Paying An Overdue Balance

Paying a delinquent balance doesnt erase the negative entry on your credit report. Once you pay the balance, the account status will change to Current or Ok as long as the account isnt charged off or in collections. Charge-offs and collection accounts will continue to be reported that way even after you pay the balance.

Wait Out The Credit Reporting Time Limit

If all else fails, your only choice is to wait for those negative items to fall off your credit report. Fortunately, the law only allows most negative information to be reported for seven years. The exception is bankruptcy, which can be reported for up to 10 years. The other good news is that negative information affects your less as it gets older and as you replace it with positive information. The wait may not be as difficult as youd think. Consumers can request their own credit report for free every 12 months from the three major reporting agencies. So, to be sure, you should request a report after the aging period to confirm.

It is important to note, however, that while the credit reporting agency will generally delete the negative information from the report after the seven-year aging period, information may still be kept on file and can be released under certain circumstances. Those circumstances include when applying for a job that pays over a certain amount, or applying for a credit line or a life insurance policy worth over a certain amount. Depending on where you live there may be more favorable regulations under state law, such as a shorter statute-of-limitations. You should contact your state’s Attorney General’s office for more information.

In the meantime, you can improve your credit by making timely payments on accounts you still have open and active.

How Do Errors Impact Your Credit Score

Your is calculated using different models such as VantageScore and FICO, the two most widely used credit-scoring models. Each model has its proprietary metrics and criteria. However, both use data from the major credit reporting agencies to generate your score.

Both scoring models also consider similar factors when calculating your score. These include your total credit usage and length of credit history, for example. But your payment history is the most important factor when determining your credit score.

Your payment history alone makes up around 35% of your FICO score and 42% of your VantageScore 4.0. Since payment history is so significant, a single inaccurate late payment could impact your score considerably. According to FICO, if your report has a 90-day missed payment, your score could drop by as much as 180 points.

You May Like: Why Wont Equifax Give Me My Credit Report Online 2017

Send Your Credit Dispute Letter

You shouldnt just throw these into an envelope and then toss them into the mail.

You need a way to verify if and when they received the letters so that you can be sure that the investigation was completed in a timely manner .

So be sure to take these to the post office and send these as Certified Letters return receipt requested.

Once they receive the items you will be notified that they have received the certified letters. This helps you keep track of things, as mentioned above.

What Happens Next

It will take about 30 days before you receive a response from the credit bureaus, although it could be less or more. Be patient, but dont lose track.

Your response will be that they deleted all the item, some of the items or none of the items. If they deleted all of them, youre done. You need not do anything more from here. Congratulations!

Youve completed the task and will only re-open the investigation if you do contact them regarding errors already deleted. We dont want that, obviously. No need to contact them again if they deleted all of the items.

If they deleted some of them or none of them, then its time to get back to work. Now we can send a new letter regarding the items that were not deleted .

Note: You can move directly to the Method of Verification letter or send out a similar letter to the original. The MoV will have more of a positive effect for you, but if youre patient enough sending out a second letter may be easier.

This right states that:

Full Name

Ways To Remove Negative Items From Your Credit Report

Posted on July 4, 2017

Your credit report almost always has a huge influence on the financial aspect of your life and if your credit report is full of negative items like closed credit accounts, overdue bills, repossessions, and foreclosures, you may have some serious issues in your financial life. If you have a bad credit score, your eligibility for car loans, apartment rentals, and even job opportunities can be seriously damaged.

But the good news is, theres hope! Even if you have bad credit, there are some basic steps that you can take to remove negative items from your credit report, and start your journey towards better financial health.

In this article, Ride Time will take a look at the 5 most common ways that you can get negative items removed from your credit report, so that you can start rebuilding your credit today!

Read Also: How Long Does It Take To Improve Your Credit Score

Write A Goodwill Letter Asking The Creditor To Remove The Negative Item

If a creditor reports negative information and that information is legitimate, you wont have a basis to challenge it.

