How Long A Closed Account Stays On Your Credit Report

The length of time a closed credit card stays on your credit report depends on whether the account was closed in good standing. A negative closed account, like a charged-off credit card, will remain on your credit report for seven years. That’s the maximum amount of time most negative information can be included on your credit report.

If your account was closed in good standing, there is no law requiring it to be removed from your credit report in a certain time period. It could stay on your credit report indefinitely, but will likely be removed ten years after it was closed based on the credit bureau’s guidelines for reporting closed accounts.

It’s not a bad thing that a closed account still remains on your credit report, depending on how the balance and status of the account. Closed accounts generally only hurt your credit score when you have a negative account status or a high credit card balance. An account closed in good standing, however, may have a positive impact on your credit score for as long as the account is included on your credit report.

You might want to scrub your credit report of all closed accounts, but you can only have inaccurate or outdated information removed from your credit report. If this is true for any of your closed accounts, submit a dispute with the credit bureaus to have the account removed from your credit report.

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

How Do I Freeze My Credit

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax , TransUnion and Experian . If you request a freeze, be sure to store the passwords youâll need to thaw your credit in a safe place.

Whether or not you choose to freeze your credit, fraudsters could still take advantage of you by getting things like your credit card number or passwords to online accounts. Make sure youâre taking the proper steps to secure your information so that it doesnât fall into the wrong hands.

Recommended Reading

Also Check: Kroll Factual Data Complaints

What Should I Do When I Get My Credit Report

Your credit report has a lot of information. Check to see if the information is correct. Is it your name and address? Do you recognize the accounts listed?

If there is wrong information in your report, try to fix it. You can write to the credit reporting company. Ask them to change the information that is wrong. You might need to send proof that the information is wrong for example, a copy of a bill that shows the correct information. The credit reporting company must check it out and write back to you.

How To Check Your Credit Report For Collections

Checking your credit reports regularly can help you determine whether you have any collection accounts that might be hurting your score. You can request a free copy of your Canadian credit report from Equifax Canada and TransUnion Canada in writing. If you dont have time to wait for your credit reports to be mailed out, you can purchase a copy of your credit reports from either bureau online.

Keep in mind that your credit reports and credit scores are two different things. The information in your Canada credit report is used to calculate your credit scores. If youd also like to see your scores, you can request them separately from each credit bureau for a fee.

Once you have copies of your Equifax and TransUnion credit reports, review them carefully. Look for any collection accounts and if you find them, make a note of:

- Who the debt is owed to

- The name of the collection agency, if there is one

- How much is owed

- How many payments the account is behind

Also, make sure you have the right contact information for debt collectors, which youll need for the next step. Again, some creditors will route past due accounts to their in-house collections department while others will assign or sell past due accounts to a collection agency. You need to know who to contact if you want to remove collections from your credit report in Canada.

