What Is A Credit Score

A credit score is a numeric summary of your credit history, a commonly used method for lenders to predict the likelihood that you will repay any loans they make to you.

There are no exact cutoffs for good scores or bad scores, but there are guidelines for each. Most lenders view scores above 720 as ideal and scores below 630 as problematic.

Consumers are becoming more aware of how raising their credit score improves their financial outlook and Homonoffs study has evidence of it. She found consumer behavior improved dramatically when people were aware of their credit score.

Many people thought they had a great score, but then found out they overestimated it, she said. They realized they had to start changing credit behaviors, so they stopped making late payments, they paid off cards with a balance and their scores improved.

The FICO credit score is used by 90% of the businesses in the U.S. to determine how much credit to offer a consumer and what interest rate to charge them for that credit.

FICO uses five major components in the equation that produces your credit score. Those five include:

Check And Understand Your Credit Score

Its important to know that not all credit scores are the same, and that they fluctuate from month to month, depending on which credit bureaus lenders use and how often lenders report account activity. So, while you shouldnt worry if you see your scores rise or fall by a few points, you should take note when a big change occurs.

The two main consumer credit scoring models are the FICO Score and VantageScore. Here are the factors that comprise your FICO Score and how much each factor is weighed:

- Payment history

- Amounts owed

- Length of credit history

- New credit

Here are the factors influencing your VantageScore:

- Total credit usage, balance and available credit

- Payment history

- Age of credit history

- New accounts

There are a variety of options for checking your credit score for free.

For example, consumers can get a free FICO Score from the Discover Credit Scorecard even without having a Discover credit card, and a free VantageScore by creating a LendingTree account. American Express and Capital One also offer free credit scores to both card account holders and the general public, though many other card issuers offer free access only to their cardholders.

Here are the tiers that credit scores can fall into, according to FICO:

| FICO Score tiers |

| Poor credit |

Should I Pay Off My Collection Debt

If possible, negotiate a way to get the collection DELETED from your report. Sometimes agencies will do this if you agree to pay back the debt. Be careful when going this route, and seek out a bit of professional advice to avoid making matters worse.

Here are the basic steps for paying off a collection debt

Youre going to wait a while between step one and two, which will give you plenty of time to dive into the gritty details of what next. Know that the more of your debt youre willing to pay, the greater chance you have of them removing it from your report.

Also Check: Cbcinnovis Credit Check

Does Paying Collections Improve My Credit Score

The answer to this question, like so many others, is it depends. As mentioned above, different credit-scoring models are used by different lenders, and the models differ. Some lenders, including many mortgage lenders, use older credit-scoring models that still count zero balance collections toward your credit score, which means that even if you pay off the debt, it will still hurt your credit.

But paying off collections could raise your credit for newer scoring models that ignore paid-off collections accounts with no balance. Though paying off debt may not help much if you have several debt collections or if the paid-off collection is old, because older debts have less of an impact on your credit than newer debts.

While paying off your collections account may or may not help your credit score, it could help you in the future by making you a better, more reliable loan candidate in the eyes of lenders. Thats because, while it still affects your credit, at least youre showing them that you paid it off. Plus, some mortgage lenders require borrowers to pay off collections before they can be eligible for a mortgage.

How To Pay Off Debt In Collection

Before paying a collection, make sure it’s valid and within the statute of limitationsthe time when you can be sued. You can send a written request to the debt collector. In it, ask for information proving the amount you owe and showing that they’re authorized to collect the debt.

Once you’ve received sufficient proof of the debt and you’ve decided you want to move forward with payment, here are your best options, from most to least desirable.

You May Like: Does Paypal Report To Credit Bureaus

Request A Goodwill Deletion

While you can leverage your willingness to pay to get a deal with your creditor to remove a negative item, when youve already paid, you can no longer negotiate. What you can do is to send a letter to your creditor, requesting to delete a negative item out of goodwill. You need to convince them to help you, such as by pointing out how long youve been a good customer to them and assuring them that youll keep your accounts updated moving forward.

This Man Removed 12 Collections Accounts On His Own And His Credit Score Improved By 169 Points

Editors Note: This is the personal story of one consumer . You should know that:

- Debt settlement sometimes causes a tax liability. The IRS considers forgiven debt taxable income. Depending on the type and amount of debt forgiven, and whether and how it is reported to the IRS, you could be liable for additional federal taxes.

