How Not To Get Rid Of A Timeshare In A Pandemic

One thing about getting rid of a timeshare hasn’t changed. There are some ways you should not try to exit. The Federal Trade Commission issued a recent warning against timeshare resellers, noting that some of them prey on seniors by taking money up front and then failing to sell the timeshare.;

“Never hire someone without checking out their background first and never pay an up-front payment before any services are provided,” says FTC spokesman Mitch Katz.

The situation has gotten worse in the last two months, according to Gordon Newton, author of The Consumer’s Guide to Timeshare Exit.;

“Right now, it is critical that timeshare owners are aware that there are so many new entrants in the timeshare exit space,” he says. “I’ve counted over a dozen since the start of the pandemic. Many of these companies have no experience in the timeshare exit business and there is no regulation to stop anyone from opening a timeshare exit company.”

Only trust a company with a proven track record of helping timeshare owners, he says.

“There are so many scams out there in the timeshare exit space,” he adds.

How do you know if a timeshare exit company is legit? You should ask three questions about any company you’re thinking of hiring:

1. Has the company been in business for at least five years?

2. Does it have a history of positive reviews online?

3. What kind of guarantees does it offer and how can it back up the promise?

Should you stop paying your fees if you can’t?

Getty

Deed In Lieu Vs Foreclosure

If youre facing foreclosure, a deed in lieu can protect you from a formal foreclosure process. There are still significant consequences for your credit and your prospects for getting a mortgage in the near future. For this reason, you should look at all other options and only use a deed in lieu of foreclosure as a last resort.

How To Remove A Foreclosure From My Credit Report

It is very common for people to wonder how to remove a foreclosure once it has been placed on their credit report. If this sounds familiar, you are not alone. This is especially true if you are looking to purchase a new home or refinance an existing mortgage loan. Foreclosures can be tricky and they can take a long time to get removed from your credit report.

The problem with having a foreclosure listed on your credit report is that it hurts your credit score. In fact, it will have a very negative impact. A foreclosure should be avoided at all costs, even if you are looking forward to starting a home buying campaign. There are some options that can be used in order to remove a foreclosure. One of the most effective methods involves a short sale.

Foreclosure listings are usually placed in three credit bureaus: Transunion, Experian and Equifax. These credit bureaus are required by law to keep information about all transactions involving homeowners in their credit reports. This information is important for the credit reporting agencies to determine what loans are worth offering home loans. If you want to know how to remove a foreclosure from your credit report, a short sale is the way to go. A short sale allows home owners to sell their property for less than what they owe the mortgage company before the end of the contract.

Read Also: Cbcinnovis Credit Inquiry

Types Of Timeshare Properties

If you;fall behind on your timeshare payments, the process for what happens next depends on the type of timeshare that you own. The two main types are:

- Deeded:;All timeshare owners in a deeded property own a certain percentage of the property. If you own this type, youll have a deed to the property and written rules about its use. For example, you might have the property for two weeks each year.

- Right-to-Use:;In this type of timeshare, you dont have any ownership in the actual property, but you pay for the right to use the property for a certain amount of time each year, for a specified number of years. You dont have a deed or own real property in this type of timeshare.

If a timeshare is a right-to-use type of property, and the owner fails to make payments, it wouldnt go through a foreclosure process, but would instead likely be repossessed. For a foreclosure to occur, the timeshare property would have to be a deeded timeshare. With this type of property, the owner signs a mortgage or deed of trust, which allows the lender to foreclose when payments are missed.

Timeshare Exit Team Reviews: Know Your Timeshare Exit Options

When you bought a timeshare, you probably never thought you would be up late at night, losing sleep, googling timeshare exit team reviews. But here you are needing to know how to get out of a timeshare without losing any more money. ; You may feel like you have tried everything and getting out of your timeshare without losing a huge chunk of changes feels impossible. You probably called the timesRead More About Timeshare Exit

