Is 893 A Good Credit Score

An 893 credit score is excellent. Before you can do anything to increase your 893 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and don’t count towards your score.

Which Credit Scores Do Banks Use

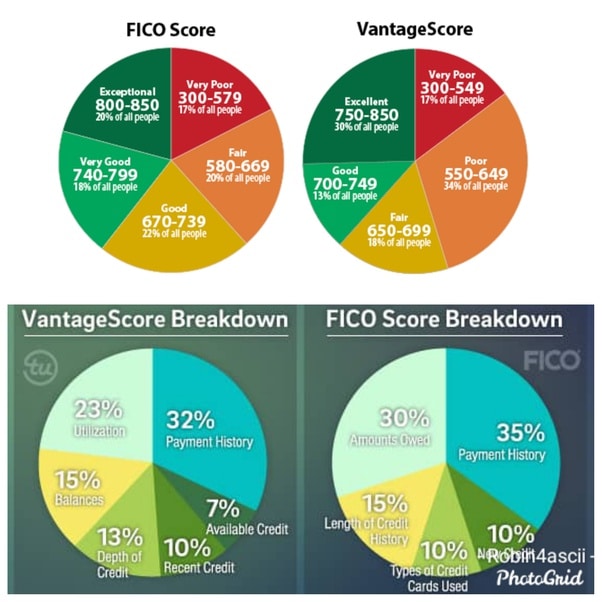

Many banks provide your FICO® Score, which is commonly used to make lending decisions, but banks can show you whatever credit score they prefer to use. Quite a few versions of the FICO® Score exist. If this is the score your bank provides, it will most likely show you your FICO® Score 8 or 9 because they’re used by the widest variety of lenders.

Another commonly used credit score is VantageScore®, which was created cooperatively by the three major credit reporting bureaus . It, too, comes in several versions.

FICO® Scores and VantageScores are just two types of credit scores that can appear on your app, though, so check with your bank to find out which it uses. There are many dozens of credit scoring models, including those used for only for educational purposes. Your bank may opt for any of them, including the one it produces and uses for its lending decisions.

Why Is My Credit Score Different When Lenders Check My Credit

The credit score you see and the one your lender uses may be different for several reasons.

To start, it’s important to understand that credit scores are based on the information found in credit reports maintained by the three major credit bureaus. If those reports differ, a credit score based on one report may not be identical to a score based on another.

Another reason the scores differ might be because there’s more than one credit scoring model, and there’s no guarantee the one you’re using to check your own credit is the same one your lender relies on. Plus, each model regularly releases updated versions of the scores it producesand there are score versions that are specific to certain industries. For example, when you check your for free, you might receive a score calculated using the VantageScore® 3.0 model, but your mortgage lender might use the FICO® Score 2 to assess your credit.

We’ll explain more about the differences between credit scoring models below, as well as other reasons your score may differ. What’s important to remember, though, is that the same positive behaviorpaying bills on time, limiting credit card debt, maintaining a long credit historywill typically lead to a good or excellent credit score across the different models and versions and credit bureaus.

Here’s what you need to know about the various credit scores you have, and which are most important to keep an eye on when you’re seeking new credit.

Recommended Reading: How To Remove Repo From Credit Report

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Get A Credit Builder Loan

Until the loan is repaid in full, a lender does not allow you to access the money you borrowed from a credit builder loan. The lenders who offer such loans dont risk anything by controlling the funds, so theyre more willing to lend to borrowers with bad credit or no credit. After youve received the loan, the lender will report your payment history to the credit bureaus. The on-time payments you make during this period will help you build credit.

