Assess Your Current Situation

Dont think about buying a car with an auto financing loan until youre sure that you can pay your existing bills on time. If doing so remains a problem, then call your creditors, explain your financial situation, and negotiate monthly payments you can afford. And if negotiations are successful, request a written copy of the new agreement.

Also, ask each creditor how a new agreement will be reported to the credit bureaus: account not paid as agreed or new loan terms now being paid as agreed?

Get Preapproved With Your Bank Or Credit Union

Sometimes, the best way to get approved for a loan is to work with the financial institution you have an existing relationship with. They can review your payment history on your past loans, and if you show that youre paying your bills on time, they may be willing to forgive any late payments in the distant past. Its a good idea to see whether your bank or credit loan will finance you and how much it’s willing to lend.

Getting preapproved is more significant than getting prequalified. Walking into a dealership with a preapproval sets a firm budget for your purchase. From there, you can search for vehicles that fall within your purchase limit and dealers will know you mean business.

Capital One Auto Refinance: Best For Bad Credit Auto Loan Prequalification

Loan amount: $7,500 to $50,000Best for: Refinance and prequalificationCar financing types: New and used purchase loans, refinancing loans

If you want a large bank experience, we recommend checking out Capital One Auto Refinance. Capital One offers prequalification for both purchase loans and refinancing loans.

Capital One doesnt have a credit score requirement. However, it requires you to make at least $1,500 or $1,800 per month depending on your credit. If you are prequalified, you can get a loan at one of Capital Ones 12,000 participating dealerships.

Don’t Miss: What Does Collection Mean In Credit Report

Where To Find A Bad Credit Car Loan

Car loans are available through most banks, credit unions and online lenders. You can also use dealership financing, as discussed above. But if you have bad credit, youre more likely to get a loan with reasonable terms through an online lender.

Online lenders to consider that work with borrowers of all credit levels include:

- Autopay: ideal if youd prefer to explore offers from multiple lenders, and rates start at 1.99 percent.

- iLending: caters to borrowers who want to refinance their existing loan, and rates also start at 1.99 percent.

- Carvana: offers a seamless online experience with rates starting at 3.9 percent.

Capital One is another popular choice for consumers with less than perfect credit, and the entire lending process can be handled online if you dont live near a branch. Some credit unions will also approve you for a bad credit car loan if you have a good history with their institution.

Where To Get Auto Loans For Bad Credit

You can find auto loans for bad credit from a variety of legitimate lenders on the market today. Some of these lenders have minimum credit score requirements, while others do not. However, you will need to show some form of regular income. Most bad credit auto loans require you to make at least $18,000 per year.

People with bad credit may have a harder time finding auto loans than people with good credit, but there are still plenty of options. Here are the main types of lenders for bad credit auto loans:

Be prepared to face higher interest rates if you have poor credit. However, you can reduce the amount of interest you will pay on a bad credit auto loan if you make a bigger down payment or choose a shorter loan payoff period.

You May Like: What Credit Score Do They Use To Buy A House

Know How Much You Can Afford

An auto dealers job is to upsell you on a car, so before you begin looking, its critical that you assess how much car you can afford. You, better than anybody, should know how much debt you can afford on a monthly basis based on how much you spend per month against your income.

Beyond this, start doing online research about how much youre likely to pay for car insurance, registration fees, parking, gas, property taxes and other expenses that are tied to owning a vehicle beyond the loan.

Buying a vehicle is an emotional experience. Dont get caught up in either the hype of the purchase or the intimidation of sitting in a sales managers office. Write the number youre comfortable with spending on a car and stick to it. The last thing you want to do is finance a car you cant afford and damage your credit score further.

Featured Partner Offers

On Consumers Credit Union’s Website

Dont Be Afraid To Walk Away

Buying a car is often a very high-pressure sale that can impact your credit score significantly, either in a good way or bad. Thats why it is so important to do your homework and take your time, regardless of how much you want a car.

If you like a vehicle that costs more than what you can afford, dont accept a longer loan term to achieve cheaper monthly payments. If you accept longer terms on a car loan, you will pay more in interest over the life of the loan and may pay more for the car than its actually worth over time.

