Goodwill Letter To Remove Charge Off

Your name

Your address

Complete account numberAttn: Collection Manager,This letter is in reference to a debt claimed under the account number listed above. I wish to settle this debt in full without prejudice, in return for removal of the charge-off status with the credit rating agencies. This is not an admission of the debt or a payment agreement, unless you agree to have all information related to this debt removed from my credit file. In return for your removal agreement, I am willing to make payment in the full amount of $XXX.XX to be sent by certified funds. If this is acceptable, please acknowledge the details of this agreement in a letter written on your companys letterhead. You will also agree to contact the collection agency to inform them of dismissal of the aforementioned debt.In addition, please be aware that as per my rights under the Fair Debt Collection Practices Act, I have a right to request full verification of this debt and to dispute it unless full verification is made. This offer is valid for 14 days from the date of receipt, after which it will be withdrawn and I will exercise my right to full verification.Sincerely,

Your Name

Strategies For Dealing With Charge

One strategy that many people have had success with is asking the creditor to remove the charge-off in exchange for some sort of payment. You don’t need to offer your account’s full balance — after all, even if the creditor accepts your debt settlement offer, you still legally owe the entire debt to a third party. But, the more you are prepared to pay, the better position you’ll be in to negotiate.

As always, get any promises to delete the charge-off in writing. Ask the person you’re speaking with to mail the agreement on a company letterhead and don’t send any money until you have the document in your hand.

You can send a removal request in writing. This is known as a pay-for-delete letter in which you state that you’re willing to pay a certain sum of money in exchange for removal of the charge-off.

Here’s one point to remember. The creditor you’re dealing with is a business. At the end of the day, they really don’t care about your life story or any excuses about why you didn’t pay the debt. If it makes good business sense for them to stop reporting the charge-off, they’re likely to do it. Be polite and keep the conversation or letter to the point you want them to know — that it’s in their best interest to accept your offer of payment for removal.

Talk To A Bankruptcy Attorney

If there is no possible way for you to pay your debts, bankruptcy is a viable option. Bankruptcy is not a financial death sentence, its a fresh start.

There are risks and some associated costs, so you will have to consider your options carefully, but many people come out of bankruptcy in better financial condition than they were in when they went in.

Many bankruptcy lawyers offer free initial consultations. Theyll review your situation, help you decide whether bankruptcy is right for you, and explain the process. Another way to look into bankruptcy is through Upsolve, a free app that has been called TurboTax for bankruptcy.

Recommended Reading: What Credit Score Do I Need For Ashley Furniture

Consult With A Credit Repair Company Buyer Beware

People with charge-offs sometimes choose to speak with a credit repair company. These companies charge a fee.

However, some work on your behalf to challenge negative items creditors may have placed on your credit reports with the three credit bureaus.

Services like perform a full analysis of your credit history, challenges the damage you disagree with and sets you up with a plan to build credit.

The service comes highly-regarded by other users, showing 4.9 out of 5 stars with almost 170 reviews on ConsumerAffairs.com.

Consider this service if you need assistance with repairing your credit. Set up a consultation to learn more about and whether it can help with your charge-offs.

What Is A Pay

A pay-for-delete letter is when you offer to settle a balance on a negative account in exchange for the debt being deleted from your credit report. The creditor or debt collector is not obligated to agree to your request, but it may be worth sending the request. If you’re sending the request to a collection agency, you’ll need to offer enough for it to be profitable for them to settle. There’s no way to know how much that is, though. If you’re close to the seven-year mark for the item to fall off your credit report, it may not be worth sending a pay-for-delete letter.

Read Also: Remove Student Loans From Credit Report

How Long Does Charged

Just like late payments, a charged-off debt stays on your credit report for seven years. The seven-year clock starts on the date of the last scheduled payment you didnt make and doesnt restart if the debt is sold to a collection agency or debt buyer. Paying the charged-off amount wont remove it from your credit report. The accounts status is simply changed to charged-off paid or charged-off settled, which remains on your credit report until the end of the seven-year period, when it automatically falls off your report.

Try To Negotiate A Pay

If your debt is still with the original lender, you can ask to pay the debt in full in exchange for the charge-off notation to be removed from your credit report. If your debt has been sold to a third party, you can still try a pay-for-delete arrangement. The debt owner still wants to collect their money, so they might be open to a pay-for-delete arrangement.

