Average Credit Score By State

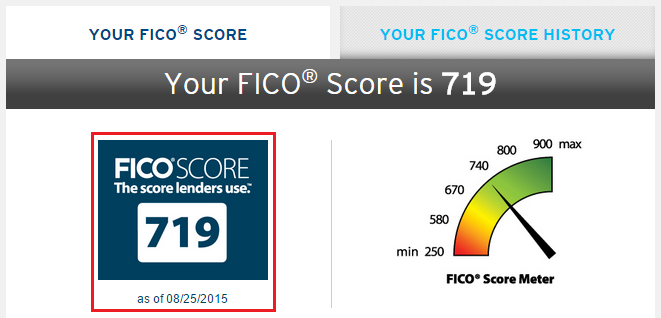

Finances look very different across all 50 states, and the average credit score looks pretty different, too. While Mississippi has the lowest average credit score, Minnesota has the highest credit score at 720. Here’s the average credit score in each US state and the District of Columbia, according to data from Experian.

| State | Average credit score in October 2020 |

| Alabama | |

| 719 |

Have At Least Three Credit Cards But Only Use One

This first step comes completely from my own experience after experimenting with different techniques.

To optimize your credit score, it works best to have no more and no less than three major credit cards.

These cards should have long, good payment histories, and low credit utilization .

Its best to use only one of these cards on a regular basis and simply keep the other two cards with a $0 balance.

Its not that you cant ever use the other two cards, but generally, I like to keep their balances at zero. This technique will maximize your credit score.

Estimated Monthly Payments For New Car Loan Of $20000 By Credit Score

|

$373 |

$279 |

*Sample Quote For Credit Scores of 700 to 709. ;Single digit credit score changes dont change the payment, so a 701, 705, and 708 score should all cost the same. ; Assumes $2,000 down payment. ;Scores sourced from Nerd Wallet site and are accurate as of 7/8/19. ;All loan payment amounts are based on a new car loan APR interest rate of 4.56% for prime borrowers with a credit score of 660 to 780. ;The loan terms included in this chart are for 3 years , 5 years , and 7 years . However, speak to your lender about additional loan options for new, used, or refinancing. ;Dont forget to ask about their auto ;loan payment terms that cover; 1 year , 2 years , 4 years , 6 years , 8 years , 9 years , and 10 years . This is not an offer for a loan or a loan approval. Rates and stipulations change by state, income, credit score, and a variety of other factors. For informational purposes only. ;

|

$560 |

$418 |

Don’t Miss: Is 584 A Good Credit Score

What Credit Score Do You Need To Buy A House

The minimum credit score required for a mortgage loan can vary based on the type of loan and the lender offering it. That said, here’s a general idea of what you can expect with different types of mortgage loans:

- Conventional loans: The most popular loan type typically comes with a 620 minimum credit score.

- Jumbo loans: These loans exceed the maximum amount for conforming loans, jumbo loans typically have a higher credit score requirement at 680 or above.

- Federal Housing Administration loans: With a 3.5% down payment, homebuyers may be able to get an FHA loan with a 580 credit score or higher. If you can manage a 10% down payment, though, that minimum goes as low as 500.

- U.S. Department of Veterans Affairs loans: VA loans don’t technically have a minimum credit score, but lenders will typically require between 580 and 620.

- U.S. Department of Agriculture loans: In general, lenders require a minimum credit score of 640 for a USDA loan, though some may go as low as 580.

Remember, though, that while meeting the minimum credit score requirement is crucial, it doesn’t guarantee that you’ll be approved for a mortgage loan. Lenders review several aspects of your financial situation to determine whether you qualify for a loan and what your interest rate will be.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

Earning A Good Credit Score

Unfortunately, we don’t start with a clean slate as far as credit scores are concerned. Individuals have to earn their good numbers, and it takes time. Even when all other factors remain the same, a person who is younger will likely have a lower credit score than an older person. That’s because the length of accounts for 15% of the credit score.

Young people can be at a disadvantage simply because they do not have the depth or length of credit history as older consumers.

Cash In With A Credit Card

If you don’t plan to get a mortgage or refinance any existing debt, at least consider getting a rewards credit card. Thanks to robust competition for credit card customers, banks are offering friendly terms to borrowers who have credit scores over 700. Some particularly good offers can be found in cash-back rewards cards and travel credit cards.

