Give Boost Access To Your Checking Account

Boost learns how you pay your utility bills by looking for payments you have made to utility companies from your online checking account. Youll have to give Boost access to your checking account by providing your login credentials.

If your bank requires multi-factor authentication , youll be prompted to enter this code to verify that you want to give Experian access to your checking account.

Banks are very particular about you sharing your log-in credentials. Be prepared to work through this process. Be careful not to enter wrong information so you dont accidentally get locked out of your online bank account.

When It Doesnt Really Help

But although Experian Boost can increase your credit score, the service doesnt help everyone

Remember:

This service is only offered through Experian.

So, on-time utility and cell phone payments will only appear on your Experian credit report.

The inclusion of these payments on your credit file is only beneficial when future creditors pull your Experian credit report. Or, when they pull your score from credit scoring models that recognize Experian dataFICO and VantageScore .

There are three major credit bureaus, the other two being Equifax and TransUnion.

Some creditors and lenders pull all three credit reports when reviewing credit applications. But others only pull one report.

So if you improve your Experian credit file, yet a lender reviews your TransUnion credit file, Experian Boost isnt going to help.

Be mindful that Boost scans your bank account to look for qualifying on-time payment.

So the service also doesnt help if you make your cell phone payments or utility payments with a credit card.

How Does Boost Affect My Credit Score Updates

If you are a Free customer, your score will continue to update every 30 days if you log in. If you are a CreditExpert customer, your score will continue to update daily. Participating lenders will always see your latest boosted score when you apply for credit.

We will recalculate your boost when we update your score or, if you add or remove any of your connected current accounts.

Don’t Miss: How To Print Out My Credit Report

Should You Use Experian Boost Before Applying For A Mortgage How It Can Help

You may have seen commercials lately for Experian Boost, a program that says it can increase your credit scores instantly.

Their latest ad spot features wrestler John Cena riding around on a horse, giving people with no hope of getting approved for a loan, well, hope.

Even better, its free to use. So if youre on the cusp of average, good, or even excellent credit, perhaps a boost could improve your approval odds and save you money.

Well, thats the idea at least. In practice, it might not actually work that way, especially if were talking about a home loan.

Some Of My Boost Data Looks Wrong What Can I Do

If something doesnât look right, youâll be able to let us know via a feedback form when you view your Boost data. If you do give us feedback, weâll get a better idea of how we can improve the Boost service in the future. Right now, we arenât able to action individual comments, or make changes to the categorisation as this is an automated process. If youâre not happy with this, you should disconnect all your accounts, or remove the Boost service. This will mean we cannot share your boosted score or a summary of your Open Banking data with participating lenders.

If you see payments that you havenât made, we advise that you contact your bank directly.

Recommended Reading: Does Your Credit Score Go Down When You Check It

Which Is Better Experian Boost Or Credit Karma

Experian Boost is the only service out there right now that offers the chance to increase your credit score through the use of on-time payments as alternative credit data. For other services, however, Experian and may be comparable.

One key difference between Experians and Credit Karmas monitoring services is that Experian offers a FICO score and Credit Karma offers a VantageScore. While the VantageScore is helpful to understand the general health of your credit profile, lenders typically consider the FICO score in lending decisions.

That said, Credit Karma offers credit scores and credit report information from two credit bureaus, Equifax and TransUnion. With Experians free tier, you only get access to your Experian data.

Given this, it could potentially be a good idea to have accounts with both services. That way, you can keep tabs on your credit files with all three credit bureaus.