If your debt is now sitting with a collection agency, it can work to your advantage. A debt collector can pull your credit report and see if you have ways of paying off the debt, such as a credit line or an available balance on a credit card. This is a strong motivator for the debt owner to work with you.

Additionally, you can assume that if a collection agency now owns your debt, they bought it for a fraction of the total amount. This means theyll potentially be willing to accept less than your total debt amount as payment.

When youre negotiating, some financial experts suggest offering just 25 percent of your original debt if you have a large sum. The collection agency might push back and ask for more, but you can begin negotiations and settle on an amount you deem fair . If you have a small balance, such as $500, its more likely that youll have to pay the full amount to the collection agency.

Recommended Reading: Cbna Thd Credit Inquiry

How To Delete A Charge

A charge-off account may be removed from a credit report under any of the following circumstances using this special dispute letter, and using the specific dispute reasons listed below:

Unrecognizable Account: If the account in question is one you do not recognize, the account can be disputed as such. You will need to dispute the account as no knowledge of account.

Fraudulently Opened Account: If you are certain the account is indeed fraudulent, where an identity thief opened an account without your knowledge, then you will need to file identity theft reports. These will need to be filed with the Federal Trade Commission and the local authorities. After which you will need to forward these reports to both the creditor and the credit bureaus in order to dispute the account as a Fraudulently opened account.

Fraudulent Charges on Account: If you incurred fraudulent charges on an account you opened that led to late, then the item can be disputed under the Fair Credit Reporting Act under the provisions afforded to fraud victims. You will need to file the requisite fraud reports, as described in the section above for fraudulently opened accounts. You will be disputing this item as having incurred fraudulent charges and would specifically need to point out the fraudulent charges. Then you will need to submit the fraud reports to the credit bureaus and the creditor.

Sample Letter To Remove A Charge

Note: Use this in attempting to negotiate a complete removal or PAID AS AGREED on a debt that states CHARGE-OFF or SERIOUSLY PAST DUE on your credit report.

RE: account #

Dear Sir or Madam, After recently reviewing my credit report, I took notice that the above-mentioned account is currently in status. I sincerely would like to take care of this account as soon as possible.

Due to , I unfortunately got behind on my payments and was unable to meet my obligations. However, since then my situation has greatly improved and I am in the position to recompense this debt.

I am willing to pay equalling the amount of provided that the above account is updated on all credit reporting agencies to state: PAID AS AGREED, or completely removed from all credit reporting agencies upon my final payment.

I am not agreeing to an updated credit report that states this account as: PAID CHARGE-OFF or the like, as this will not significantly increase my credit score, nor will it reflect my sincere willingness to restore my good name and hopefully, someday, again do business with your company.

Your written response will serve as an agreement to my proposal and I will begin payments. Thank you very much for your valued time.

Best regards,

Recommended Reading: Kroll Factual Data Complaints

How To Avoid Balances Being Charged Off As Bad Debt

Even better than working to settle a debt and potentially get a charge-off removed is avoiding the issue in the first place. The ideal time to act is as soon as you see youre struggling to make regular payments. Waiting until items are charged off as bad debt means your credit score will take numerous hits as you miss payments.

But if you cant pay your debts, what choice do you have? Turns out you have many options, including some of the ones summarized below.

- Consolidate your debt. Apply for a debt consolidation loan that lets you bring several debt items under a single account. You may be able to qualify for more favorable terms that reduce the amount you pay each month to make it easier to manage your debt. But this is more likely before your credit score drops due to missed payments and charge-offs.

- Get a balance transfer card. If the debt youre struggling with is credit card related, apply for a balance transfer card. If you can get approved for a card with a 0% APR offer, you may reduce how much you have to pay each month and make it easier to pay down your debts.

Upgrade Triple Cash Rewards Visa®

Snapshot of Card Features

Card Details +

Wait For Accounts To Drop Off

If you choose not to take steps to remove closed accounts, you’ll be happy to hear that these closed accounts won’t stay on your credit report forever. Depending on the age and status of the account, it may be nearing the credit-reporting time limit for when it will drop off your credit report for good. If that’s the case, all you might have to do is wait a few months for the account to fall off your credit report, and then for your credit report to update.

Most negative information can only be listed on your credit report for seven years from the first date of deliquency.

If the closed account includes negative information that’s older than seven years, you can use the credit report dispute process to remove the account from your credit report.

