Do You Have Tradelines On Your Credit Report

- 0 Comments

You probably have tradelines on your credit report and dont even know it. They may be working for you or working against you depending on the usage history of the tradeline. As with anything on your credit report, timely payments, age, and credit limit and use all determine whether a tradeline is hurting or helping your credit.

Before you can determine whether you have a tradeline on your credit report, you need to understand what a tradeline is.

How Do I Get A Tradeline

There are two ways to get a tradeline.

One way to get a tradeline is to reach out to a lender or creditor and apply for a new loan or credit card. If you have a high enough credit score and credit history then they may approve you.

If you have been denied credit or your score is not above 700 then check out

The Second way to get a tradeline is to piggy back off someone elses.

In other words you can be added to someone elses credit card or loan.

There are companies that offer access to other peoples tradelines for a small fee.

Related: How Can I Get A Loan With Bad Credit?

What Should I Do After Receiving Update Notifications

Whether the update is specifically related to a tradeline or just an update to your credit report, you should check it. The first thing you need to confirm is whether this matches your current credit activity. Next, verify that the information is accurate. If you come across inaccurate or suspicious information, query it.

Recommended Reading: Usaa Credit Repair

How Much Will A Tradeline Boost My Credit

A tradeline can boost your credit by up to 200 for an excellent tradeline.

The age and the credit limit of a tradeline are the most important considerations. The older the tradeline and the higher credit limit will increase your score even higher. The number of trade lines bought depends on an individual situation and need.

The best tradelines to get have a large credit limit, $10,000 to $20,000, low credit utilization and a long credit history . These tradelines will boost your credit score the most as these categories make up most of your credit and it shows lenders that you are responsible.

Tradeline Supply company has designed a platform upon which individuals can boost their overall credit report by using trade lines. The Act of benefiting a credit report using Primary Users and Authorized Users tradelines is called piggybacking and is defended using the equal opportunities Act.

Buying & Selling Tradelines

Tradelines can be bought and sold for their impact on credit. Using this concept, people can benefit from others spouses, employers, children etc. This form of business benefits both the primary account holder and the appended authorized user. The Tradeline supply companies serve as a third-party platform for the sale of trade lines while protecting cardholders and authorized users privacy.

Also Check: Goverment Free Credit Score

What Is A Tradeline On A Credit Report

A tradeline is a term used to describe credit accounts by credit reporting agencies. There is a distinct tradeline for each credit account you have, including information about your debt and the creditor. It would be best to familiarize yourself with how tradelines work so you can better understand your credit report and the aspects lenders check for when analyzing your credit.

