Cluster Your Hard Credit Inquiries

By grouping your mortgage or credit card applications into the same two-week window, credit reporting bureaus will usually view them as a singular inquiry. But if you apply for a mortgage and five months later apply for a credit card, you may find a drop in your rating due to those multiple inquiries. Those small dings add up and eventually, they can affect your interest rates.

Try A Store Credit Card

Most store credit cards offer charging privileges only at the issuing store and its brands or partners and work the same as other credit cards, though they may be easier to get approved for compared with traditional credit cards. Some may even offer rewards on purchases.

What you have to watch out for, however, are the annual percentage rate and the credit limit. Because store credit cards may have lower credit requirements for approval, they may charge a higher APR, which means that carrying a balance on one of these cards month to month could cost you more money. And a low credit limit means that you could max your card out quickly, leading to a higher , which can lower your credit score.

Open A Uk Bank Account

If you haven’t already got one, having a UK bank account benefits your credit report in three ways:

-

A long-held bank account can make you appear more stable to lenders, as it proves you have a good ongoing relationship with your bank

-

It allows lenders to verify your residency

-

It helps you manage your money and make payments on time, which ultimately affects your credit score

To open a bank account, youâll usually need proof of ID and proof of your address. If you live with your parents or have recently moved to the UK, getting proof of address can be a challenge. But donât worry. Hereâs how you can get around it:

-

Skip ahead to step 2 and step 3, then open a bank account once you have a utility bill or other acceptable proof of address.

-

Consider a digital alternative such as Starling Bank– a bank aimed specifically at people who donât have proof of address.

Recommended Reading: What Is A Good Credit Score To Get A Car

How To Improve Your Credit Score By Closing Old Accounts

Close any credit card or store card accounts you no longer use because a new lender will wonder why you want another line of credit if you already have plenty open to you. Make sure all old accounts are debt-free. Even owing a few pence on an old catalogue account or not clearing a mobile phone bill could cost you dearly.

Why Do I Need To Know How To Improve My Credit Score

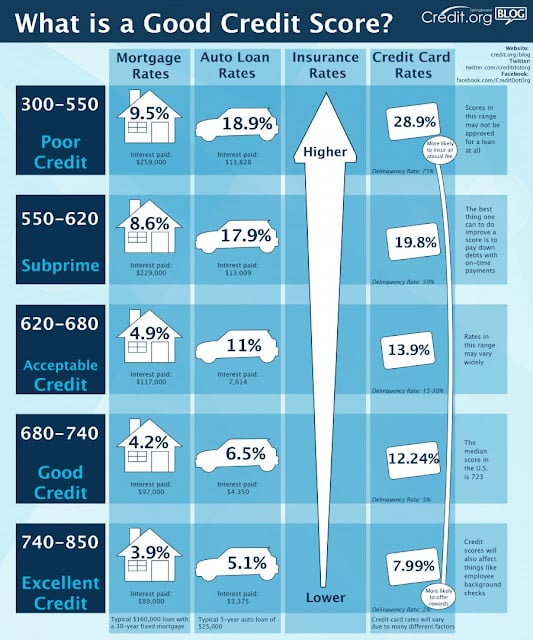

Boosting your credit score means that you become a desirable candidate for borrowing. Having your score looking ship-shape means youre also likely to pay less for loans. This may be for a personal loan or if you need to remortgage with a different lender. When you want to rent a property there will be a credit check and the same goes if you want to enter a new mobile phone contract.

James Jones, head of consumer affairs at Experian says: As well as the key to being accepted for loans and credit cards, a good score can be kind to your pocket as it will increase your chances of securing the best deals, such as the headline interest rates, which are often reserved for the top scorers.

Loan and credit card providers only need to offer their headline rate to 51% of successful customers. The remaining 49% can be offered a different deal which is dependent on your credit worthiness.

