Closing An Account Could Impact

If you decide to close your existing credit account, keep in mind that this could impact the following factors that are considered when credit bureaus calculate your credit score.

- Account mix: What type of credit accounts you have active. This metric can demonstrate to creditors how you handle different types of credit such as a student loan, mortgage, or credit card account.

So, if your credit score is already goodId think about letting sleeping dogs lie.

Wait For The Information To Disappear On Its Own

Also, remember that closed accounts on your report will eventually disappear on their own. Negative information on your reports is removed after 7 years, whereas accounts closed in good standing will disappear from your report after 10 years. If you have tried to dispute incorrect negative information without success, or if your goodwill request went unanswered, its possible that youll just have to wait it out until your problem corrects itself.

If youre curious about which accounts are still on your reports or you simply want to monitor the information on your reports over time, note that you can get a free copy of your credit reports from all three credit bureaus via the website AnnualCreditReport.com. Where you could previously only get a free report from each bureau on this site once per year, you can now access a free report every week through April 2021.

Should You Close Accounts After Paying Off The Debt

If you are working to improve your credit scores, it’s typically best to leave your credit cards open once they are paid off. Ideally, you should keep those accounts active by making small purchases and paying your balances in full each month.

This is especially true if you are planning to take out a loan, such as an auto loan or mortgage, in the next three to six months. You’ll want to keep your credit history stable until that credit transaction is complete. If you still want to close your account, check to see if the account was paid before you close it.

Recommended Reading: Does Walmart Do Klarna

Plastic Not Always So Fantastic: How Closed Accounts Affect Your Credit

Plastic, Not Always So Fantastic: How Closed Accounts Affect Your Credit

Your negative credit card history won’t disappear any faster if you cancel the card.

If your credit report contains some negative information from your credit cards, you can’t magically erase it by canceling the credit card. “Closing a credit card has both short-term and long-term effects on your credit score,” says Alan Moore, a certified financial planner practicing in Milwaukee, Wisconsin. So, before you make a call to cancel your account, make sure you know how it will continue to affect your credit score.

Payment History Disappears Over Time

Typically, your negative credit history disappears after seven years, even if the card is still open, while positive information never falls off. Closing your card won’t accelerate the bad information falling off, but it will allow the good information to fall off over time. Your missed payments will come off after seven years from when you missed them, but all your on-time payments will also come off seven years later, too. However, that doesn’t mean that your score won’t change until then. “It is important to know that the older the data, the less it affects your score,” says Moore. “This means if you close a card with negative data, it will hurt your score less over time. If you close a credit card with positive data, such as making all payments on time, it will cause your score to drop slowly over time.”

Length of Credit History

Reasons to Close

Can You Remove A Closed Account From Your Credit Report

Unless an account has inaccurate information or does not belong to you, removing it from your credit report is almost impossible regardless of whether it has positive credit history behind or negative history.

If your account was never delinquent and all of your payments were made on time, it will remain on your credit report for ten years and will positively affect your credit score.

However, if you missed payments on your account, your account will only remain on your credit report for seven years from the date you first became delinquent on the account.

Also Check: What Credit Score Does Comenity Bank Use

Next Steps: How To Recover If Your Account Is Closed

If youre worried about your credit scores dropping after an account is closed, you may want to consider these ideas.

- Getting a credit-builder loan If your account was charged off or closed because of delinquent payments, a credit-builder loan may help you establish a positive payment history and build credit.

- Rounding out your credit mix Getting a new loan just to improve your credit mix probably doesnt make sense. But if you dont have any open revolving accounts, you may want to consider getting a credit card. If you use it sparingly and pay the balance in full each month, you wont accrue interest on your purchases. And itll improve your credit mix, possibly helping to bring your scores up.

- If a revolving account was closed, reducing the balances on your remaining revolving accounts will help decrease your credit utilization rate, which may improve your credit scores.

- Have your rent payments reported to the credit bureaus Rent payments arent automatically reported to the credit bureaus. But you might be able to get them added by signing up for a rent payment service that reports your payment history. On-time rent payments might help lift your scores. But keep in mind that not all credit-scoring algorithms use them.

