Fico Score Vs Credit Score

The three national credit reporting agencies Equifax®, Experian and TransUnion® collect information from lenders, banks and other companies and compile that information to formulate your credit score.

There are lots of ways to calculate a credit score, but the most sophisticated, well-known scoring models are the FICO® Score and VantageScore® models. Many lenders look at your FICO® Score, developed by the Fair Isaac Corporation. VantageScore® 3.0 uses a scoring range that matches the FICO® model.

The following factors are taken into consideration to build your score:

- Whether you make payments on time

- How you use your credit

- Length of your credit history

- Your new credit accounts

What Is Fico Score 8

FICO Score 8 was launched in 2009. Itâs one of FICOâs base credit scores, which means it isnât designed for a certain type of credit. Like other base credit scores, the scores range from 300 to 850. And like FICOâs other base credit scores, Score 8 is intended to determine the likelihood that a borrower will pay back a loan.

Top 5 Times When Your Credit Score Matters The Most

July 7, 2017Hank Coleman

Some people downplay the importance of good credit, but whether you realize it or not, your credit matters. Your credit score and the information on your . It has a tremendous impact on your financial life. You may already know that banks pull your credit report when applying for loans or credit cards, but you may not realize that other institutions pull your credit as well.

As consumers, each of us is entitled to one free credit report from the bureaus each year. You dont have to pay for these reports, nor do these requests affect your credit score. This is one of the best ways to keep an eye on your credit history and catch fraud early. Get Your Credit Scores & Reports From All 3 Credit Bureaus.

On the other hand, when an institution pulls your credit report, it can create a credit inquiry, which can lower your credit score by 2 to 5 points. Your credit report keeps a record of every credit application youve submitted over the past two years.

There are different types of credit report pulls. A soft pull is used by many financial institutions to prescreen applicants, and these dont hurt your credit. A hard pull is an official credit check to determine if youre eligible for financing, and these can hurt your credit. Get your credit and finances on track with Lex OnTrack

Also Check: How Do You Find Out What’s On Your Credit Report

Other Factors That Impact Your Credit Score

While payment history ranks as the top factor in calculating your FICO® Score, it’s important to be aware of the four other factors:

