How To Unfreeze Credit With Experian

Experian is the only credit bureau that requires a PIN to unfreeze your credit.

An Experian credit freeze lift can be for a specific time theres no maximum. The online form warns, however, that you cant change the date range for unfreezing your credit once youve submitted it.

Experian also offers a single-use PIN that can help ensure your information is seen only by a creditor you authorize, so it isnt exposed needlessly. Experian gives you the PIN, and you give it to the entity checking your credit.

Contact info:Experian Experian Security Freeze, P.O. Box 9554, Allen, TX 75013 888-397-3742.

How Do You Freeze Your Credit At Each Bureau

To freeze your credit, which is different from locking your credit, contact each of the three major consumer credit bureaus Equifax, Experian and TransUnion and request a credit freeze.

When you make the request, youll need to provide your name, address, birth date and Social Security number. Youll then be asked a few questions to verify your identity and get a PIN that you can use to unfreeze and refreeze your as needed.

Note that a new federal law requires all three bureaus to offer freezes for free as of Sept. 21, 2018, according to the Federal Trade Commission.

Heres how to place a credit freeze at each of the three bureaus.

How To Unfreeze Credit

Unfreezing credit, sometimes called thawing, can be done on a temporary or permanent basis.

Itâs free to unfreeze your credit, but the process is different at each bureau. Hereâs what they say:

- Equifax: You can manage and unfreeze your account in multiple ways. But it might make sense to use the same method you used to place the freeze. You can , call 888-298-0045 or use the same form to submit a request through the mail.

- Experian: Make sure you have the PIN you were given when you placed your freeze. Itâs crucial whether youâre removing a freeze online or over the phone . If you donât remember your PIN, youâll have to go through the verification process again. You can also submit through the mail, but youâll need to provide the same information and documents used to freeze your credit.

- TransUnion: The bureau says that the simplest way to remove a freeze is to do it online. You may also be able to do it over the phone or through the mail. You can call TransUnion at 888-909-8872 to find out more.

Don’t Miss: How To Get Credit Report With Itin Number

Can A Credit Freeze Damage My Credit Score

No. A credit freeze does not damage your . It wont affect your credit score in any way.

A credit freeze also doesnt do these things, according to the FTC.

- Prevent you from obtaining your free annual credit report.

- Keep you from opening a new account, although youll need to lift the freeze temporarily.

- Prevent you from applying for a job, renting an apartment, or buying insurance. A freeze doesnt apply to these actions, according to the FTC. However, if youre doing any of these things, you may need to lift the freeze temporarily, either for a specific time or for a specific party, say, a potential landlord or employer. Its free to lift the freeze and free to place it again when youre done accessing your credit.

- Prevent a thief from making charges to your existing accounts. You still need to monitor your bank, credit card and insurance statements for fraudulent transactions.

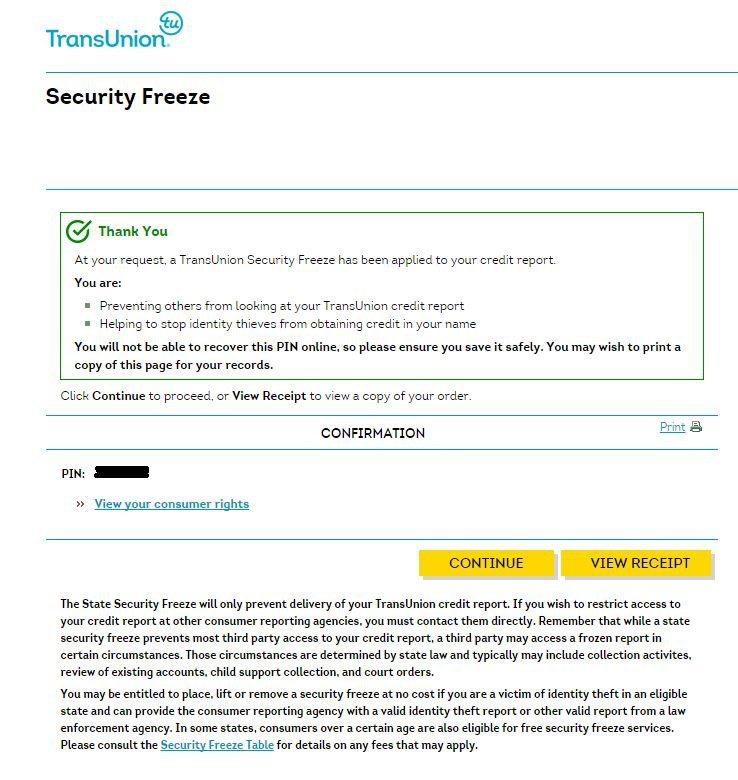

Freezing Your Transunion Credit Report

TransUnion is one of a trio of major U.S. credit bureaus, which also includes Equifax and Experian. These businesses collect consumer credit information and then sell it to other businesses. Freezing your TransUnion credit report lets the credit bureau know that it should not provide your credit information to other businesses. This information freeze has the effect of denying anyone from opening new credit accounts using your information.