But another strategy is to write a goodwill letter. Thats where you politely request the creditor to remove the negative information.

This strategy will work best on accounts when the negative items are either old, insubstantial, or infrequent.

It can also be effective if you are a current customer in good standing. The creditor may agree to remove the negative item in the spirit of retaining your business.

For example, lets say you had a 60-day late payment reported two years ago. Its a legitimate entry, so you wont be able to dispute it successfully. If you had an otherwise good credit relationship with the creditor for the past five years, you can write a goodwill letter asking them to remove the single late payment based on the otherwise outstanding credit history you have with that the company.

However, you should be aware that it will be much more difficult and probably impossible to have more substantial negative information removed. For example, if youve had three 60-day and a 90-day late payment within the past two years, the creditor will be unlikely to remove the information.

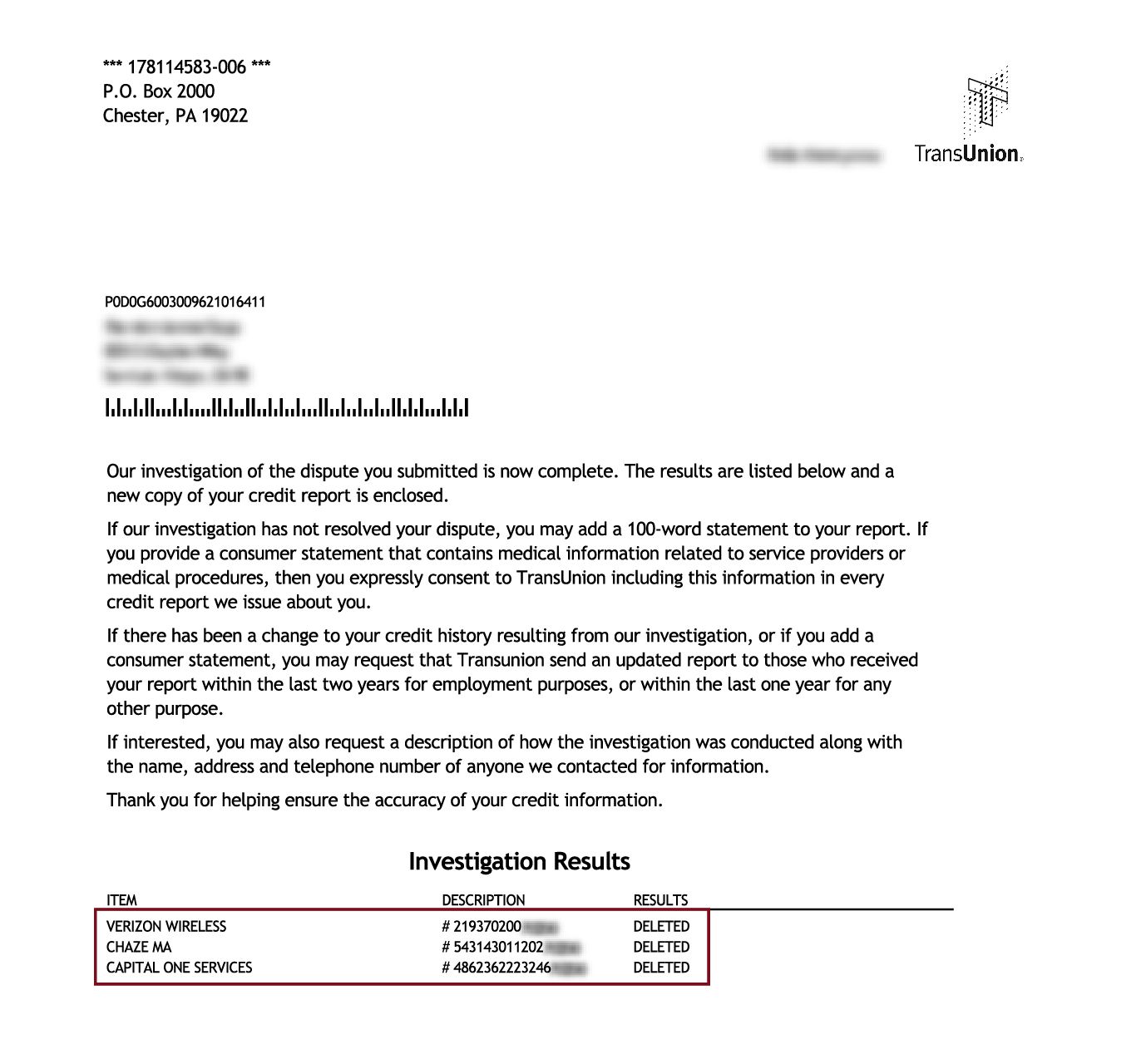

What Happens When An Item Is Deleted From Your Credit Report

Whenever your credit report is altered because of a dispute lodged by you or a credit repair service, the credit bureau must inform you in writing. You are then entitled to a fresh copy of your credit report from the bureau.

Many credit cards offer free alerts that inform you whenever your credit score changes. Thus, if an item deletion results in a change to your score, your credit card company may be the first to inform you of the good news. You also may get a free fraud alert service.

You should see your credit score improve when negative items are removed from your reports. How much it improves, however, depends on the type of item that is removed and its age.

The credit bureau must send you written results about your dispute, which usually arrive within the initial 30-day window. If the results are favorable, you can instruct the bureau to notify anyone who received your report in the past six months.

You May Like: How To Get Free Credit Report Without Paying

If All Else Fails Get Legal Help

If you absolutely must have a negative item removed from your credit report, or you have a series of negative entries you hope to remove, you may need to get legal representation.

A credit law firm will be the best choice. Probably the best in the business is Lexington Law Theyve been helping consumers work out credit problems for years, and with much success.

As a law firm, they know of more strategies to get negative information removed from your credit report. And even if they dont have 100% success, theyre likely to get much closer than you can on your own.

