Does Debt Collections Affect Credit Score

Do you know how making late payments on debt can harm your credit score? Having a debt go into collections is worse.

When a debt goes into collections, it means that the original lender has given up on trying to collect payment from the borrower. At this point, they pass the burden off to another agency that has the resources or skills to help a borrower start paying back that debt.

However, passing this debt off to a collection agency shows other lenders that you have a track record of not paying back your debts for a long time. For lenders, your payment history is an important consideration. That fact is why credit score calculations all make payment history such a large part of their evaluation and total scoring system.

Having a debt go into collections also means that your credit score can take longer to recover. Collections stay on your report until you pay back the debt. Depending on the size of the debt, this could take years to pay back the debt and have it removed from your credit report.

Rule #: Dont Let Debt Collectors Credit Score Worries Stress Or Other Factors Force You Into Bad Decisions

Dont Make Decisions Based on Debt Collection Harassment. A debt collectors job is to convince you to pay its debts first. Instead, make your own decision as to which debt has the highest priority. The collector contacting you most aggressively is often collecting on a low priority debt. Do not be persuaded just get the debt collector off your back. Chapter 2 sets out nine ways to stop debt collection harassment, including four different sample letters that typically will stop collectors from contacting you.

Worries About Your Credit Score Should Not Move Up a Debts Priority. If you are behind on your bills, this almost certainly ends up on your credit record. You cannot stop this, short of always being current on your bills. Nevertheless, do not prioritize a particular bill first just because a collector is threatening to ruin your credit record.

Threats to Sue You Should Not Move Up a Debt in Priority Until You Are Actually Sued. Many threats to sue are not carried out. Even if they are, it may be years before you are actually sued. On the other hand, non-payment of rent or car loans may result in immediate loss of your home or car. It is hard to predict whether a particular creditor will actually sue on a past-due debt. How aggressively a collection agency threatens suit is no indication whether the creditor will actually sue, even if the threat appears to come from an attorney. Whether you will be sued and what to do if you are sued is covered in Chapter 4.

How Does A Derogatory Account Affect My Credit

Your payment history is the most important factor in your credit scores, so even a single late payment can hurt your scores. However, a seriously delinquent or derogatory account, such as a charge off or collection account, will be harder to recover from than just one or two missed payments. While some lenders still may be willing to extend credit to someone with derogatory items on their report, they may do so with less than favorable terms, such as higher interest rates or fees.

Derogatory accounts or items such as collection accounts and bankruptcy may also prevent you from qualifying for an apartment. You may also have to pay hefty security deposits to open a cellphone or other service account.

Accounts with derogatory payment history can remain on your credit report for seven years from the original delinquency date. A Chapter 13 bankruptcy remains on the report for seven years from the date it was filed, while a Chapter 7 bankruptcy may remain part of your credit history for 10 years from the date filed.

Also Check: What Is Reported On A Credit Report

What Happens If You Dont Pay The Collection Agency

You could simply not pay the debt.

As I explained earlier, if you havent made a payment in a long time, by not paying, the debt is purged from your credit report earlier than if you pay the collection agency.

Now I dont necessarily recommend this course of action. While the account might fall off your credit report, collection agencies dont give up. They will continue to call, and you need to weigh the risks of whether the collection agency can or will sue, take you to court and garnishee your wages.

First, will a collection agency sue you? If the debt is small, likely not. It costs money in legal fees to make an application to the court for a judgment and getting a garnishment order.

Second, if the account is too old, the agency cant sue you. All provinces in Canada have something called a statute of limitations. In Ontario, the limitation period is two years. If you have not made a payment in the last two years, debt collection calls will continue, but they cant legally sue you to collect.

And thats one more reason why you should never pay a collection agency. If you make a partial payment, the limitation period starts over, so now the collection agency or your creditor has two more years to sue you in court.

How Long Do Collection Accounts Stay On Your Report

Paid or unpaid collection accounts can legally stay on your credit reports for up to seven years after the original account first became delinquent. Once the collection account reaches the seven-year mark, the credit reporting companies should automatically delete it from your credit reports.

If your collection account doesnt fall off of your credit report after seven years, you can file a dispute with each credit bureau that lists it on your report.