Cars do not appreciate in value like houses. Its often said they depreciate the moment you drive it off the lot. Keep in mind that if you do get a longer term loan and are forced to sell the car before you have finished paying off that loan, you still have to pay back the balance on the loan.

Your best bet is to walk away from a car you know you cant afford and find a comparable vehicle that costs less.

Don’t Miss: Is 748 A Good Credit Score

What Credit Score Do You Need For Carvana

Carvanas creative delivery services of new vehicles quickly made it a popular choice among car shoppers.

Carvana also has in-house bad credit car loan options. It has no minimum credit score requirement, but all applicants must make at least $4,000 per year and have no pending bankruptcies.

You can prequalify for an auto loan through Carvana on its website and begin shopping the dealers online inventory immediately. Once you find a vehicle you like, you can complete your purchase paperwork online. Carvana will then deliver your vehicle to you for a fee or you can pick it up at a nearby location.

You then have seven days to get to know the car. If you are not satisfied, you can return it with no obligation.

You can also apply for financing through an outside financial institution to purchase a vehicle through Carvana. According to the company, it currently does not work with the following lenders:

- A+ Federal Credit Union

- Honda Financial

- Exeter Finance Corp

If you have any further questions about financing through Carvana, you can contact one of the companys finance experts at 1-800-333-4554.

Good For People Who Have Filed For Bankruptcy: Prestige Financial

Why Prestige Financial stands out: Bankruptcies have a significant negative impact on your credit scores, which may affect your ability to qualify for an auto loan. But Prestige Financial considers applications from people who have filed for bankruptcy. Just keep in mind that if you filed for Chapter 7 bankruptcy, your bankruptcy documents must be available for review on the court website. And if you filed for Chapter 13 bankruptcy, your repayment plan must be approved for your application to be considered.

Here are some more details on Prestige Financial auto loans.

Read our full Prestige Financial auto loans review.

Recommended Reading: What Does Closed Accounts Mean On Your Credit Report

Top 3 Bad Credit Car Loans

Lenders today have made it easier than ever for consumers to apply and receive a bad credit auto loan. Instead of dressing up and heading down to a bank and hoping to impress a loan officer, you can now apply for an auto loan without even getting out of bed.

With the online lenders and lending networks below, you can submit a short loan request form and receive a credit decision in a matter of minutes. If you qualify, you can start the shopping process and, in some cases, have keys in your hand by the end of the day.

| 2 minutes | 7.5/10 |

MyAutoLoan.com partners with lenders that offer consumers a wide array of auto financing options including refinancing options, new and used car loans, and lease buyouts.

Once you submit a short prequalifying form to the network, you can receive an email with up to four auto loan offers in a matter of minutes. Be sure to carefully study each offer because they all contain a unique loan term, payment amount, and annual interest rate.

Tips For Car Buyers With Bad Credit Scores

Theres no getting around the fact that if you have less than perfect credit and need an auto loan, the cost of financing is going to be higher. Despite this drawback, you can use your car loan to help improve your credit score for the future all you have to do is make your payments on time each month.

Here are some tips you can use to help you save money on your bad credit auto loan:

These tips can give you an advantage if you need a bad credit auto loan, where your average interest rate typically reaches double digits if your credit score falls around 600 or below. If you apply these tips and use the loan to improve your credit score, you can put yourself in a much better situation the next time you need to finance a vehicle.

You May Like: Is 700 A Good Credit Score To Buy A House

Car Loans For Bad Credit

Home MediaUp to 72Varies

- Great for customers with limited/no credit

- Offers special military rates

Up to 842.49%

- Average annual savings over $1,200

- Lending platform that partners with banks

- Approval and loan terms based on many variables, including education and employment

All APR figures last updated on 7/6/2022 – please check partner site for latest details. Rate may vary based on credit score, credit history and loan term.

When you have bad credit, trying to find a car loan to purchase a vehicle can be stressful. Bad credit car loans typically come with higher interest rates and may require large down payments. However, there are options available when it comes to auto loan providers that specialize in bad credit car loans.

