Is Knowing Your Own Credit Score Important

Some people really want to know what their credit score is. However, it changes often, so be prepared. Also, keep in mind that your credit score is intended to reflect the likelihood that you will repay any money that you borrow. Most people dont need a score to know if they will pay themselves back the money they lend themselves. Instead, focus on managing your money carefully with a budget and only apply for credit that you need your score will take care of itself.

Getting a copy of your credit report, however, is important and can be done for free. It will allow you to spot concerns, inaccuracies, or potential fraud.

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Will My Score Be The Same At All Three Credit Bureaus

The three major credit bureausTransUnion®, Experian and Equifaxare responsible for collecting and maintaining consumer credit reports in the U.S. These reports are then provided to subscribers, such as landlords, mortgage lenders, credit card companies and others who are deciding whether or not to extend you credit.

It can be confusing when your score seems high but you still get denied for a new line of credit. Chances are you’re not looking at the same score as your bank or finance company. Subscribers dont work with every credit reporting agency, so the credit report information included in one report might be slightly different from that in another.

Check your credit scores and reports from each bureau annually to ensure all the information is accurate. By law, you’re entitled to one free annual credit report. You should also use a credit monitoring service year-round. TransUnion offers some of the latest and most innovative credit monitoring services, like Credit Lock and Instant Alerts. These services will help you spot inaccuracies, potential fraud and other blemishes that could lead to higher interest rates.

Don’t Miss: Century Link Collections

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Psbs Are Offering Personal Loans At Attractive Rates Shows Cibil Data

The overall personal loan business dropped by 42.2% on a year-on-year basis in August 2020 due to economic disruptions caused by the Covid-19 pandemic.

However, the approach taken by public sector banks kept them in a good stead during the pandemic as their business grew by 66.5%, according to a data by credit bureau CIBIL data.

PSBs are offering personal loans to customers at attractive rates compared to their peers. This is attracting consumers to avail loans from PSBs despite facing financial hardship.

29 December 2020

Don’t Miss: Do Evictions Go On Credit Report

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

Checking Your Credit Score

In the UK, there are many credit reference agencies you can check your credit score with. Each of them uses a different rating system. At Lloyds Bank, we use three major credit reference agencies, listed below:

-

If youve never borrowed money before, your credit score can reflect this as you have no track record of being a responsible borrower.

Thats why many people get their first credit card as a way to build up a stronger credit score for later in life.

We suggest making payments with your credit card that you can afford to pay back in full by the due date. To find out more, read our guide for first-time credit card customers.

Recommended Reading: Speedy Cash Collection Agency

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

How To Check Your Credit Score

- Jade Schulz for Money

Your credit score is a very important number to know and understand. The terms on just about every credit card, personal loan or mortgage you apply for are influenced by those three little digits. Lenders look at your credit score as shorthand to determine how risky or reliable you are as a borrower, so you should get into the habit of checking it often.

In this guide, well walk you through the different ways you can check your credit score whether youre an individual or a business.

Recommended Reading: Aoc’s Credit Score

Dont Use Up All Your Credit

According to Value Penguin, One of the factors lenders consider when modeling an individuals credit risk is their credit utilization the percentage of total available credit a consumer is using month to month.

Your credit utilization ratio refers to the portion of your credit limit that youre using at any given point in time. One way to keep your credit utilization in check is to pay your credit card balance in full at the end of every month. However, if this is not achievable, its wise to keep your total outstanding balance at 30% or less of your credit limit.

One final strategy is to request financial institutions to raise your credit limit. The worst they can say is no. A higher credit limit lowers the percentage that your current outstanding debt will take, helping your overall ratio.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and, if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Recommended Reading: Does Prosper Report To Credit Bureaus