There will be a cost to use the services of a credit law firm, so youll need to evaluate the benefits youll receive from cleaning up your credit report against the cost youll pay to have it done.

But if you need to get your credit report cleaned up in a hurry, a credit law firm is your best strategy.

How Do I Remove Negative Items From My Credit Report For Free

You can remove negative items for free, but youll have to invest some sweat equity in the form of time and attention. If youre watching every penny, its good to know you can get your credit reports and submit disputes for free.

You start your cost-free DIY odyssey by ordering a free credit report from AnnualCreditReport.com. This source is authorized by the federal government to give you a free annual credit report from each consumer reporting company: Equifax, TransUnion, and Experian.

If after scouring your reports you identify items you wish to dispute, you can do so for free online, thereby saving the cost of paper, ink, and postage.

Because youre going it alone, youll have to do the record-keeping and dispute tracking that a credit repair service would have done for you. This will take up your time, but you neednt shell out any money to do the job.

Perhaps you would like to make the job easier by spending just a little money. If so, consider a software package as an alternative to support from a credit repair service. For example, offers software-as-a-service for less than $20 per month that supports consumers who wish to dispute items on their credit reports.

Credit repair services can range from about $80 to $150 a month. As mentioned earlier, these companies aim to have you , so costs may run anywhere from $300 to $900 for the period. Thats how much money youll save if you do it yourself.

Don’t Miss: Where To Get Your Credit Report

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

How Do I Get Inaccurate Negative Items Removed

Removing errors from your credit report can help improve your credit. The first step to removing negative inaccurate items from your credit history is to find them. You do this by getting your free credit report from all three of the major credit bureaus . You have the legal right to get your report from all three bureaus once per year for free. In response to the coronavirus pandemic, the three reporting agencies are allowing consumers to access their credit reports once a week for free through April of 2022. You can also enroll in fee-based credit monitoring services from the three major bureaus, which include additional access to your credit report and credit score.