Improve Your Credit Score

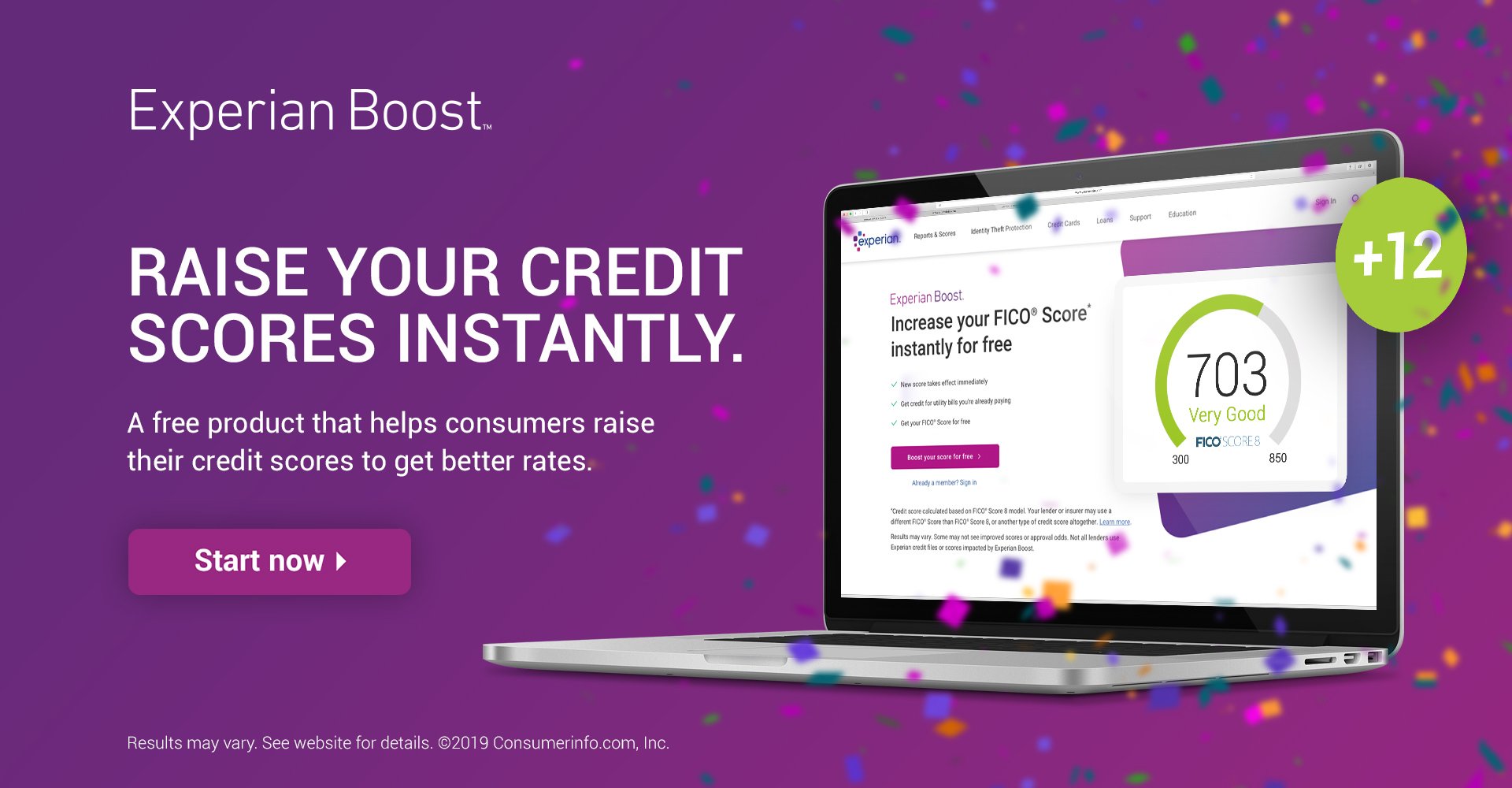

According to Experian, the average Experian Boost user improved their FICO score by 13 points. This can be a major benefit when it comes to your personal finances.

With even a small credit score boost, you could unlock better financing terms to save yourself thousands on major purchases. This is especially true if the boost gets your Experian credit score over the threshold from fair to good.

Experian Boost is a useful option for those with a thin credit file. It will add information to your account that will expand your credit report.

You May Like: How To Clean Up Your Credit Rating

Four Million People Served & 50 Million Fico Points Added

Launched in 2019, Experian Boost is an innovative tool that enables consumers to increase their credit scoreinstantly. To date, Experian claims more than four million people have used Boost to enhance their FICO scores by 50 million+ pointswith an individual average of approximately 19 points. And theres no charge to people who want to take advantage of this service.

Can Experian Boost Lower My Credit Score

Have you always assumed raising your credit scores takes a long time? Think again. Experian Boost is a revolutionary new tool that helps consumers instantly improve their FICO® Score by giving them credit for on-time telecom and utility payments they’ve already made.

This free tool is great for people looking to take their credit scores to the next leveland for those who want to begin establishing their credit history.

Don’t Miss: When Can Bankruptcy Be Removed From Credit Report

You Can Delete Accounts

If for any reason you no longer want your utility account reported to your credit report, you can delete the account from Boost. Boost will stop searching for the account you delete.

If you no longer want Experian Boost logging into your online bank account for any reason, you must delete the service from your Experian Profile altogether.

If you change your online bank account log-in credentials, dont forget to change the same information in Experian Boost.

Experian Boost can help you build your credit record with phone and utility paymentsand its absolutely free!

How Does Experian Boost Work

Consumers who want to use Boost must allow the product to scan their bank account transactions to identify streaming, utility and cell phone payments. Information about payments will appear in their Experian credit report and be used when certain credit scores are calculated from that data.