In this article, we at the Home Media reviews team will explain the loan application process and provide you with tips to help increase your chances of getting approved. Based on our research, well also recommend several auto lenders that offer services to people with poor credit including some that offer the best auto loan rates or best auto refinance rates of 2022.

Questions To Ask About Car Finance With Bad Credit

Before you apply for car finance with bad credit, find out as much as you can about the offer youre getting. Ask yourself these questions before you apply.

You May Like: Is 570 A Bad Credit Score

Other Ways To Improve Your Credit Rating

Cut ties with those who have bad credit

You may have an old joint credit account with someone who has since fallen into bad credit. In cases like this its possible that the black mark against their name is dragging you down. If you want to sever ties with these people financially, youll need to issue a notice of disassociation. After some checks, credit reference agencies should be able to remove this person from your file.

Register on the electoral roll

When lenders do credit checks, theyll check your name and address. Being on the electoral roll makes this process much easier for them, and also helps to reduce the risk of fraud.

Pay debts off in a timely fashion

If youre trying to borrow money, having an already-growing debt isnt going to do you any favours. Keeping up with your repayments is a good sign to lenders that you can borrow responsibly. This will over time help to improve your credit score.

Increase your deposit

With finance deals like hire purchase or personal contract purchase, youre usually asked to put down a deposit. Normally this can be around 10%, but itll vary depending on what deal youre after. Putting a little more money down at this stage could help the lenders confidence in your ability to make repayments. This in turn may result in a better interest rate for you.