Recommended Reading: Does Aarons Help Build Credit

How To Remove A Credit Freeze

How To Remove A Credit Freeze. There is no fee for indiana residents to place, temporarily lift, remove or request a new password or pin. Equifax, experian, transunion, and innovis) is able to sell personal financial identity data.the credit freeze locks the data at the consumer reporting.

How to request a security freeze. You will need them if you choose to lift the freeze with each bureau. Improve your credit score after a hard inquiry

Source: www.eatwell101.com

How to request a security freeze. A freeze or fraud alert will not affect your credit score, so go ahead and apply for that loan .

Source: www.currys.co.uk

To place a freeze, either use each credit agency’s online process or send a letter by certified mail to each of the three credit agencies. If you have a security freeze on your equifax credit report, you will need to remove it to lock your equifax credit report.

Source: www.us-appliance.com

If you are not planning to apply for new credit, you can put a credit freeze or security freeze on your credit report. Improve your credit score after a hard inquiry

Source: www.lowes.com

Its absolutely free to freeze and unfreeze your credit, and it wont affect your credit score. You may even want to consider a credit freeze or locking your credit

Source: www.eatwell101.comSource: www.sciencephoto.com

Keep the pins or passwords in a safe place. How to place a credit freeze

How Much Does A Credit Freeze Cost

Fees for instituting and lifting a freeze vary depending on where you live and whether you were a victim of identity theft. The typical range is between $5 and $10. People age 65 and older sometimes receive a discount.

If you are a victim of identity theft, you may be able to get your credit reports frozen for free. Youll need to provide a copy of the identity theft report you filed with the Federal Trade Commission.

This Equifax chart provides a helpful state-by-state breakdown of the costs associated with instituting a freeze, lifting a freeze or requesting a replacement PIN.

Once the bureau has processed your request, youll receive a confirmation letter and a PIN. Be sure to hang on to that PIN, as youll need it to lift the freeze. If you lose it, you can request a new one but there might be a fee.

Don’t Miss: Remove Student Loans From Credit Report

What Is The Difference Between A Fraud Alert And Credit Freeze

Equifax, experian, transunion, and innovis) is able to sell personal financial identity data.the credit freeze locks the data at the consumer reporting. Improve your credit score after a hard inquiry However, the alert may delay or interfere with or prohibit the timely approval of any subsequent requests or application you make regarding a new loan, credit, mortgage, insurance, rental housing, employment, investment, license, cellular phone, utilities,.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Ccb Mprcc

How Does A Credit Freeze Compare With A Fraud Alert

While to credit reports indefinitely, fraud alerts are temporary. An initial alert remains for one year, while an extended alert remains for seven. And while freezes must be removed before most access is granted, fraud alerts give lenders access to your credit reports and ask that they verify your identity before processing credit applications made under your name.

Compared with the process of lifting and reapplying a credit freeze at all three credit bureaus anytime you need to allow access to your report and scores, a fraud alert offers a more convenient and potentially safer alternative. A fraud alert stays in place while you continue to use your credit as normal, and won’t need to be lifted like a credit freeze would.

Unlike a credit freeze, when you request a fraud alert at any one of the three credit bureaus , alerts are automatically placed at all three bureaus. Removing fraud alerts before they expire will require you to contact each bureau separately.

Children & Identity Theft

Check to see if your child has a credit file. Many scammers get ahold of a child’s SSN and compromise it. Anyone under 18 is vulnerable because they have no credit history.

Thieves use children to file false tax returns or claim them as dependents. Scammers get credit cards and loans. Child identity fraud impacts 1 in 50 children and costs families almost $1 billion per year.

If you find your child has a credit file, you need to take advantage of lock credit report identity theft immediately.

Also Check: 611 Credit Score Mortgage

Freeze Your Credit With Experian Equifax And Transunion

Youll need to contact each of the three major credit reporting agencies individually to freeze your credit with them. You can do this online, via the phone, or through the U.S. mail.