Don’t Miss: How To Report Credit Card Fraud To Amazon

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

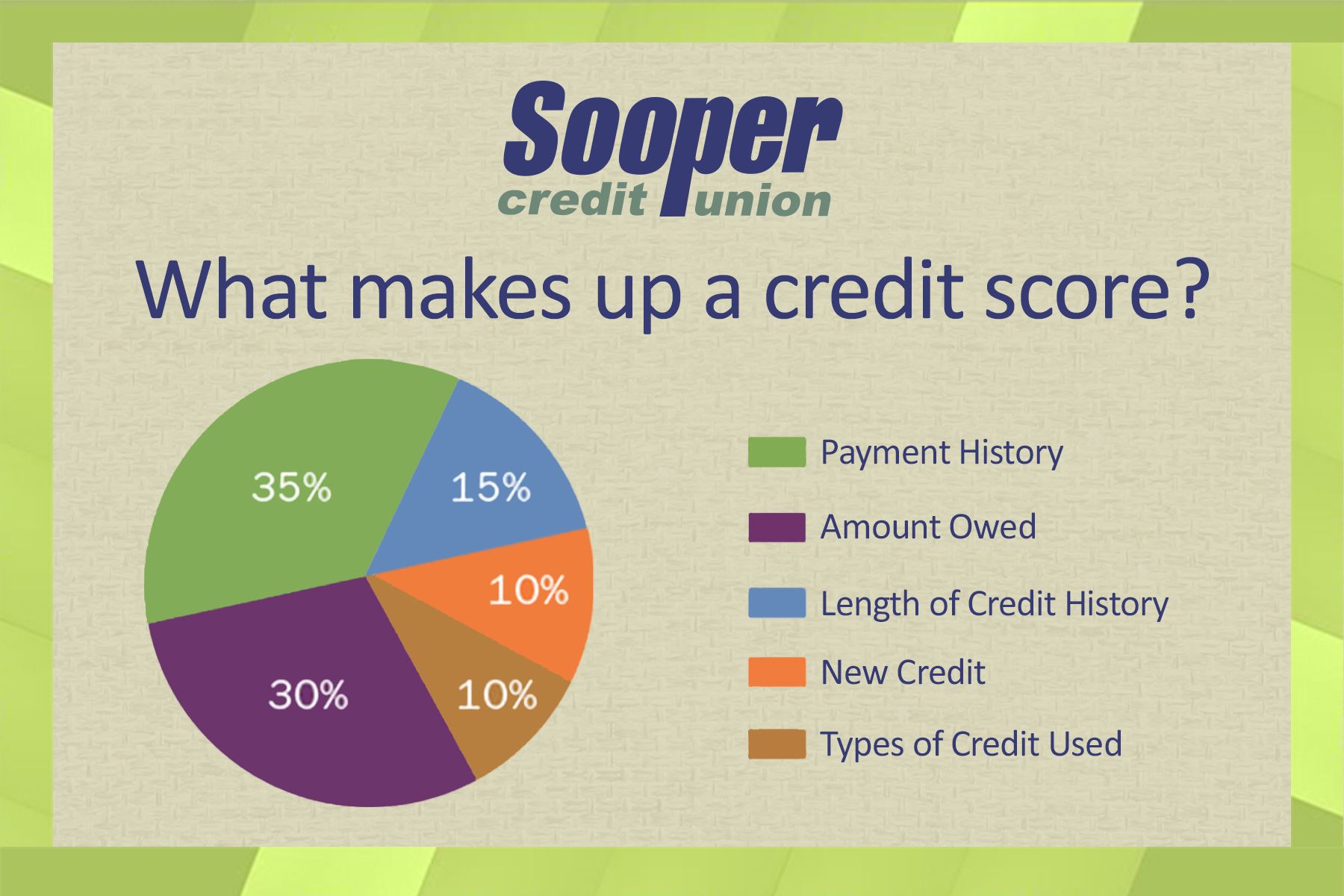

The Truth About Raising Your Credit Scores Fast

While a lucky few may be in a situation where they can raise their credit scores quickly, the bottom line for most of us is that building credit takes time and discipline, especially if youre trying to rebuild bad credit. Thats because your credit scores are complex and made up of several interconnected factors .

So trust us: While some credit repair agencies may promise to raise your credit scores fast, theres no secret that will help boost your credit scores quickly.

But if you start developing healthy habits now, you can build credit over time all by yourself.

Recommended Reading: What Credit Score Do You Start Out With

How To Improve Your Credit Score

There are things you can do to increase your credit score no matter your credit situation. Learn the basics of how to build credit, how to use credit cards and practice positive credit behavior.

Reading time: 7 minutes

Highlights:

- If you’re looking to improve your credit score and establish positive credit behavior, there are multiple options available.