How Your Credit Score Affects Your Mortgage Eligibility

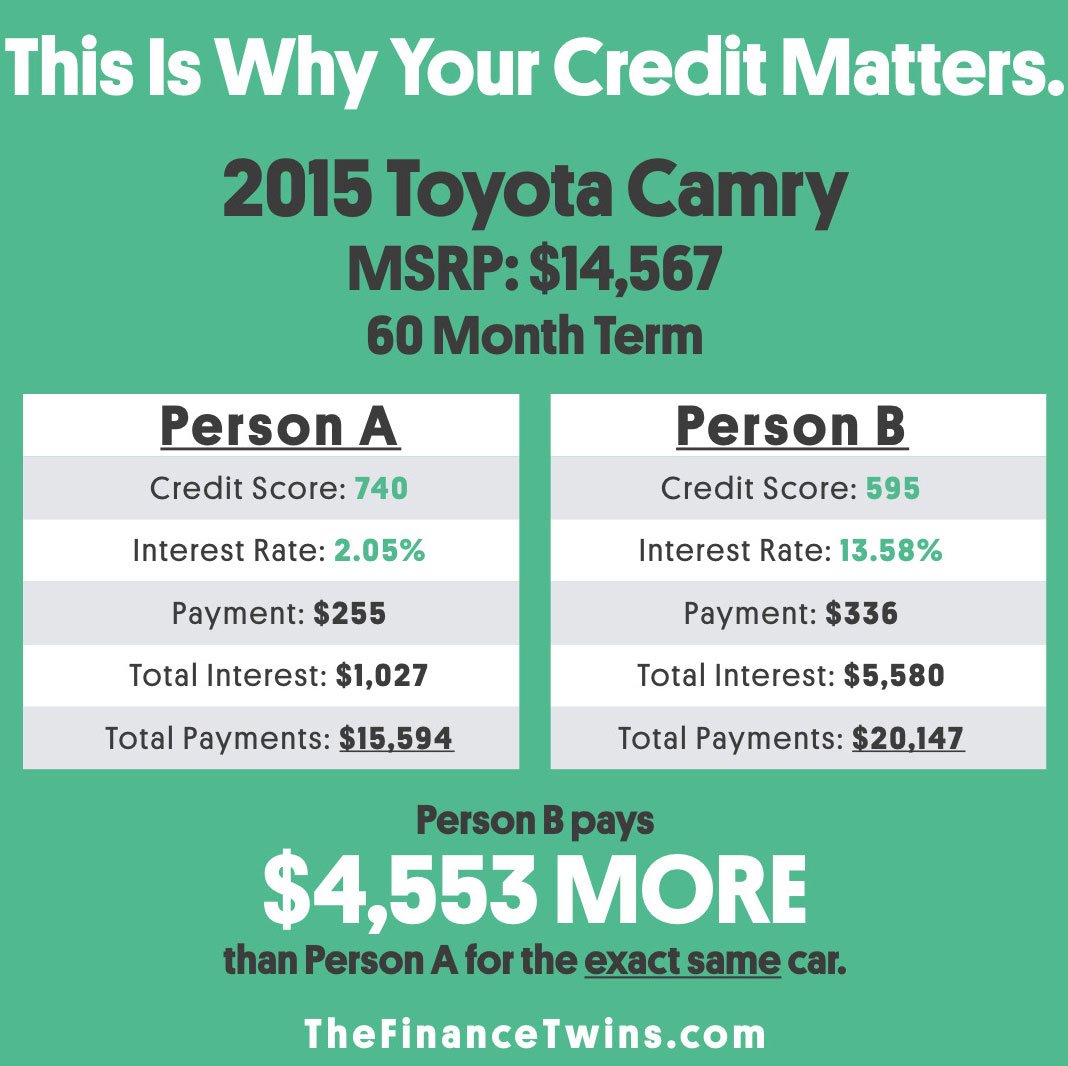

When it comes to getting a mortgage, your credit score is incredibly important. It determines:

- What loan options you qualify for

- Your interest rate

- Your loan amount and home price range

- Your monthly payment throughout the life of the loan

For example, having a credit score of excellent versus poor could save you over $200 per month on a $200,000 mortgage.

And if your credit score is on the lower end, a few points could make the difference in your ability to buy a house at all.

So, it makes sense to check and monitor your credit scores regularly especially before getting a mortgage or other big loan.

The challenge, however, is that theres conflicting information when it comes to credit scores.

There are three different credit agencies and two credit scoring models. As a result, your credit score can vary a lot depending on whos looking and where they find it.

Also Check: What Is Informative Research On My Credit Report

How Do You Check Your Credit Score In Canada

Nearly half of Canadians dont know where to check their credit scores.

In Canada, your credit score is calculated by two different credit bureaus: Equifax and TransUnion. You can request a free copy of your credit report by mail at any time though your credit score is not included on the reports.

Both of these bureaus can provide you with your credit score for a fee, and also offer credit monitoring services. For more information visit TransUnion or Equifax.How do you improve your credit score?

When you understand how your credit score is calculated, its easier to see how you can improve it. Thats the good news: no matter how bruised your score is, there are a few relatively easy ways that you can change your behaviours and improve it.

1. Make regular payments

One of the easiest ways to improve your credit score or to build it from the ground up is to make consistent, regular payments on time over time. These are things that potential lenders love to see: consistency, dependability, regularity and history.

When it comes to credit cards, the best financial advice is always to pay it off every month so youre never running a balance. Making regular payments is one of the best habits to get into because youre always paying down your debt.

2. Close your newer accounts

3. Accept an increase on your credit limit

Just be careful you’re not getting into more debt in an attempt to improve your credit score.

4. Use different kinds of credit when possible

Is Equifax Or Experian More Accurate

The main difference is Experian grades it between 0 1000, while Equifax grades the score between 0 1200. This means that there is not only a clear 200 point difference between these two bureaus but the perfect scores are also different, which is 1000 as reported by Experian and 1200 as reported by Equifax.

Read Also: Which Of These Is Not A Valid Fico Credit Score

What Type Of Credit Score Matters The Most To A Mortgage

Blog posted On November 18, 2020

When you apply for a mortgage, your lender will evaluate several factors to determine how much money you qualify for and how much interest you will pay. Based on your application, you could qualify for a larger mortgage, buy a more expensive house, and save thousands of dollars on interest. Though all parts of your application are important, many experts recommend that you prioritize boosting your credit score to help qualify for the best rates possible.