The quickest and easiest way to freeze your credit is online. Heres how:

- Date of birth

- Social Security Number

You will also likely be asked some questions about prior places of residence and credit accounts you may have or have had in the past. This is all to ensure that you are actually the one requesting the freeze.

Who Can Access Frozen Credit Reports

A credit freeze makes your credit reports inaccessible to most people, with a few exceptions:

-

You can access your own records, including getting your free annual credit reports. You can also check your free credit report summary and score from NerdWallet while your credit reports are frozen.

-

Your current creditors still have access, as do debt collectors.

-

In certain circumstances, government or child support agencies can see them.

-

You can still give permission to an employer or potential employer to check your credit .

You May Like: Realpage Credit Inquiry

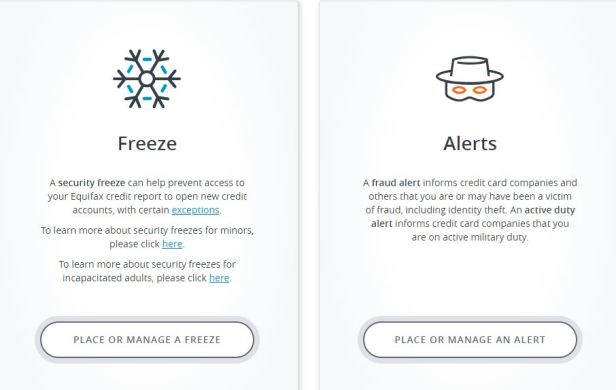

How To Freeze Your Equifax Credit Report

Equifax outlines three steps on its website to freeze your credit. Heres how it works.

1. Click the Get Started button2. Create an account.3. Place, temporarily lift, or permanently remove your freeze.

The website includes information about how you can place a security freeze for a child under 16 or an incapacitated adult.

Equifax offers a mobile app to lock or unlock your credit file.

Tip: When you go online to freeze your credit, remember to opt out if you dont want to receive pre-screened offers of credit or insurance that you didnt initiate. Youll need to click the Opt Out of Offers button to begin the process.Another option? You can visit www.optoutprescreen.com or call 888-567-8688 to opt out of offers from partners of TransUnion, Experian, Equifax, and Innovis.

Stay Alert Stay Protected

Concerned about identity theft or someone stealing your credit card number? Itâs important to take steps to secure your information and identity. Part of that might include freezing your credit.

You can also monitor your credit by regularly reviewing your credit reports. You can get free copies from all three bureaus by visiting AnnualCreditReport.com.

Another tool that might help is . Itâs free for everyone, even if youâre not a Capital One cardholder. And it has security features like dark web surveillance and an SSN Tracker to help you take action quicker if your personal information is compromised.

You can also use CreditWise to monitor your credit in other ways. It gives you access to your TransUnion credit report and weekly VantageScore® 3.0 credit score. Best of all, using CreditWise wonât hurt your scores.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

Read Also: How To Get A Repossession Off My Credit Report

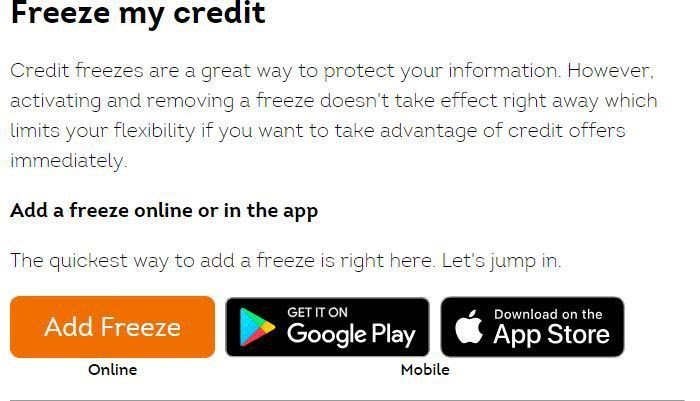

How To Freeze Your Credit For Free

Freezing your credit file for free is simply a matter of contacting each of the three credit bureaus and requesting a freeze. All three bureaus allow you to freeze your credit online:

- TransUnion: Visit www.TransUnion.com/credit-freeze

You can also initiate a freeze by phone.

When electing to freeze your credit, youll need to provide your name, Social Security number, date of birth, address, and phone number. If youre freezing your report online, youll also be asked to create an account using your email address and a unique password. From there, you just need to verify your identity and youre set.