How Closing A Bank Account Affects Your Credit Score

Bank accounts don’t have to be forever. You might want to close an account because you’ve found a better account, you’re relocating to a new state where your bank has no branches, or you’re dissatisfied with your old bank’s customer service. Before you move on from your bank, you want to know whether closing a bank account affects , so you can take precautions if necessary.

Your credit score affects many of your financial decisions. It impacts your ability to get a credit card, rent an apartment, buy a house or car, have utilities turned on in your name, and more. Of course, you want to avoid doing anything that would negatively affect your credit score, even if it means sticking out a bad relationship with a bank.

Read Also: 671 Credit Score Good

How Can I Wipe My Credit Clean

How to Clean Up Your Credit Report

How Long Will A Paid

It can take one or two billing cycles for a loan or credit card to appear as closed or paid off. Thats because lenders typically report monthly. Once it has been reported, it can be reflected in your credit score.

You can check your free credit report on NerdWallet to see when an account is reported as being closed.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Lindsay Konsko is a former staff writer covering credit cards and consumer credit for NerdWallet.Read more

Recommended Reading: Hutton Chase Reports To Credit Bureaus

Can I Have Closed Accounts Removed From My Credit Report

If you have closed accounts on your credit report that are not delinquent or hurting your credit, then there is no need to remove them. They may actually be helping your credit, even though they are closed.

Accounts that were closed in good standing should automatically fall off your after 10 years, while delinquent closed accounts will fall off your credit report after 7 years.

How To Remove Closed Accounts From Your Credit Report

If you need to attempt to remove a closed account from your especially one that includes inaccurate information or negative itemsthere are three ways to do so. You can either dispute inaccurate information with the , write a formal goodwill letter to request removal or simply wait until the account is removed after a period of time. Each of these approaches can be useful depending on your particular situation.

Read on to learn more about when to try each of these different methods for getting a closed account off your credit report.

Recommended Reading: Comenity Bank Pulls What Credit Bureau

Why You Should Never Pay A Collection Agency

On the other hand, paying an outstanding loan to a debt collection agency can hurt your credit score. … Any action on your credit report can negatively impact your credit score – even paying back loans. If you have an outstanding loan that’s a year or two old, it’s better for your credit report to avoid paying it.

Reduction Of Your Credit Mix

Closing an account can have a negative effect on your credit score because it can reduce your credit mix. The credit reporting bureaus reward those who have a more diverse mix of credit accounts, such as credit cards, auto loans, home loans, and student loans.

When you close down an account, you are effectively reducing your credit mix, which can cause a small drop in your credit score since youll have a less diverse pool of accounts. So, if you want to maintain your credit score or improve it, you should avoid closing down accounts.

Don’t Miss: The Higher Your Credit Score The Brainly

When Should You Remove An Account From Your Credit Report

Don’t try to remove an account that illustrates positive payment habits. Ventures that generate good credit are highly impactful, as they symbolize responsible credit habits.

You may wish to cancel the account because of high fees or poor service. It might be closed by the lender due to too many late payments, inactivity over a substantial period, or if the account is defaulted, meaning that you have broken agreed-upon terms regarding credit utilization and maintenance.

Always double-check your report before deciding to do anything. Fortunately, youâre entitled to a free credit report from either of the three bureaus once a year. Afterward, you can submit a dispute if any negative information is still present.

Additionally, your report will also indicate whether you or an external party closed the account.

How To Get Rid Of Closed Accounts On Your Credit Report

If your credit card has been closed, you can try calling your credit card issuer to ask if the account can be reopened, but dont wait too long.

If a closed account on your credit report is reporting inaccurately, then you can dispute it and have the update the account with the correct information or remove it.

Contact each credit bureau or check their websites for instructions on how to dispute accounts on your credit report.

Recommended Reading: Tri Merge Credit Report With Fico Scores

How Closing A Credit Card Account May Impact Credit Scores

Reading time: 2 minutes

Highlights:

-

Closing a credit card could change your debt to credit utilization ratio, which may impact credit scores

-

Closing a credit card account youve had for a long time may impact the length of your credit history

-

Paid-off credit cards that arent used for a certain period of time may be closed by the lender

Youve paid off your credit card, and youre wondering if you should close the account – and whether that might impact your credit scores, for better or worse. The answer depends on your unique credit situation.