Also Check: Is 641 A Good Credit Score

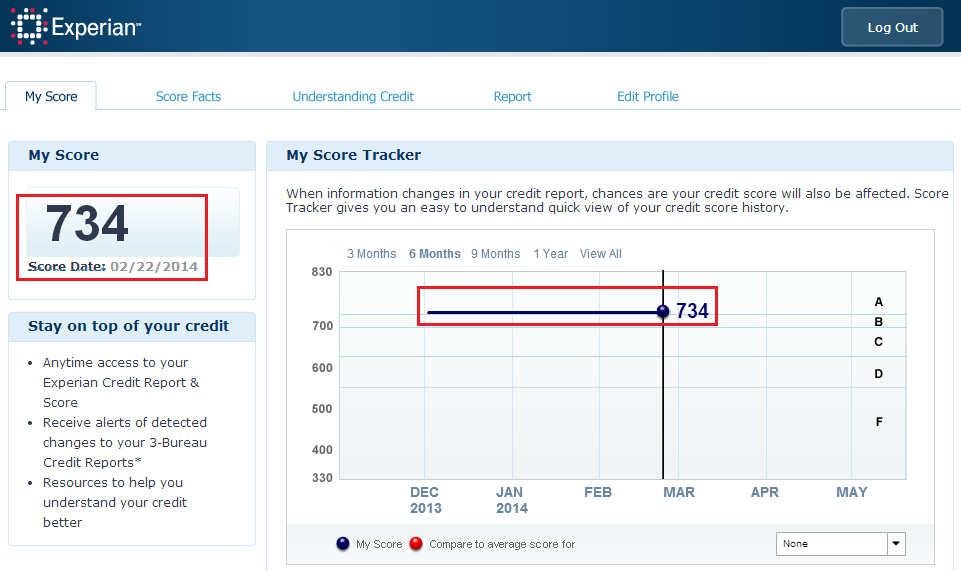

Experian Vs Credit Karma: Whats The Difference

Experian is one of the three major credit bureaus, along with Equifax and TransUnion. These companies compile information about your credit into reports that are used to generate your credit scores.

Instead, we work with Equifax and TransUnion to provide you with your free credit reports and free credit scores, which are based on the VantageScore 3.0 credit score model. We also offer recommendations for credit cards, personal loans, auto loans and mortgages.

Comparing Scores From Experian And Credit Karma

If you decide to enroll in both services, keep in mind that the FICO Score based on Experian data is calculated differently than the VantageScores based on TransUnion and Equifax data youll get from Credit Karma. Your FICO Score may differ from your VantageScores because of those different calculation methods.

When working on building your credit, its helpful to bear in mind that, while the FICO Score and VantageScore may weigh them differently, both scoring systems look into similar good credit habits, and focusing on those behaviors will tend to increase all your credit scores. These best practices include:

Experian and Credit Karmas free services both have much to offer if youd like to track your credit scores, work toward improving them over time, and help you shop for credit offers youll likely qualify for based on your credit scores. Experian and Credit Karma make money if you apply for those offers, but youre under no obligation to do so, and you can learn an awful lot for free from both services.

Don’t Miss: Is 700 A Good Credit Score

Who Should Use Credit Karma

There are a lot of people who are too scared to use Credit Karma because they do not want to give their personal information. One of the pieces of information you need when signing up on Credit Karma is the Social Security Number. Not everyone is comfortable with giving these details.

However, its a necessary piece of information if you want to track your credit history and score. If you wish to find out your credit score and monitor it in order to know when you can buy a house or a car, then Credit Karma is the way to go.

Even if you dont give your information to Credit Karma, when you want to buy a new home, you will have to give the mortgage lender your Social Security Number. This will allow him/her to check your credit score. But when that happens, there will be a hard inquiry on your credit report, which will bring down your credit score by a bit.

On the other hand, Credit Karma doesnt end up in a hard inquiry on your report. It is only there to gather information and let you monitor your credit.

So, Credit Karma is a good alternative for first-time homebuyers or just anyone who wants to keep an eye on their credit before they borrow a loan or make a great purchase. You should consider this service and sign up in order to monitor your credit score. On top of allowing you to check your score, Credit Karma also lets you learn more about credit scores, what impacts them and how to improve them.

Which One Is Better For You

To determine which one is better for you, ask yourself a few questions:

- Are you looking to apply for new credit soon? You will need a score lenders actually use win for Experian.

- Would you still consider yourself a credit beginner? Perhaps Credit Karma is a good fit.

- What credit scores are your potential lenders using? If theyre using FICO, youll want to go with Experian. For VantageScore, youll want Credit Karma.

- Which specific features do you need when building credit? Credit monitoring services, monthly score updates, identity protection, score tracking, and credit score planners are a few options.

- Do you like using robust digital tools to help you out? Experian, all the way.

Ultimately everyones credit goals are different, so youll have to make the choice for yourself.

As someone who has used both, Id recommend Experian since you get so much more for free. Credit Karma is great to start with. It helps you learn about credit basics and still offers credit score monitoring.