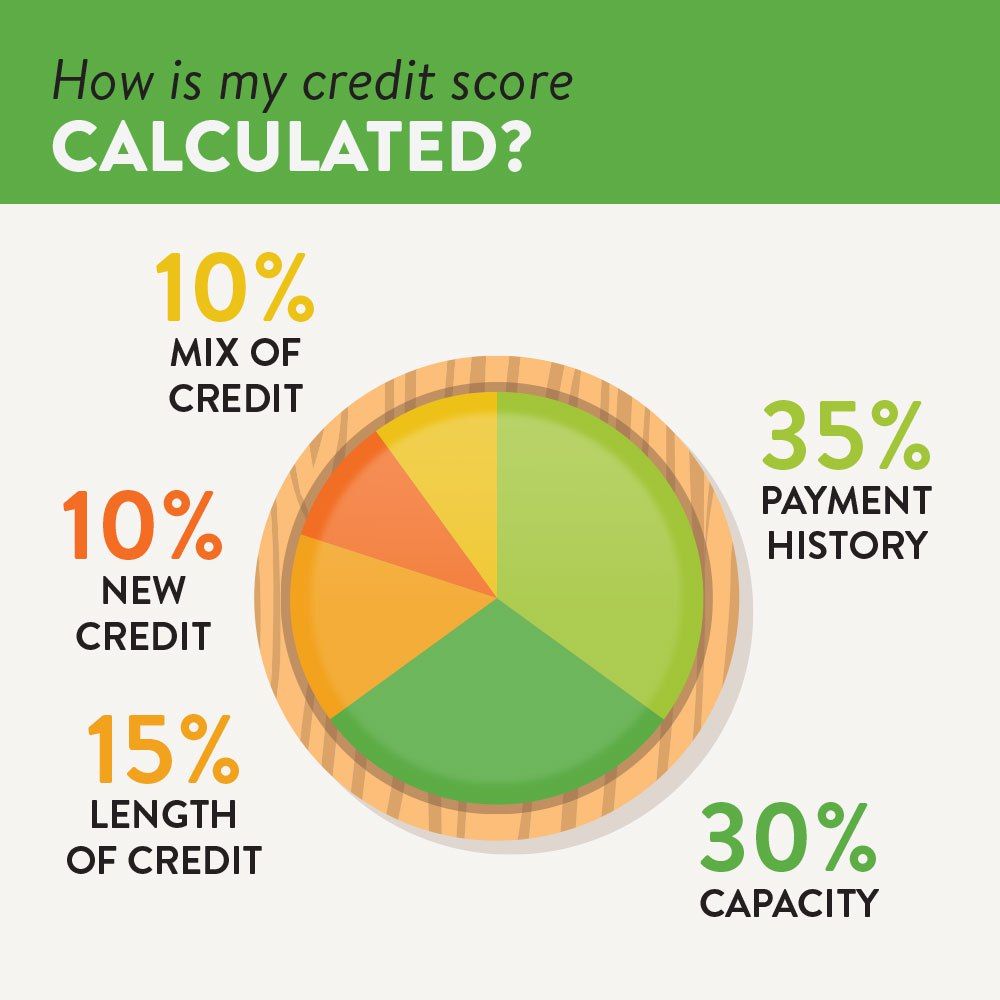

Does Removing Hard Inquiries Improve Your Credit Score

Yes, having hard inquiries removed from your report will improve your credit scorebut not drastically so. Recent hard inquiries only account for 10% of your overall score rating. If you have erroneous inquiries, you should try to have them removed, but this step wont make a huge difference by itself.

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Recommended Reading: How To Get Car Repossession Off Credit Report

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Also Check: Chase Preferred Credit Score

How Does A Credit Score Work

Your credit score is calculated whenever you apply for credit, such as a loan, credit card, mortgage, or even a mobile phone contract. How your score is worked out depends on the company youâre applying to â different companies have different methods and may use different information, so your credit rating may vary between them.

Lenders typically look at your borrowing history, your current borrowing, and other relevant information such as your income. Usually, theyâll look at information taken from the following:

Your credit report

Get A Handle On Your Bill Payments

Organizing your bill payments so that you make every payment on time is one of the best ways to increase your score, as payment history makes up the most significant percentage of your credit score. Some ways to get a handle on your bill payments are to:

- Create a budget: List your expenses and income on a sheet of paper or your computer. Then determine whether or not you can make each of your obligations. If not, immediately cut non-essentials out, like your cable TV package or satellite radio in your car.

- Set due-date alerts: Many people miss bill payments because they forget a bill. An easy way to avoid this is by setting due-date alerts on your calendar or phone to remind you to pay your bills on time.

- Automate your bill payments: If you have recurring bill payments you need to make , consider setting up automated payments. The bank will take money out of your accounts and pay your bills without you needing to worry about it.