- Start the process by learning how credit scores are calculated so you can practice positive credit behavior.

- Remember: Improving your credit score takes effort and patience. There’s no one-size-fits-all solution that will increase your credit score overnight.

Many banks and credit card companies offer credit score dashboards and maybe you’ve already checked yours. Now, you want to know how to increase your credit score. The good news is, with effort and patience, it’s possible regardless of your unique credit situation.

Before we dive into the ways you can improve your credit score, let’s start with some basics.

Only Apply For Credit You Need

Every time you apply for a new line of credit, a hard inquiry is pulled on your report. This type of inquiry lowers your score temporarily. Applying just to see if you get approved or because you received a pre-qualified offer of credit is not a good idea.

If its a single hard credit pull, the drop will be slight. However, a string of hard inquiries could signal to lenders that you are taking on too much debt. The effects of a hard credit pull on your score, according to a representative of TransUnion, can last up to 12 months.

If you do need to apply for new credit, research your likelihood of approval to ensure youre a good candidate before applying. If possible, get a pre-approval or pre-qualification, as in many instances these result in a soft rather than hard credit pull. Soft pulls dont affect your credit score You dont want to risk lowering your score for a denied application.

You should also refrain from applying for several credit cards within a short time frame, or before taking out a large loan like a mortgage.

When you shop for a mortgage, auto, or personal loan, you can keep hard inquiries to a minimum by making rate comparisons within a short time period. Applications for the same type of loan within a designated time frame will only appear as a single hard inquiry. According to FICO, this span can vary from 14 to 45 days.

Don’t Miss: Do Payday Loans Show On Credit Report Australia

How To Improve Your Credit Score By Using A Credit Report Package

Some of the agencies offer a service that says will boost your credit score. Experian Boost uses Open Banking to factor additional positive information from your bank account into your credit score calculation, such as payments to digital streaming services like Netflix and Spotify. It is free of charge.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

You May Like: What Is A Fair Credit Score Range

Ask For Higher Credit Limits

When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit. If your income has gone up or you’ve added more years of positive credit experience, you have a decent shot at getting a higher limit.

Impact: Highly influential, because utilization is a large factor in credit scores.

Time commitment: Low. Contact your credit card issuer to ask about getting a higher limit. See if it’s possible to avoid a hard credit inquiry, which can temporarily drop your score a few points.

How fast it could work: Fast. Once the higher limit is reported to credit bureaus, it will lower your overall credit utilization as long as you don’t use up the extra “room” on the card.

Buy A Home With Renewed Confidence

![The Fastest Ways to Build Credit [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/the-fastest-ways-to-build-credit-infographic-ways-to-build-credit.jpeg)

Once youve taken the necessary steps and seen an improvement in your credit score, its time to apply for a home loan with improved confidence. ooba Home Loans can apply to multiple banks on your behalf, giving you the best chance of home loan approval, as some banks may have stricter lending criteria than others.

They also offer a range of tools that can make the home-buying process easier. Start with their Bond Calculator, then use the ooba Home Loans Bond Indicator to determine what you can afford. When youre ready, you can apply for a home loan.

Do you know your credit score?

Check your credit score for free in minutes.

Recommended Reading: Does Car Insurance Check Credit Report

How Long Does It Take To See Changes In Your Credit Score

The amount of time it takes to improve a damaged credit score varies depending on your circumstances, but it will likely require a bit of patience and won’t happen right away.

Some negative factors are easier to overcome than others. For example, it may take you less time to bounce back from one late payment or a few hard inquiries than from a foreclosure or having an account go into collections.

Most negative information, like late payments, will generally remain on your credit report for up to seven years. However, Chapter 7 bankruptcies can linger for up to 10 years.

Just remember: Improving your credit score takes effort and patience. There’s no one-size-fits-all solution that will change your credit score overnight.

Reduce Your Credit Ratio

The gap between the amount you owe and the limit to your credit affects your credit record. This is known as your credit utilization ratio. For example, if your available credit is R20 000 and you owe R10 000, your credit utilization ratio is 50%.

A good rule of thumb is to keep your credit utilization ratio at 30% or lower. So in the above example, paying down what you owe in order to reduce the 50% rate to 30% will boost your credit score. Paying your account before the due date also increases your score.

The credit utilization ratio is one of the primary factors in determining your credit score, along with payment history.

