How To Check Your Credit Score For Free

There are dozens of resources available for you to check your credit score for free, but the type of score you receive varies between a FICO® Score and VantageScore. While both are helpful for understanding the key factors that influence your credit history, FICO Scores are used in the majority of lending decisions.

The simplest way to access your free credit score is through your credit card issuer. Many card issuers provide their cardholders with free access to their FICO® Score or VantageScore. Beyond your bank, consider free resources from Experian, Discover and Capital One.

Where To Go From Here

Theres no time like the present to get started on repairing your credit. Begin by checking your current credit score as a baseline, and reviewing your credit reports in detail to see what areas look weak.

Then create a solid plan to address those weaknesses with responsible habits such as paying all of your bills on time and aggressively paying down debt to lower your credit utilization.

Some categories simply take time to rebound from, such as delinquencies or new lines of credit. As you continue to work on your credit, check your credit scores once a month to monitor your progress.

This can help you determine when youre ready to make a major financial decision, such as qualifying for a competitive home loan, or it can simply serve as motivation to keep up the good work with your finances.

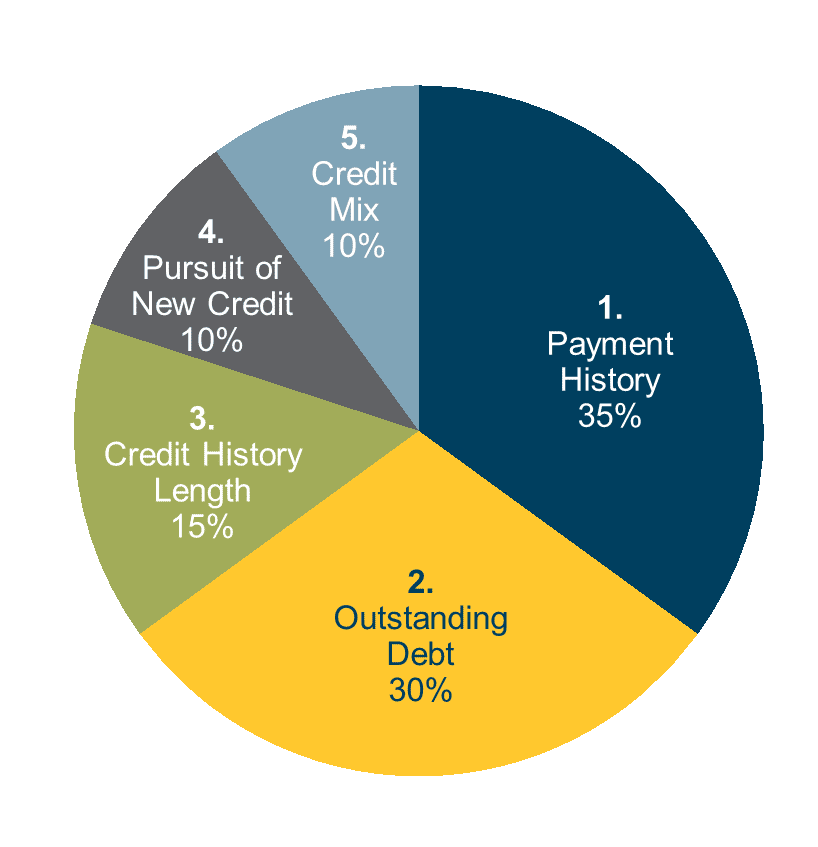

The 5 Factors That Make Up A Credit Score

There are five factors that make up a credit score: payment history, credit utilization, length of credit history, types of credit, and new credit. Each factor is given a different weight, and together they produce a score that ranges from 300 to 850. The higher the score, the better. Heres a closer look at each factor:

Payment history: This is the most important factor in your credit score, accounting for 35% of your total score. It includes your record of on-time payments, late payments, collections, bankruptcies, and foreclosures.

Length of credit history: This is 15% of your credit score and refers to the amount of time youve been using credit. A longer history will boost your score a shorter history will drag it down.

Types of credit: This measures the variety of accounts in your name and is 10% of your total score. It includes mortgages, auto loans, student loans, personal loans, and revolving lines of credit such as credit cards.

New credit: This is 10% of your total score and refers to the number of new accounts youve opened recently as well as the inquiries made on your account by lenders who are considering lending you money or approving you for a new line of credit.

Recommended Reading: How To Get Charged Off Accounts Off Credit Report

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

The Impact Of Credit Inquiries

Your credit score is designed to give lenders an idea of how likely you are to repay a loan on time. A higher score means youre more likely to repay a loan, while a lower score means youre more likely to default on a loan.

One factor that can impact your credit score is credit inquiries. These are requests for your credit report made by lenders, businesses, or companies that are considering lending you money or extending you credit.

Hard inquiries can impact your credit score because they indicate that youre looking for new credit. This can be viewed as a higher risk by lenders, and it can cause your score to drop slightly. Depending on the scoring model being used, hard inquiries can stay on your report for up to two years and can have a bigger impact on your score if they occur in a short period of time.