Boost counts only positive payment history, Experian says, so missed streaming, utility or cell phone payments will not hurt your score. Thats different from how credit scores usually work, where missed or late payments are recorded in your credit report and can reduce your score.

To use Boost, consumers sign up for a free membership on Experians website and grant permission to connect their online bank accounts. Boost then identifies streaming, utility and cell phone payments. Once a consumer verifies the data and confirms they want it added to their Experian credit file, an updated FICO score is delivered in real time.

Also Check: Does Mortgage Pre Approval Affect Credit Score

How To Use Credit

To use any new scoring program, you must opt in.

For Experian Boost, that means granting permission to the accounts you use to make your payments, such as checking, savings, and credit card accounts. While the bureau says Boost does not access your account information beyond collecting payment history, this access could be a drawback for some users.

UltraFICO also relies on permission to access your banking information, but scrutinizes your accounts further, looking into your day-to-day financial activity to determine your UltraFICO Score. TransUnions eCredable Lift, on the other hand, does not require access to banking information at all. Instead, you only need to grant permission via your utility accounts logins.

After opting in to Experian Boost, up to 24 months of payment history is added to your credit report, and reports each month like any traditionally-reported credit account. The payments you choose to add to your score are optional you could add your Netflix bill but not your natural gas payment, for instance.

Only positive payments are added, so missed or late payments on these accounts wont affect your score through Boost though TransUnions program does report negative information in addition to positive.

Really fit it into your budget, Livadary says. Making those payments is an essential, non-negotiable expense.

What Happens When I Use Experian Boost

Experian will look for your qualifying bills and then youll decide which ones to share. Behind the scenes, Experian will verify that all the accounts are accurate, then add the accounts to your Experian credit file. Specifically, Experian looks at your qualifying bills to make sure youre a) paying them through Chime and b) paying them on time. Experian Boost only considers your on-time payments, so late payments wont hurt your credit scores.² The whole process takes about five minutes. Its a fast, safe, and easy way to boost your credit scores.

You May Like: What Is Elan Financial Services On My Credit Report

Can I Disconnect Experian Boost

While Experian Boost works for most people, some consumers may see their scores stay the same or go down once they link their bank accounts.

This is a result of the complex algorithm used to calculate credit scores. If you see your FICO® Score decrease as a result of connecting your bank accounts through Experian Boost, you can simply disconnect your linked banks and your score should return to its previous number. Remember, you can always give Experian Boost another try by reconnecting your accounts later on.

If your credit scores stay the same, keeping your bank accounts linked can help your overall credit health and may help boost your FICO® Score in time. If your bank accounts stay linked, Experian will continue to check for qualifying on-time payments and will add them to your credit file if they are found.

If you pay utility or telecom bills using your checking or savings account, consider trying Experian Boost to see if you can instantly raise your FICO® Score and get credit for your past on-time payments. You can always get your free credit score from Experian to stay on top of your credit and see how you may be able to improve your scores.

Is Experian Boost Safe To Use

Whether Experian Boost will actually help your credit may vary. Even if it doesn’t help you, however, Experian Boost will not hurt your credit score.

For one thing, Experian Boost looks at your banking data, not your credit history. This means there is no . Plus, Experian Boost only includes on-time payments, which add positive payment history. So, that bill you paid three days late last year won’t be included.

That being said, it’s important to keep in mind that failing to pay your utility or other bills can hurt your credit score. But that would happen whether you use Experian Boost or not.

If you fall behind by more than 60 days, your provider can report your account as delinquent to the credit bureaus. Payment history is 35% of your FICO® Score. As such, late payments can severely damage your credit. Additionally, negative items, like late payments, can stay on your credit reports for up to seven years.

Read Also: Is Your Credit Score On Your Credit Report

Other Ways To Add Payments To Your Credit Report

There are several other systems that let you add regular payments to your credit report.

Experian RentBureau adds rent payments to your Experian credit report. Its free and easy to use. Your landlord will have to be willing to participate.

Rent reporting services like Rent Reportes, LevelCredit, and Rental Kharma will report your rent payments to the three credit bureaus, but you will pay a fee.

eCredable Lift is a service similar to Experian Boost but run by TransUnion. Using both Experian Boost and eCredable Lift will place your utility payment records on two of your three credit reports.

These services have limitations. The change in your credit score wont be dramatic, and it will only affect one credit report.

On the other hand, Experian Boost is free . These services are easy to use and pose little or no risk. What have you got to lose?