Recommended Reading: Credit Score To Get Care Credit

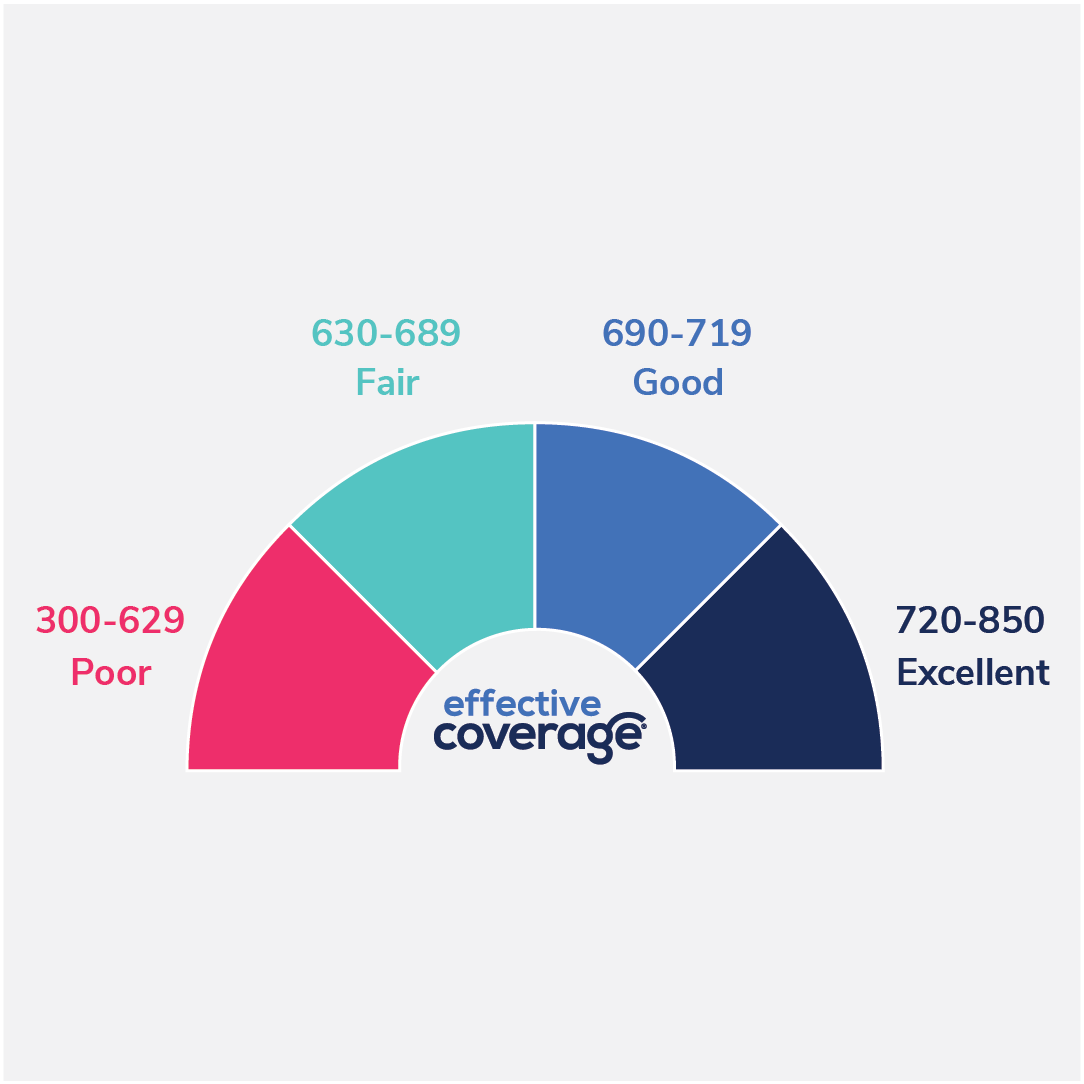

What Is A Good Credit Score What Are The Credit Score Ranges

The most commonly used credit scoring models range from 300 to 850. Each lender sets its own standards for what constitutes a good credit score. But, in general, scores fall along the following lines:Excellent credit: 720 and higher Good credit: 690-719Fair credit: 630-689 Bad credit: 629 or lowerIf you’re just starting out or haven’t used credit in at least six months, you might not have a score. Don’t worry, NerdWallet has a guide to help you get started with building credit.

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

Also Check: Syncbppc

What Does This Mean When I Apply For Credit

Any application for credit might be subject to further checks to prove your identity. As this is often a manual check, if youre applying for credit your application could be delayed.

Having a marker under this section wont automatically mean your application will be rejected. Its there to protect you from being a victim of fraud.

Understanding Your Credit Profile

Determining your score is more complicated than just weighing the different aspects of your credit history. The credit scoring process involves comparing your information to other borrowers that are similar to you. This process takes a tremendous amount of information into consideration, and the result is your three-digit credit score number.

Remember, no one has just one credit score, because financial institutions use more than one scoring method. For some agencies, the amount owed may have a larger impact on your score than payment history.

You May Like: What Fico Score Does Carmax Use

Why Your Credit Score Impacts Your Mortgage Rate

Your credit score is a numerical representation of the items on your credit report. Lenders report your loans and payments to credit bureaus and those are listed on your report.

Then an algorithm crawls over your report, assigning numerical values to each item. So you get negative points for late payments and other bad behavior. And you get positive points for ontime payments and other good behavior.

The goal of your credit score is to determine how responsible or irresponsible you are as a borrower. This can help lenders decide how risky your loan is and what interest rate to charge you.

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

Don’t Miss: Does Carmax Have Good Financing

How To Check My Business Credit Score

Businesses also have credit scores, which are used by lenders, banks, partners and other agencies to determine their creditworthiness and/or legitimacy. Business credit score ranges are usually on a scale of zero to 100. A businesss credit score is in many ways shorthand for does this business repay its debts, but the score itself could be determined by a host of factors including number of credit accounts, payment history, credit utilization and more.

A good credit score for a business is 80 or above.

To establish business credit and obtain a credit score, your business will need to meet a few benchmarks. It must be registered as its own legal entity , and it must have either a Taxpayer Identification Number or an Employer Identification Number through the IRS, as well as a Data Universal Numbering System number through Dun & Bradstreet.

Once your business is properly registered and has a credit history, you can start checking its credit score in a number of ways.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Read Also: Does Uplift Report To Credit Bureaus