Soft inquiries have no effect on your credit score because they dont indicate that youre looking for new credit. However, they may still show up on your report so that businesses can see your entire borrowing history.

If youre concerned about the impact of hard inquiries on your credit score, there are a few things you can do to minimize the damage:

Also Check: How Does Credit Utilization Affect Your Credit Score

What To Do If Your Credit Score Is Not Updating

Why is my credit score not updating? It could be due to several reasons:

- There is no new information being reported to the credit bureaus.

- You have negative information on your credit report that is dragging down your score.

- Your credit score is not updating because you have a thin file. This means there isnt enough information on your credit report to calculate your score accurately. If this is the case, there is not much you can do except to wait and build up your credit history over time.

Is It Possible To Get A Perfect Credit Score

Yes, earning a perfect credit score can be possible. But that level of perfection most likely represents a peak on a continuum. Although more people may achieve this perfect credit score, at any given moment, few can maintain it. If this inspires you to shoot for the best credit score in the land, there are ways to improve your standing step by step.

Recommended Reading: Do Removed Collections Show On Credit Report

What Information Goes On A Credit Report

Your credit report provides details on your financial history over the past 5 to 10 years. This report includes both personal information and details of your credit history, such as:

Personal Information:

It is also important to note that any credit applications that have been made over the past five years will also be recorded on your credit report. These are also known as inquiries, and they come in two types: hard inquiries, and soft inquiries.

Hard inquiries are typically performed by lenders when you apply for a loan, credit card, or mortgage. These inquiries have the ability to negatively impact your credit score.

Soft inquiries happen during instances such as when you check your credit score, or when an employer checks your credit score as a type of background check. Unlike hard inquiries, soft inquiries will not impact your credit score.

For more information read: Understanding Credit Scores and Reports

How Often Does Your Credit Score Change

Waiting for your credit score to improve seems like it can take forever. If you’re checking daily, like most of us do now that there are so many convenient apps to keep up with your score, you probably notice that your moves up and down all the time. One day you might gain a few points the next day, you might lose a few. This can happen even if you’re checking your score from the same on the same app.

While the changes may be a little concerning, especially if you’re considering applying for a mortgage or car loan soon, they’re completely normal.

Recommended Reading: How To Unlock Credit Report

Why Is It Important To Know When Credit Companies Report

Some confusion can be cleared up by knowing when credit-card companies report to the CRAs. Its usually at your statement closing date.

Dont be alarmed if you check your credit report and see a balance when you know your card is paid off in full each month. At the end of your billing cycle, theres a great fluctuation, sometimes causing as much as a 30% shift in the credit score for most consumers. But when the payment is accounted for, it shifts back into form.

Billing cycles can vary. Some credit-card companies might do it at mid-month and others at the end of the month.

Credit-card companies probably are providing a snapshot of your current balance when they report to the CRAs. If this is a concern, keep track of your spending by your statement closing date. Making a payment before your statement closing date will keep the balance lower when its reported, helping your overall credit.

This also helps your credit utilization rate, an important factor when it comes to your credit score. Your credit utilization rate is your total credit-card balance divided by your total credit-card limit. Experts advise consumers to keep that ratio under 30%. Paying down your revolving debt and carrying a lower balance is a possible way to help your credit score, although it is influenced by several factors.

The bottom line is if you pay your bills on time and you keep a low credit-card balance, your credit score will take care of itself.

All that being said, here are some tricks:

What Is A Credit Score

A credit score is a three-digit number that represents your creditworthiness at the lenders. It estimates how likely you are to repay the loan and pay the bill. A credit score depends on several credit histories: the number of accounts opened, total debt level, repayment history, and more.

This data is gathered by the credit-reporting agencies. Using this credit score, lenders can estimate the likelihood of a person making timely payments. For example, if your credit score is up to 700, you will be eligible for various loan offers.

On the contrary, a credit score under 629 is considered poor because many lenders decline credit applications from people in the score range. If your credit score is under 629, dont be upset. There are numerous credit repair services available on the internet that help to gain a Reliable Credit score.

Don’t Miss: Does Checking Credit Score Lower It

Length Of Credit History

Your credit score is also related to how long you have been utilizing the credit. Financial experts recommend keeping credit card accounts open, even if you no longer use them. Your credit score will automatically increase based on the age of your account. Once you close your oldest account, your credit score will drop sharply.

How To Improve Your Credit Score

You can do a few things to help improve your credit score, such as paying your bills on time and maintaining a good credit history. Its also a good idea to obtain a copy of your credit report from credit bureaus and check that no errors have been made.

If you see any mistakes, you can dispute them and have them removed.

How to update your credit report quickly?

- Make sure you are punctual when it comes to your payment activity. This means making all of your payments on time and in full.

- Reduce your credit utilization ratio, which is the amount of credit youre using compared to your credit limit.