Read Also: Speedy Cash Late Payment

The Different Types Of Credit Scores

The three main credit bureaus are Equifax, Experian, and TransUnion. Each bureau gives you a score, and these three scores combine to create both your 701 FICO Credit Score and your VantageScore. Your score will differ slightly among each bureau for a variety of reasons, including their specific scoring models and how often they access your financial data. Keeping track of all five of these scores on a regular basis is the best way to ensure that your credit score is an accurate reflection of your financial situation.

Keep Your Credit Utilization Rate Low

Your credit utilization rate is the percentage of your available credit that you use. The usual recommendation is to keep your credit utilization rate below 30% in other words, using less than 30% of your available credit at any given time. Generally speaking, the less available credit you use , the better.

If you check your credit reports and find that you have a credit utilization rate higher than 30%, you have options to lower it, such as paying down debt or increasing your credit limits. To increase your credit limits, youll need to ask your current lenders for a limit increase but be aware that this could result in lenders doing a hard inquiry on your credit when they make their decision.

Don’t Miss: How To Get Credit Report Without Social Security Number

A New Report From Experian Found That The Average Fico Score In The Us Reached An All

A new report from Experian;found that the average FICO Score in the U.S. reached an all-time high in 2019 of 703.

-2.38% of 700 or higher, the largest percentage ever at that threshold.

Having a credit score at or above 700 is generally an indicator of good credit for most lenders, Experian noted. These borrowers may receive a wider variety of credit product offers, at better interest rates, than those with scores below 700, Matt Tatham, manager of content insights and data analyst at Experian Consumer Services, wrote in the report. A score of 800 or higher is usually considered excellent.

The growth in credit scores largely reflects the positive changes consumers have been making. Late-payments and delinquency rates have steadily dropped for most forms of debt over the last decade, which has gone a long way toward improving scores. Moreover, the average credit score among millennials has improved 25 points since 2012.

These higher credit scores are due mostly to our decade-long economic expansion, said Ted Rossman, industry analysts at CreditCards.com and Bankrate. Generally speaking, consumers are doing a good job keeping up with their bills.

Paying off loans and closing out credit cards may be in your best interest, but often may be a demerit to your score.

Peter Hoglund, senior vice president at Wealth Enhancement Group

Auto Loan Rates For A New Car 700 To 709 Credit Score

Dont be tricked into applying for the advertisements promising unbelievably low APR percentage rates on your next new car auto loan.

Those rates are for people with;Super Prime Credit Scores of 800+.;

You probably wont qualify for those offers within our credit score range, such as 703, 704, or 706.

But it gets worse!

These same companies use practices to lure you in and charge you a much higher interest rate than what you could have gotten from a reputable lender.;

The interest rates we use in our sample auto loan monthly payment charts, are current rates for prime borrowers, like you, with credit scores in the 700s, such as 702, 703, and 707.

If you have a credit score in this range then this article was written just for you!;;

If you have a credit score around 702 to 705, it is considered a prime credit score, which includes ranges from 660 to 780.

Generally, all people in this credit range will be offered similar interest rates.

As you move into the super prime market with your credit score rising to 800 or 825, you would be eligible for the absolutely best rates.;

If you are interested in improving your credit score, Credit Knocks offers a 90 day Credit Sprint Challenge to get that score kick started and moving up!;

You May Like: Does Paypal Working Capital Report To Credit Bureaus

Average Credit Scores By Age

FICO scores range from a low of 300 to a high of 850a perfect credit score which is achieved by only 1.2% of consumers. Generally, a very good credit score is one that is 740 or higher.

This score will qualify a person for the best interest rates possible on a mortgage and the most favorable terms on other lines of credit. If scores fall between 580 and 740, financing for certain loans can often be secured, but with interest rates rising as the credit scores fall. People with credit scores below 580 may have trouble finding any type of legitimate credit.

Based on data compiled by Credit Karma, there is a correlation between age and average credit scores, with scores rising along with age. According to their data, the average credit score by age is as follows:

Keep in mind, these are averages based on a limited sampling of data, and many individuals’ credit scores will be above or below these averages for a variety of reasons.

A twenty-something, for example, could have a credit score above 800 by making careful credit decisions and paying bills on time. Likewise, a person in their 50s could have a very low credit score because they took on too much debt and made late payments. Whether younger or older, anyone struggling to escape a dismal credit score ought to consider reaching out to one of the best credit repair agencies for assistance.

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

Recommended Reading: Is 524 A Good Credit Score

Your Lender Will Have The Last Say

As I mentioned before, the numbers were 708 and 635, but this is just a reference for you and your lender. When you sign and agree to run a Credit check, it means that you are granting access to obtain a full and detailed Credit Report that will describe every vital aspect of your score.

