Reasons Why Late Payments Appear On Credit Reports

In general, there are two main reasons that late payments would appear on credit reports:

You actually made a late payment or missed a payment entirely

A creditor mistakenly reported a late payment

If your creditor has mistakenly reported a late payment, the error can be relatively easy to fix. If you made a payment late and are at fault, it will be much more difficult to have the late payment notice removed from your credit report.

Accurate Or A Mistake

Late payments appear in your credit reports when lenders report that you paid late. That can happen in one of two ways:

If the report is accurate, it can be difficult and time-consuming to get the late payment removed from your reportsand it likely won’t be removed for seven years.

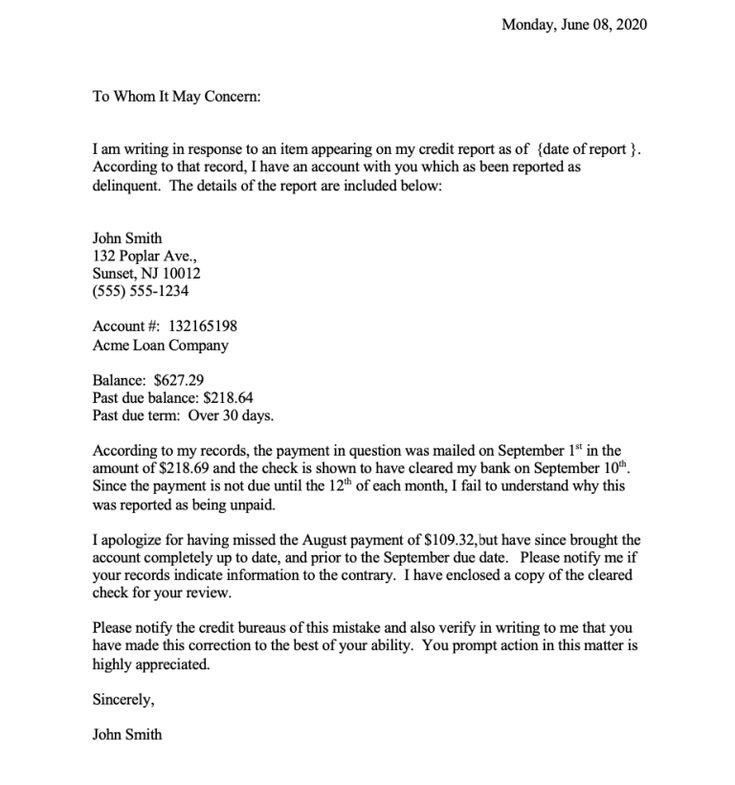

If the report of a late payment is incorrect, it can be relatively easy to fix the error. You need to file a dispute explaining that your report contains a mistake and demand that the payment be removed. If you mail the letter, then you should send it by certified mail with a return receipt request.

Consumer reporting agencies must correct errors, and failing to do so is a violation of the federal Fair Credit Reporting Act .

Fixing the error may take several weeks, but your lender may be able to accelerate the process using rapid rescoring, in which you pay for a faster update of your report. Doing this typically only makes sense if youre in the middle of a home purchase or another significant transaction.

How Do You Dispute An Inaccurately Reported Late Payment

Use this method if theres an incorrect late payment on your credit reports that didnt actually occur. If you were at fault, learn more about removing actual late payments below.

You can also use this method if you actually made a late payment but theres some inaccurate information associated with it. In this case, you probably shouldnt expect to have the late payment record completely removed. Instead, your creditor will probably just correct the error but the delinquency will stay on your report.

Disputing items on your credit report is free. You may need to dispute the late payment with several companies in all. Heres the basic procedure:

Remember to be patient. This process may be solved successfully at step 2, or it could take longer. You shouldnt have much of a problem with the major credit card issuers if they clearly made a mistake, even if you have to spend more time on the phone than youd like. But, its possible that other credit card companies might be more difficult to work with, like issuers of subprime cards.

MoneyHack

Recommended Reading: How Does Leasing A Car Affect Credit Score

How To Dispute Late Payments That Were Accurately Reported

If you actually made a late payment thatâs been recorded on your credit report, it can be much more difficult to get it removed. Here are some alternatives steps you can take to resolve the matter.

Goodwill Adjustment from your creditor

Once a late payment is reported to the credit bureau, it can be very difficult to get it removed. As soon as you realize that youâve made a late payment, itâs always worth reaching out to your creditor to ask them to not report it to the credit bureau. If you are a good client and donât have a history of making late payments, your creditor might agree to not report it to the credit agency as a goodwill gesture. They may request to have something in writing for their files, so they may request that you write a goodwill letter.