- The credit bureaus are under no obligation to remove an account from your credit report before it legally ages off, including paid collection accounts, and in fact may refuse to remove a collection account from your file even if the creditor agrees to request removal. Paid collection accounts do not hurt your score in the newest FICO® scoring model.

If youve heard you have to wait seven years for a collection account to fall off your credit report, take notes while reading this heroic story about a guy who conquered 12 collections and emerged victoriously with a dramatically higher credit score after a very short amount of time.

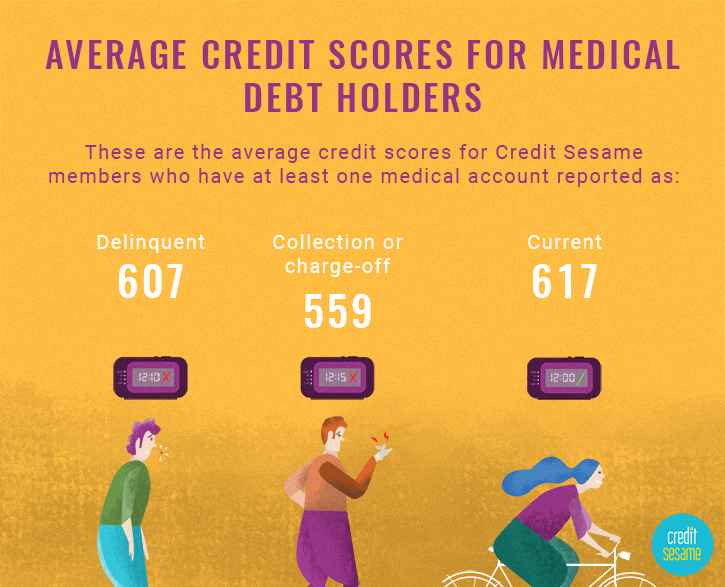

While that may seem far-fetched, Credit Sesame member Larry Marion, owner of Rogue Wave Media in Chicago, Ill., learned that its doable by anyone.

Read Also: Does Paypal Report To Credit Bureaus

Here Are Top Rules That Will Help You Stay Away From Debt Traps

A credit card comes in handy in various emergency situations. Moreover, it offers several benefits and discounts to the card holder. However, you should be careful and when it comes to using the credit card as there is a high possibility you will over use it. Here are some easy steps that will help you keep aways debts.

23 May 2018

How Can I Get Help Paying Off Debt In Collection

While you can work with collection agencies on your own, it may be helpful to get assistance from a nonprofit credit counseling organization. A credit counselor can help you figure out how much you can afford to repay, and they may even negotiate a payment plan with the collection agency.

As a last resort, you may also consider a for-profit debt settlement company to help you work out a settlement arrangement with the collection agency.

Recommended Reading: What Is Syncb Ntwk On Credit Report

Is The Debt Time

Finally, take note that if your debt is time-barred meaning the statute of limitations has passed. In this case, your debt collector may no longer have the right to sue you and win a judgment. But in some states the clock can restart if you make a written acknowledgement of the debt or make a payment toward it.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How To Remove Items From Credit Report After 7 Years

Can You Raise Your Credit Score By 100 Points In 30 Days

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Your credit score affects everything from the interest rate youll pay on an auto loan to whether youll be hired for certain jobs, so its understandable if youre wondering how to raise your credit score quickly.

While there are no shortcuts for building up a solid credit history and score, there are some steps you can take that can provide you with a quick boost in a short amount of time. In fact, some consumers may even see their credit scores rise as much as 100 points in 30 days.

Learn more:

Know Your Rights With Debt In Collections

Having a debt in collections doesn’t mean you don’t have rights. You shouldn’t suffer harassment as a result of being unable to pay your bill.

The Fair Debt Collection Practices Act outlines your rights, including the following:

- A collection agency cannot contact you at work if you have specifically informed them that your employer will not allow you to receive their calls in the workplace.

- They cannot contact you before 8 a.m. or after 9 p.m.

- Debt collection agencies are strictly prohibited from deceiving you. For example, it would be illegal for them to claim they are a law enforcement agency in order to scare consumers into paying.