- Try to get any errors or adverse information removed from your credit report.

Don’t Miss: Will Collection Agencies Remove From Credit Report

Monitor Your Credit For Free With Creditwise From Capital One

Whether youâre trying to maintain your credit or improve your credit scores, itâs important to monitor your credit regularly. Why? Because monitoring your credit can help you see exactly where you standâand how much progress youâve made.

is one way you can monitor your credit. With CreditWise, you can access your free TransUnion credit report and weekly VantageScore 3.0 credit score anytimeâwithout hurting your score. And with the CreditWise Simulator, you can explore the potential impact of your financial decisions before you even make them.

You can also get free copies of your credit reports from all three major credit bureaus. Call 877-322-8228 or visit AnnualCreditReport.com to learn more. Keep in mind that there may be a limit on how often you can get your reports. You can check the site for more details.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

When Is Your Payment History Reported To The Credit Bureaus

Most creditors typically report information to the three major credit bureaus each month. The information they send includes payments that are paid on time and in full as well as any credit accounts that have entered delinquency.

However, companies like utilities and cell phone carriers usually only report late payments to the credit bureaus. Its important to pay your bill by its due date to avoid being penalized. However, those timely payments probably wont do anything to actually help your credit scores, they just prevent your credit scores from dropping.

They start at 30 days past due, then 60 days past due, and 90 days past due. Your credit score will go down with each additional period so be sure to pay as soon as possible to avoid further damage.

Credit card companies also update your account credit card balances each month. This affects your . If you paid off a large chunk of one credit card but racked up a balance on another, all of that will be reflected on your credit report, and consequently, your credit score.

Remember that the amount you owe accounts for 30% of your FICO score. Most lenders want to see your credit utilization ratio under 30% which means you dont want to owe more than 30% of your available credit limit. If you pay off your credit card balance to lower this amount, you will increase your credit scores.

Also Check: How Remove Charge Offs From Credit Report

How And When Are Credit Scores And Reports Updated

Normally, you can expect your credit scores and credit reports to be updated about once every 30 to 45 days. However, this depends on a number of factors. Not all lenders and creditors report to the credit bureaus at the same time each month, so this will affect how your credit scores fluctuate. Furthermore, the credit bureau or company that you check your credit with will also affect what credit score you see. Not all lenders and creditors report their data to both credit bureaus, so if you check your credit with Equifax and then TransUnion, you may see two completely different scores or one of those scores may fluctuate more frequently than the other.

Stay Below Your Credit Limit

Hitting your credit limit leads to a hard inquiry and a poor credit utilization ratio. Both of these events will hurt your score. Paying off debt helps you stay below the credit limit. You shouldnt view a credit limit as your safety net. Getting close to your limit will hurt your score and can lead to higher interest from late payments. Interest will compound, making it more difficult to get out of the hole.

Prioritize repaying your balances and making on-time payments. Cut your expenses, grab a side hustle, and perform other necessary actions to improve your credit utilization. You can use a debit card to limit your spending to your checking account. Some debit card issuers report your financial activity to the major credit bureaus.

You May Like: When Was Credit Score Invented

Can Experian Help You Improve Your Credit Score

Experian Boost is a free tool offered by the credit bureau to improve your credit score effortlessly. Youll get credit for qualifying on-time payments to streaming services, utility, cable and cell phone providers on your Experian credit report. Participating service providers include AT& T, Disney+, HBO, Hulu and Spectrum. There are no credit checks or minimum qualification criteria, and late or missed payments wont be reported.

The average Experian Boost user sees a 12 point increase in their FICO Score 8. Users with established credit history generally wont see that much of an impact, if any at all.

You can give Experian a test drive by signing up for a free Basic membership. When you register, youll also get access to your free Experian FICO® Score and credit report with monthly updates, and FICO score monitoring of Experian data, Experian alerts and credit monitoring, and a loan and credit card matching tool.

If you sign up for Experian Boost and decide its not a good fit, you can un-enroll at any time.

When Do Your Credit Scores Get Updated

Since your are based on the information in your , your scores can be updated whenever your reports are updated. And how often your reports are updated might depend on how often the three major credit bureausâEquifax®, Experian® and TransUnion®âreceive information from lenders.

Every lender has its own schedule for reporting information to the credit bureaus. And lenders typically donât report information to each of the credit bureaus at the same time. But information is typically reported every 30 to 45 days. And your scores could change every time new informationâlike new accounts or changes to your account balancesâis reported by a lender and reflected in your credit reports.

Because every lender has its own reporting schedule and policies, your credit scores can change oftenâeven multiple times a day. Itâs normal for your scores to fluctuate a little.

And keep in mind that you have many different credit scores. Thatâs because there are many credit-scoring modelsâmathematical formulas used to calculate credit scores. And each formula is a little different. Formulas can use information from just one credit report or a combination of different reports. Then, each formula might assign different levels of importance to that information.

You May Like: When Does Open Sky Report To Credit Bureau