Read Also: How To Remove Repossession From Credit Report

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

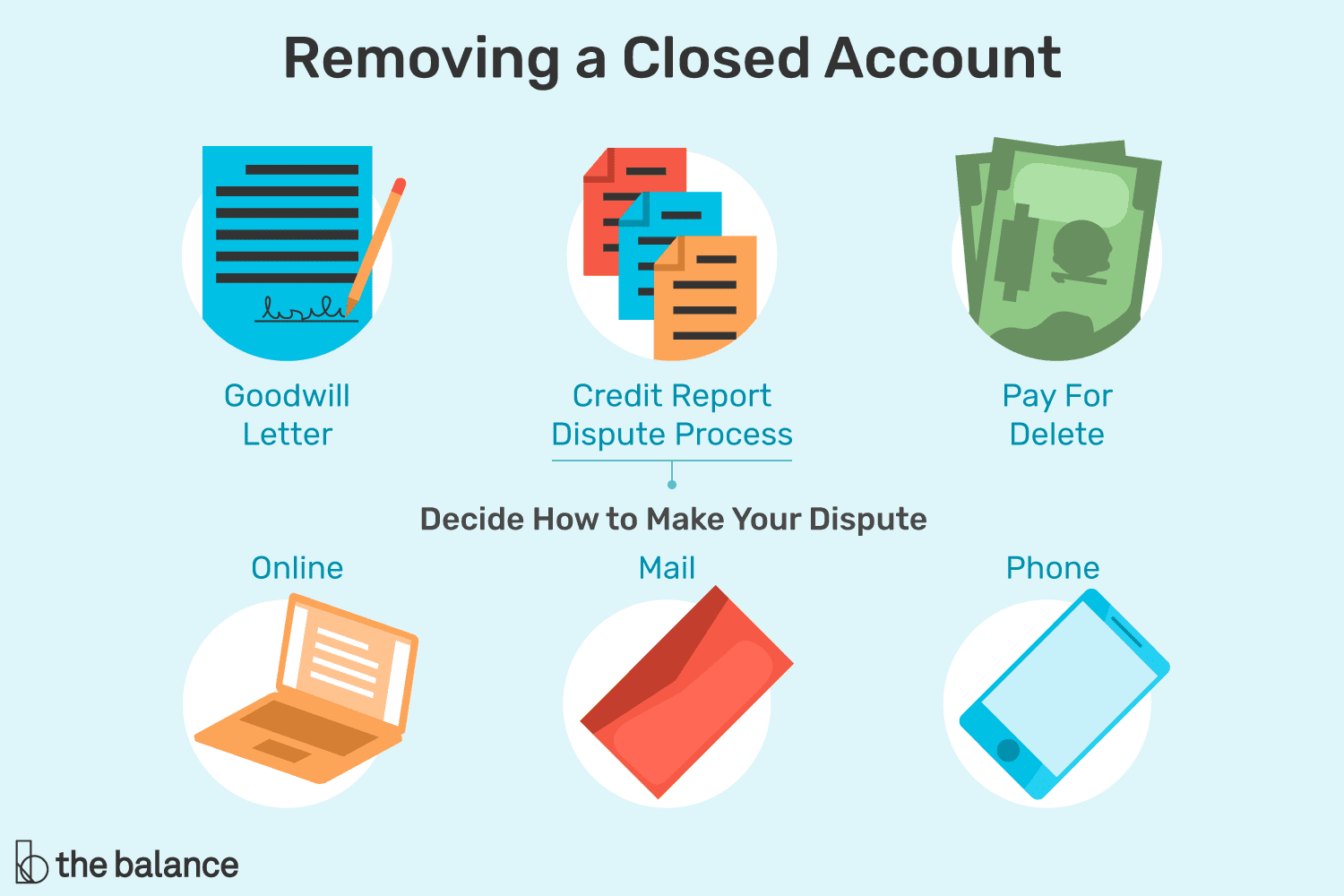

Politely Ask For The Information To Be Removed

If you dont necessarily have any incorrect information to dispute but you still want a closed account removed from your credit reports, you can also write the credit bureaus a goodwill letter. This type of formal request could lead to having an account removed out of goodwill, yet there are no guarantees.

Either way, you can ask and all they can say is no. You can find out how to contact all three credit bureaus using the links below:

- Transunion: TransUnion.com/credit-help

Recommended Reading: Usaa Credit Check

Your Creditor Closes The Account

Here are two of the top reasons a creditor may close an account.

1. Lack of use

Everything about doing business, from advertising to customer service, costs money. Likewise, every credit card account costs the company money to maintain. Its business model is to make money by charging interest and fees. If you don’t use the card for a while, the bank finally realizes they’re losing money. Let’s say you’ve had a for several years and only used it long enough to take advantage of the signup bonus. You may try to log into your account one day and find it’s gone. It was the credit card issuer’s way of ghosting you and moving on to another customer who might use the card and earn the company some cash.

2. Misuse of the account

A credit card company may allow for a few mistakes. You may make a late payment, then pay less than the minimum payment a few months later. Your debt may even go to a collection account for a debt collector to deal with. At some point, the lender may say enough and close your account.

How To Remove Delinquent Accounts

First things first, is the delinquent account yours? If it is a mistake, you need to file a dispute with the credit scoring company its filed under.

Theres only 3, its either Experian, Equifax or Transunion. Youll need to create an account online through their websites to file a dispute or you can call them via the phone.

If you have credit monitoring accounts with Credit Karma, you can start to file a dispute from their platform. If the past charge is your responsibility, youll need to contact the company to get it took care of.

You need to see which company added the delinquent account to your credit report. Youre going to need to get the companys name, amount of the bill and their phone number.

Removing negative information will help you achieve a better credit score. A better credit report is also the key to getting approved for credit cards and loans and to getting good interest rates on the accounts that youre approved for.

To help on your way to better credit, here are some strategies to get negative credit report information removed from your credit report.

You May Like: How To Remove Inquiries Off Credit Report

Removing Closed Accounts From Your Credit Report

In some cases, a closed account can be harmful to your credit score. This is especially true if the account was closed with a delinquency, like a late payment or, worse, a charge-off.

Payment history is 35% of your credit score, and any late payments can cause your credit score to drop, even if the payments were late after the account was closed.

Removing the account from your credit score could potentially lead to a credit score increase.

Removing a closed account from your credit report isn’t always easy, and is only possible in certain situations.

If the account on your credit report is actually open but incorrectly reported as closed, you can use the to have it listed as an open account. Providing proof of your account status will help your position.

Having a credit account reported as closed could be hurting your credit score, especially if the credit card has a balance. You can dispute any other inaccurate information regarding the closed account, like payments that were reported as late that were actually paid on time.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Recommended Reading: When Do Hard Inquiries Fall Off Credit Report

What Happens When An Account Is Closed

When you pay off or close an account its not available for purchases or payments.

An account can be closed for many reasons such as paying off the amount borrowed or closing an unwanted line.