Read Also: How Long Does A Delinquent Account Stay On Credit Report

What Is A Credit Report And How Do I Access Mine

Institutions that have issued you credit cards and loans send regular updates about your accounts to , also known as credit reporting agencies. Credit bureaus collect all the data and combine it into a single file, known as your credit report. When you apply for new credit, the financial institution pulls your to determine whether you meet the qualifications.

To quickly figure out the likelihood that you’ll repay a loan on time, creditors may instead use your , a three-digit numerical summary of your credit report information at a given point in time.

It’s important to check your credit report periodically to make sure the information it contains is accurate, complete, and within the allowed reporting time limit. You can access your credit report online from any of the credit bureaus, but there may be a fee. You’re also entitled to a free credit report each year from the major credit bureaus.

You can get one free credit report per week from Equifax, TransUnion, and Experian through December 2023 at AnnualCreditReport.com.

As you read through your credit report, reference this guide to better understand some of the abbreviations you see. Different credit bureaus and credit report providers may use slightly different codes, and some codes may only appear on the reports issued to lenders. Well clarify as much as possible.

How Long Does A Collection Entry Remain On Your Credit Bureau

Regardless of whether you paid the collection amount owing or not, the collection entry will stay on your credit report for seven years. As a result of this, for seven years, the collection entry will impact your chances of applying for new credit.

The unfortunate part is that even if they approve your credit, youre almost always going to pay a higher interest rate. As the collection entry gets older, it will affect your credit score less and less.

You May Like: Is 714 A Good Credit Score

Does Paying Off Collections Improve Your Credit Score

Unfortunately, paying off a collection wont necessarily improve your credit score right away. Why?

As we said, with all FICO scores except FICO 9 , both paid and unpaid collections are considered to be major derogatories on your credit report. Since a paid collection is still a major derogatory mark, paying off your collection likely wont help your credit score if the scoring model used is FICO 8 or earlier.

On the other hand, since FICO 9, VantageScore 3.0, and VantageScore 4.0 ignore paid collection accounts, your score should rebound after paying off a collection with these credit scoring models.

Choose Your Plan Of Action

There are a few ways to handle a collection account on your credit reports:

- If the collection account is inaccurate, dispute it with each credit bureau thats reporting it. The consumer credit bureaus let you file disputes online for convenience. You can also dispute inaccuracies with debt collectors and creditors themselves, though these disputes will typically have to be by phone or mail. In this case, consider sending a 609 dispute letter via certified mail.

- If the account is legitimate but has been paid, contact the collection agency to request a goodwill deletion. This literally involves asking for the account to be removed because you paid it. Its probably not going to work, but its worth a shot. A goodwill adjustment may be more viable if you havent made any other credit blunders in the past.

- Just wait. A collection can usually remain on your reports for about seven years after the account was declared delinquent, even if its unpaid, and its impact on your scores will dissipate over time.

You May Like: How Long Hard Inquiry On Credit Report

S To Take When You Receive A Notice That Your Debt Is Transferred To A Collection Agency

If you receive a notice that your creditor will transfer your debt to a collection agency, contact your creditor as soon as possible.

You may be able to:

- pay a portion of the amount or the full amount owed to avoid having the debt transferred to collections