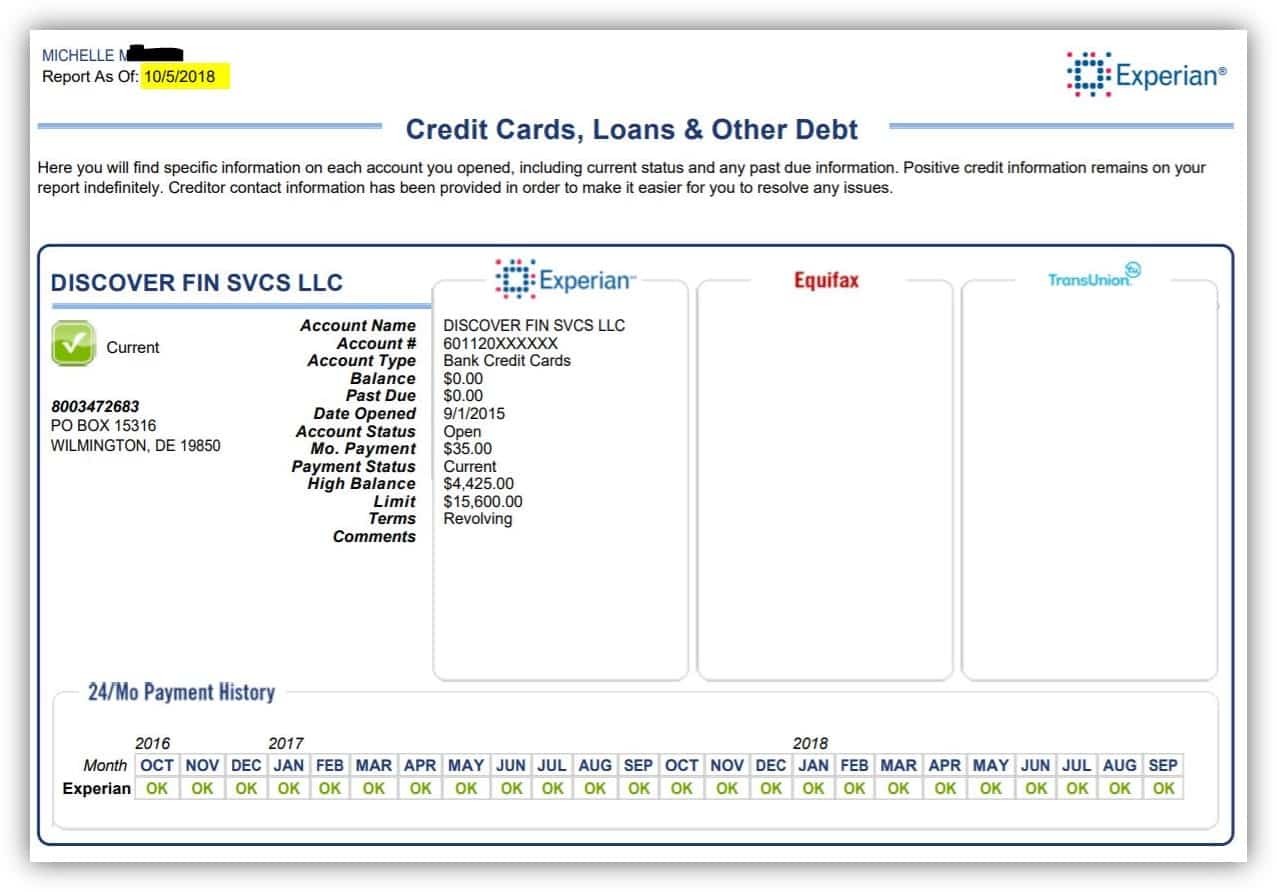

You have a tradeline on your credit report for every installment and any revolving credit account. Installment tradelines comprise loans such as personal loans, student loans, auto loans, and mortgages. Revolving tradelines, on the other hand, include lines of credit and credit cards. A tradeline is basically used to identify your type of debt. However, it also relays information about your credit account. This information may include:

- Type of credit account

- Name and address of the lender

- Current status

- The dates your account was opened and closed

- Current balance

- or original credit amount

- Payment history

- Monthly payment

This information is crucial if you want to analyze all aspects of your credit accounts collectively. The information on tradelines is given by your lenders since they report the most updated information they have regarding your accounts. However, some lenders may have different ways of entering tradeline information than others. As such, you shouldnt freak out when you see information variations.

Where To Buy Tradelines

Tradeline companies are everywhere. Go online and search on Google, and you will be amazed at the so many options out there. But where do you exactly buy tradelines that will help positively change your credit scores?

You can buy authorized user tradelines from a third-party service for a certain fee. The prices vary from a few hundred dollars to thousands of dollars. But, before purchasing one, make sure to do your research about the company you are eyeing for. As mentioned, there are bogus companies selling tradelines. To avoid getting into their trap, make sure to look into the following:

- Company Reputation To check how credible a company is, ask yourself these questions: Is the company well-known in the tradeline industry? Do they have any past or existing complaints? How do they fare among their competitors?

- Age How long the company has been in the tradeline industry indicates how well they are in the business. After all, they wont last long if they are not legit and not good at what they do, right? The older the company, the better. While theres nothing wrong with new ones, just be wary. Once you find a red flag, dont push through with any transaction.

- Customer Reviews Customer reviews are helpful to know more about the company. Its also a great way to learn how credible or reputable the company is. Having many positive reviews means the tradeline company is a good one.

Read Also: What Is Coaf On My Credit Report

Where Does The Credit Bureaus Get Their Tradeline Information

Each credit bureau is different and different companies will report their financial information to different credit bureaus. When your credit is pulled by a lender, sometimes the lender will pull your credit from one credit bureau or all three. Each company is different. So how do you know which tradeline will report to each credit bureau? While its not possible to predict which credit bureau the lender will use to pull your credit there is a few ways to make an educated guess.

Related: Top 3 Credit Bureaus in 2021

What Is An Updated Tradeline

An updated tradeline is simply a tradeline that has had some sort of change occur, which caused it to update with one or more of the .

