Get Credit For Rent And Utility Payments

Rent reporting services can add your on-time rent payments to your credit reports. Rent payments are not considered by every scoring model VantageScores include them but FICO 8 does not, for example. Even so, if a would-be creditor looks at your reports, rent records will be there, and a long record of consistent payments can only help.

Experian Boost also can help, but in a more limited way. You link bank accounts to the free Boost service, which then scans for payments to streaming services and phone and utility bills. You choose which payments you want added to your Experian credit report. If a creditor pulls your FICO 8 using Experian data, you get the benefit of that additional payment history.

Impact: Varies.

Time commitment: Low. After initial setup, no additional time is needed.

How fast it could work: Boost works instantly rent reporting varies, with some services offering an instant “lookback” of the past two years of payments. Without that, it could take some months to build a record of on-time payments.

Practice Good Credit Habits

Building a good credit score takes time and a history of on-time payments.

To have a FICO score, you need at least one account thats been open six months or longer and at least one creditor reporting your activity to the credit bureaus in the past six months. A VantageScore, from FICO’s biggest competitor, can be generated more quickly.

Practice these good credit habits to build your score:

Does Your Credit Score Start At Zero

The answer is no. As briefly mentioned above, your credit score can never start at zero. This is the case because a lender calculates your credit score when you want to apply for a loan. Additionally, your credit card issuer often completes this process to check out your creditworthiness.

When this procedure starts, the card lander or other entity will look for a credit score that mirrors how you are dealing with your credit accounts.

Don’t Miss: Credit Inquiries Fall Off

Common Mistakes When You Start Building Credit

When youâre establishing credit for the first time make sure you donât make one of these common mistakes:

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Recommended Reading: How To Get Rid Of Repo On Credit

How Can You Check Your Credit Scores

Reading time: 2 minutes

-

There are many different credit scores and credit scoring models

-

You can purchase credit scores from a credit bureau or get one free from some banks and credit unions

Many people think if you check your credit reports from the two nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports do not usually contain credit scores. Before we talk about where you can check your credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score there are many different scores used by lenders and other organizations. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time.

Score providers, such as the credit bureaus Equifax and TransUnion along with companies like FICO, use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the two nationwide credit bureaus may also vary because some lenders may report information to both, one or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you check your credit scores? Here are a few ways:

In addition to checking your credit scores, its a good idea to regularly check your credit reports to ensure that the information is accurate and complete.

What Is The Quickest Way To Build Your Credit

The fastest way to build a credit score from scratch is to open a credit card, maintain a credit utilization ratio below 10% and pay it off every month.

If you already have a credit card, aim for a credit utilization below 10% and never miss a payment. If you have a loan, like an auto loan or student loan, make payments on time and avoid opening new loans. It will still take several months to build your credit, so follow the steps above and be patient.

You May Like: Syncb/ntwk

How Do Secured Credit Cards Work

In order to qualify for a secured credit card, you need to first make a security deposit with the same lender or bank. Those funds are held in a separate account. Youre then approved for a credit card . Make some minor charges, then repay the balance in full each month, otherwise youll end up having to pay interest. After six months to a year of successfully managing your card, you may be able to qualify for a traditional credit card and get that security deposit back.

Open A Second Credit Card

Once youve built up a positive credit history with your first credit card, its time to apply for a second credit card. Having multiple credit cards under your name increases the amount of credit available to youand if you can avoid running up high balances on your credit cards, you could lower your and improve your credit score.

Plus, having more than one credit card gives you the opportunity to earn different . You might want a travel credit card and a cash back credit card, for example, or a card that rewards groceries and a card that rewards dining out.

You May Like: Usaa Fico Score

A Credit Score For No Credit History

What credit score do you start with if you have no credit history? We already know that you cannot start your credit at zero, so the first thing you need to do is find a way to build your credit. Some of the most effective and efficient ways that will help you build credit include:

- Secured credit cards

Start Creating A Good Credit History

Itâs hard to get credit if you donât have a credit history. But you canât have a credit history if youâve never had credit. Itâs a bit of a chicken and egg situation.