- make alternate arrangements with your creditor to pay back your debt

If A Collection Is On Your Report In Error Dispute It

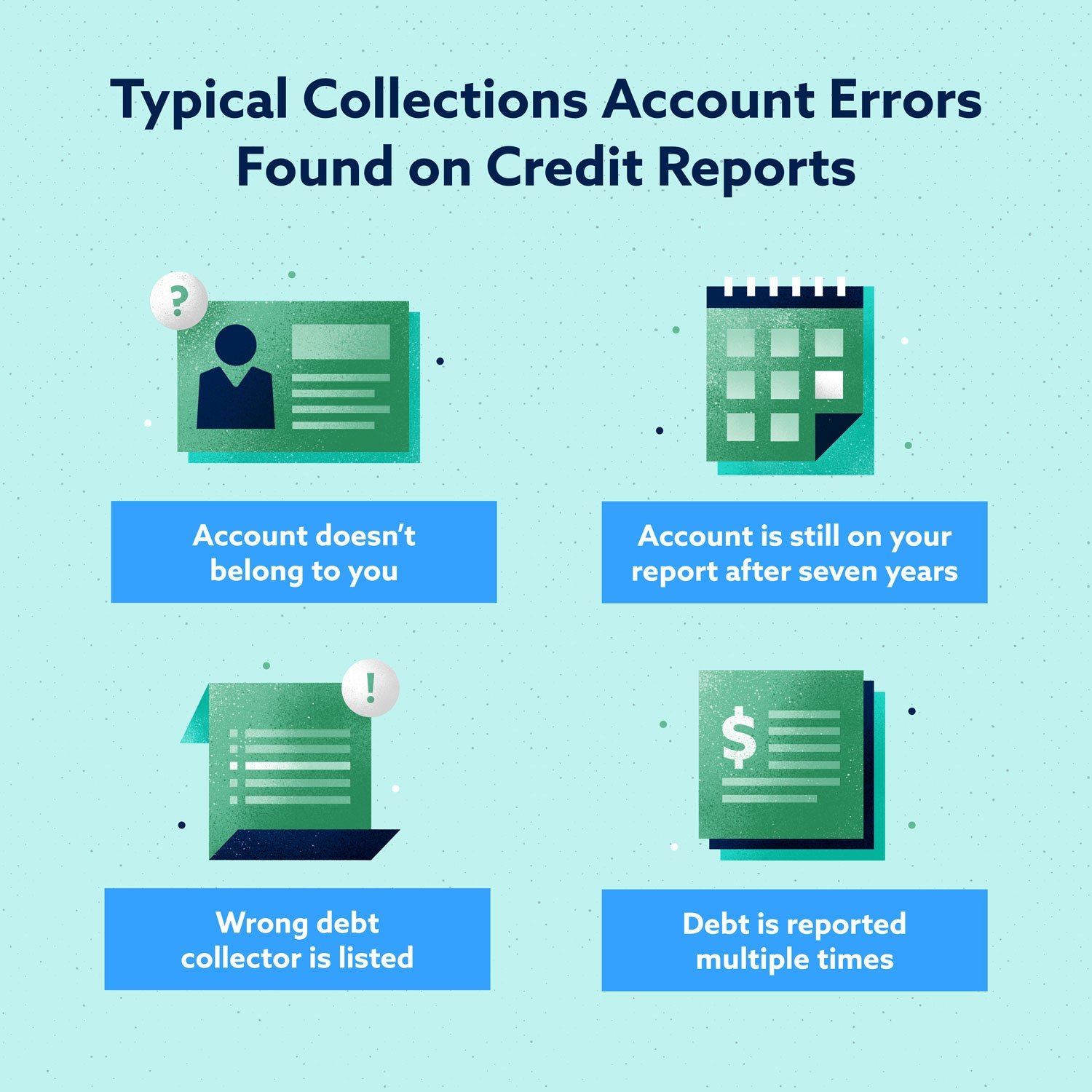

You may have a collections account on your credit report that shouldnt be there. Maybe its too old to still be reported, or the collection itself is incorrect.

Too old to be reported: Delinquent accounts should fall off your credit report seven years after the date they first became and remained delinquent. But that doesnt always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

If a credit bureau has made a mistake on your report if you dont recognize the account or a paid account shows as unpaid, for example gather documentation supporting your case. Then, file a dispute by using the credit bureau’s online process, by phone or by mail. The bureau has 30 days to respond.

Collection is incorrect: If you think the error is on the part of the debt collector, not the credit bureau, ask the collector to validate the debt to make sure its yours. Note that you have 30 days from the date the collector first contacted you to dispute the validity of the debt. If the collector cant validate, the collection should come off your reports. Follow up to make sure.

You May Like: Can You Remove Closed Accounts From Credit Report

What Does It Mean For Debt To Go Into Collections

If you dont pay back a debt on time, it can eventually go into debt collection. This phase of debt repayment is when a collection agency reaches out to the people that co-signed the debt for the money that the client is owed.

Debt collection agencies are third parties that operate outside of the borrower and lender relationship. A collection agencys job is to find a way to reach the borrower and either collect the money for the overdue debt or find a way for the borrower to start repaying their debt to the lender.