Having a debt in collections is overwhelming for anyone, but you should remember that you still have rights. If a debt collection agency violates these rights, you can report them to the Attorney Generals office in your state or the Federal Trade Commission .

Don’t Miss: What Is The Highest Credit Score A Person Can Have

File A Dispute Directly With The Reporting Business

Reporting businesses include credit card issuers and banks. Upon receiving a dispute, they are required by law to investigate and respond. If the reporting business corrects the issue, you saved yourself the step of contacting the credit reporting agency. It is vital to make sure the items are cleaned up for all three credit bureaus mentioned above.

However, trying to work out your debt directly with the lender will not necessarily change the amount of time said negative item would remain on your credit report. It will only change if the dispute is resolved with the lender and deleted from your credit report.

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts, such as your old student loans, remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Recommended Reading: How To Get Credit Report Without Social Security Number

Changing The Status To Paid Doesnt Do Anything To Your Credit Score

Changing the status to Paid, Paid as agreed, or Settled will not have any impact on your credit score. The balance will not impact your credit score, either if a collection company refuses to pay for delete and responds to the credit bureau when you file a dispute.

You will have to wait it out the more time passes, the less impact collections have on your score. A collection account will drop off your credit report 7 years from the date the account went 180 days past due.

How Many Points Does A Credit Score Go Up When A Collection Is Removed

How many points does a credit score go up when a collection is removed? We know that even small oversights can cause huge damage to your report. So, its understandable that youd be concerned.

And, without trying to be too ominous, you should be concerned.

High credit scores provide access to bank loans, higher mortgages, credit cards, and better interest rate. Some employer even run credit checks to vet potential employees.

As you can imagine, its important to know your credit score. In a survey from LendEDU, 25% of millennials dont even know what a credit score is 5% of them even believe its youre waiting list spot for a credit card.

So, its safe to say that were getting into a bit of technical territory as we jump into collections. Lets take a minute to review the basics.

Read Also: Does Paypal Credit Affect Credit

Can Paying Off Collections Raise Your Credit Score

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

If you’ve ever received a phone call or a letter from a debt collector, you know it can be stressful. Debt collectors attempt to collect money owed to a landlord, medical service provider or some other creditor. And while paying or settling your collection accounts may certainly look better to future lenders, there’s no guarantee your credit scores will improve as a result.

How Will A Debt In Collections Affect My Credit

Unfortunately, a debt in collections is one of the most serious negative items that can appear on credit reports because it means the original creditor has written off the debt completely. So when a debt is sent to collections, it can have a severe impact on your credit scores. Thats why working hard to get current before an account enters collections can help your credit recover faster from a late payment.

Additionally, lenders also may consider frequency of debt collections. For example, someone whos had only one debt transferred to collections may have an easier time getting approved for credit than someone whose credit report shows multiple debt collections.

If you already have debts in collection, the good news is that the impact on your credit scores will diminish over time. And eventually the debt collection will fall off your credit reports completely. Generally, an account in collection will remain on your credit reports for seven years.

Also Check: How Do I Get A Repo Off My Credit

How Bad Do Collection Accounts Hurt Your Credit Score

Collection accounts can destroy your credit score. A single collection account could drop a credit score by as much as 100 points. Your payment history makes up 35% of your overall credit score, according to FICO.

If you have collections on your credit report, then youre probably wondering if you pay off the collections, will it improve your credit score? There are many different opinions on this matter, but the short answer is no.

A collection account is part of your payment history. The amount of debt owed is no longer a factor in your credit score because its been charged off. Thats right, a collection account with a $10,000 balance hurts your credit the same as a collection account with a zero balance.

Can You Remove A Collection Entry From Your Report

If you have a collection entry, the simple answer is yes. Its possible to remove it in most cases. And thats something youll want to do. A collection entry appearing on your credit bureau can hurt your credit score and, in some cases, stop you from getting car loans and mortgages.

Before we discuss how to remove a collection entry, it helps to talk about what a collection entry actually means, how much it can lower your credit score and how long it can remain on your credit report if you dont do anything about it.

Can you use some help with your finances? Learn about credit counselling today.

You May Like: Does Paypal Credit Check Your Credit