I have personally had success with contacting a creditor and asking them to forgive a late payment as a goodwill gesture. I once completely lost track of my credit card payment due date and made a payment that was about three days late. I contacted the credit card company who agreed to make a âgoodwill adjustmentâ and not report the late payment because in the five years I had been a cardholder, I had never made a late payment. The credit card company didnât even charge me a late fee! It was indeed a much-appreciated goodwill gesture on their part. As a rule-of-thumb, it never hurts to ask and be honest with your creditor.

Try to get to an agreement with your lender

Will Creditors Delete My Late Payment History If I Submit A Goodwill Letter

Now that weve explored late payment disputes, lets talk about goodwill adjustment letters.

If youre familiar with the subject, you may know that goodwill letters used to work to some extent to remove late payments from your credit record. However, that was 10-15 years ago.

However, at this point in time, the bottom line isgoodwill letters do not work. In fact, many bank websites say so explicitly.

Whats more, submitting a goodwill letter may actually decrease the chances of removing a late payment from your record .

But the sad part is, every self-proclaimed credit expert still claims you will achieve forgiveness on a late payment with a goodwill letter.

Signs to look out for

As a result, many folks end up wasting their time sending courtesy removal requests to creditors. Lots of other people have wasted money with ineffective credit repair companies, including the likes of and Lexington Law Firm, whove been known to prey on customers and have been sued by one of the governments regulating agencies.

Want more proof that goodwill letters are a waste of time? Check this out:

Here is Bank of Americas own website stating that goodwill letters will not work. Bank of America says the following:

Were required to report complete and accurate information, and thats why we arent able to honor requests for goodwill adjustments.

Recommended Reading: Is It Bad To Check Your Credit Score

How Long Will A Late Payment Stay On A Credit Report

Once a late payment is recorded on your credit report, you should know that it will be there for six years. Fortunately, as time passes, the impact on your score will decrease, because lenders care more about your recent credit history instead of the old one.

Therefore, its always important to keep up with future payments even though you were unable to make one payment on time. Your score will also improve over time, so it will be easier to get approved for credit.

How Long Does Information Stay On My Equifax Credit Report

Reading time: 3 minutes

Highlights:

- Most negative information generally stays on credit reports for 7 years

- Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type

- Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years

When it comes to credit reports, one of the most frequently asked questions is: How long does information stay on my Equifax ? The answer is that it depends on the type of information and whether its considered positive or negative.

Generally speaking, negative information such as late or missed payments, accounts that have been sent to collection agencies, accounts not being paid as agreed, or bankruptcies stays on credit reports for approximately seven years. Here is a breakdown of some the different types of negative information and how long you can expect the information to be on your Equifax credit report:

Here are some examples of “positive” information and how long it stays on your Equifax credit report :

- Active accounts paid as agreed. Active credit accounts that are paid as agreed remain on your Equifax credit report as long as the account is open and the lender is reporting it.

- Closed accounts paid as agreed. If the last status of the account is reported by the lender as paid as agreed, the account can stay on your Equifax credit report for up to 10 years from the date it was reported by the lender to Equifax.

Also Check: Does Care Credit Affect Your Credit Score

Get A Free Copy Of Your Credit Report

The Fair Credit Reporting Act promotes the accuracy and privacy of information in the files of the nations credit reporting companies. Monitoring your credit report is a necessary practice to keep in check any negative information. Consumers should obtain their free credit report and review it at least once a year to catch any irregularities on time and keep track of disputed items.

Consumers are entitled by law to a free annual credit report from each of the three main reporting bureaus: Equifax, Experian, and TransUnion, and you can access all three of them through one single website:

AnnualCreditReport.com is the only authorized website through which you can gain free access to your credit report from the three major bureaus. Be wary of other sites that promise the same, as they may have hidden fees, try to sell something, or collect personal information.

You May Like:

How To Handle Accurate Late Payments

You canât erase a valid negative item from your credit report just because you donât like it. The FCRA lets the credit bureaus leave accurate late payment information on your credit reports for up to seven years. But there are potential ways to get a correct late payment removed from your credit report. If you are now wondering, âHow often does my credit score update?“

Also Check: How Long Does Stuff Stay On Your Credit Report

Why Do Late Payments Show Up On Credit Reports

There are two basic reasons why a late payment might be shown on your credit reports:

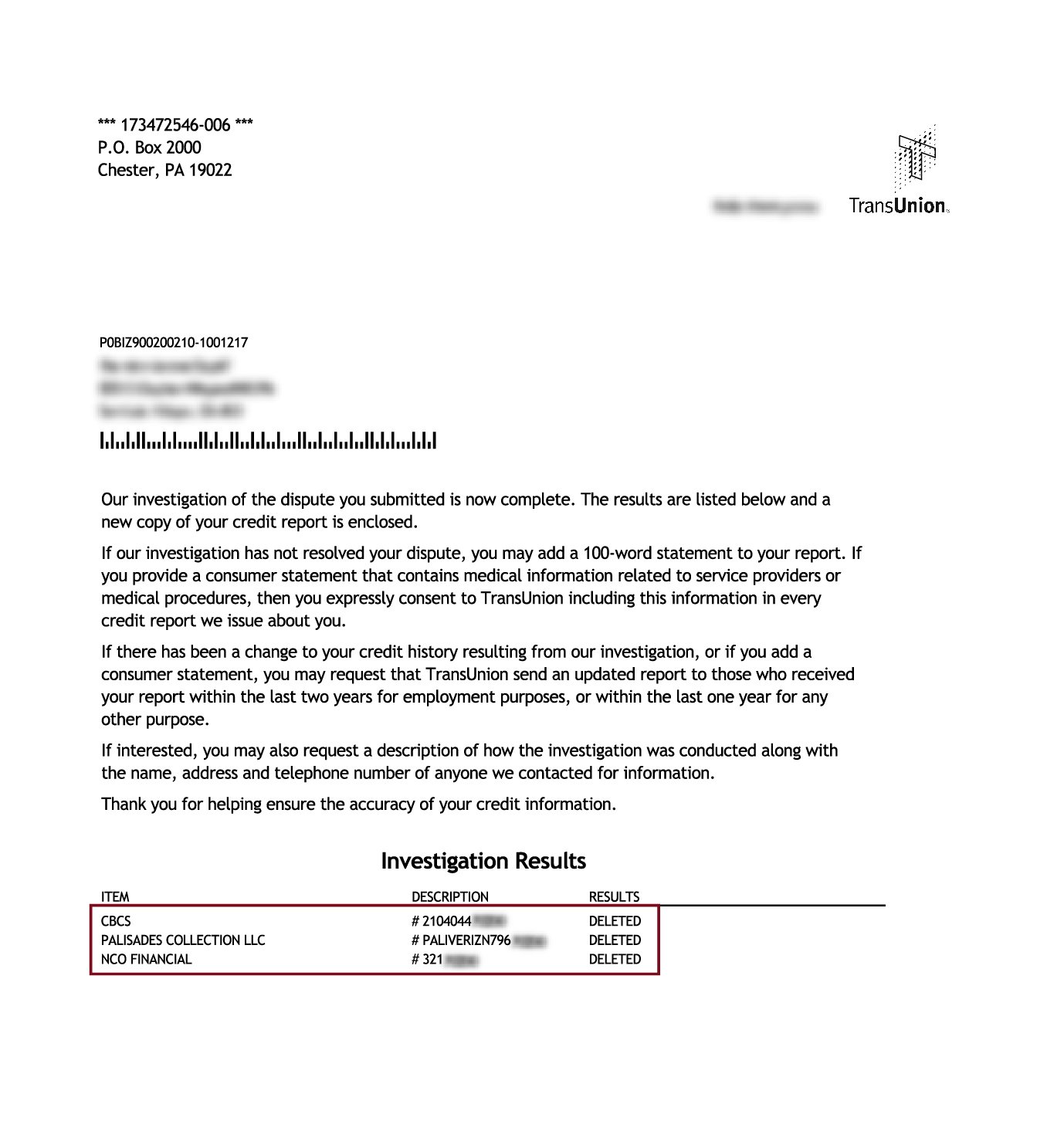

In the first case, it may be possible to remove the late payment from your credit reports by filing a dispute. The credit bureaus dont want inaccurate information on their reports, so if your claim can be verified, theyll take steps to fix the problem.

In the second case, you may be able to have the late payment removed from your credit reports. This process basically consists of asking nicely, explaining your situation, and promising to be more responsible in the future. Theres absolutely no guarantee that this will work, and youll have better success if you have a positive payment history other than this blemish.

No matter how the late payment got on your credit reports, it usually will be worth your time to attempt to remove it.

In this article well discuss when late payments will show up on your credit reports, and why you should remove them if you can. Then well go over the actual steps of how to dispute an inaccurate late payment, and how to ask lenders to remove legitimate late payments from your reports.

MoneyHackAvoid Scams

Many credit repair companies offer to fix your credit fast for a price. They claim miraculous results. The truth is, they have no special privileges or access.

How Much Does A Late Payment Hurt My Credit

If you have perfect or near-perfect credit, a late payment could knock upwards of 100 points off your FICO score.

As you can see, a single late payment can have a bigger impact on your credit file than you may think.

Thats because payment history comprises 35% the biggest chunk of your credit score.

When you already have excellent credit, you have more room for one negative item to take a big hit.