There are a number of things that would be considered a tradeline update, such as:

- If you get a

- If the balance of the account changes

- When the account goes from open to closed

- When you are added or removed as an AU

- If you dispute inaccuracies that are then deleted or removed from the tradeline, such as incorrectly reported late payments

You May Like: Speedy Cash Collections

How Do Trade Lines Work

Trade lines are subsections of your credit report, which is used to calculate your credit score. They contain details for each credit account. This information is then compiled and quantified to calculate your credit score.

Lenders generally use credit scores to determine how likely you are to pay bills on time. Newer information and activity on your trade line generally has a more significant impact on your credit score. Negative details in your trade lines will have less of an effect as time passes.

Typically, trade lines will stay on your account for years, even if you close the account. Good trade lines may remain on your credit account indefinitely. Derogatory marks, such as missed payments, must usually be removed after seven years.

Its also possible to be added to trade lines as an authorized user. In this case, someone else will be the primary account user, but youre also authorized to use the credit.

If your parents have an excellent credit history, for example, you can be added to one of their credit cards as an authorized user. Your parents good history may boost your credit score.

How Can I Buy A Tradeline

To buy a tradeline, you can use a third-party service such as Tradeline Supply Company and look through their list of available tradelines to buy. You will be able to see what bank is listed when the account was opened, the credit limit, a purchase by date, and the price. Once you select the tradeline you want to buy, you complete the checkout and the tradeline will show up on your credit report during the next reporting period.

The tradeline is allowed to remain on the report for two reporting cycles before being removed to appear like it was closed. However, the close trade line will remain etched on the credit report for several years and will continue positively influencing the credit score.

The age and the credit limit of a tradeline are the most important considerations. The number of trade lines bought depends on an individual situation and need.

You May Like: Transunion Account Locked

The Different Tradeline Types

1. Revolving tradeline is any line of credit. Examples of revolving tradelines would be credit card accounts, home equity lines or business lines of credit.

2. Installment tradeline is a fixed loan that you have to pay back. Examples of installment tradelines would be car loans, mortgages, student loans, and personal loans.

If you took out a $40,000 car loan, your credit report would show an installment tradeline with an opening balance of $40,000. As you make payments each month, those payments are deducted from the opening balance, and your tradeline will show your current balance. The lower the current balance and each successful payment you make strengthens your .

3. Open Account is a hybrid of both revolving and installment accounts, which is what we help establish!

Our tradelines function as a revolving monthly credit in the amount of the rent due each month. As long as your rent is paid on time each month, your tradeline balance will be at $0. We cant stress enough the importance of not being late on rent or credit card payments!

Youre Our First Priorityevery Time

![Tradelines 101 [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/tradelines-101-infographic-credit-card-hacks.jpeg)

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Care Credit Minimum Score

Turn Your Monthly Rent Payments Into A New Tradeline

Rent is for many people the single biggest monthly payment. Because you cant directly report rent payments to credit bureaus and most landlords arent authorized reporters, you should work with a certified credit reporting agency like RentTrack to report your rent payments to all three credit bureaus.

Carefully Check Tradelines On Your Credit Reports And Fix Any Inaccuracies

Thanks to the Fair Credit Reporting Act, you have the legal right to dispute errors on your credit report. Unlike reporting tradelines to credit bureaus, which only an approved reporting agency can do, you can contact credit bureaus directly to fix any errors or incomplete information. The Federal Trade Commission has sample letters you can use to dispute incorrect information, and they also make recommendations on how to make sure your request is received and addressed by the bureaus.

Read Also: How To Notify Credit Reporting Agencies Of Death

Tradelines For Sale: How To Buy Tradelines

Wondering where to find tradelines for sale?

There are many companies that sell tradelines to consumers.

If youâve decided to buy a tradeline, compare offers before you hand over your payment information.

Shopping around may help you find a better deal or avoid a scam .

Letâs check out a list of tradelines for sale.

Is It Still Worth Getting A Tradeline In 2021

If you already have excellent credit, purchasing a credit line might not significantly impact your score. It may only be a waste of resources. Instead of buying one, continue paying your loans on time. But, tradelines can provide that boost you need to climb into lower interest brackets and earn more favorable terms for consumers with lower or poor credit scores. However, it is vital to know the right tradeline to buy based on your accounts needs. Thus, its best to talk to a financial expert first. Find out more about how Coast Tradelines can help. Call us today or send us a message via the contact form.