Getting your Experian credit report comes with one of the best credit monitoring services, identity monitoring, and solid recommendations for borrowers with good credit. If you decide you want access to better tools, theyre in the same place.

A reasonable monthly fee grants you up to $1 million in identity theft insurance along with access to specialized tools to help you grow your credit. The only thing they dont give you is a good credit score. Youll have to earn that one.

Don’t Miss: Is 807 A Good Credit Score

Why Is My Experian Score So Much Lower

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureauswhich is also unusual.

How Much Does Experian Boost Cost

Experian Boost is a free service. However, in order to use it, you have to share personal data including your Social Security Number and access to bank accounts.

Experian may also try to upsell you to paid products. For example, you may see an offer to upgrade to CreditWorks Plus , a service provides credit monitoring, daily credit reports, a score tracker and lost wallet assistance.

You May Like: What Is The Connection Between Credit Report And Credit Score

Is Experian Better Than Credit Karma

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Think of it this way Credit Karma is like a newspaper that writes about the credit scores other companies give you. But we have no influence over your scores.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Also Check: How To Read Your Credit Report

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Where Can You Check Your Credit Scores

Some banks or credit card companies offer free access to your credit score. You can also get credit scores directly from each of the three credit reporting agencies.

- Equifax and TransUnion both provide a VantageScore 3.0 credit score for a fee.

- Experian CreditWorks provides free monthly access to both your Experian credit report and your FICO Score. Theres also a premium version that includes daily access to these and monthly access to credit reports from all three credit bureaus for credit monitoring purposes.

MyFICO.com charges a fee to see up to 28 different FICO Scores, including those used by mortgage lenders, auto lenders, and credit card issuers.

Its equally important to check your credit report with each of the three major credit bureaus on a regular basis. You can get a free credit report from each of the three credit bureaus once per 12 months from AnnualCreditReport.com.

Also Check: Does Affirm Show Up On Credit Report

Complete Guide To The Three Major Credit Reporting Bureaus: Equifax Vs Experian Vs Transunion

- Chelsea KrauseChelsea Krause is a writer who has specialized in accounting for over five years and is a QuickBooks Certified User. She has a BA in English & Creative Writing from George Fox University and studied at the University of Oxford as well. She has been quoted in Forbes and her work appears in Startup Nation, Small Business Bonfire, and Women on Business.

Expert Analyst & Reviewer

If youve ever applied for a loan whether it be for a car, a house, or even a small business then Im sure youre well acquainted with the importance of credit scores. But what about credit reports?

In this post, well cover everything you need to know about credit bureaus. Then well break down the big three credit bureaus so you can confidently understand your credit report and score.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: What Credit Score Is Used To Buy A Car

Other Differences To Recognize

In addition to differences between VantageScore and FICO credit score calculations, each major player in the consumer credit scoring market has had several versions designed and implemented over the years. FICO has developed no less than 56 versions of its credit score one for each of the three major credit bureaus along with one for each specific industry that may use it.

For instance, auto loan lenders have an Auto Score available from FICO that uses the same credit information to determine specific risk factors a borrower may show as it relates to defaulting on a new car loan. The same is true for credit card issuers , mortgage lenders, and general credit inquiries.

While VantageScore does not have as many iterations of its credit scoring model, there are at least two versions still in use today by consumers and some lenders. The differences between these credit scoring versions might be subtle, but the details used to calculate an individuals credit score are varied enough to create multiple scores for a single person at any given time.

Address:80 River St., STE #3C-2, Hoboken, NJ,07030

What Credit Score Do Lenders Use

The two main companies that produce and maintain are FICO® and VantageScore. Lenders most commonly use the FICO® Score to make lending decisions, and in particular, the FICO® Score 8 is the most popular version for general use. If youve taken an interest in the health of your credit and how lenders will view it, checking your FICO® Score 8 is a smart place to start.

There are, however, many types of FICO® Scores. FICO® has released updates to its basic score over the years, and the FICO® Score 10 is the most recent. Mortgage lenders most often use older versions to assess applicants: the FICO® Score 2, 4 or 5.

There is also the FICO® Bankcard Score and the FICO® Auto Score . If you know youre interested in a certain type of credit, it could be worthwhile to check beforehand the specific score type you know a lender will look at.

Also Check: When Do Accounts Fall Off Credit Report