Once the account is closed, its then settled and will appear on your credit report as such.

When an account is closed with a balance, the creditor will still report the status and account details to the credit bureaus on a monthly basis.

The information that is reported is the balance, monthly payment history, and the date of your last payment.

Dealing With Delinquencys Aftermath

Once you become current on your bill, you will need to get to work on reversing the effects of delinquency. Delinquency is like a black eye on your because it signals consumer irresponsibility. However, the more you cover it up with positive usage information, the less glaring it becomes.

The best way to infuse positive information into your credit reports is to open a credit card, because information about credit card usage is reported to the credit bureaus on a monthly basis. Whether you make purchases and pay for them in full or simply maintain an open card with a zero balance, a credit card will provide you ample opportunity to demonstrate fiscal responsibility.

If your credit report contains a record of delinquency that did not occur, then you can send a credit report dispute to have it investigated and possibly removed.

Secured credit cards are particularly apt for credit improvement because to open one, you must place a refundable security deposit. This security deposit makes approval guaranteed, provides your issuer protection against default, and erases the need for an expensive fee structure. Additionally, since its also your credit line, the security deposit ensures that you cannot spend beyond your means.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

What Does Freezing My Credit Do

When you freeze your credit, the credit reporting bureaus canât give any information to anyone who makes an inquiry about you. Typically, businesses inquire about your credit when you are trying to, for instance, open a new credit card, buy a car or rent an apartment. The credit check helps the business determine if they want to lend or rent to you, and it can help set your rates and lending terms for loans and credit cards.

When your credit is frozen and the business canât get any information about you, it typically stops the process â which means a fraudster will be unable to open an account while using your identity.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How To Remove Repossession From Credit Report

Have A Professional Remove The Charge

Companies like Lexington Law, and Sky Blue have years of experience getting inaccurate and negative items removed, and may help speed up the process of repairing your credit.

If you have several items to remove, arent able to commit dedicated time to do it yourself, or want an expert to help guide you through the process, we recommend getting assistance from these experts. Heres our full list of recommended credit repair companies. Each company offers a free consultation to help determine how they can help you restore your credit.

Even if you pay several hundred dollars to a credit repair company like Lexington Law, Credit Saint, or Sky Blue, you can save even more by getting lower interest rates and building a more stable personal finance life.

How To Avoid Credit Card Delinquency

The best way to avoid delinquency on credit cards is to manage your debt responsibly. Here are some suggestions:

- Set up autopayIf you have numerous monthly bills and struggle to keep track of them, then setting up autopay with your bank or credit union can help ensure that you never miss a payment.

- Prepare your budgetIf you were able to take advantage of debt deferment or forbearance during the 2020 economic crisis, then youll need to get ready to pay more to cover those debts. Try to set aside enough to pay more than the monthly minimum on your credit cards.

- Stop using credit cardsFeel like youre underwater on your bills? Put away your credit cards so you dont rack up more debt and dig yourself into a deeper hole. Once you have stopped using your cards, you could also consider taking out a personal loan to pay off what you owe with one easy monthly payment. Just be sure not to run up more bills.

- If youre getting behind on payments, then reach out to the creditor right away. Alerting them to your situation will make them more likely to work with you on a solution.

Read Also: Paypal Working Capital Log In

Remove Collection Account Without Hurting Your Credit Score

Categories

Your credit score is your key to loans and low-interest rates. If your score is too low, youll end up paying more for a loan than you need to or even be denied credit altogether. Your credit score is determined by a combination of factors, including how often you pay your bills on time, how much credit you have at your disposal, how much of that credit you are currently using, and how many recent inquiries there have been about your credit history.

A single incident, like an errant collections account, can do damage to your score without you even being aware of it. Unfortunately, this happens all too often as it is very easy to simply ignore or forget about issues with your credit. Perhaps you closed a credit card account that still had a couple of charges pending or maybe you had a medical procedure that wasnt covered under your health plan and are unable to pay for it. Collection accounts are a reality for a lot of individuals. What matters is how you deal with them, and thats what sets the responsible consumers apart from the others.

Why Doesnt Everyone Just Freeze Their Credit Then

While freezing your credit wonât guarantee safety, itâs a pretty strong defense against identity theft. But remember â you still need to unfreeze your credit if you legitimately want to apply for a loan or line of credit. While itâs not a heavy burden, it does add extra steps anytime you do something that requires a credit check.

You could opt for credit monitoring instead of a full freeze. When you pay for a credit-monitoring service, youâll get alerts about any activity involving your credit report. This can quickly bring a potential problem to your attention â but itâs not preventative, so you wonât know if someone has used your identity until after it happens.

You can also request a free copy of your credit report annually from each of the major credit bureaus and check it for any activity you donât recognize. If you find anything suspicious, report it immediately and take steps to lock down your credit through a fraud alert or credit freeze.

Read Also: Does Carmax Pre Qualification Affect Credit