Before you close a credit card account, consider the following:

- Closing a credit card could lower the amount of overall credit you have versus the amount of credit you’re using , which could impact your credit scores. You can calculate your debt to credit utilization ratio by adding all your available credit and all the debt you owe on those accounts. Divide the total debt by the total available credit. Creditors and lenders like to see a lower ratio of how much debt you have compared with how much available credit you have.

- Closing a credit card account youve had for a long time may impact the length of your credit history, which is another factor generally used to calculate credit scores. In general, creditors like to see youve been able to properly handle credit accounts over a period of time.

- If you have a paid-off credit card you haven’t used in a certain period of time, it may be declared inactive and closed by the lender.

Add Positive Data To Your Credit Report

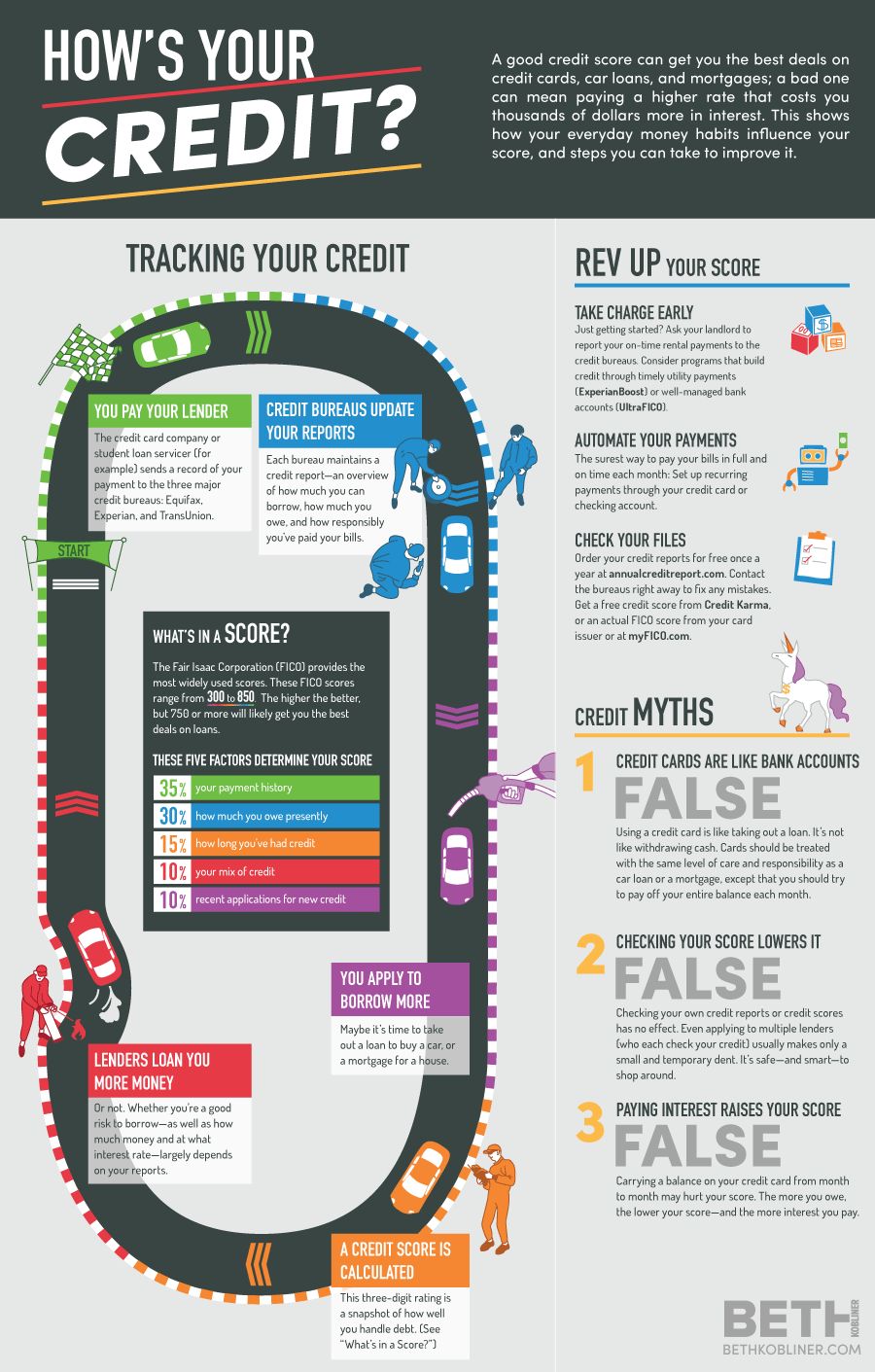

There are a couple of fairly new options that may be attractive to help raise your score, like Experian Boost and UltraFICO. These are programs that allow the consumer to supply positive data in their credit report that can be used to increase scores. This is especially effective for people with limited credit histories. Both are simple to use and results are seen instantly.

To use Experian Boost you must allow the credit bureau to access to your banking information in order to pull things like utility and phone bill payments. Positive payment histories are incorporated in your report and can add points to your score.UltraFICO looks at your checking and savings account information for positive data such as how much you have in savings, how active your accounts are and how long they have been open.

Both use only positive data and you can enroll or drop out at any time. Also, both only impact your Experian report, so keep that in mind. If you pay rent to a landlord that does not report to the bureaus, consider using a rent payment service that acts as a middleman when you pay your rent, enabling them to report positive rent payment history on your credit reports.

Read Also: Usaa Credit Check And Id Monitor

Removing Closed Accounts From Your Credit Report

In some cases, a closed account can be harmful to your credit score. This is especially true if the account was closed with a delinquency, like a late payment or, worse, a charge-off.

Payment history is 35% of your credit score, and any late payments can cause your credit score to drop, even if the payments were late after the account was closed.

Removing the account from your credit score could potentially lead to a credit score increase.

Removing a closed account from your credit report isn’t always easy, and is only possible in certain situations.

If the account on your credit report is actually open but incorrectly reported as closed, you can use the to have it listed as an open account. Providing proof of your account status will help your position.