The first step to improving your credit is knowing your credit score. While you may think you know your credit score, you might be surprised to hear there are multiple variations each serving a different purpose for different lenders. Most lenders use the Fair Isaac Corporation data analytics company for credit scoring, but within FICO, there are several different credit scoring models.

The most widely used scoring model is the FICO 8. The FICO 8 credit scoring model is used for auto loans, credit cards, and most other loans. In the housing industry, however, we use FICO scores 2, 5, and 4. Though the varying models evaluate the same four credit factors payment history, credit use, credit mix, and age of your accounts each factor is weighted slightly differently with the different models.

Can Your Credit Scores Be Different On Your Credit Reports

When a lender performs a hard credit inquiry on a borrower, they can choose which credit report to pull information from. Your creditors might not report all of your information to all three credit reporting agencies, so your score could vary based on which credit report is used. For example, you could have different FICO scores based on information from Experian. vs. your Equifax credit report.

Also Check: Will Paying Off Closed Accounts Help Credit Score

Why There Are Different Credit Scores

For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus . The first version was built in 2006. The latest version, VantageScore 4.0, was released in 2017 and developed based on data from 2014 to 2016. It was the first generic credit score to incorporate trended datain other words, how consumers manage their accounts over time.

FICO® is an older company, and it was one of the first to create credit scoring models based on consumer credit reports. It creates different versions of its scoring models to be used with each credit bureau’s data, although recent versions share a common name, such as FICO® Score 8. There are two commonly used types of consumer FICO® Scores:

- Base FICO® Scores: These scores are created for any type of lender to use, as they aim to predict the likelihood that a consumer will fall behind on any type of credit obligation. Base FICO® Scores range from 300 to 850.

- Industry-specific FICO® Scores: FICO® creates auto scores and bankcard scores specifically for auto lenders and card issuers. Industry scores aim to predict the likelihood that a consumer will fall behind on the specific type of account, and the scores range from 250 to 900.

How Are Credit Scores Created

Our FICO Score vs Credit Score article also explores the five factors of how a credit score is defined, including:

-

Number of Accounts

Lenders and creditors want to know how many types of accounts you have, to determine if youre able to successfully manage said accounts. If you have multiple credit accounts that are maxed out, for example, your credit score will more than likely be affected.

-

Types of Accounts

A credit score takes into consideration the different types of accounts you have in relation to revolving debt and installment loans .

Lenders check to see if youre staying within your credit limit means, which would demonstrate responsible behavior. Your available is the amount of your limit you can still use for purchases.

-

Length of Credit History

The length of your credit history demonstrates how long different accounts have been active. Credit score calculations are indicators of how long your oldest and most recent accounts have been open.

-

Payment History

An individuals payment history reveals a lot about a persons creditworthiness. Such history, for example, may include credit card utilization, retail department store accounts, auto loans, student loans, or mortgages. How long it took you to repay these loans would affect your current credit score.

Also Check: How To Remove Negative Items Off Credit Report

How To Get Your Credit Score For Free

You might be able to get your score for free from your credit card issuer. Getting a FICO score is more useful than a VantageScore because lenders use that score more frequently. Experian will also provide you with a free score based on the FICO Score 8 model, though you’ll have to create an account with the company to get it.

How To Check Your Credit Score

Checking your credit score was once a difficult task. But today, there are many ways to check your credit scores, including a variety of free options.

Your bank, credit union, lender or credit card issuer may give you free access to one of your credit scores. Experian also lets you check your FICO® Score 8 based on your Experian credit report for free.

The type of credit score you get can depend on the source. Some services may offer you a version of your FICO® Score, while others offer VantageScore credit scores. In either case, the calculated score will also depend on which credit report the scoring model analyzes.

Some services even let you check multiple credit scores at once. For example, with an Experian CreditWorks Premium membership, you can get your FICO® Score 8 scores based on your Experian, Equifax and TransUnion credit reportsplus multiple other FICO® Scores based on your Experian credit report.