Once your credits frozen, youll have to make another request to unfreeze it, but again, it wont cost you anything. Just be sure to consider the timing when unfreezing your credit file.

Rossman says the new law mandates that credit freezes be lifted in less than an hour, but he recommends giving yourself a longer window if youre planning to apply for credit soon after. If youre car shopping, for instance, he suggests lifting a freeze three business days before applying for a loan to avoid the odds of being caught in limbo waiting for financing to be approved because your credit file is inaccessible.

One other thing to note: The new law extends short-term fraud alerts to one year, versus the old 90-day limit. Placing a fraud alert on your credit file requires lenders to contact you to verify your identity when they receive an application for credit in your name.

Should I Temporarily Unfreeze My Credit Report

There are two ways to temporarily unfreeze credit:

- If you’re applying for a loan, you could ask your lender which bureau they use and unfreeze just that account for a specified date range, or you can unfreeze indefinitely and refreeze once the process is done. Just make sure not to forget to refreeze.

- You can lift a freeze for a specified number of days .

Temporarily unfreezing your credit is safer than permanently unfreezing credit, as it can still protect you against identity theft. Also, if you do a temporary unfreeze, you won’t need to worry about remembering to freeze your credit again.

Read Also: How To Unlock My Transunion Credit Report

Freezing Your Accounts At The Three Major Credit Bureaus Is The Best Way To Prevent Thieves From Opening New Credit Accounts In Your Name

Tony Cordoza

Not so long ago, a credit freeze was a tool usually reserved for people who had suffered identity theft. But as data breaches have piled up, the freeze has become more widely recognized as the most effective way to protect your credit, even if a thief hasn’t yet made fraudulent use of your personal information.

The reason: When you place a credit freeze on your credit reports, new creditors can’t review them to judge whether you’re eligible for a credit card or loan — and in turn, lenders are unlikely to grant credit to fraudsters posing as you. When you need to shop for credit, you can temporarily lift the freeze.

Do I have to pay? Nope. Placing and lifting a freeze is free at each of the major credit agencies, thanks to federal law.

To set up a credit freeze, take these three steps.

1. Gather your information. At a minimum, you’ll have to supply identifying information such as your Social Security number, birth date and address. If you haven’t lived at your current home for more than a couple of years, you may need to have your previous address on hand, too.

Think about the number you’d like to use for your PIN — don’t pick something obvious, such as your birth date — and of passwords that you can use for your Equifax and TransUnion accounts, if you choose to place the freezes online. Keep a pen and paper handy to jot down your PINs and passwords.

Equifax Information Services LLC,P.O. Box 105788,Atlanta, GA 30348

888-298-0045

888-397-3742

888-909-8872

Get Started With Freeze For Free Through Our Transunion Service Center Where You Can:

- Control who can access your credit information with Credit FreezeAre you applying for credit or has a lender referred you here to lift a freeze on your TransUnion credit report? Youre in the right place.

- Manage or fix any inaccuracies on your credit report

- Place Fraud Alerts to protect your identity

- Add a note to your report around any COVID-19 or other financial considerations

Dont Miss: What Company Is Syncb Ppc

You May Like: Credit Score To Get Care Credit

How To Temporarily Or Permanently Lift The Freeze

The freeze generally remains in place until you choose to lift or “thaw” it. When you place a credit freeze on your file, you’ll receive a personal identification number or password that you can use to:

- permanently lift the freeze or

- temporarily lift the freeze for a specific party or amount of time.

Under federal law, the bureau must lift the security freeze not later than:

- one hour after receiving the request, if you make the request by toll-free telephone or secure electronic means, or

- three business days after receiving the request, if you make the request by mail. .

What Is Identity Theft And Credit Freeze

According to the FTC, identity theft harms almost nine million Americans per year.

While the internet is responsible for the growth of freeze credit identity theft, this violation has been around longer than the internet. The crime isn’t, and never has been, just the act of strangers hovering over a remote computer. Family members, neighbors, friends, and co-workers can all victimize you by, say, simply going through your garbage.

All they need is your:

- Name

- Phone number

- Bank or credit card statements

Once someone has your personal information, they can use it to gather more data about you. Ultimately, they use the info to commit identity fraud.

The scammers clean out bank accounts, take out loans, open or use existing financial instruments to put you in debt. Victims have lost their homes, cars, and more. Collectors bombard victims they believe owe money.

Read Also: How To Check Hard Inquiries Credit Karma