Read Also: 524 Credit Score Good Or Bad

How Many Tradelines Do I Need For A Fha Loan

When applying for a FHA loan you will need to have at least two open tradelines to get approved. This doesnt mean that if you have two tradelines you will automatically be approved. This means that you have met the minimum requirements for the FHA loan but you should focus on optimizing your credit scores to have the best chance of getting approved for a loan and getting the best interest rates.

What Happens When You Are Removed From A Trade Line

It’s possible to be removed from a trade line. You can become an authorized user on someone elses credit card. For example, your parents could add you to their credit card account. Your parents could later remove you, however. Or you can have yourself removed. The relevant trade line will then be removed from your credit report.

Every trade line affects your score. When one is removed, the data from the trade line is no longer used to calculate your credit score.

If the trade line had positive information, such as regular payments, your credit score could go down. On the other hand, if the trade line contained negative information, such as missed payments, your credit score could increase once it’s removed.

You May Like: Does Apple Card Affect Credit Score

How Do You Sell A Tradeline

Selling a tradeline invlolves you adding people as authorized users to your credit card accounts. In return these authorized users will piggyback off your good credit score and your tradeline account will report their credit report and will reap the benefits of having good payment history, long credit age, a high credit limit and low credit utilization.

In order to sell a tradeline you will need to have a good credit score of 700 or better. You will also need to have a credit utilization of 10% or below.

Review Your Credit Report Regularly

The fact that lenders review your credit report from time to time doesnt mean that you should ignore it. You should check your credit report to ensure that all your tradelines contain legitimate and truthful information. Every credit holder is entitled to a free credit report from all major credit reporting agencies, including TransUnion, Equifax, and Experian, once every year. Experian also offers free credit monitoring every 30 days to members when they sign in. reviewing your credit report regularly also allows you to discover inaccuracies and fraud before they significantly damage your credit scores. Contact a credit bureau as soon as you spot any unfamiliar tradelines.

Recommended Reading: Public Record On Credit

Why You Shouldnt Buy Tradelines To Build Your Business Credit

If your account is associated with a suspicious tradeline, your credit profile is likely to be red-flagged and potentially shut down. Furthermore, purchasing tradelines means that you are complicit in committing fraud.

In a 2008 New York Times article on credit score boosting, an executive at FICO, a major provider of credit scores, expressed that even if there is a legal loophole to artificially inflating ones credit score, the borrower is deliberately misrepresenting himself and his credentials to the lender. This act of falsifying ones credit history constitutes as one definition of loan fraud.

As FICO, as well as the 3 major credit bureaus, Equifax, TransUnion, and Experian, are keenly aware of such schemes, they have been finetuning credit scoring models in order to limit the impact of authorized user tradelines. For instance, the FICO 08 scoring model, which was released in late 2009, amended the impact of authorized user accounts on credit scores – authorized users will receive no impact to their credit scores unless they are associated with immediate family members such as relatives or spouses.

Find Out The Average Monthly Balance On The Card

Too high of a balance on the card could increase your overall credit utilization ratio and thus bring down your credit score, which obviously is counterproductive.

On the other hand, the lower the utilization ratio is, the better it is for your scores, so look for a low monthly balance when considering an authorized user account.

Read Also: 820 Fico Score

How Do I Get A Tradeline For My Business

Establishing business credit is often a confusing process because not all lenders and vendors report to all major business credit reporting agencies. For example, information about a supplier account may appear on your Dun & Bradstreet credit report, while information about business credit cards is often shared with lenders via the Small Business Financial Exchange .

One great way to establish tradelines is to simply ask. Ask your suppliers or vendors if they offer credit or payment terms. There may be a basic credit check involved, but most dont require good credit and will rarely check a FICO score.

If you arent yet doing business with suppliers or vendors that report to commercial credit bureaus, you can seek out vendors that report. Purchase items your business needs then pay on time.

Some types of business financing also report to business credit many business loans, business lines of credit, business credit cards and other types of financing can help establish a business credit profile.

Tip: Before you begin establishing business credit, create the foundation for your business, including details such as getting a business license, getting a business phone number and requesting your DUNS number. Learn more here.