to borrowers of loans in order to help mitigate financial challenges in light of the Covid-19 pandemic. This would help borrowers to pay off their Equated Monthly Instalments in a way that was more feasible and affordable to them.

The loan restructuring was a one-time measure after the end of the 6-month moratorium that was offered from March to August 2020. The RBI has allowed financial institutions to report these loans to credit bureaus as ‘restructured’ while maintaining them as ‘standard’ in their own loan books. This was meant to help lenders to lower their Non Performing Assets . However, restructured loans often have a negative impact on the credit scores of borrowers. This usually affects the eligibility when applying for future loans as well.

However, it is not yet clear how this restructuring will affect the credit scores of borrowers. Restructured loans may also have higher interest rates, which will depend on the lender. The interest lost by the lender during the period of restructuring of the loan may also be added to the principal amount, which will further increase the outgo of interest for the borrowers.

6 October 2020

Read Also: Does Walmart Use Klarna

What Do I Need To Sign Up For A Credit Karma Account

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data.

You must be at least 18 years old to sign up for a Credit Karma account.

How To Get Your Transunion Credit Score For Free

You can access your TransUnion report and score for free via its service. This also advertises loans and cards you are likely to be accepted for.

Signing up to a free trial with CheckMyFile will give you access to all the information held on you by TransUnion, Experian and Equifax for 30 days.

After this, youll have to pay £14.99 a month to keep the service.

Also Check: How Do I Get A Repossession Off My Credit

Does Checking My Credit Scores Hurt My Credit

Checking your free credit scores on Credit Karma doesnt hurt your credit. These credit score checks are known as soft inquiries, which dont affect your credit at all.

Hard inquiries generally happen when a lender checks your credit while reviewing your application for a financial product. This kind of check can negatively affect your credit.

Read more about the difference between hard and soft credit inquiries.

How Is Your Credit Score Calculated

Your credit score is calculated by credit reporting agencies such as Veda, Australias largest.

Although these agencies score in different ways , in general the higher the number, the more likely you are to have your request for credit accepted.

To calculate your score, credit reporting agencies look at:

- Your debt , including any problems youve experienced repaying that debt

- Loans youve taken out for household, personal or family reasons or to buy, refinance or renovate a property or as a guarantor for someone

- Your credit cards and store cards

- Your current credit limit

- Accounts youve opened and/or closed

They will also check if you have a court writ or default judgment against you and look out for any history of bankruptcy.

Don’t Miss: Child Support Credit Score

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Recommended Reading: How To Remove Hard Inquiries From My Credit Report

What Are The Minimum Credit Scores Required By Lenders Per Loan Type

The minimum credit score you need to qualify for a loan depends on the mortgage type. Typically, loans insured by the federal government have less strict credit requirements because the lender isnt taking on much risk by lending you money.

Therefore, score requirements differ depending on whether you’re applying for a conventional mortgage or loans backed by the Federal Housing Administration or the U.S. Department of Veterans Affairs , as shown in the table below.

|

Type of loan |

|

Veterans & active military |

How Do I Check My Credit Score For Free

You now have a legal right to access your credit report for free from any credit reference agency. These statutory reports offer a snapshot of your credit history and dont include a credit score.

But the three main credit reference agencies all offer more comprehensive services for a monthly fee.

These provide unlimited access to your credit report, plus extra features, such as a score and alerts when major changes are made to your report.

However, it’s now possible to access both your credit report and score without having to pay for a subscription.

Also Check: Capital One Remove Authorized User

What Does My Credit Score Mean

Making sense of your credit score can be fairly straight-forward no matter which credit reference agency its from. Thats because all three CRAs base their ratings on similar financial criteria. So while the number may vary from one agency to another, the actual rating is usually pretty consistent. Heres a simple guideline for assessing your credit score:

- Experian scores range from 0-999. A score of 721-880 is considered fair. A score of 881-960 is considered good.

- Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good.

- TransUnion has an scores range from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good.

What Does A Bad Credit Score Mean

If your credit score is poor, companies will take notice and theyll be reluctant to lend.

Bad credit means you might find it harder to get a loan or be accepted for a credit card. If you do get credit, chances are your interest rates will be higher than on standard products.

Your credit score affects other areas of your life as well. When you apply for a phone contract or try to switch energy provider, companies often check your credit score to make sure youll be able to pay. Your credit score might affect your ability to start work at a new job or rent a new home.

But if you have a low credit score dont panic: there are plenty of ways you can improve your credit and some are very quick and simple steps. We have more tips and information in our detailed guide to improving your credit score.

Recommended Reading: Credit Cards For 611 Credit Score

Do I Need To Get My Credit Score

It is very important to know what is in your credit report. But a credit score is a number that matches your credit history. If you know your history is good, your score will be good. You can get your credit report for free.

It costs money to find out your credit score. Sometimes a company might say the score is free. But if you look closely, you might find that you signed up for a service that checks your credit for you. Those services charge you every month.

Before you pay any money, ask yourself if you need to see your credit score. It might be interesting. But is it worth paying money for?

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

You May Like: Credit Score To Get Amazon Credit Card

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Don’t Miss: Speedy Cash Net

How Credit Scores Are Calculated

Credit scores are determined by computer algorithms called scoring models that analyze one of your credit reports from Experian, TransUnion or Equifax. Scoring models may use different factors, or the same factors weighted differently, to determine a particular score. However, consumer credit scores generally share a few similarities:

- Scores are calculated based on the information in one of your credit reports.

- Scoring models try to predict the likelihood that a borrower will be 90 days late on a bill in the next 24 months.

- A higher score indicates a person is less likely to fall behind on a bill, and vice versa.

The vast majority of lenders use credit scores calculated by FICO and VantageScore® scoring models. The most recent versions of their generic credit scores use a score range of 300 to 850and a score in the mid-600s or higher is often considered a good credit score. .

Considering how different credit scores use the same underlying information to try and predict the same outcome, it might not be surprising that the steps you take to try to improve one score can help increase all your credit scores.

For example, making on-time payments can help all your credit scores, while missing a payment will likely hurt all your scores. There are several factors that can affect your credit scores. Here, we’ll focus on the actions you can take to help improve your credit scores.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Don’t Miss: Itin Credit Check