Read Also: What Credit Score Does Carmax Use

Waiting Period After Timeshare Foreclosure

Is A Timeshare Foreclosure Considered Mortgage Foreclosure? A timeshare, foreclosure on the credit report is treated like regular residential home foreclosure. As reported on a credit report, it can significantly drop credit scores. A timeshare, the foreclosure will stay on the credit report for 7 years like any other foreclosures. Timeshare Foreclosure Considered Mortgage Foreclosure? On the credit report yes, but not with mortgage lenders. Timeshare foreclosures have been skyrocketing after the 2008 real estate and banking collapse. Most lenders will treat Timeshare Foreclosure Considered Mortgage Foreclosure. If a lender treats timeshare, foreclosure considered mortgage foreclosure, then they will require a three-year waiting period. FHA Borrowers with a foreclosure on their record need to wait 3 years from the recorded date of the foreclosure for them to qualify for FHA Loans. Many lenders can treat a timeshare, foreclosure as a regular foreclosure. But per HUD mortgage lending guidelines, a timeshare is not treated as a regular foreclosure and is treated as consumer debt. Gustan Cho Associatesdoes not treat Timeshare Foreclosure as a real estate foreclosure so we do not have any waiting period after foreclosures on timeshares.

How To Fix Your Credit By Yourself

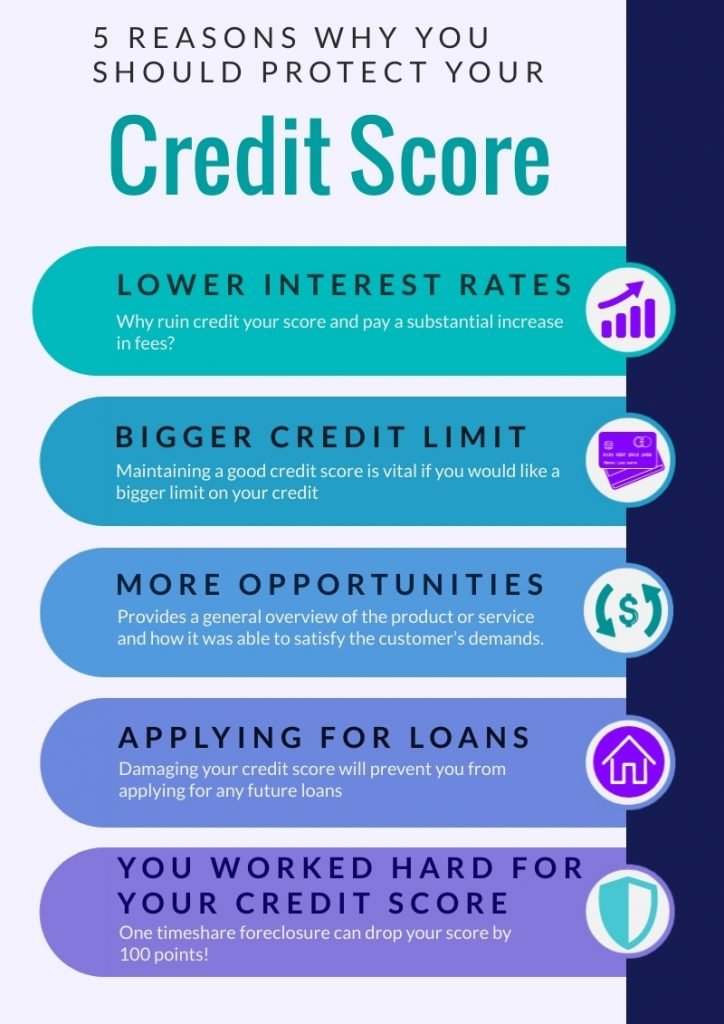

Bad credit can remain on your report for 7-10 years, and theres no quick way of fixing it. Credit factors such as missed or late payments, bankruptcies, sent to collections, or in this case, a timeshare foreclosure can genuinely put your credit score in jeopardy. Below are a couple of steps you can take to start rebuilding your credit score on your own.

- Improve Your Payment History

Maintaining a current status on your payments will always have a positive impact on your score. The more missed payments that you, the more these negative marks will drive down your credit score.;

- Be Cautious of New Credit Accounts

Opening numerous credit accounts within a short period could drop your credit score as well. Stay in control, open credit lines at a steady pace.

- Take Into Consideration the Number of Accounts

Multiple accounts, all with debt, can drastically lower your credit score as well. You should start paying some of these accounts off. However, the accounts in good debt standings can be beneficial if you leave them open and pay them off with time.