Debt collection agencies receive payment from the lender when they collect on the debt owed. Usually, the collection agency receives a percentage of the debt as their service fee. However, some collection agencies instead buy out the debt for a fraction of the total amount and then go after the original borrower for payment.

Several different debts can go into collections, such as:

- Car and auto loan debts

- Unpaid utility bills, such as electricity or water

In summary, having a debt go into collection is not great. In addition to the credit score troubles it can cause, having a debt go into collections means that you now have a third party hounding you for money. Its stressful, unpleasant, and could be making a bad situation worse.

Q How Can I Update My Contact Information In My Fraud Alert

A. To change the contact information in your alert, please contact our Fraud Victim Assistance Department . Any changes to the statement need to be sent in writing with two photocopied pieces of identification.

All information should be supplied to:Correspondence in EnglishTransUnion Fraud Victim Assistance Department3115 Harvester Road,Suite 201 Burlington ON L7N 3N8Correspondence in FrenchService daide aux victimes de la fraude TransUnion3115 Chemin Harvester,Suite 201 Burlington ON L7N 3N8

Read Also: How To See Your Credit Score

Can You Remove A Collection Entry From Your Report

If you have a collection entry, the simple answer is yes. Its possible to remove it in most cases. And thats something youll want to do. A collection entry appearing on your credit bureau can hurt your credit score and, in some cases, stop you from getting car loans and mortgages.

Before we discuss how to remove a collection entry, it helps to talk about what a collection entry actually means, how much it can lower your credit score and how long it can remain on your credit report if you dont do anything about it.

Can you use some help with your finances? Learn about credit counselling today.

How Long Do Derogatory Marks Stay On Your Credit

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

Derogatory marks on your credit are negative items such as missed payments, collections, repossession and foreclosure. Most derogatory marks stay on your credit reports for about seven years, and one type may linger for up to 10 years. The damage to your credit score means you may not qualify for new credit or may pay more in interest on loans or credit cards.

If the derogatory mark is in error, you can file a dispute with the credit bureaus to get negative information removed from your credit reports. You can see all three of your credit reports for free on a weekly basis through the end of 2022.

If the derogatory marks are not errors, youâll need to wait for them to age off your credit reports.

If you are not in a position to pay your bills, learn how to limit the damage to your finances.

Heres how long derogatory marks stay on your credit reports click to learn how to recover:

Donât Miss: Is 643 A Good Credit Score

Don’t Miss: Does A Judgement Show Up On Your Credit Report

Re: New Alert Flagged As Collections

I’ve had that happen several times now…When I first started my rebuild I had 7 collections on TU, 3 of which were from medical and I know insurance paid them and I paid the coinsurance. I disputed them, they were removed, fast foward about 6 months all three came back, the status was closed collection…About a year into my rebuild, they suddenly updated again, this time they were updated to open collections nothing else but that status changed.

Here’s my thoughts. Collection companies do this when they see you’re rebuilding. Bet you 10 to 1 you see them constantly softing your CRAs. They know having it appear as something about the collection changed, anything other then being completely removed, will hold your scores and rebuild stagnant.

What To Know About Debt Collection

What types of debts are covered under the law?

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA. Business debts are not.

Can debt collectors contact me at any time or place?

No. Debt collectors cant contact you before 8 a.m. or after 9 p.m., unless you agree to it. They also cant contact you at work if you tell them youre not allowed to get calls there.

How can a debt collector contact me?

Debt collectors can call you, or send letters, emails, or text messages to collect a debt.

How can I stop a debt collector from contacting me?

Mail a letter to the collection company and ask it to stop contacting you. Keep a copy for yourself. Consider sending the letter by certified mail and paying for a return receipt. That way, youll have a record the collector got it. Once the collection company gets your letter, it can only contact you to confirm it will stop contacting you in the future or to tell you it plans to take a specific action, like filing a lawsuit. If youre represented by an attorney, tell the collector. The collector must communicate with your attorney, not you, unless the attorney fails to respond to the collectors communications within a reasonable time.

Can a debt collector contact anyone else about my debt?

What does the debt collector have to tell me about the debt?

What if I dont think I owe the debt?

What are debt collectors not allowed to do?

Also Check: How Much Does A Hard Inquiry Affect Credit Score