So what can you do instead? Here are some ideas:

Consider asking your bank for a small overdraft facility

An overdraft allows you to borrow money from your bank account. Since itâs a form of credit, it shows up on your credit report.

Some current accounts feature a small automatic overdraft facility, so itâs worth checking if yours has one. If it doesnât, try explaining your situation to your bank and ask them what your chances of being approved would be if you were to apply.

You donât have to use your overdraft. In fact, itâs usually better not to, as overdrafts tend to be expensive due to the interest you pay. The point is to build your credit history by adding more information to your credit report.

Put your utilities, broadband and other household bills in your name

More and more, companies such as utilities and broadband providers are sharing data with credit reference agencies. If you donât have a credit history, putting these bills in your name is your opportunity to start building your score.

For best results, check that your name is spelled correctly and always write your address in the same format. Even something as simple as a misspelled street name could lead to inaccuracies in your report.

Pay by direct debit whenever possible

Read Also: Remove Transunion Inquiries

How To Build Credit Responsibly

One of the best ways to demonstrate responsible use of credit whether were talking credit cards, auto loans or home mortgages is to check your credit report and credit score at least once a year.

You can receive a free credit report from each of the three major credit bureaus by going to AnnualCreditReport.com and requesting it. You can get one at a time every fourth months or get them at the same time. Either way, compare the information from one against the other two to be sure there are no mistakes.

Also, checking your credit score has become increasingly easy and free! Many of the card companies supply free credit scores on their monthly statement or by going online to their website and requesting it. There also are personal finance websites that offer free scores.

8 MINUTE READ

How Your Credit Score Is Calculated

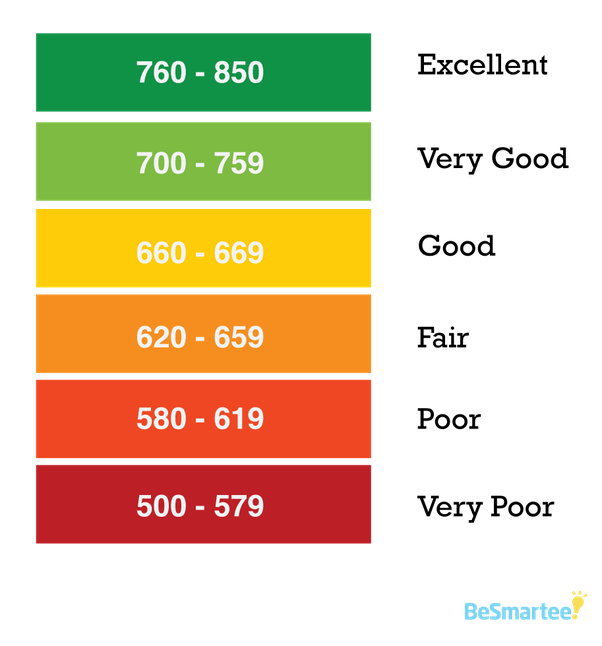

To understand why your first credit score is likely to be somewhere in the middle range, it’s important to know how credit scores work. Your credit score is calculated using five factors:

Don’t Miss: Trimerge Credit Report

What Is A Credit Builder Loan

Accordingly, if you are building your credit for the first time, you might consider a . This will help you complete fixed payments to your lender, thus, gaining access to the determining loan amount.

The credit builder loan works in quite a simple way. The lender will set aside the money if you get an approved credit builder loan application. Then, you will proceed with making monthly payments, and the lender will report said payments to credit bureaus. If you have completed all of your payments on time, just by the end of the loans term, all of the funds will be available for you to use.

Once the procedure for building your credit history begins, you will have to follow several simple steps to further help you get into the good credit score category.

These steps include:

- On-time payment of your bills, because this action directly affects your credit score.

- Limit your credit usage to keep the recommended balance.

- Consider a mixing of account types, including installment loans with regular payments, and so on.

Keep Your Accounts Open Unless Theyre Costing You

The length of your credit history also factors into your credit score, which is why it can be so challenging when youre learning how to start building credit for the first time. Once you have some accounts open, avoid closing them unless you have a good reason to do so.