Your credit utilization ratio is the sum of all your debt, divided by the total credit, then multiplied by 100 to get a percentage. The lower the credit utilization ratio, the less negative impact it will have on your score. In other words, keep your balances low.;

- Stay In Control

Recommended Reading: Does Paypal Report To The Credit Bureaus

How Does Foreclosure Affect My Credit

Youre probably feeling the pain of how much foreclosure affects credit. Some sources say it can knock down your score by as much as 400 points, which leaves you with a very poor credit score. Nobody knows the exact impact.

Each agency has unique rules and weights for every bit of information on your credit report. One company may weigh open collections heavily, while another gives more weight to a recent missed credit card payment.

It takes time, effort, and persistence to bounce back from foreclosure. Unfortunately, not a lot of us have time. You may be in a tough spot financially from moving and the many other changes youve gone through.

What Is Deed In Lieu Of Foreclosure

A deed in lieu agreement is an arrangement where you give your mortgage lender the deed to your home. Homeowners agree to deed in lieu agreements to avoid foreclosure.

Foreclosures show up on your credit report, which can make it virtually impossible for you to buy another home for years. A deed in lieu of foreclosure can release you from your mortgage responsibilities and allow you to avoid a foreclosure on your credit report.

When you hand over the deed, the lender releases its lien on the property. This allows the lender to recoup some of the losses without forcing you into foreclosure. When you turn over your deed, the lender also releases you from anything else you owe on the mortgage. Many homeowners seek deed in lieu agreements when their mortgage ends up underwater, meaning they owe more on their home than the home is worth.

Get approved to refinance.

You May Like: Syncb/ppc On Credit Report

How Much Does Timeshare Foreclosure Affect Your Credit Score

According to nolo.com, a foreclosure will drop your FICO score at least 100 points. FICO credit scores, which happen to be the most popular type of credit score, range from 300-850. This means that a timeshare foreclosure could hand you a significant loss in your score.

Nolo.com goes on to talk about how a timeshare foreclosure will have more of an effect on an owner who holds a higher credit rating, as opposed to an owner whose credit score is already lower.

If you find yourself in a situation that continues to throw a financial burden on your family, you might want to start examining other options to get out of your timeshare.

How Does A Foreclosure Affect Your Credit

You can expect to lose anywhere from 85-160 points on your credit score when the foreclosure first hits your credit report. If your credit score was good to start with, expect a much sharper drop than if your credit was already poor or average.

In most cases, you will not be able to qualify for a new credit card, auto loan, or mortgage immediately after a foreclosure. In addition, you may also see the interest rates on your current credit cards rise due to the drop.

You May Like: Syncb/ppc Credit Card

How To Avoid A Foreclosure Before It Affects My Credit

If your mortgage loan servicer has already started foreclosure proceedings, you may not be able to stop the process.

But if youre struggling with delinquencies but the bank hasnt foreclosed yet, theres still time to prevent the foreclosure.

Always remember that your lender makes money when you make regular payments with interest for the life of the loan. Foreclosing is a last resort for the lender.

So you should get in touch with your lender or loan servicer immediately. Most servicers now have ways they can help you avoid foreclosure.

Some borrowers instinctively ignore bad news from their lenders. They dont answer the phone and throw away mortgage statements. This is the worst idea.

Even when its painful or embarrassing, you need to get in touch with your lender. Answer the phone. Open the mail. Call them and say youre having trouble making the payments and need some help before its too late.

If you truly cant afford to make the payments and want out of the home loan, try to sell the home and pay off the loan balance yourself. Your future personal finances will thank you.

Timeshare Cancellation: You Can Count On Us

Good News If You Need A Timeshare Cancellation!; If you are a timeshare owner, who can NOT sleep at night because you want a;timeshare cancellation;but you need to know;how to get out of a timeshare, then keep reading. We talk to so many people who are just like you.; Here is good news,;we can;help; you;get a;timeshare cancellation. Just to know that there is relief out there that can reRead More About Timeshare Exit

Don’t Miss: Paypal Credit Soft Pull

Deed In Lieu Vs Foreclosure: Whats The Difference

A deed in lieu is different from a foreclosure. A deed in lieu means you and your lender reach a mutual understanding that you cannot make your loan payments. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably.