Having a credit account reported as closed could be hurting your credit score, especially if the credit card has a balance. You can dispute any other inaccurate information regarding the closed account, like payments that were reported as late that were actually paid on time.

Is It Possible To Reset Your Credit Score

Unfortunately, there is no restart option when it comes to your credit history. … The whole point of the credit reporting system is to help lenders make decisions about potential borrowers based on their credit history. If people could get new credit reports, that would negate the value of the system.

Don’t Miss: Sywmc On Credit Report

Setting Yourself Up For Success

Now, lets say your credit score isnt perfect . There are plenty of things you can do to improve your credit score, even if you have inaccurate information recorded on your profile or a short credit history lifetime.

Your credit score is based on a variety of factors and can take a lot of time to build or repair, but you have the resources to change it with time and a healthy dose of dedication.

Here are a few ways you can work toward a better credit score in your future:

- Change your credit limit by paying off some of your balance or increasing your credit limit.

- Set up autopayto ensure youre making payments on time each month.

- Keep old accounts opento extend the lifetime of your credit age.

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

Read Also: Is Kornerstone Credit Legit

Dont Remove Closed Accounts Unless Negative

What does a closed account with a balance mean on your credit report?

When a creditor closes an account, they typically do so because the account is delinquent or has been charged off. A charge-off means that the creditor has written off the money as a loss and will not be trying to collect it.A closed account with a balance indicates that the account was once open and had a balance, but is now closed with a balance. The account may be closed because it was delinquent or because it was charged off.

Will paying off closed accounts help credit score?

Closed accounts dont have any effect on your credit score, so you wont see an improvement if you pay them off.

How long do Closed accounts affect your credit?

Closed accounts typically dont affect your credit. The credit scoring model that is used by FICO, for example, doesnt take into account the balance on an account if its closed.

How do I remove closed accounts from my credit report?

You can ask the credit reporting agencies to remove closed accounts from your credit report by contacting them and requesting that they do so.

Is it better to close a credit card or leave it open with a zero balance?

Closing a credit card will hurt your credit score. Its better to keep the account open and make regular payments, or to transfer the balance to another card with a lower interest rate.

Why do closed accounts affect credit score?Do I still owe money on a closed account?How can I quickly improve my credit score?