How To Earn A Good Credit Score:

If you currently have a credit score below the “good” rating, you may be labeled as a subprime borrower, which can significantly limit your ability to find attractive loans or lines of credit. If you want to get into the “good” range, start by requesting your credit report to see if there are any errors. Going over your report will reveal what’s hurting your score, and guide you on what you need to do to build it.

How To Build And Maintain A Good Credit Score

Once you have a credit score, how can you help maintain or improve it? First, you need to understand what is considered a good credit score. Both the FICO® Score and VantageScore models range from 300 to 850. Using the FICO scoring model, a score 670 or higher is considered good and a score of 800 or above is considered exceptional. A VantageScore 661 or above is considered good while a score 781 or above is considered excellent.

The higher your credit score, the more likely you are to be approved for loans or credit at the best rates and most favorable terms. The lower your credit score, the more difficult it will be to get a credit card, obtain favorable terms on a loan or even rent an apartment.

Whether you want to improve your credit score from good to excellent or you’re trying to raise your poor credit score to the fair range, there are plenty of things you can do right away to build credit history and improve your credit score.

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

You May Like: Syncb/ppc Closed Account

Option : Apply For A Card Marketed Toward Consumers With Poor Or Average Credit

In addition to secured cards, there are some other credit card options for people with no credit or poor credit who don’t want to or are unable to put down a deposit. After you open a credit card, make sure you spend within your means and pay your balance on time and in full. In some cases, like with most Capital One cards, paying your bills on time for several consecutive months will automatically entitle you to a higher credit limit .

Here is our top pick for the best credit card for building credit:

Whatdoes Your Starting Credit Score Qualify For

Lenders look to your credit score to determine how financially risky you are. Here are some specific examples of what you could qualify for with your first year of available credit :

- Poor to Low : If you fall into the low credit score range, you wont be able to qualify for much . Most lenders wont offer a loan or credit card to people with this low of a score, and if they do the terms will not be in your favor, with high interest rates or other restrictions. If youre looking to rent an apartment or apply for a loan, youll probably need a cosigner to ensure your payments.

- Fair to Good : With a good credit score in this range, you shouldnt have a problem qualifying for credit cards and loans, although you may have higher interest rates and limited credit balance.

- Very Good to Excellent : If youre able to earn a starting credit score in this range , youll be able to shop around for the best financial products to fit your needs and wont have problems qualifying for loans or leases.

Also Check: How To Remove Child Support From Credit Report

Average Credit Score By Year

The average U.S. credit score can tell us a great deal about the health of consumers and the economy more broadly. Thats especially true when you examine credit-score averages over time.

For example, the average VantageScore credit score improved by 11 points from 2007 to 2015, reflecting our rebound from the Great Recession. And in more recent years, average credit scores have stabilized along with the economy.

Average Credit Score by Year

What Are The Benefits Of Having Higher Credit Scores

Thankfully, you dont need a perfect score to qualify for some of the best rates on loans and mortgages. Scores in the 700s can qualify you for great interest rates from lenders. Get your scores anywhere above 760 and youll likely be offered the best rates on the market.

Why is this the case? Because banks and credit card companies care less about the specific numbers on your credit reports and more about the broad credit score range where your scores fall.

For example, FICOs score bands look like this.

- Poor: 300-579

- Very good: 740-799

- Excellent: 800+

Improving your scores from 740 to 790 will likely have little effect on your interest rate offers since both scores fall in the very good range. But moving your scores from 650 to 700 could mean getting lower interest rate offers.

If you want to improve your scores and get as close to 850 as you can, youll need to understand what causes your scores to go up or down.

Read Also: Free Paydex Score

What Is Your Beginning Score

Everyone starts out the same. No one has a score at all. Nobody starts out with a credit report. Credit scores are based on the info on your credit reports. Those reports are not created until you have had credit in your name for at least six months. Some people think that you magically get credit once you turn 18 years old. It doesnt work like that, though. However, you can apply for a credit card once you 18.

Very Good Credit Score: 740 To 799

A credit score between 740 and 799 indicates a consumer is generally financially responsible when it comes to money and credit management. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. are relatively low compared with their credit account limits.

Read Also: What Is Cbcinnovis On My Credit Report

The Best Ways To Establish Credit

If the question What does your credit score start at? is at the top of your mind, here are some suggestions that can help you establish a strong FICO® Score and set you on the path to excellent credit:

- A secured credit card can be a great way to establish credit. Secured cards work just like regular credit cards and report your payment record to the three credit bureaus, but they do require a refundable security deposit. I used a secured credit card to help establish my own credit, and highly recommend this route.

- Alternatively, being added as an authorized user to a parent or guardians account can help you establish a FICO® Score. Just be sure the person who adds you uses their card responsibly — otherwise, it could have the opposite effect.

- Pay your card in full and before the due date every month. If you absolutely must carry a balance, be sure to make at least the minimum required payment to keep your account in good standing.