So it will depend ultimately on the specificities of the financing institution, but I would say that a 700 Credit Score is good enough to be accepted for a loan in most places. It should be enough for that 0% financing or 1,99% APR Lease Rate you saw on the ads 😉

The Average Credit Score By Age State And Year

Personal Finance Insider writes about products, strategies, and tips to help you make smart decisions with your money. We may receive a small commission from our partners, like American Express, but our reporting and recommendations are always independent and objective.

- The average American has a credit score of 711, according to data from Experian. That’s considered ‘good’ by FICO’s score ranges.

- People over 50 have average credit scores higher than the national average. Scores in some states, including Minnesota, Wisconsin, and Vermont, tend to exceed the US average, too.;

- Get your free credit score with CreditKarma »

The average credit score in the US is 711, according to credit reporting company Experian, calculated using the FICO scoring model.

Credit scores, which are like a grade for your borrowing history, fall in a range of 300 to 850. The higher your score, the better people with higher credit scores tend to get better interest rates on loans, have access to credit cards with better perks and lower interest rates, and could even pay less for insurance.

Popular Articles

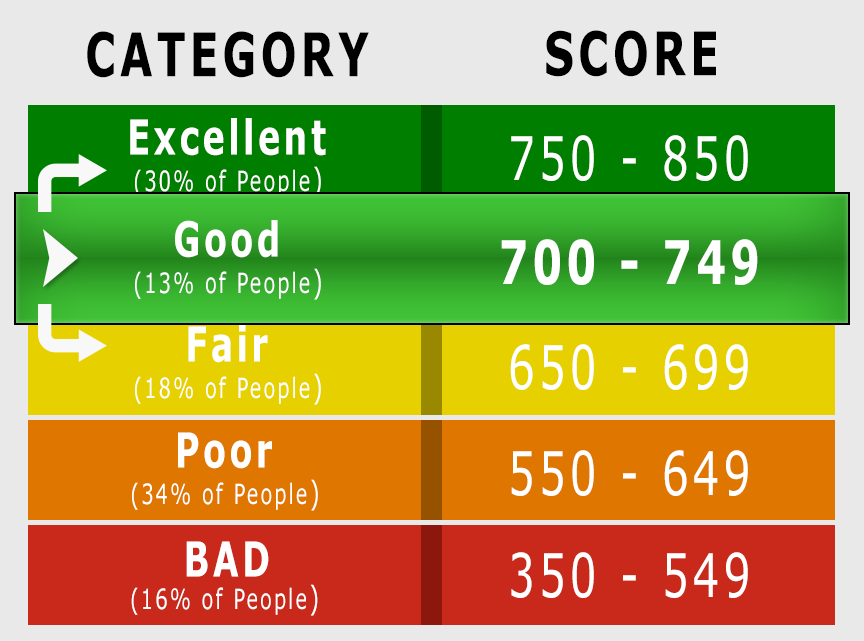

The FICO;model of credit scoring puts credit scores into five categories:;

- Very poor: 300-579

- Very good: 740-799

- Exceptional:;800-850

Based on this scoring system, the average American has a good credit score. But, the average credit score is different by demographic.

Read Also: Is 524 A Good Credit Score

What A Fair Credit Score Means For You:

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible ;Individuals whose;credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

You May Like: Aargon Collection Agency Address

Getting A Car Loan With A 700 Credit Score

Image Source: http://bit.ly/2juIwNc

Buying a car is less stressful when you have a good credit score to show the lender. With a 700 credit score, auto loan approvals may come with fewer obstacles, although approval ultimately hinges on what the lender wants to see in your credit history. For many dealer-lenders, excellent payment history on past auto loans is the primary consideration.

If you apply for car loan through a bank, a 700 credit score may not be good enough for approval at the best terms if you have a shorter credit or employment history.

Remember to view your credit score in the context of the model used to calculate it. FICO®, for example, offers an auto credit score that ranges from 250 to 900. The most recent version, FICO® Auto Score 9 XT, is based on TransUnion CreditVision data, which can span up to 30 months of credit history. This score uses trended data, something that sets it apart from the more traditional FICO® scoring models. The newest FICO® auto score examines factors like whether your credit card balances and credit utilization ratio have increased or decreased over time, not just whether you make your payments on time.

Lenders like transactors, people who pay off their credit cards each month or at least make steady improvement to lower debt levels. Revolvers, people who carry balances from month to month and only pay the minimum due will be penalized under the trended data guidelines.