No law requires credit bureaus to remove a closed account that’s accurately reported and verifiable and doesn’t contain any old, negative information. Instead, the account will likely remain on your credit report for ten years or whatever time period the credit bureau has set for reporting closed accounts. Don’t worrythese types of accounts typically don’t hurt your credit score as long as they have a zero balance.

Don’t Miss: 888-826-0598

Tips For Managing Debt

- Be sure to make payments on time and in full as much as possible. That way, you dont add on more and more to what you owe. If you need help making a payment plan, online debt calculators can lead you in the right direction

- If youve not yet reached a charge-off, you may want to look into a balance transfer card. This allows you to transfer a loan balance to the card that has a time period where you can pay off your debts without a hefty interest rate.

Get Any Agreement In Writing

A pay-for-delete arrangement is legal under the Fair Credit Reporting Act. However, the lender isnt legally obligated to honor the request and remove a charge-off from your account. So, while you may ask for the arrangement, the lender can say no.

For this reason, you want to ensure you get the pay-for-delete arrangement in writing. You should get the details of the arrangement written out on the companys letterhead. This includes the amount youre going to pay, that you wont owe any more after you make the payment and that the creditor intends to remove the charge-off from your credit reports.

Don’t Miss: Does Apple Card Affect Credit Score

Negative Accounts Stay On Your Credit Report For 7 Years

Although few Americans have likely read it, they owe some thanks to the Fair Credit Reporting Act . Responsible for regulating the collection, dissemination, and use of consumer information, the FCRA is responsible for, among other things, keeping your credit information in the right hands.

The Fair Credit Reporting Act dictates how long negative accounts can remain on your credit report.

Another important section of the FCRA is the portion that addresses the length of time harmful information can stay on your credit report. Specifically, most types of negative accounts can stay on your report for up to seven years from the initial date of delinquency.

This means any charge offs and the hefty credit score dips that accompany them will remain a thorn in the side of your attempts to get credit for the better part of a decade. Whats more, paying off the debt will not automatically remove the charge off from your account. Instead, it is designated a paid charge off, which has less impact on your report but still isnt looked on very favorably by future lenders.