Boost Vs Ultrafico And Other Ways To Build Credit

Experian is testing another product in conjunction with FICO, also aimed at helping thin-file consumers. The UltraFICO score, which launched as a pilot in 2019 and will roll out in the spring of 2020, also requires access to your bank account data to gauge financial behavior. Instead of utility payments, the score factors in how much you have in savings and whether you incur overdrafts in your checking account.

Boost competitor eCredable Lift can pull information from utility accounts. It reports utility tradelines to TransUnion, and it goes back up to 24 months. It requires credentials to connect to utility accounts, and can be useful even if the customer is unbanked or underbanked. It’s not free, though. It costs $24.95 a year and affects only TransUnion credit reports.

Right now, both Boost and UltraFICO influence only your Experian credit report and scores built using that data. You can do other things to strengthen your credit, and the effect of these steps can extend to all three credit bureaus:

Building credit takes time and patience, and it pays to track your progress. NerdWallet offers a free VantageScore credit score as well as a free credit report from TransUnion.

About the author:Amrita Jayakumar is a former writer for NerdWallet. She previously worked at The Washington Post and the Miami Herald.Read more

Recommended Reading: How To Boost Up Your Credit Score

Users Support Can Experian Boost Hurt Your Score

Experian Boost provides customers support through email, phone calls, or live chat. Experian Boost declares that they provide the very best customer support in the credit repair industry since Experian Boost supplies 24/hour calls with a real individual to chat through any problems you may have.

The customer support at Experian Boost was timely, knowledgeable, friendly, and considerate. Experian Boost also has an extensive helpdesk system that includes videos and blog posts on exactly how to make use of the Experian Boost system as well as troubleshooting functions such as report spam. Experian Boost is always updating its system to ensure that customers experience will be continuously enhancing.

Experian Boost is likewise constantly working to make Experian Boost much easier to use. Experian Boost has a practical training that can walk you through getting started as well as an extensive library of content on their platform describing how Experian Boost works the ideal for your needs.

Overall Support Rating Can Experian Boost Hurt Your Score

Experian Boost customer assistance is a topic with combined reviews from Experian Boost customers. Experian Boost has a helpdesk that you can log into and make use of at any time. Nonetheless, some customers have noticed the good quality of Experian Boost user support to be subpar or lacking detail.

Can Experian Boost Hurt Your Score Credit Repair

Experian Boost supplies its clients a chance to fix any errors on their personal financial background through the online website as well as using phone or email correspondence if needed.

Consumers have actually designated situation managers that function straight with clients in order to resolve disagreements rapidly and effectively before they impact your creditworthiness further down the road.

There are no upfront prices entailed during enrollment into Experian Boost because of the truth that you will only be charged once results show improvement within two months from the date of your registration. Experian Boost likewise provides its consumers a cost-free copy every month to check just how their credit score is enhancing or deteriorating based on Experians findings and suggestions.

Experian Boost has actually been operating for more than 20 years, and during that time, it has helped improve thousands upon countless personal financial records to make sure that customers can acquire lower interest rates from banks when requesting home mortgages and auto loans.

You May Like: What Does Credit Score Mean

Become An Authorized User On A Credit Card

Becoming an authorized user on someones credit card can also boost your credit score.

Youll benefit from their on-time payment history, as well as their account history.

Youre not the primary account holder, though. So only become an authorized user if you trust this person to be responsible with their credit account.

Disadvantages Can Experian Boost Hurt Your Credit Score

Right here are some downsides of Experian Boost that we need to look at to derive at a good analysis of Can Experian Boost Hurt Your Credit Score.

Not Offered In All Areas

Experian Boost is not available in all states. Experian, one of the three major credit bureaus, does not offer its services to every U.S state. There are 17 states where Experian can not aid enhance your FICO rating which may lead you to think about various other choices for enhancing a bad credit rating or even give up on Experian Boost completely if it cant be made use of at all in your state.

Not ideal For Mortgage Loan

You ought to not use Experian Boost if you are going to get a mortgage loan. Experian discloses that its Experian Boost product is made only as an academic platform.

The credit score it offers might transform relying on which credit rating record detail is made use of, whether your FICO Rating has actually been changed recently due to modifications in the scoring model, how many times your information has altered when given that last time Experian opted-in updated your data with new ratings.

Mistakes On Credit Rating

If there is any sort of mistake on the credit reports supplied by lenders Experian Boost is unable to take any type of action on it. Experian does not regulate the info in your credit score records. And Experians products are unable to make improvements or avoid mistakes from showing up on your credit history report.

Quality Is Not Assured

You May Like: When Do Creditors Report To Credit Bureaus