- Keep your credit card debt balances below 30% of your available credit. Experts generally agree that credit utilization above 30% can hurt your credit score.

- Apply for new credit sparingly. A flurry of new credit accounts and applications all at once can be a big negative for your score, especially if you have a limited credit history.

How To Get An Ultrafico

Not all consumers will have UltraFICO if your credit score is high enough to have an application approved, you wont need the extra boost from your banking information. A lender may offer the UltraFICO score to you if your application is turned down based on your traditional credit score. At that point, youll have the option to have your bank information accessed to generate an UltraFICO score for you.

Experian will be the first bureau to partner with FICO for the new credit score system. For UltraFICO to benefit you, a lender must be willing to base their credit decision on your Experian credit score alone.

Keep in mind that agreeing to an UltraFICO means allowing these companies to electronically access your bank information.

Make sure you understand how your data will be protected before going forward.

You May Like: Does Paypal Credit Report

How Quickly Does Your Credit Score Update

Unlike a lot of financial metrics, your credit score doesnt tick away silently in the background, changing without your knowledge. Instead, its recalculated each time you or a business requests it. If you request it often, itll update more frequently. Most popular free credit score websites request this information every month that way, you get a new score update every 30 days.

It also depends on how often the companies you do business with report your information. For example, if your credit card company doesnt report your payments until the end of the month, you wont see the impact of your payments on your credit score until then, even if you pay it off at the beginning of the month.

How Do I Monitor My Score

SFIO CRACHO / Shutterstock

With so many factors affecting your score from month to month, it can be hard to tell how much of an impact your efforts are making. Thankfully, a number of free online services allow you to monitor your progress.

One popular option in Canada is Mogo, which provides access to your Equifax credit score for free, as well as a suite of services to improve your financial health .

This article was created by Wise Publishing, Inc., which provides clear, trustworthy information people can use to take control of their finances. Millions of readers throughout North America have come to count on the Toronto-based company to help them save money, find the best bank accounts, get the best mortgage rates and navigate many other financial matters.

You May Like: Does Barclaycard Report To Credit Bureaus

Fair Credit Score: 580 To 669

Borrowers with credit scores ranging from 580 to 669 are thought to be in the fair category. They may have some dings on their credit history, but there are no major delinquencies. They are still likely to be extended credit by lenders but not at very competitive rates. Even if their options are limited, borrows in need of financing can still find solid options for personal loans.

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Recommended Reading: What Is Cbcinnovis On My Credit Report

How To Check Your Credit Score

If you’re not sure what your credit score is, it’s easy to find out by getting a free FICO® Score from Experian. You may also be able to get a free credit score from credit card issuers or lenders with whom you have accounts. Keep in mind that although FICO is the most commonly used credit scoring model, there are other models out there, and your score may vary slightly depending on which model is used. Learn more about how to check your credit score and what it means.

Protect Credit Against Fraud

Learning how to protect your credit score, finances and identity from fraud, coupled with monitoring your accounts and utilizing credit card services, can increase your personal security both on and offline and make sure someone elses attack doesnt hurt your credit.

You now know a lot more about your starting credit score including that it cant be zero, and being credit invisible wont help much if youre interested in applying for credit cards or other loans. The good news is that whatever your initial score is, there are several ways to build a positive credit history and keep a good credit history and credit score.

If you prefer not to receive your FICO® Credit Score just call us at 1-800-DISCOVER . Please give us two billing cycles to process your request. To learn more, visit Discover.com/FICO.