Read Also: Does A Soft Pull Affect Credit Score

Apply For New Credit Only When Necessary

Try not to apply for new credit more than once every three months. Whenever you apply for new credit it will show up on your credit report, and it’s known as a “hard enquiry”. One hard enquiry isn’t concerning, but if many are made in a short period then this could reduce your credit score. A lender might perceive too many applications as a sign you’re desperate for credit, or careless with money.

- How it helps you improve: In comparison to taking out new credit, which may impact your score negatively, a pattern of not applying for any new credit may show an effort to reduce your credit.

How I Raised My Credit Score Over 100 Points

Raising my credit score with a secured card took some disciplined, conscientious spending.

Here are the rules I followed to maximize the benefits of my secured credit card.

- Spend what you have: After I received my secured card and started spending, I made sure that I would only spend money I already had or would receive, before the next pay period.

- Pay often: I ended up paying off my credit card roughly four times a month to ensure I never carried a balance from one month to the next.

- Know your limits: I would never let my credit limit exceed $800, and I would never pay it off if the card balance was under $300 unless the pay period was coming to an end.

- Make purchases: I would put every penny of my spending on the credit card from the smallest expenses such as a drink from the gas station to major purchases such as airline tickets or hotel rooms.

- Be consistent: I repeated this process for 5 months to establish a credit history of regular use and always pay on time.

Read Also: How Many Years Does Debt Stay On Your Credit Report

Deal With Collections Accounts

Paying off a collections account removes the threat that you will be sued over the debt, and you may be able to persuade the collection agency to stop reporting the debt once you pay it. You can also remove collections accounts from your credit reports if they aren’t accurate or are too old to be listed.

Impact: Varies. An account in collections is a serious negative mark on your credit report, so if the collector agrees to stop reporting the account it could help a great deal.

If the collector keeps reporting the account, the effect depends on the scoring model used to create your score. The FICO 8 model, which is most widely used for credit decisions, still takes paid collections into account. However, more recent FICO models and VantageScores ignore paid-off collections.

Time commitment: Medium. You’ll need to request and read your credit reports, then make a plan to handle collections accounts that are listed.

How fast it could work: Moderately quickly. On credit scores that ignore paid collections, such as VantageScore and newer FICOs, as soon as the paid-off status is reported to credit bureaus it can benefit your scores. In other cases, such as disputing a collection account or asking for a goodwill deletion, the process could take a few months.

S To Improve Your Credit Score Right Now

Leslie Cook11 min read

Having a good credit score can help you improve your financial health, especially in times of economic uncertainty.

Interest rates are on the rise on all kinds of products, from student and personal loans to and mortgages. As a result, it’s more expensive to borrow money than in previous years. The good news is that a higher credit score can help you qualify for a lower rate when you apply for a new line of credit or refinance an existing loan. A lower score can also bring down the amount of money you’re on the hook for with your monthly payments, which frees up cash that can be put into your savings account or used for other expenses.

Increasing your credit score takes work and patience. If you aren’t sure how to start, the following steps will get you on the right track.

Also Check: Does Your Credit Score Drop When You Check It

Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

Periodically Use Dormant Credit Cards

As your credit history grows, you likely qualify for credit cards with better rewards and interest rates. Instead of closing your first credit card, make occasional purchases to keep it active.

When you keep the card active, banks are less likely to reduce your credit limit or close the card. The credit bureaus look at each revolving credit account’s credit utilization ratio as well as your overall credit utilization ratio.

A credit line decrease impacts your total credit utilization ratio.

Closing an old credit card account can also hurt your score. If your old card charges an annual fee, see if you can downgrade it to one without an annual fee. You maintain your account history and that continues to strengthen your credit.

You May Like: Is 773 A Good Credit Score

Action #: Get A Cell Phone With A Contract

I knowits cheaper to buy your own phone or go with the low-cost mobile providers like Koodo or Wind. But applying for a cell phone on a contract is a great way to start rebuilding your credit history.

You can often offer phone companies a deposit if they deny you based on your credit history.

Major phone companies report your payment habits to the credit bureaus.

Tip: pay your bill every month. Set-up automatic payments with your bank if this helps. Paying your bills on time every month will dramatically help to improve your credit rating. This means on the day they are due. All the reporting is automatic, so even three days late makes a difference. Pay your bills a few days earlier if possible.