A single late payment will have a smaller impact if your credit file already has some problems such as multiple late payments or a charge-off or collection account.

Read Also: How To Figure Out Your Credit Score

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

Additional Problems You May Encounter

If you can devote a serious chunk of your time to contacting all the different credit vendors, your chances of getting forgiveness of these late payments are 50/50 at best.

If you are trying to rebuild your credit, then going forward, you may miss one of the late payment creditors, causing your efforts to fail. If you do get a loan with your late payments showing on your credit report, you are probably going to be paying a lot extra in interest fees since you will be at a high risk of making payments on time.

Some creditors suggest you send a letter to them explaining the reason for the late payments. This is called a goodwill letter, and the object here is making sure your letter ends up in the right hands, viewed by the right person or people.

Wouldn’t it be nice to have a solution to this letter-writing campaign that would be hard at work on your behalf, removing late payments from your credit report? There is such a solution.

You May Like: How To Remove Child Support From Credit Report

Work With A Professional

If youre not confident in your ability to successfully dispute a late payment on your own, there are several popular credit repair companies that can help you.

have knowledgeable legal professionals on staff to help you out. They also help with other negative information on your credit reports.

Its easy to call for a free consultation to get an idea of the cost and the services theyll provide you with. Working with a pro is a great idea if youre short on time, unsure of your own abilities in disputing, and have some buffer room in your budget for this short-term expense.

Request A Goodwill Adjustment

This is an ideal option if you generally have a good payment history with your creditor and have been a customer for a while.

To do this, write a goodwill letter to the credit card issuer or lender and explain your situation. Credit card companies have some flexibility when it comes to reporting late payments. They can remove late payments from your credit report under the right circumstances.

Did you have an unexpected expense arise last month that made you late? Are you trying to perfect your credit score so you can get a mortgage or an auto loan?

Include your personal story in the goodwill letter so that the customer service representative reading your letter understands why this would be helpful.

Many people succeed with this method because creditors dont want to risk losing your account because of a single disagreement.

Don’t Miss: How To Increase Credit Score To 800

When To Consider Using A Goodwill Letter

When you send a goodwill letter to a creditor, youre asking them to do you the favor of removing accurate information from your credit reports. Your only hope is that the creditor will want to stay in your good graces and be willing to extend this courtesy. A goodwill letter also shows that you are willing to take some initiative when it comes to your credit health, and thats generally a good sign.

Typically, you should consider sending a goodwill letter to a creditor when youve made a late payment and have a good excuse. For example:

- You thought your bill was set up for automatic payment, but you were mistaken

- You switched banks and your payment was accidentally forgotten during the transition

- You moved and your bill never arrived at your new address

- You were in the midst of a balance transfer and you didnt realize your old balance wasnt paid off

- A financial crisis temporarily impacted your ability to cover your bills

In any case, your goodwill letter should ask for mercy and relief from an accidental late payment, but you should also be able to confirm the same mistake will not happen again. As a result, you should consider sending a goodwill letter when you are truly ready to take your credit seriously and never miss a payment again.

Impact Of Identity Theft On Your Credit Report

Identity theft occurs when someone steals your personal information and uses it to apply for new lines of credit. If these new accounts go into default, they will appear on your credit report and hurt your score.

Cleaning up your credit after identity theft can take anywhere from a day to several months or even years. The longer it takes you to realize someone stole your identity, the more difficult it will be to undo the damage. Monitoring your credit report will help you to stay on top of potential fraudulent charges.

Read Also: How To Check My Credit Rating Free Online

When Is A Late Payment Reported To Credit Bureaus

Just because a payment is late doesnât mean it will be reported. If a payment is made before itâs 30 days past due, it likely wonât show up on credit reports from the three major credit bureaus: Experian®, Equifax® and TransUnion®.

There are a few reasons for that. One is because those bureaus have standardized the way negative information is reported. That includes late payments. And within that system, thereâs no method or code available to report payments that are between one and 29 days late.

What Happens if a Payment Is Between 1 and 29 Days Late?

Even if a late payment isnât reported, there could still be consequences. Your issuer can charge a late fee, even if itâs the first time your credit card payment is late. And being late again within the next six billing cycles can result in an even higher fee.

Late payments could also affect your interest rate. You can check with your credit card issuer or read your card agreement for more information.

What Happens if a Payment Is More Than 30 Days Late?

Late payments are also typically reported at 60 days, 90 days, 120 days and 150 days. At 180 days, an account is required to be charged off. That means the account is closed and written off as a loss by the issuer.

But be aware that some lenders may charge off accounts earlier than 180 days. And even when an account is charged off, the debt is still owed. And it could be sent to collections.

You May Like: How To Remove Credit Report Freeze