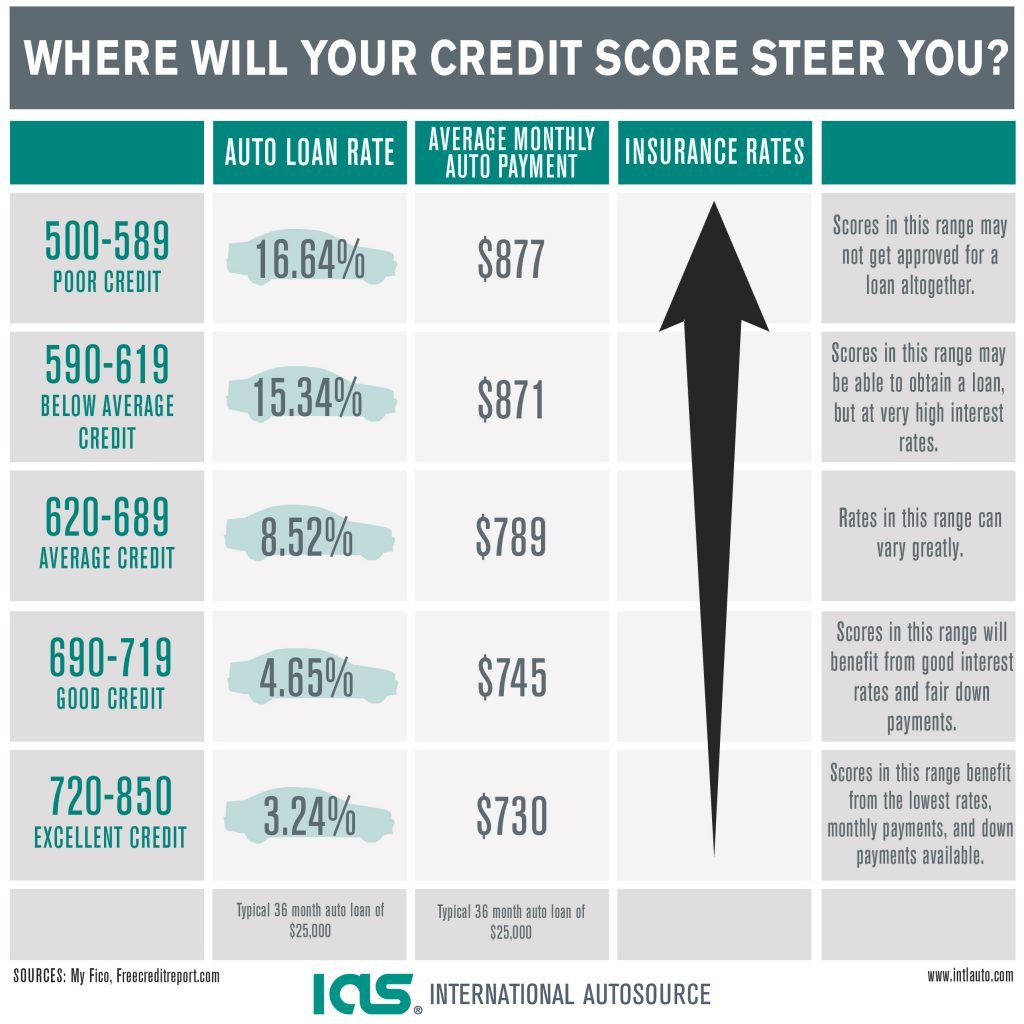

The Difference Between A Bad And Good Credit Rating

A good credit rating means that you are more reliable. In the past, you have likely paid all of your bills on time, you dont pay late or not pay at all. If you have a poor credit rating, you are probably someone who misses payments quite a bit or pays them late. Now, were not saying that this is entirely your fault, sometimes things happen, and they are beyond our control, but your credit score wont take any of that into account. As far as its concerned, if you make your payments regularly and on time, your credit score will be far better than if you dont.

Also Check: Why Is Mortgage Not On Credit Report

Best Choices For Vehicle Loans For Bad Credit

As with any type of loan, be sure to comparison shop when looking at vehicle loans for bad credit. This may require a little bit of legwork on your part to compare direct lenders. But you can let lending networks do the comparisons for you and connect you with lenders that want to do business with you after seeing your prequalification information.

Be sure to compare the loan terms, including the interest rate, loan term, and monthly payment to find the best deal for you. You should be able to get a car loan quickly, sometimes within 24 hours, but dont let that persuade you to make a quick decision on a loan that could be part of your monthly bills for years to come.

Financing A Car After Bankruptcy And With No Credit History

Consumers who have been through bankruptcy or have no credit experience may think auto financing is off the table, but there are lenders, such as RoadLoans, that accept applications from consumers will all types of credit. A down payment, vehicle trade-in and cosigner are some of the elements that may strengthen an auto loan application in these situations.

Don’t Miss: How Do You Get An 850 Credit Score

How To Save Money

In conversations with lending-industry experts, CR found that there are a number of ways to save money, even if you have a suboptimal credit score.

Know your credit score. Experian recommends checking your credit score at least once per year as a matter of course. That way, youll know where you stand so that you can manage expectations regarding loan eligibility, and be aware of what you have to do to bring up your score. You should also look for errors in your credit report, which can affect your score, Bell says.

Luckily there is no shortageof sites you can visit online to get a free credit score,” says Nana-Sinkam. All the major credit bureaus offer one free credit report annually.

If theres time, improve your score. A credit score can be improved in a number of ways, mostly by paying bills on time. Always pay credit card and other bills when theyre due, even if its only the minimum payment. This is good advice for any loanthe more you pay up front, the less youll pay in the long run.

Bring a bigger down payment. Having a bigger down payment reduces the amount of loan you need, and a smaller loan means less interest, says Amy Wang, associate director of Credit Karma Auto. A down payment can be in the form of cash, a trade-in vehicle, or a combination of the two.

Get prequalified. Much like knowing your credit score, getting prequalified for a loan from your bank helps manage expectations about whats possible.

Benjamin Preston

Bad Credit Car Loan Rates

Bad credit is defined as a persons inability to pay bills on time and the likelihood of failing to make future payments. This is typically reflected in a FICO score of 579 or lower.

If your credit score falls below this threshold, you may not be eligible for all loans and could face higher interest rates. The tables below show average auto loan interest rates by credit score for new and used cars, according to Experians State of the Automotive Finance Market Q1 2022report.

Recommended Reading: How To Get A Bankruptcy Off Your Credit Report