In exchange, the lender releases you from your obligations under the mortgage. Your lender might even offer you a bit of financial assistance as an incentive to keep the property in good shape before you leave. Though a deed in lieu will show up on your credit report, its impact isnt as severe as a foreclosure.

Your lender must go through the proper legal channels to remove you and take back control over the property in the event of a foreclosure. Though a foreclosure is an immediate solution to falling behind on your payments, it comes with many drawbacks. A foreclosure will impair your credit score and stay on your credit report for 7 years. During this time, it will be impossible for you to buy another home unless youre able to pay cash for the home. Your lender is also unlikely to offer you a financial incentive to leave the property if you allow the home to go into foreclosure.

Get approved to refinance.

How Much Does A Foreclosure Affect My Credit

Scoring systems used by both FICO® and VantageScore® consider foreclosure a derogatory event. And while the impact to credit scores will vary by consumer, it’s safe to say that a foreclosure can be very problematic.

The foreclosure itself, as well as the late payments that preceded it, will have a major impact on your credit scoresespecially if your scores were high to begin with. If your score is on the high end of the scale, you may see a much more significant impact than someone whose credit score is lower.

In addition to a foreclosure’s potential impact on your credit scores, it may also cause you to face consequences due to mortgage policies published by Fannie Mae and Freddie Mac. You may not be eligible for either a Fannie Mae- or Freddie Mac-backed loan for several years if you’ve gone through a foreclosure. This penalty is called a mandatory waiting period, and it may freeze you out of the homebuying market for as long as seven years regardless of how well your credit scores have recovered.

Don’t Miss: Carmax Credit Score Requirements

Understanding The Process Of Timeshare Foreclosure

If you fail to make timely timeshare mortgage payments over a certain period of time or have stopped paying your maintenance fees altogether as outlined above, your timeshare could eventually be foreclosed on. What is the timeshare foreclosure process? Foreclosure is a legal process that involves the timeshare company going to court for breach of contract to get a lien on your timeshare if you should default in the payment of your timeshare loan, as well as any other costs, fees and assessments associated with the specific timeshare in question. Be aware that the foreclosure process for timeshares varies from state to state since timeshares are governed by state law. For example, in 2010 Florida passed a timeshare foreclosure law that shortened the amount of time needed to process a timeshare foreclosure from 18 months to just 90 days. However, in other states, the foreclosure process could still take up to a year or more.

Note that state law often outlines the requirements for how and when timeshare liens can be foreclosed. For example, the timeshare company can foreclose on the lien either through judicial foreclosure or a nonjudicial or out-of-court process based on state law and the terms outlined in the specific timeshare declaration.

Can I Get A Foreclosure Removed From My Credit Report

When you borrow money to finance a home purchase, the home you buy acts as collateral on the loan. If you’re not able to make your monthly mortgage payments, your lender may take your home through a legal process called foreclosure.

Mortgage lenders and servicers generally report foreclosures to the three major , which will then add it to your credit reports. As long as the foreclosure is legitimate, it cannot be removed from your credit reports until it has run its full seven-year credit reporting lifecycle.

Read Also: What Credit Score Does Carmax Use

You Might Face A Deficiency Judgment Or Tax Implications

Following a timeshare foreclosure, you could face a deficiency judgmentthough most timeshare lenders only go after the property. Still, your case might be the exception.

What is a deficiency judgment? In a foreclosure, the borrower’s total debt sometimes exceeds the foreclosure sale price. The difference between the sale price and the total debt is called a “deficiency.” For example, say the total debt owed for a timeshare is $15,000, but the foreclosure sale brings only $10,000. The deficiency is $5,000. Some states allow the foreclosing bank to seek a personal judgment, which is called a “deficiency judgment,” against the borrower for this amount.

State law sometimes prohibits a deficiency judgment. Whether you’ll face a deficiency judgment after a timeshare foreclosure depends on state law and whether the lender decides to go after you for one. In Florida, for instance, the borrower isn’t subject to a deficiency judgment after a timeshare foreclosure even if the proceeds from the sale of the timeshare are insufficient to cover the debt. ).

Tax implications. If the lender decides to write off the deficiency balance instead and sends you a 1099-C, “Cancellation of Debt” form, you might have to include this amount in your taxable income, unless you qualify for an exception or exclusion.