Don’t Miss: Is 611 A Good Credit Score

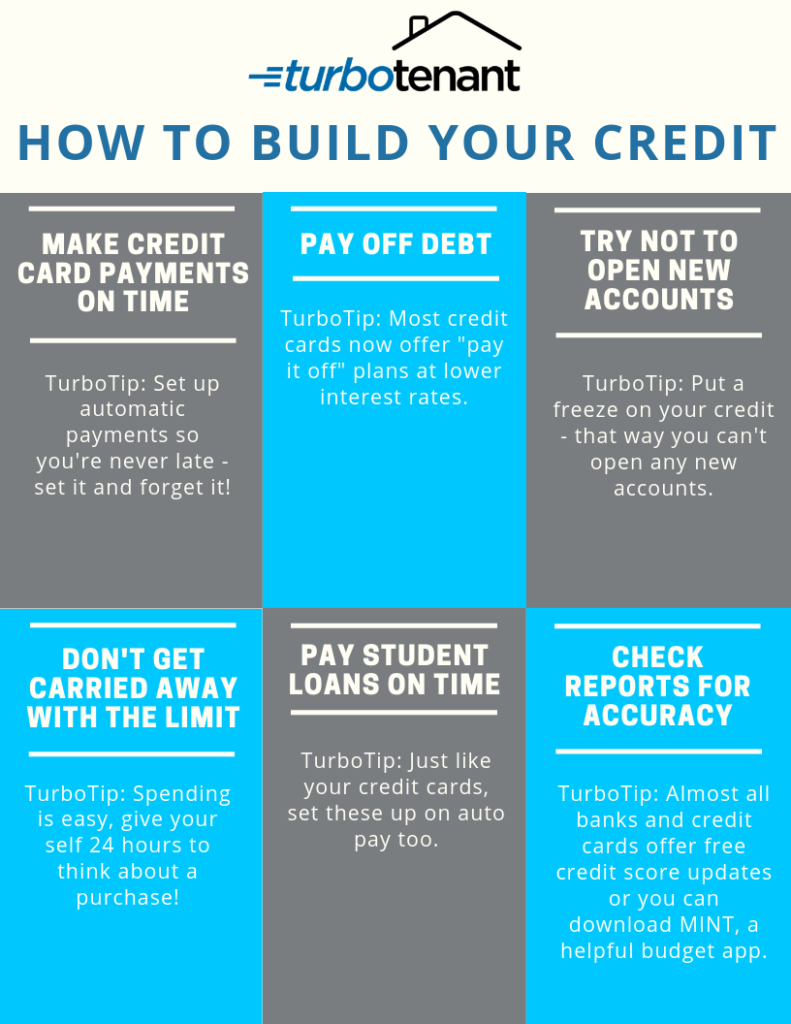

Tip : Pay Bills On Time And In Full

Payment history is the most important factor making up your credit score. If you miss a payment, it will show up on your credit report, and multiple missed payments can make it impossible to achieve an excellent score. For this reason, you should always pay at least your minimum payment.

It’s also a good idea to pay off your bill in full each month to avoid potential late payment fees, penalty and interest charges that often result from carrying a balance.

As a rule of thumb, set up autopay for at least the minimum payment, so you can avoid forgetting a payment. You can also schedule email, text or push notifications through your card issuer.

If you struggle to remember to pay your bills each month , there’s an easy fix: autopay. If you’re not sure you’ll be able to pay your bill in full, you can set it so you just pay the minimum as a safeguard to avoid missed payments.

Here are some tips:

The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments, matter less as time passes. So start now and stay consistent.

Some credit building credit cards reward cardmembers with an automatic credit limit increase after they make six on-time payments. An example is the Capital One® Platinum Credit Card.

See our methodology, terms apply.

What Credit Score Do You Start With

John S Kiernan, Managing EditorFeb 15, 2016

The truth is that we all start out with no credit score at all. Credit scores are based on the information in our major credit reports, and such reports arent even created until weve had credit in our names for at least six months. Without any credit history, reports and scores wont magically burst into existence when we turn 18 the age at which we first become eligible to apply for credit contrary to common myth.

This connection between the contents of our credit reports and our eventual credit scores means that we all wont start with the same number. Rest assured that your first score wont be zero, though, as the most common credit-scoring models start at 300. Its unlikely to be that low, either. Ratings at the lowest end of the reflect the most serious credit-score damage, and its nearly impossible to get into that much trouble when youre just starting out.

Rather, your first score could range anywhere from under 500 to well into the 700s, depending on your initial performance, according to credit expert John Ulzheimer, who has worked at both FICO and Equifax. The only correlation between your first score and the scoring metrics would be the age of your credit file, he said. But that category is only worth about 15% of the points in your score, so even if you bombed that category and did well in the others you’d still score well above 640.

Recommended Reading: Does Carmax Do Credit Checks

How Long Does It Take To Get A 700 Credit Score

That depends. Since credit history carries the most weight in determining your overall credit score, paying your bills, including credit cards, loans, rents, etc., on time every month , will build your credit score faster. If you pay your bills only some of the time on time, it will take a little longer to reach the magic number of 700. In fact, making late payments is like taking two steps forward and one step back. Your credit score will actually drop.

Use Loans To Build Credit

If you have outstanding student loans, one of the easiest ways to build credit is simply to make all your loan payments on time. If you don’t have student loans, getting a car loan or a personal loan and repaying it on time is another way to demonstrate you can use credit responsibly. If you have trouble getting good loan terms on your own, asking someone to cosign on the loan with you can help.

Another option: Some smaller banks and credit unions offer designed to help you establish credit. As with a secured credit card, these loans require you to make a deposit, which you then pay off over six to 24 months. Those payments are reported to the credit bureaus, and you get your deposit back once the loan is paid.

Whatever type of loan or credit you obtain, remember the factors used to calculate your credit score. Be sure to make your payments on time, keep your credit utilization ratio below 30%, and avoid generating too many hard inquiries on your credit report.

You may even be able to build credit and improve your credit score simply by paying bills related to daily living. For example, Experian Boost is a free service that adds your positive cellphone and utility bill payments to your credit file, often instantly improving your FICO® Score.

Read Also: Comenitycapital/mprcc