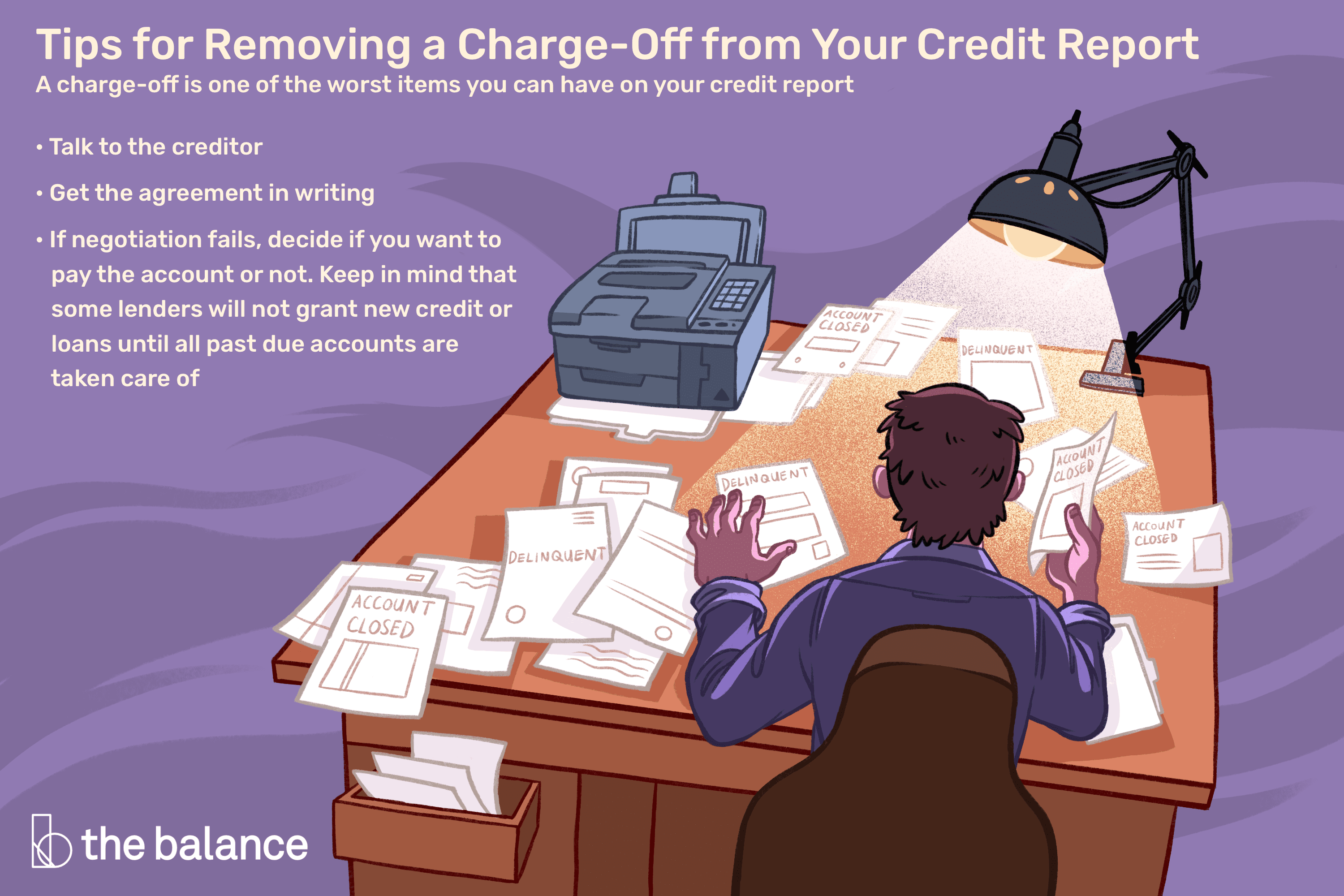

What If The Creditor Wont Budge

This situation is entirely possible and can certainly take the wind out of your sails. That said, you should still make an effort to repay the debt, as having a paid charge-off is much better than an unpaid one on your credit report. If the creditor wont settle or remove it, however, it will remain on your report for seven years.

You May Like: Does Sprint Report To Credit Bureaus

What To Do If You Have A Charge

Once you receive the validation notice, ask yourself the following:

- Is the account mine? Make sure that the charged-off debt is actually yours. If you have a common name or have a relative with the same name , a mix-up regarding who the debt belongs to might have occurred.

- Is the account actually unpaid? If you know that the account belongs to you but dont remember having an unpaid debt, consult your payment records. An accounting error may have happened on the creditors end, especially if the account is old.

- Is the debt past its statute of limitations? Ask the creditor for the last payment date noted on the account. Legally, theyre required to answer honestly if they know. If the debt is older than the statute of limitations in the presiding state, you may not have to worry about being taken to court. However, creditors can still contact you to collect the debt, and the account will still be reported on your credit report for seven years.

Ultimately, if the charge-off account does belong to you, youre legally responsible for paying the debt. Some collectors agree to settle for a reduced amount, and you might decide to pay the settlement amount. If the debt is nearing or past its statute of limitations, you might choose to not pay the charged-off account. Its best to consult with a debt attorney about the option thats best for you.

Disputing An Inaccurate Charge

If your credit report has an error, such as an inaccurate charge-off, you can report it. You need to write a letter disputing the error and send it to the major credit bureaus. You should also send a copy to the institution that supplied the inaccurate data, such as your bank or credit card company.

Be sure to collect any supporting documentation to go with your dispute letter. This could include statements, contract agreements, or letters from your lender. You need to make a strong case to show that the charge-off is inaccurate.

For example, say you pay off an overdue credit card balance in full before it goes to collections. Your credit card company sends out a letter to you acknowledging you paid the debt.

However, they also accidentally report your non-payment as a charge-off. You would include the letter from the credit card issuer as documentation of the inaccuracy.

Details of your charge-off can be inaccurate as well. That means you could still have a charge-off, but the amount could be wrong.

Lets say you owe $1,000 on your car, but your lender reports a charge-off for $2,000. You can dispute the inaccurate amount.

Don’t Miss: Unlock Transunion Account

When You Can’t Get Your Way

If your negotiation fails, and you cant get the creditor to budge, decide whether you want to pay the account or not. Even though the account will continue to be reported as charged off until the credit reporting time limit is up, it will affect your credit score less as time passes. However, some lenders will not grant you new credit or loans until youve taken care of all past-due accounts. So, if you plan to get a mortgage or auto loan in the next seven years, its better to pay the account. Once its paid, make sure your credit report reflects the payment.