Once you have your credit reports the next step is to check each of them for errors. Itâs important to check all three reports because they may contain different information. Many lenders report to all three agencies, but some do not. What are you looking for? Start by looking at your personal information. Ensure your name, address, and phone number are correct. Ensure there are no accounts listed with a similar name that belong to someone else. This can happen if personal identification information is not carefully checked by the credit reporting agency.

According to the Consumer Financial Protection Bureau , these are the other most common credit report errors:

You May Like: How Long Hard Inquiry On Credit Report

Is It Better To Pay Off Collections Or Wait

From the viewpoint of repairing your credit score, its better to pay off a collection sooner rather than later, assuming you can afford to do so. However, a paid collection will only help your credit score if the collector agrees to remove the item from your credit report. Short of that, paying off a collection may have no effect on your credit score.

As explained above, you may have bargaining leverage with a debt collection agency. This manifests when you submit a pay for delete letter that offers to pay the debt in return for removing the collection item from your credit report. Your offer may be for the full amount owed, but you can request a partial write-down of the balance due.

For example, suppose you had a $10,000 credit card balance and were unable to make payments. Eventually, the card issuer wrote off your account and sold it to a debt collection agency for 20 cents on the dollar. The issuer collected $2,000, which means the collection agency must collect at least that much just to break even.

The fact that your original debt was $10,000 may be less important to the collector than to the credit card issuer. If the collector were to collect, say, $4,000 on the old debt, it would rack up a gross profit of 100%. Therefore, the collector may be willing to accept a pay to delete deal.

That is, a higher score will improve your access to credit and lower the amount of interest youll be charged. A higher credit limit will reduce your credit utilization ratio.

Wait For The Negative Items To Expire

The final method would be to just wait it out. Negative remarks stay for seven years on average. While it may seem like a long time, your credit score improves continuously with on-time payments. Moreover, as your debt gets older, the impact it has on the overall credit score decreases.

| DID YOU KNOW? Negative items cant be put back on your credit report once theyve expired. Weve exposed various other myths about credit repair as well to help you get a better understanding of credit repair. |

Don’t Miss: Is 596 A Good Credit Score

How To Remove Negative Items Before The 7

If you cant wait 7 years for derogatory marks to fall off your credit report, then you have three options.

The first method is a reliable way of deleting outright errors from your credit report. If you want to delete legitimate information, youll have to use the second or third method, both of which have a much lower chance of success.

Is It Possible To Remove Accurate Negative Information From My Credit Report

You generally cannot have negative but accurate information removed from your credit report.

You can, however, dispute accurate information if it appears multiple times. Most negative information will remain in your report for seven years. Some types of information remain longer.

You can also dispute negative information that arose from identity theft or is not information about you. The credit reporting companies should remove these items from your credit reports.

Beware of anyone who claims that they can remove information from your credit report thats current, accurate and negative. Its probably a .

You have the legal right to dispute inaccurate information directly with both the credit reporting companies and the companies that furnish your information to the credit reporting companies. To fully protect your rights, you should always dispute credit report inaccuracies with them both. They must conduct a reasonable investigation, and fix mistakes as needed, usually within 30 days, at no cost to you.

There is no reason to pay someone else to dispute inaccuracies on your credit report for you as it is already a legal right available to you for free.

If you are having problems with credit reporting or credit repair companies you can also submit a complaint to us. We will forward your complaint to the company and work to get you a response.

You May Like: Do Late Payments On Closed Accounts Affect Credit Score

How Long Do Negative Items Stay On Your Credit Report

It depends on what the item is, but most will fall off after seven years. Yes, I said seven years. I know thats a long time. Its even longer for a chapter 7 bankruptcy, which takes 10 years to fall off.

But before you hang your head in despair, you should know that the impact of negative items to your score will lessen before those seven years are up as long as you dont mess up again. This lessening can start in a matter of months for a minor mishap like a 30-day late notation to more than a year for a really serious issue like a charge-off or a bankruptcy.

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Don’t Miss: Is 745 A Good Credit Score