Its fine to close an account if its charging you a big annual fee or if its a loan you want to pay off as fast as possible. But if the account isnt costing you, closing it could shorten your credit history and ding your score.

Recommended Reading: Verizon Credit Collections

Where Can I See My Credit History

You can see your credit history using any of the three UK CRAs. Each CRA creates their own credit report based on the information they have access to. This means your report may vary from one CRA to another, depending on what information they hold on you.

You can get your free Experian Credit Score by signing up with us. To see your up-to-date Experian Credit Report, get personalised tips for improving your credit score, and benefit from report alerts and more, you can take out a paid subscription â this starts with a 30-day trial if youâre a new customer*. Alternatively, you can order your statutory credit report, which gives you a one-off copy either in print or online.

Qualify Based On Your Credit In Another Country

If you established credit in another country and then move to the U.S., your credit history wont get added to the U.S. credit bureaus systems. But the credit you built overseas may not all go to waste.

International banks and card issuers have programs that can help existing customers get a credit card in the U.S. based on that relationship. They can then report the U.S. credit card to the bureaus to help you establish your credit here.

Other companies are taking different approaches. For example, Nova Credit allows you to use your credit history from select countries to apply for U.S. financial products.

Theres also Jasper, a credit card company that creates a card for professionals who are moving to the U.S. and have a job offer. If that describes you, you can apply and qualify for the card before you arrive in the country.

Recommended Reading: Free Credit Report With Itin Number

Open A New Credit Card

Approach this method with caution. Having your own credit card is an exciting, but equally daunting prospect. There were347 million credit card accounts opened in 2019 alone.

Some people, especially those who are new to handling credit responsibility, can find it difficult to withhold from racking up debt. An excellent strategy for ensuring you dont get carried away is watching your credit utilization, or your credit-to-debt ratio, which can be calculated by dividing how much youve spent by how much youve been given. As a general rule of thumb, it is best to keep this number below 30%.

If your credit score is currently suffering because youre not in a financial position to pay off your debt and lower your credit utilization in the near future, an alternative option could be opening a new credit card. This would give you more credit, and assuming you dont put any more money on the new card, your overall utilization would drop.

Opening a new card might also help you save on fees and interest. Many credit cards charge an annual fee in addition to an Annual Percentage Rate , which is the interest rate youll have to pay on any outstanding debt after each billing cycle. Oftentimes, you can open a new card with a different issuer and bargain for a lower APR, then transfer your balance from one card to another so that youre not racking up interest. Some issuers will promote 0% APR on balance transfers for around 13 months.

Limit New Credit Applications

“More isn’t always better when it comes to building credit,” Griffin warns. “Opening too many accounts at one time can make you look like a greater risk to a lender and have a negative impact on your credit scores.”

Each time you apply for credit, an inquiry appears on your credit report, regardless if you’re approved or denied. This can temporarily lower your credit score by roughly five points, though it will bounce back in a few months. While one credit inquiry isn’t likely to hurt your score, the effect can add up if you apply for multiple cards within a short period of time.

If you want to open more credit cards, consider doing it over time instead of within the same month. While there’s no number of credit cards that’s too many, it’s not wise to apply for several cards at once. It’s a good idea to space them out I opened 10 credit cards over a span of five years.

You May Like: Eos Cca Pay For Delete

Add Alternative Data To Your Credit Profile

Alternative data refers to information that traditionally hasnt been widely found on credit reports, such as your history of making rent, utilities or cellphone payments. When youre first starting out and have a thin file, additional accounts could help you build credit. If you can get this information to the credit bureaus, they may be able to add it to your credit reports.

Some companies, like Experian Boost and eCredable, allow you to link eligible bank or utility accounts. The programs look for qualifying payments or accounts that they can report to a bureau. Currently, Experian Boost can add data to your Experian credit report while eCredable reports to TransUnion.

There are also services, such as LevelCredit, that you can use to add rent payment information to your credit reports. As with other alternative data, rent reporting programs may only report your information to one or two of the bureaus.