Also Check: How To Dispute Late Payments On Credit Report

The Rate You Are Offered On A Mortgage Can Vary Quite A Bit Depending On Your Credit Score

Your credit score is only one factor in a mortgage lenders decision, but its an important one.

While there are no firm rules about exactly how your credit score affects the interest rates you may be offered for a home loan, in general:

- The best rates go to borrowers with credit scores in the mid- to high-700s or above. These borrowers typically also have the most choices available to them.

- Borrowers with credit scores in the high-600s to the low-700s typically pay somewhat higher rates.

- Borrowers with credit scores in the low- to mid-600s range generally pay the highest rates and have the fewest choices. Borrowers in this range may have trouble qualifying for a loan, depending on the loan type and the specific lender.

- Borrowers with scores below 600 may want to improve their credit before applying for a mortgage. If you need help improving your credit, contact a HUD-approved housing counselor.

Explore interest rates for different credit scores to get a sense of how much your credit score matters.

Paying For Your Credit Score

You can also pay to get your credit score. The FICO website offers access to up to 28 of the most widely used FICO score versions, including mortgage, auto, and credit card versions, and access to a copy of credit scores based on your Equifax, Experian, or TransUnion file. But you might have to pay for credit monitoring as well to get them.

Other companies, including the credit reporting agencies, offer credit scores for sale, but it’s not always worth the money because you might not get the scores that creditors really use. Instead, companies sometimes sell scores developed to assist consumers in understanding credit scores or a VantageScore, which fewer creditors rely on. Even if the company does provide your real credit score, because creditors use different scores , you can’t be sure that the score you buy is the one any particular creditor will look at. Also, if you purchase your score from one of these companies, watch out for extra fees for services like credit monitoring, which can drive up the price.

Read Also: How To Get Closed Accounts Off Credit Report

What Affects Your Credit Score

The FICO Score and VantageScore credit models take the same general factors into account when calculating your credit score, although they weigh them slightly differently.

- Payment history: Paying your bills on time is the single biggest factor in your credit score. In the FICO Score model, this comprises up to 35% of your credit score.

- The amount of credit you use as a percentage of your available credit is another important factor. To maintain a good credit score, you shouldnt use more than 30% of your credit limits. If you have a credit card with a limit of $3,000, that means your maximum balance should be $1,000. Credit utilization accounts for 30% of your FICO Score.

- Length of credit history: The longer youve had credit, the more time youve had to prove you can make your payments on time. The length of your credit history accounts for 15% of your FICO Score.

- This refers to the different types of credit you have. A mix of both installment credit and revolving credit will help boost your FICO Score this accounts for 10% of the FICO Score.

- Every time you apply for credit, the lender checks your credit report this process is known as a hard inquiry. Because a hard credit inquiry typically lowers your credit score slightly for a few months, you should avoid applying for too much credit in a short time. Having a lot of hard inquiries accounts for 10% of your FICO Score.

How Is A Credit Score Calculated On A Joint Mortgage

When two people decide to buy a house together, they have a lot to consider. You and your partner have likely talked about how youll combine your finances, share expenses and save for major purchases.

Buying a home is one of the biggest decisions people will make. Youve probably kept careful track of your credit score and made sure not to do anything that could lower it.

But what about your partners credit score? If you and your partner decide on a joint mortgage, both of your credit scores will come into play. This guide will review how credit scores work, how they affect mortgage applications, how to calculate credit score on a joint mortgage and what to do if your partner has bad credit.

Read Also: Is 816 A Good Credit Score

What Are Credit Bureaus And How Many Are There

, otherwise known as credit reporting agencies are companies that collect and maintain data regarding your consumer credit information.

They pull information about your payments related to timeliness, things sent to collection, etc. Each bureau produces its own credit score.

Way back when the three big credit unions served different regions of the country. Since, numerous smaller credit agencies have emerged, though the big three are still the main ones most lenders defer to.

The three names you should know are:

Though these agencies are independent, many of them collect and compile the same information. Even though the information they collect about your credit history might be similar, the math they use is different.

What does that mean for you?

Well, it means you may have a different score for each bureau. These scores should all be similar, but if you have a wild difference between one score and another, you should consider doing some digging.

Some credit lenders may prefer to use one bureau over another for your credit information. Usually, one score suffices, however, some larger loans like mortgages use all three bureaus reporting.